Date: 19/04/2024 (Edition 7) Download PDF

.png)

It’s been largely quiet this week in the news except for the continual back and forth on interest rate speculation and the reassessment of the strength of the Chinese economy. Whilst the former continues to yo-yo based on monthly released employment and inflation figures, a recent move in China to cut jobs in brokerages, investment banking, and tech sales, amongst just a few, has been the ammunition used to signal that Chinese growth remains under pressure. As ever, it remains difficult to fully judge whilst political tension remains. However, Q1 GDP appears to have exceeded earlier estimates (5.3% v 4.7%), which is comforting, but without a clear return to consumer confidence, economic demand remains subdued. Hence why rating agencies have China on a negative watch.

From the point of view of capacity, this is less apparent for domestic travel as March 2024 figures now exceed the same period in 2018 by over 30% - whilst international capacity originating from China remains 30% down from the 2018 baseline. Combined though, domestic capacity pulls up the number to a 12% increase over the period aided by China-European capacity, now back to 2018 levels, and the rest of the APAC region feeding back. Essentially, the trend consistently moves in a positive direction until you assess North America as a destination. Back in 2018/2019, ASMs closely matched those generated by Europe, however, since then the divergence has substantially increased to the point that the North American trend appears to be getting worse! For March 2024, capacity originating from China and heading to North America remained 80% down from 2018 levels.

) 2.png)

