12/06/2023

Over the past few weeks, we have been focusing heavily on supply chain, order rumours, regional growth, ESG, rising costs, failures pointing the blame at reliability and strengthening airline results; probably the key factors that have so far defined the mood of 2023. That mood has a chance to thoroughly express itself in one week’s time as we head to Paris Air Show after a four-year break.

So, IBA has been focusing on considering all the rumours and other key factors, and combining them with our own analysis to develop our customary pre-show predictions.

Of course, as we all know, deals aren’t struck at air shows. However, they are the public face of where airlines and lessors can play their hand in securing future market share, the primary PR events for OEMs across all aviation sectors, and serve equally well as the industry barometer to close off the first half of the year.

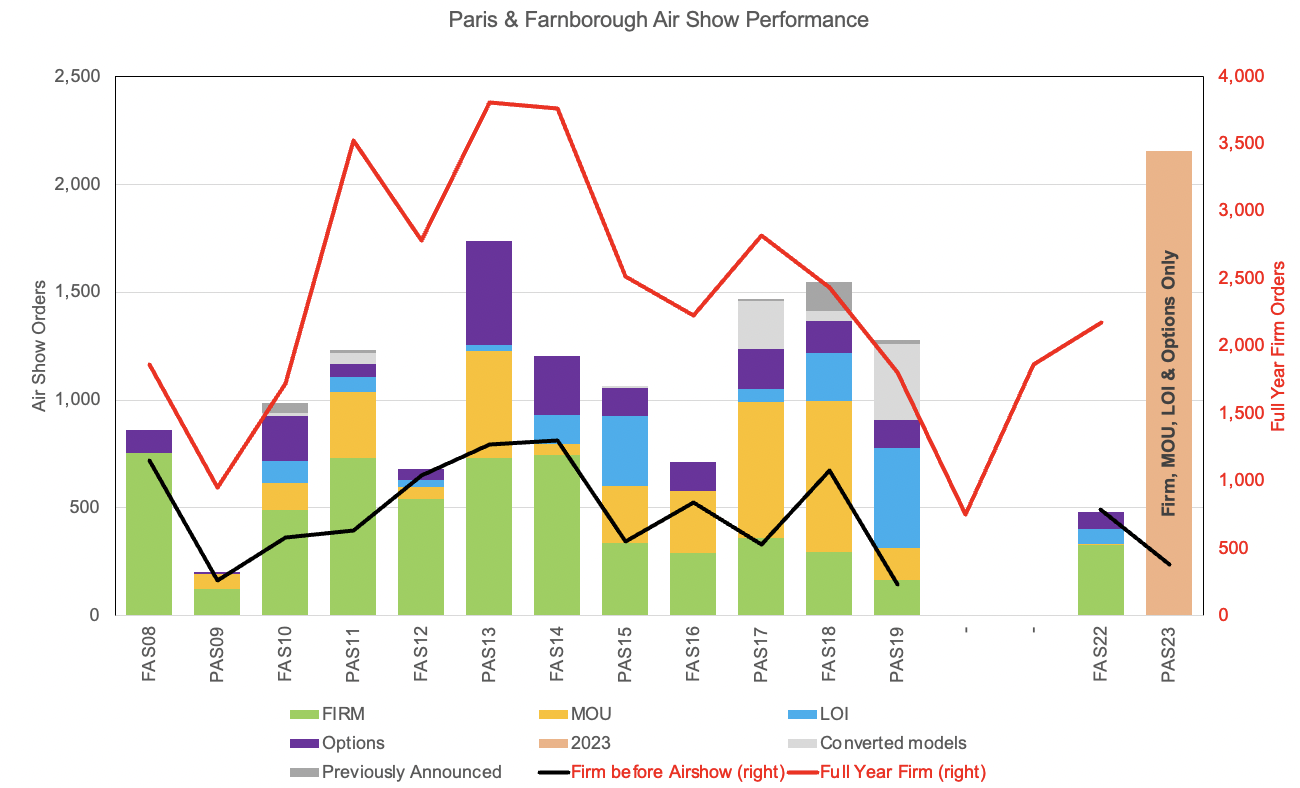

Firm order levels thus far in 2023 have been largely below par when compared to any other year before 2019, which probably isn’t that surprising given that delivery slots for narrowbodies are in a different decade for ‘normal’ customers. Even in 2019, which was considered a good year, there was a very poor pre-show firm order tally leading into the start of the week. This was due to oil price being down, and as many of the largest customers had secured large portions of the backlog already.

