27/11/2020

This month Adil Slimani, IBA's Head of Aftermarket Advisory shares his opinion on Covid and material Fair Market Values.

'Unprecedented' and 'Covid' have become synonymous with 2020 and the pandemic's tragic human cost has been the gravest many have experienced in generations. Numerous industries have also suffered and aviation has been one of the worst hit. Every step of the supply chain from financing, manufacturing, operation, maintenance and recycling has had to adapt to survive and, fundamentally, there are several market forces that have yet to play out. Here I'll try to share some insight into the causes and effects of a reduction in aircraft material fair market values (FMV).

For many entities, common strategies to protect capital, be they mothballing fleets, leveraging assets or furloughing staff have largely been played out and restructuring is underway. Various support mechanisms adopted by stakeholders such as renegotiating lease rates, payment holidays and deferred aircraft deliveries or redeliveries have enabled operations to continue at minimal levels and undoubtedly been a lifeline.

With high level major changes sweeping the industry, why should we care about aircraft material Fair Market Values (FMV)? After fuel and crew, maintenance is the next highest operating cost, with an approximate 80:20 split between material and labour expense. Today, much of the aftermarket is in a state of limbo, awaiting operators' final decisions over whether to return aircraft to service, convert them to freighter or part out. This potential supply and demand volatility creates waves that are likely to be felt even in the medium term (2022/23). The global fleet's material demands will be definitively revealed only once restructuring effects are understood and pre-Covid aircraft utilisation returns. The risk to FMVs will differ based on aircraft type, utilisation, material commonality and fleet maturity. Speculative M&A has adopted a wait and see attitude while the market bottoms out and stabilises. It also seems expected consolidation in the European market has yet to significantly materialise, despite the traditional peaks and troughs of seasonality being almost three times higher than in North America.

Investors completing immediately prior to Covid groundings have had difficult choices, but many have chosen to weather their acquisitions' storms, even if to minimise losses rather than see a positive return on investment. Transactions that traditionally relied upon market value are being completed using base value where the term is long enough to justify it and soft value when it cannot be deferred. Financiers providing support for end of life (EOL) aircraft acquisitions should be concerned, not only about the timeline for realising residual values, but because the residual values now risk negative equity. Similarly, those providing working capital may also now find collateral covenants have been breached; impairments are likely to feature in most financial reporting. Operators leveraging assets have produced an increase in sale and leaseback (SLB) activity.

Manufacturers have seen significant numbers of cancelled orders, including those created by the A380's accelerated demise and the MAX's issues. A reduction in FMVs can lower operators' costs at a time when cash management is key, making the case for a switch to newer aircraft in the short term more difficult. Indeed, prior to Covid one operator calculated that, with its particular circumstances, it would need to see an oil price of $80 USD per barrel before it would become economically viable to operate a newer narrowbody. With material FMV under pressure, some operators may also be revisiting the terms seen within various OEM service level agreements, especially if there is an abundance of material available on the market.

Stockists have witnessed a severe drop in demand. Many are reporting demand has fallen directly in proportion to the reduction in aircraft utilisation. Expectations of material flooding the market and reducing FMV has caused some to heavily discount prices in anticipation. Older modification status A320 family material, 737CL, A330/A340, 747, 757, 767 and 777 have experienced greater pressure, with each ad hoc material request having almost five times as many competitors. Conversely, stockists with operator Power-by-the-Hour material support agreements in place may find servicing those agreements less costly and the benefits of assured demand versus ad hoc are evident.

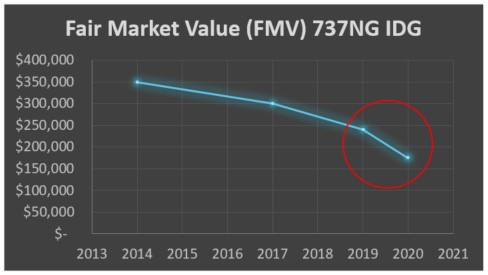

One might assume liquid material from, for example, a 737-800 would retain its value. However, Covid has challenged this conventional logic with some material. For instance, a 737-800 Integrated Drive Generator (IDG) typically selling for $250k before the pandemic has seen almost two years of depreciation in the first six months of Covid-related groundings. This is primarily because a single six figure transaction will have a significant effect on monthly revenue.

Stockists that were actively acquiring and parting out aircraft will have to be creative to extricate themselves from transactions that are no longer competitively priced; airframe values have fallen up to 45% in some instances. Of the 1,000 parts typically removed from a part out, in most instances the sale of the top 20% represents more than 80% of revenue expectation. In some circumstances smaller stockists previously unable to fund a part out have found themselves in a better position to survive Covid than their larger, encumbered competitors.

MROs (maintenance and repair organisations), including stockists and manufacturers with MRO programs, have probably had the greatest variety of challenges in the supply chain. MROs preparing to support newer technologies whilst also maintaining support for existing fleets present a significant demand on resources. OEMs have, at times, seen third party MROs as facilitators for new fleet adoption and occasionally competed to include aftermarket revenue in their streams. With a fall in FMV the $USD threshold for material becoming Beyond Economic Repair (BER) may be reduced, albeit it's a steady 60% of FMV currently. This can affect expected yields from aircraft part outs. Similarly, surplus inventory from operators' fleet reductions may mean delays and deferrals of component repairs. This is especially disruptive in the engine MRO market since reduced capability and resource may not be enhanced in time to address recovering demand and the backlog of deferred engine shop visits. Consequences could include increased engine shop visit lead times and even a spike in green time engine lease rates in the first few seasons of post-Covid recovery.

Aircraft lessors are often a few levels removed from the minutiae of material FMV shifts. However, a fall in material FMV could mean a surplus in maintenance reserves collected. Decreasing FMVs for material will also affect part out valuation models which in turn could change the dynamic between different asset management strategies: deciding to re-invest and make an aircraft ready for another lessee, to part out or to provide the aircraft as feedstock for freighter conversion. Lessors may also share the OEMs' challenge that operators will defer adoption of new technology.

Operators are, of course, varied in their size, market, fleet and financing options. However, a common trend involves outsourcing activities, either to reduce the risk of unscheduled expenditure or improve the balance sheet. The popularity of leasing aircraft and MRO service level agreement has allowed for greater focus on operational activities. A fall in material FMV can have a mixed outcome depending on the operator size, fleet age and material support arrangements. Large surplus inventories will see a write down in excess of those caused by fleet reduction and development. Long term material pooling arrangements may now represent poorer value than pre-Covid. Sale and leasebacks tend to be over long enough timescales for aircraft base values to be more relevant. However, once again falling FMVs for material can affect residual values and fleet development plans. Operators holding onto aircraft longer and benefitting from lower operating costs should be mindful of restrictions governing the maximum age of imported aircraft which may limit the size of their secondary market.

The relationship between Manufacturer List Prices and Fair Market Value of material can be used as a barometer of aircraft maturity as it is actually operated. At the component level, retirements or commonality with other aircraft types affecting supply and demand will translate to market value corrections. The change in values can be used to inform aftermarket support strategies, fleet development and residual value risks. Not all parts of or stakeholders in the market are on the losing side of a reduction in fair market values. While the steep recovery from Covid we expected is now unlikely, the positive news of effective vaccines means restructuring can consider positioning towards making a strong recovery rather than just surviving.

If you have any further questions, or comments please contact Adil Slimani