Source: IBA Insight

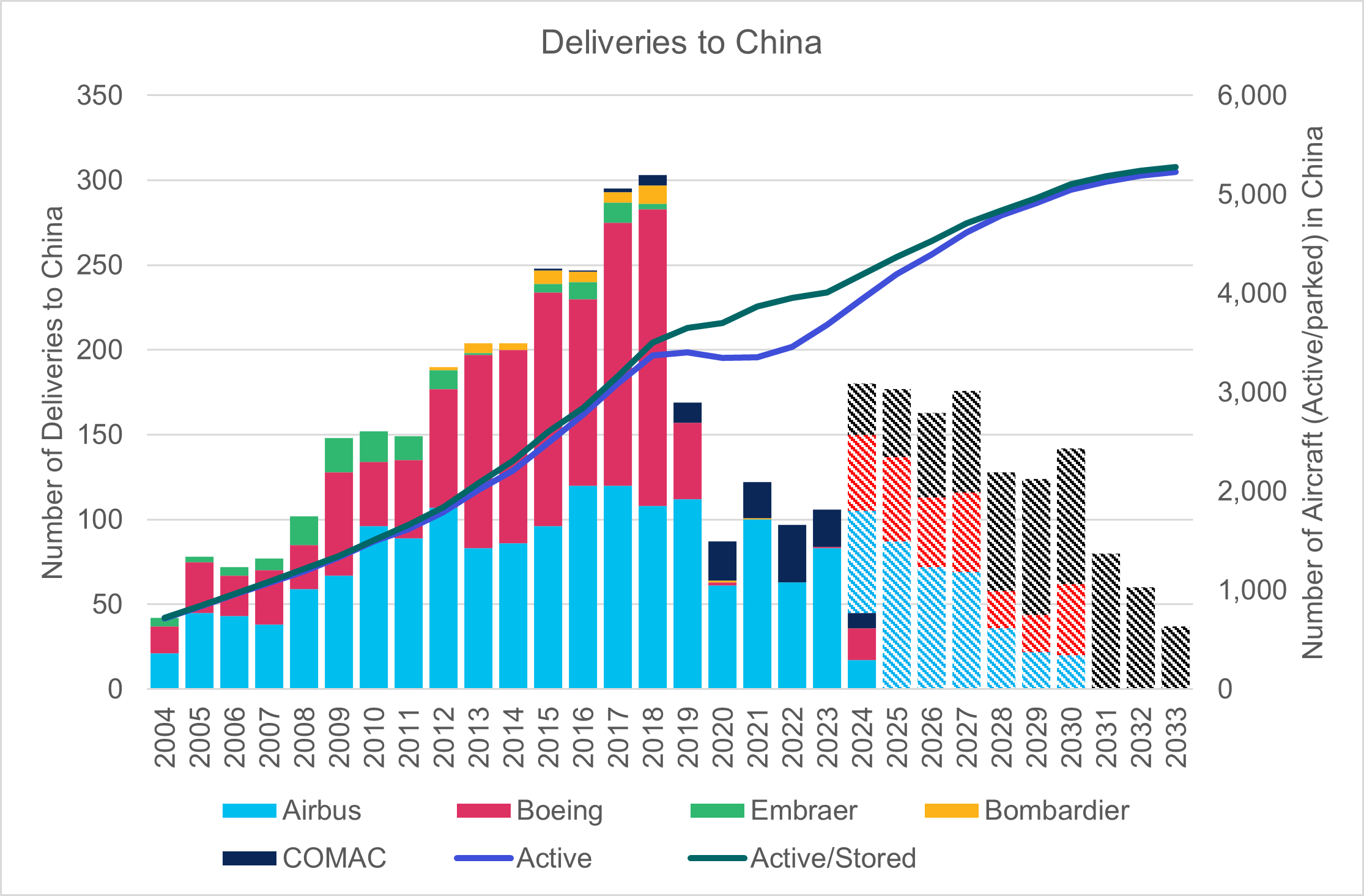

In terms of new orders and deliveries, it has been more challenging. Poor operator results and strained relations between China and the USA have funnelled new orders to Airbus and COMAC. However, deliveries of delayed 737 MAX aircraft have stepped up since the start of the year such that Boeing has beaten Airbus in terms of “deliveries” for Chinese operators. This is significant considering that the last time we saw any volume of Boeing-produced aircraft was back in 2018 when it wasn’t unusual for Boeing to take the delivery lead. Since 2020, the delivery process has been flat, in line with the number of aircraft sitting in storage. From this year though, we expect deliveries from Airbus to get to 50-75 units per year, 50 from Boeing and the remaining number coming from COMAC.

Source: IBA Insight

On the face of it, fleet growth also appears subdued, however, I expect a proportion of the undisclosed backlog is pencilled in for China and we just can't see it. However, if we factored in the undisclosed order book, we would continue to be somewhat off the path laid up until 2029. On the aircraft in storage or parked up, about a third are GTF-powered A320 family (102), whilst only a handful of MAXs (5) aren’t in full airline operation. What is telling though is the apparent high proportion of storage for specific operators versus others.

Whilst some big operators like China Southern, China Eastern, Hainan, Shenzhen and Xiamen are generally above 94% fleet activity. Air China has >10% of its fleet in storage, whilst others like Sichuan or Tianjin Airlines are above 15% and 20% respectively. The worst affected from a relative standpoint remains Air Guillin which has seven of its 10 aircraft inactive. So, whilst domestic capacity overall has well and truly recovered, regional pockets continue to perform poorly despite a high proportion of common ownership. Naturally, the lagging intra-regional recovery is playing its part too.

The freighters are arguably worse with storage exceeding 18% from a longer-term position of just 6%. However, whilst household spending remains cautious and exports remain depressed, freight recovery remains on hold.

As usual, the US Airlines Q1 results are first out of the block, whilst many airlines are still yet to report their annual results. This quarter we saw the 737 door plug issue with the backdrop of the GTF engine groundings still at their height. This has significantly limited the capacity of some airlines, but the effects seem to not have affected the carriers uniformly. United and Delta report improvements in 2023, whilst Spirit has lamented the issues pulling them further under. It is first important to note that Q1 is the weakest quarter for the US market. Whilst the Americas are not as seasonal as Europe, the quarter has represented 21-22% of the region’s annual revenue for the last two years. Therefore there is an expectation that subsequent quarters will compensate.