This in essence was the end of a trend that had started from the peak year 10 years ago at the Paris 2013 show when most orders announced both before and during the show were firm.

Looking at this year, for Airbus, aside from the restoration of the Qatar Airways A321neo (50) and A350-1000 (23) orders, the remaining gross firm Airbus orders add up to 105 with nothing really standing out as stellar. For Boeing, it’s slightly better at 154 (at end of April) – again nothing really jumping out except the relatively high level of unidentified customers appearing on the list once again.

In terms of what customers are ordering, despite the vast number of in-family options available and rhetoric highlighting that it’s a battle of just a few distinct models, there appears to be a good spread of all aircraft types being selected rather than one stand-out clear winner (although the absence of any firm Boeing 777X orders this year is apparent). This is possibly a sign that operators are feeling their way through how to build fleets tailored to specific markets, and again possibly a reason as to why the order levels are quite small on the firm side.

Source: IBA Insight & Intelligence

Taking historical trends into consideration, which is not necessarily a good place to predict the future from, air show activity broadly follows firm lead-up and firm full-year activity. If that was solely the case and we only took the firm orders into consideration, the outlook for orders would remain grim.

MOUs and LOIs grabbing headlines already

The same story, however, cannot be said for the MOU/LOI (memorandum of understanding / letter of intent) situation which has certainly grabbed the headlines already this year. Back in February, many of us were taken aback by the sheer size of the Air India order covering pretty much everything the OEMs had to offer (including the Boeing 777X). Now, we knew that Air India had to re-fleet, but moving from a fleet just above 100 to placing an order for 470 plus 70 options is quite a jump for a mature full-service carrier that had maintained a steady in-service fleet (factoring in Indian Airlines) for such a long period.

Following that in March, we had the announcement from Saudi Arabia for 78 Boeing 787s (plus 43 options) to be split between Saudia and the new start-up Riyadh Air, confirming that there is more to the Middle Eastern connection model than just the big three.

Finally, last month Ryanair placed their MOU for 150 Boeing 737 MAX 10s (plus 150 options) which is likely to be approved at its September AGM.

All in all, that’s 961 potential orders of which Boeing will take the majority share and itself covering more than a full year of production.

In terms of Paris announcements, we would therefore expect there to be something to cover the Air India and Saudi orders if nothing else – which would make the tally pretty good based on historical levels. But then there are the countless announcements and rumours that have been doing the rounds in the background. These paint a picture of a much wider commitment to growth and if fully transacted, will highlight the need for vast infrastructure investment that doesn’t yet exist today.

Turkish Airlines / Middle East

The first of the bombshells was the announcement from Turkish Airlines (THY) that they will be ordering up to 600 aircraft (including options) covering 400 single aisle and 200 widebody aircraft split between both Airbus and Boeing. THY have not been shy about their growth aspirations to restore Turkey as the gateway to Europe. However, so close to the Middle Eastern hub (at a point when large orders are already emerging from new entrants there) will undoubtedly trigger a counter-reaction from the big three who all have deep enough pockets to withstand any sort of price war. Good for consumers though!

Already, Sir Tim Clark has indicated that Emirates will continue placing orders for twin aisles from the pool of options available as the A380 retirement process won’t start until 2032. Whilst an Emirates order is possible at Paris, I’m of the view that it is a little early still and it is more likely to occur at the Dubai Air Show later in the year instead. For Qatar, they already have 197 remaining on backlog still covering just about every option, so possibly another big order to expect for later in the year.

