This week, I’m going to loop back to the transition between new and previous generation aircraft that I covered about a year ago. Over that time, we’ve had record firm orders, a slow build-up of build rates across the board and a 21% increase in global capacity year-over-year for July, with APAC showing a ~ 50% increase! Despite that, it is remarkable to see that we are still way off from the balance tipping from old to new, as visualised in the two charts below. This certainly echoes Gus Kelly’s comments this week on the AerCap earnings call.

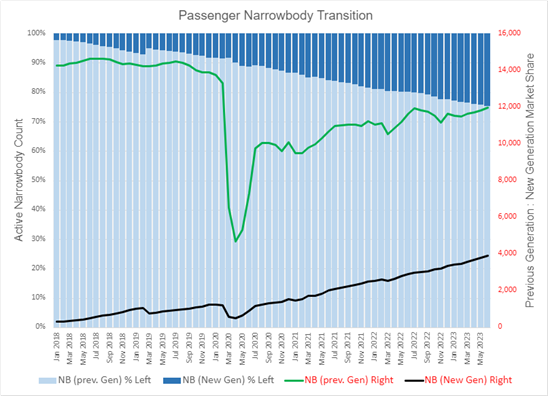

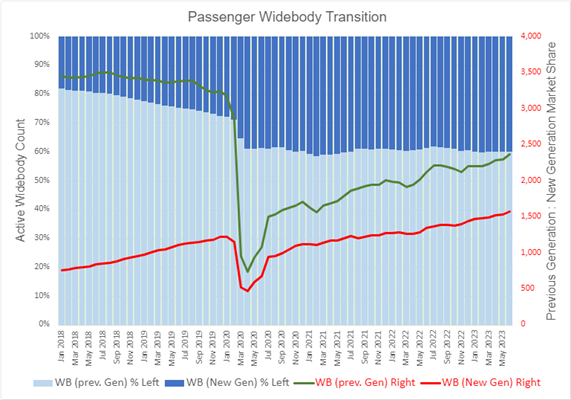

In the following charts, I present the monthly share evolution and specific active count split between previous and new generation aircraft for both passenger narrowbody and widebody fleets. For the narrowbody fleet, this means A220/A320neo/737MAX families versus the rest, and for the widebodies, 787/ A330neo/A350 families versus the rest. Both sectors have certainly encountered their fair share of problems, relating to tech groundings, engine issues, production halts, and a pandemic, yet the market share evolution trends are quite different between them.

For the narrowbody market, the share has grown 23% over the past 5.5 years to ~25% based purely on aircraft count. Despite many hiccups, the growth of narrowbody new technology has remained on a relatively ordered path. The effect of the MAX grounding is visible but has realistically only impacted the long-term position by ~7%, whilst the technology shift effect during Covid barely registers. However, it is also quite hard to visualise any rate hikes, as a 10% shift can get lost in the weeds. Despite signals from the OEMs, the shift continues to remain a slow transition and of relatively low impact against the size of the fleet. Entry into service technology issues continue to pose problems to maintain reliability and that will continue for quite some time given the size of the problem. At what point does the market reach a balance though? Taking rate hikes into consideration and the likelihood that ~1,000 previous technology narrowbodies will never return to passenger service, a 50:50 share isn’t likely to occur until we approach the end of the decade (Feb 2030 +/- 12 months based on several scenarios), and in keeping with the principle that the fleet doubles every 15 years.

That’s a very different situation to how the widebody market continues to shape up, whereby the re-fleet trend has essentially remained unchanged since April 2020.

The process started much earlier than for the narrowbodies with the arrival of the 787, and by late 2019 it looked like the 50:50 point would be reached by 2024. At the onset of Covid, there was a sudden shift towards new technology, purely due to the abrupt departure of four-engine aircraft and the disproportionate storage of older variants. Since then, a slow return to build and delivery rates, coupled with production issues with the 787 and their slow return to service, has meant that the balance has barely moved at all in three years. The response of newer technology has been so slow that whilst the size of the new narrowbody fleet has increased by >200% since early 2020, the widebody fleet has only grown by 28%. The higher cost of debt against the late recovery of the relatively young Asian widebody fleet is a battle that will certainly maintain demand for 777s and A330s for some time to come. In terms of what happens to the balance in the coming years, the rate of recovery for the newer types is certainly more visible as we are starting from close to zero. This may indicate that the balance may start to shift once again early next year, but it remains slow. Taking the rate recovery into consideration and the removal of at least 500 aircraft from the system, the bulk of the scenarios indicate that the balance will be achieved by the third quarter of 2029, only just ahead of the narrowbody sector. This indicates that the widebody fleet will only grow by two-thirds within the 15-year period. Of course, there are many things that can happen in six years, but the shift towards more economical, larger gauge/longer range narrowbodies impacting the traditional use of widebody aircraft is something that has been observed and is likely to continue up to a point. Naturally, airspace/airport constraints threaten that shift and remain a dynamic that cannot be ignored. I’m not suggesting any new designs, but further recovery of the A380s in storage and 777X orders will be expected.