Continuing from their lead in the annual results, Delta stood out in Q1. Although their Q1 net income of US$37m was slim (margin 0.3%), this was a big swing from the US$363m loss (margin -2.8%) of 2023 Q1. The airline has 55 A321neo aircraft that could be affected by the Pratt and Whitney engine issue, however only 2 are currently parked. Delta is likely benefitting from an in-house MRO facility, licenced for the PW100G type. The airline was able to up revenue by 6.9% YoY, with premium again outperforming other products (up 10%). ASKs were up 6.8% with load factor also up 2.1% to 82.7%.

United Airlines did not paint quite as rosy a picture, with a net loss of US$124m (margin -1.0%) although this was also an improvement on the US$194 (margin -1.7%) of 2023 Q1. The airline also hastens to add that they estimate the 737 MAX 9 grounding cost to be US$200m and would be in profit otherwise. The airline also upped revenue by 9.7%, with ASKs up 9.1% and load factor marginally up (0.2%) to 80.1%. However, the main story around United isn’t their results so far, but for the coming year. They have revised aircraft 2024 delivery estimates from 183 (at the end of 2023), down to only 66. This will affect capacity forecasts and significantly hamper profit (although fare inertia may compensate somewhat). Perhaps to highlight their chagrin with Boeing and the 737 MAX 10 delays, the airline signed an LOI for 25 A321neo leases for 2025 and 2026 this week.

Spirit Airlines has not formally reported its Q1 results but is already guiding to a net loss of $148 million. This is less than the likes of Delta, however, with forecast revenue of US$1.3bn, this represents a much larger net loss margin of 11.4%. This is deeper than the 7.7% net loss margin of 2023 and sustained losses will hurt the carrier’s liquidity. Spirit has already deferred 2025 and 2026 A320neo deliveries and plans on furloughing 260 pilots from September. An extra detail that will sting is that it has been revealed that the $150-$200m compensation they will receive from Pratt and Whitney will largely be in the form of future maintenance credits. One of the first lessons in economics is money now is better than money later. It is not certain Spirit will get to see that compensation!

The recent Amsterdam Court ruling against KLM's environmental messaging highlights a growing awareness of greenwashing, with advertisements making vague and general statements about environmental benefits. Specifically, painting an ‘overly rosy’ picture of the effects of their sustainability strategy. "Those measures only marginally lessen environmental impacts and give the wrong impression that flying with KLM is sustainable", the court said, requiring more concrete evidence of sustainability efforts. At the recent A4E Summit in Brussels, Air France-KLM CEO Ben Smith responded by saying that KLM’s fleet renewal and SAF uptake is a perfect example of concrete actions.

Not only does this ruling highlight potentially unethical business practices, but it is also a call for more stringent policies in the context of global aviation. CORSIA comes to mind; it is designed to pressure airlines into offsetting carbon emissions but places significant reliance upon the voluntary carbon market, the legitimacy of which remains a subject of considerable scrutiny. While the court did not mandate specific changes to KLM's messaging, the ruling serves as a powerful reminder that companies must back up their claims with concrete airline emissions data and transparent methodologies.

For an airline like KLM, which has shown significant commitment to its transition plan, claims like these can be extremely damaging. With public knowledge of the validity of offsetting increasing, airlines must start leveraging their growing data capability to provide effective marketing on actual progress.

Want more aviation ESG news?

Our regular update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

Recovery by World Region.png)

You need quick, intuitive access to the absolute best aviation data and intelligence available. Our products are designed to provide you with seamless and simple analysis, prompting better asset decisions, enhanced management of risk, and a full understanding of aviation decarbonisation strategies.

IBA provides specialised valuation services to a wide range of commercial and corporate clients including leading aviation finance and leasing companies, aircraft operators, OEMs and MROs. For more than 30 years, our experienced valuations teams have offered valuable insight, best-in-class data and opinion on aircraft financing and investment, aviation risk management, environmental reports, lease values, and fleet planning across various stages of economic cycles.

IBA provides specialised aviation consulting services to a wide-range of commercial and corporate clients including leading aviation finance and leasing companies, aircraft operators, insurance firms, lawyers, OEMs, and MROs.