India

No sooner had we caught our breath on the THY order, that IndiGo then indicated that they were planning on placing a 500 aircraft order to capture growth both within India and further afield, and that’s on top of the 488 they still have on backlog! I don’t doubt the ability for India’s capacity for growth, but how on earth will the infrastructure be able to catch up? One thing to consider with IndiGo’s business model though is that they typically only retain aircraft within their fleet for six years before returning them to the lessor, so ultimately the total fleet count won’t be additive in the same way as the vast majority of other operators in the world. It does however highlight the expectation that lessors will be preoccupied for years to come on transacting sale leasebacks, and lease turns for these aircraft. To add the cherry on top, Akasa’s CEO tweeted back in March that they would be placing a triple-digit order too! What these actions build in our minds is that by the end of the decade, the available capacity between Istanbul and Kolkata will be off the charts.

Europe

Turning back to Europe, aside from Ryanair and THY, there have been a number of other rumours circling recently about potential activity that may culminate in some orders in Paris this year. Just when we thought Turkey was going to get busy, Pegasus have hinted at further expansion for aircraft deliveries beyond 2027 with another Airbus single-aisle order. Whilst moving north, LOT Polish could come through with some regional jet replacement, and airBaltic are rumoured to be expanding its A220 fleet beyond the recent exercising and placement of more options. Moving to the large groups, whilst incremental orders are commonplace, the level of ordering activity coming from others within the region is likely to trigger some sort of response to protect market share.

AirFrance/KLM could potentially announce a number of orders to cover replacement and growth for themselves and other members of the group. There is still a large 100 aircraft LOI that requires firming on the A320neo for Air France, whilst KLM need to address its ageing twin-aisle fleet replacement strategy. Similarly, the Lufthansa Group and IAG still have some areas to address. Ageing fleet populations within their group structure and outstanding LOIs that could be firmed up covering regional, single-aisle and twin-aisle operations. Whilst they may or may not be part of groups, I also expect a few orders from the smaller LCC/leisure space who are maintaining an ageing fleet and/or expanding at a strong rate– such as Transavia, Eurowings, Volotea, Smartwings, etc. Finally, to the far north west, Icelandair are expected to firm up its XLR order.

Americas

For the Americas, I see less activity in volume terms occurring in Paris compared to that coming from other regions. Delta could potentially jump in with a twin-aisle order for 50 A330/A350s as they continue to develop their Airbus relationship. Similarly, I could easily see Hawaiian placing a small top-up order too. North of the border, Air Canada are rumoured to be firming up a 20 Boeing 787 order to add to their backlog, whilst in Latin America, rumours are circling that Aerolineas Argentinas could be ready to place an A330-900/ Boeing 737 MAX order too.

Asia Pacific

Moving to the Asia Pacific region, it is no surprise that orders have been light over recent years given the effect the Covid pandemic had on its intraregional and long-range traffic. Even today, capacity on traditionally heavy routes still has some way to go before recovering to 2019 levels before systemwide growth can be addressed. However, orders placed in 2023 are not to assist with recovery today, but future growth aspirations, so it should be no surprise to hear that I expect some activity to come from the Pacific and Southeast Asian regions.

Starting from the northernmost point, both ANA and JAL are rumoured to be expanding their domestic and intraregional capacity to A321neos and more Boeing 787s. However, I feel that Paris may be too early for that call to be made. Similarly, it might still be too early to call any Chinese expansion yet given the political climate, but I wouldn’t be surprised to see top-up orders coming through.

Next are Malaysian and Thai, two operators that have gone through some major restructuring over recent years with the former already engaged in fleet replacement, whilst Thai have been in major fleet shrink mode since 2020. I expect Malaysian to be looking to firm up an A330 order, whilst Thai are thought to be looking to buy 30 new twin-aisles to replace the ones they ditched.

Finally, the last one I have for the region is Air New Zealand. Though I haven’t heard any specific rumours, they have expanded considerably over the past five years and will want to maintain that growth with a top-up.