Source: IBA Insight & Intelligence

Source: IBA Insight & Intelligence

With Lufthansa reporting yesterday, all three of the European flag carrier groups have now reported, and are all strongly in the black. Lufthansa Group and Air France-KLM’s Q2 operating margins of 11.5% and 9.4% respectively, both set records. IAG were the standout performer, however, with EUR1.3bn operating profit representing a 16.3% margin. They are now all in H1 profit at the net level.

The European results come amidst a great bulk of positive interim results. American Airlines completed the US legacy carrier set, with all three having Q2 EBIT margins over 10%. Southwest also announced record revenue, with an operating margin of 11.3%. In the same week, in Asia, ANA, Singapore Airlines and Japan Airlines also reported profitable quarters.

Therefore, IBA’s prediction that demand would continue to support high fares into late 2023 seems to be holding true. Nonetheless, there are differentiators between carriers. Notably, the ranking of the European flag carriers seems to have flipped, where it was only AF-KLM that had a (paper thin 0.3% margin) operating profit in H1 2022.

Airline restraint in upping capacity has enabled Air France-KLM to produce an abnormally high load factor for a mainline carrier (86.9%) in H1. This was higher than both IAG (84.1%) and Lufthansa (81.7%). However, that restraint also meant that their peers were able to up profitable capacity by much greater amounts. AF-KLM’s revenue increase of 12.5% is significant but is dwarfed by the 26.2% and 45.3% increases of Lufthansa and IAG respectively. These increases in revenue improve profitability by diminishing the proportion of fixed costs.

Another strength of IAG was that all of its airlines reported strong operating profits. Transavia only just broke even for AF-KLM, whilst Eurowings and Brussels Airlines are still unprofitable for Lufthansa. This questions the wisdom of Lufthansa acquiring ITA, which itself was such a long way from profitability.

A final differentiator worth mentioning between the airlines is fuel. IAG and AF-KLM experienced greater fuel costs per ASK in H1 2023 than in H1 2022, despite the volatile market last year. This will be due to locking in more expensive hedging at the time, to avoid deeper pain. Expensive hedging will still be affecting the bottom lines of airlines for a while. However, going into Q3, the strongest quarter in the extremely seasonal European market, the airlines may not have to worry yet.

A leading aircraft engine lessor who has been a provider of global aviation services for over 45 years, is exploring a new endeavour in the promising Power-to-Liquid (PtL) SAF (Sustainable Aviation Fuel) market. The company and its recently established subsidiary, Willis Sustainable Fuels, are advancing plans for a new SAF refinery in Teesside, UK, where PtL SAF will be produced from industrial waste CO2 and green hydrogen made from renewable energy. Feasibility studies were completed at the end of 2022, and the project is now in the engineering design phase. Willis will be the first aviation leasing company to develop a SAF project of this scale, which demonstrates the company’s optimism in the currently nascent technology. PtL (or synthetic kerosene) has significant potential for meaningful emissions reduction and strategic investments are already being implemented into green hydrogen and the renewable energy sector. Once synthetic kerosene becomes technologically mature, there will likely be great investment potential within this area of sustainable aviation, especially as it becomes wider knowledge that some types of SAF go hand in hand with environmental caveats. IBA suspects that Willis’ new venture will catalyse further innovation from a broader range of sustainability stakeholders in the industry.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

Introducing IBA Insight, IBA NetZero and IBA Airlines – aviation's one-stop shop for intelligence. You need quick, intuitive access to the most accurate commercial aviation data. Our products are designed to provide you with seamless and simple analysis, prompting better asset decisions, enhanced risk management, and a full understanding of aviation decarbonisation strategies.

With our large team of award-winning ISTAT-qualified appraisers and over 35+ years' proprietary data, IBA is a leading player in the valuations market. Working globally, we offer independent, impartial opinion and advice on the value of a range of asset types including aircraft, engines, helicopters, freighters and air cargo, landing slots and spares. Always striving to exceed clients' expectations, IBA's objective judgement supports the required security needed for loans, asset repossession, commercial development and remarketing.

IBA works with leading aircraft and engine leasing companies from around the world. Our depth of industry knowledge informs our expert advice so we can support clients through the investment cycle, inspiring confidence at every stage of their journey. From valuations, fleet selection and portfolio development to redelivery and remarketing at lease end, we accompany clients through every risk assessment and asset management activity during the life of the lease.

Aviation investment can be an intricate affair and, with significant financial stakes involved, leaving things to chance is not an option. Whether you are investing for the first time or an established player in the market, IBA can help you cut through the complexities of the asset class to better understand investment opportunities. We can work with you to support portfolio development, diversification and to meet strategic needs.

For over 30 years IBA has worked with global and regional airlines providing valuation and advisory services, aviation data intelligence and aircraft and engine redelivery support. Working collaboratively on a variety of aviation projects spanning the world, we fulfil clients' additional resource requirements and provide project management support wherever and whenever needed.

We take a resourceful approach to litigation support and dispute resolution, identifying thoughtful solutions that are tailored to our clients' legal strategy. Our access to over 30 years of proprietary aviation data, regular involvement in strategic M&A and aircraft management expertise affords us regular access to the typical areas of contention between parties. IBA assists clients directly or via their legal teams across many aspects ranging from insurance related settlement for aircraft damage or loss, to disputes between lessors and lessees - often at redelivery.