15/11/2021

Average CO2 per seat per mile remains flat, despite growing global aircraft

15th November, 2021: IBA, the award-winning aviation advisory and intelligence company, has today revealed its latest monthly Aviation Carbon Emissions Index in association with KPMG.

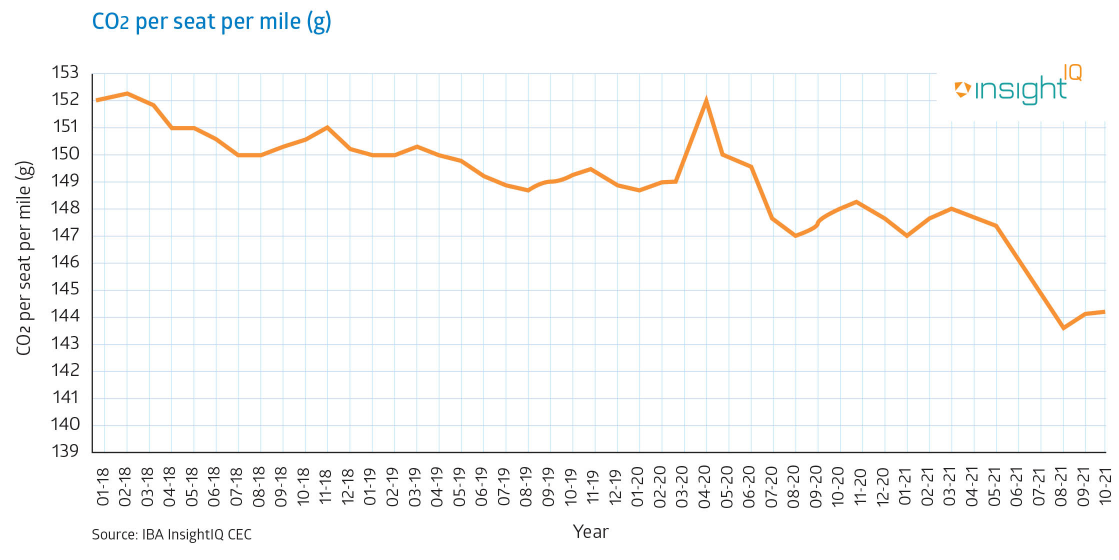

IBA's latest analysis demonstrates the aviation industry's efforts in driving further efficiency in their fleets. IBA's October Carbon Index shows that:

The top 5 most operated passenger aircraft, ranked by their share of total CO2 emissions, for October 2021, are:

Out of the largest 30 lessors, the top 5 with the lowest average CO2 per seat per mile for 2021YTD are listed below.

The AerCap acquisition of GECAS has created a 'super lessor' within the market and thus the merged portfolios represent over 2,200 aircraft with a largely varied blend of asset types. Prior to the acquisition, AerCap was recorded at 133g CO2 per seat per mile for 2021YTD, which has then increased to 138g CO2 per seat per mile since the merge.

This month, IBA has produced a spotlight on the airlines with the best performing fleets in terms of CO2 Per Seat Per Mile in the Asia Pacific, Latin American and Middle Eastern regions. These are as follows:

The top 50 airline average score for the Asia Pacific region is 151.3g of CO2 per seat per mile.

The top 50 airline average score for the Latin American region is 142.0g of CO2 per seat per mile.

The top 50 airline average score for the Middle Eastern region is 149.6g of CO2 per seat per mile.

Each month IBA, publishes its Aviation Carbon Emissions Index, tracking overall industry efficiency, with spotlights on aircraft types, airlines and lessors, accompanied by an analysis of related trends. The Index uses the widely accepted measure of CO2 per seat per mile / km, and IBA's impartial and independent measurement methodology, to produce emissions figures that match airlines' own reporting at more than 99% accuracy.

Ian Beaumont, Chief Executive Officer of IBA, says: "IBA's Carbon Index is designed to highlight how the aviation industry is working to lower global emissions, whilst providing cohesive, comprehensive insights that drive awareness of the sector's green credentials."

"As aviation opens up, it is fascinating to track flight efficiency developments now that more aircraft are back in service. Naturally, the industry kept the most fuel-efficient aircraft flying throughout the pandemic to keep costs down, but will now need to put more fleets back in the sky. Equally, there is a race to upgrade fleets with the latest generation aircraft, and it'll be interesting to see which driver wins out over the coming months."

Using information from IBA's InsightIQ aviation analytics platform, IBA calculates the Aviation Carbon Emissions Index by tracking each and every commercial flight across the globe on a daily basis. It combines this flight information with airport-to-airport Great Circle distances, and integrates this with its proprietary InsightIQ Fleets database that includes the configuration, specification and fuel burn characteristics of all commercial aircraft and engines.

Chris Brown, Partner of Aviation Strategy at KPMG, says: "Fleet planning and selection, with the 'right' aircraft at the 'right' time for the 'right' route is critical. As the pressure for further fuel efficiencies intensifies, retrofitting incremental improvements to engine, wing and fuselage will become more commonplace, and as such the futureproofing of new plane designs becomes all the more important. That's a design challenge for OEMs, and a due diligence consideration for lessors."

Notes to Editors

Further comment / interviews

Ian Beaumont, Chief Executive Officer of IBA, is available for interview to offer further comment and insight.

About IBA

IBA has over 30 years' experience in delivering independent, expert business analysis and data on the aviation sector. Established in 1988, it provides a wide range of services including InsightIQ, a one-stop intelligence platform combining speed, accuracy, visual analytics and intuitive navigation

IBA advises prominent investment funds and banks, aircraft leasing companies, operators, manufacturers and MROs. In January 2021, IBA was named 'Appraiser of the Year' by Airline Economics.

IBA media contacts

Charlie Hampton / Alisha Pyzer

Email: [email protected] / [email protected]

Mobile: +44 (0)7884 187297 / +44 (0)7557 528922