China

The other potential announcements that may come in from the Chinese market could be for more COMAC aircraft. The Chinese OEM has cited a large list of undisclosed action for 2022 and even added a substantial order from Hainan Airlines this year that could expand into more detail at the air show. Aside from China itself, potential orders could arise from other regions such as Indonesia although Paris may not be the likely forum for that.

Freighters

Whilst not covered from a geographical point of view, factory freighter orders will likely make some dent in the final tally. Whilst hard to pin down to absolute specifics, I expect several single-digit orders for 777-8F and A350Fs over the course of the week. Possibly less so for the conversion market as that is shorter-term and up against dim revenue forecasts.

Lessors

The one thing not mentioned in anything above is potential lessor activity at the show. Of course, it wouldn’t be Paris without the customary ALC order, possibly to cover some of the twin-aisle orders already mentioned above, or perhaps with a Boeing 737 MAX 10 order. There has yet to be a direct order on that model so far from the leasing community and it wouldn’t be the first time for ALC to start the ball rolling.

Similarly, we could see some action from the other giants such as AerCap, SMBC or Avolon, but given the potential for such large orders coming from the operators, there will be no shortage of sale-leaseback activity coming down the pipe. Overall compared to the operators, I don’t feel any lessor orders will be large given the position of inflation and interest rates and it may take a few years before we see the same level of speculative activity as seen over the low-interest period from 2010.

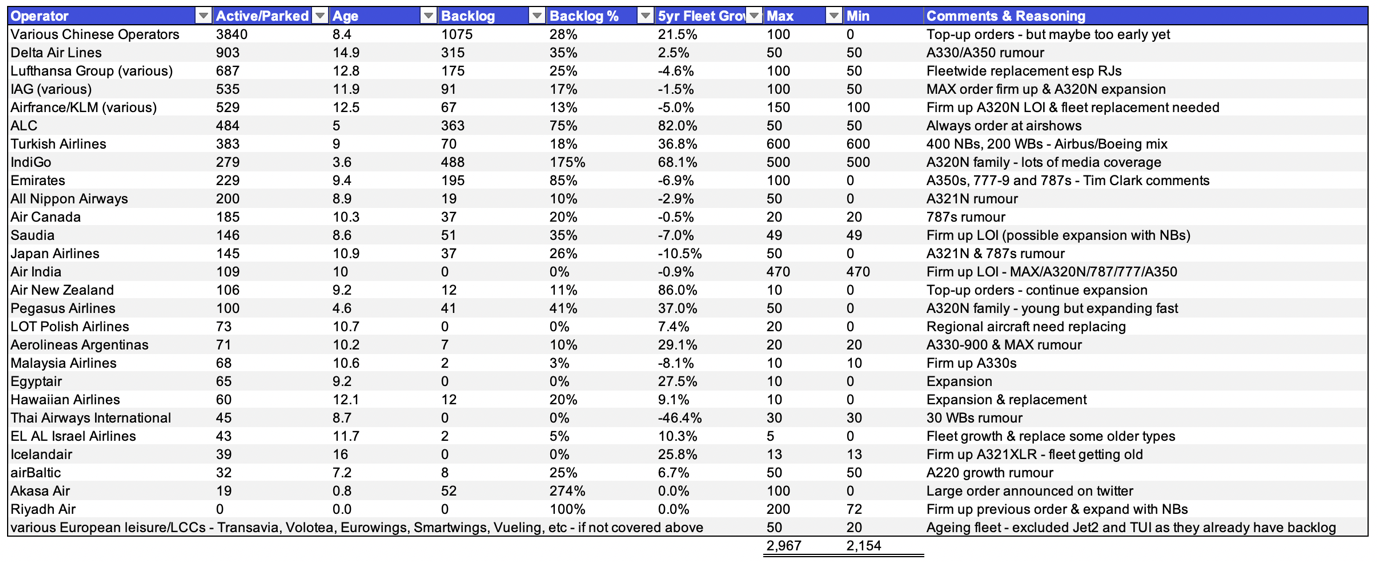

So, once I total up the full list, we get to a number just shy of 3,000 which sounds crazy and way above anything seen in the past, ever! Naturally, I don’t expect all of this to come in, plus there will be further activity from other areas not already covered. When coming up with the full list, I relied upon those IBA was aware of, those that were rumoured, and those coming from IBA’s fleet analysis of just who out there needs to consider their fleet replacement and growth given regional competitive tension or because their fleet is ageing.

However, we can’t rule out that the speculative lessor orders booked in the past will be providing a good proportion of the interim lift before any of these orders deliver, and not considering that all airlines will require the lessor community to step in and shoulder the ownership burden too.

As mentioned in previous IBA Weekly newsletters, the Turkey, Middle East and India region is an area that could potentially see orders shooting past the 2,000 mark, which will require both heavy infrastructure investment and asset ownership investment alike. Aside from grabbing market share, we expect large orders to make a dent in the ever-expanding ESG issue.

For those focused on maintaining residual value, then there has always been a priority focus on the youngest fleet from the largest lessors and banks, but investor and government pressure widens that. Of course, new technology usually means new reliability problems too, but at this stage in the game, the industry remains hopeful that many of the wrinkles will be ironed out by the time these orders are fulfilled.

It also feels like there is a lower likelihood that any major technology announcements will be made by either OEM this time too. It was rumoured that Airbus would come out with the A220-500 but that was flatly denied at the time. It could be a big bluff by the Europeans, but then if the order prospects for the existing fleet are expected to be high, why would you do it now? Some positive news from Boeing would be good – along the lines of light at the end of the tunnel regarding certification, or more news surrounding the future of 767 Freighter new deliveries in the lead-up to the 2027 deadline.

From the total list, there are also a fair number of potential orders coming the way of the regional OEMs too, and they have been factored into the comments in the final table below. The regional operators as far as I can see are the ones most in need of fleet replacement. From a per-seat per-mile basis, regional jets are the most affected from an ESG perspective, whilst relatively low from a total CO2 point of view. They have the oldest fleets, and many airlines are heavily dependent on out of production aircraft that are close to or have reached their natural cyclic lives. Aside from the obvious US fleet replacement that falls against scope clause obstacles, other operators like Lufthansa and LOT will be considering where to go with their replacement/expansion options.

Source: IBA Insight & Intelligence

If I factor everything in, we could get to a number close to 3,000, which I think would be lunacy. Even if I trim that down to the ones most likely to firm up, I get to 2,154 which still sounds high based on precedent and prevailing economic conditions.

However, when have airlines ordered rationally? They order when they have cash, they get the aircraft when they don’t and are faced with placing orders without knowing the full extent of what their competitors will be doing due to the unfeasibly long backlogs and lead times involved.

It's not a question of receiving the aircraft potentially in the next downturn, it's more a question of which future downturn they will receive them in. These are not orders for the 2020s but for the 2030s! This time it feels like a race to grab market share in unproven markets based on long-term predictions that have yet to show their full potential. It might be lunacy based on conventional thoughts, but we are not living in conventional times.

- Ends -

Comment requests

Dr Stuart Hatcher is available for further comment. Please contact Charlie Hampton / Faye Clarke at the email / numbers below.

About IBA

IBA delivers the best of all worlds - deep aviation consultancy expertise, and cutting-edge and actionable data insights, all delivered by a proven, expert team with a strong customer focus.

An independent, innovative and forward-thinking business, IBA has over 35 years of heritage and experience in aviation. Having won the Sustainable Technology award for its IBA NetZero platform in 2023 and for its Carbon Emissions Calculator in 2022, and being named 'Appraiser of the Year' by their clients for five years, IBA prides itself on its integrity, fierce independence, and continual innovation.

The key to IBA’s success is its people – some of the best in the industry, based in multiple locations across the globe – real experts who are passionate about aviation and go the extra mile for their clients.

IBA media contacts

Charlie Hampton / Faye Clarke

Email: [email protected] / [email protected]

Mobile: +44 (0)7884 187297