12/03/2021

Jie Zhou, Senior Aviation Analyst, IBA Advisory, uses InsightIQ intelligence to explore the potential impact for aircraft leasing following the announcement of AerCap's intention to acquire GECAS.

AerCap's announcement on 10th March 2021 of its intended acquisition of GE Capital Aviation Services (GECAS) will, if approved, give it a 54% holding of a superpower lessor which owns and manages an in-service fleet approaching 2,100 aircraft, has an order backlog of more than 500 units and an aggregate customer base of nearly 300 operators. As announced by both parties, General Electric-owned GECAS will receive USD 24 bn in cash from AerCap along with USD 111.5 m newly issued AerCap shares and USD 1 bn AerCap notes/cash. With diverse geographical distributions and varying customer base and asset type exposures, what impact will a leasing giant in control of almost 14% of the entire fleet have on the aviation sector and rival lessors?

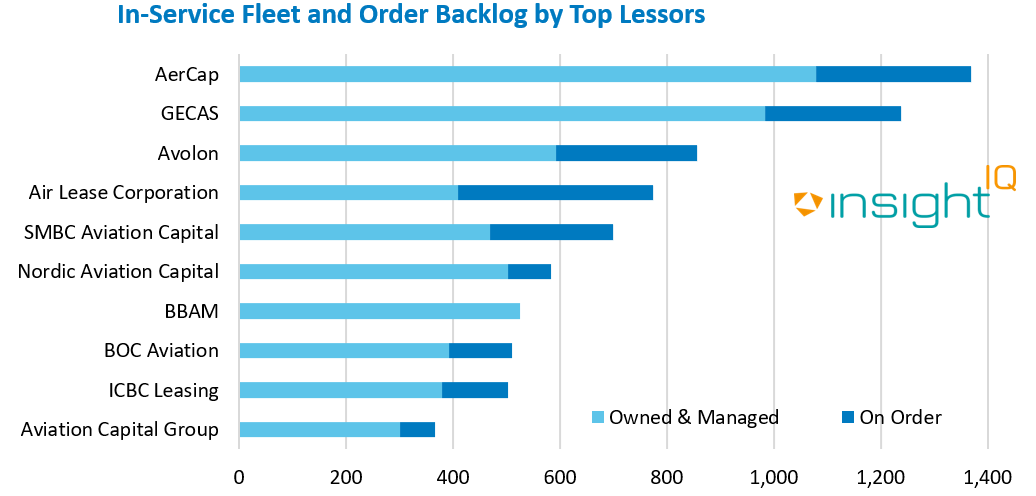

IBA has harvested data from its aviation intelligence platform InsightIQ to capture a clearer image of the acquisition's effect, involving as it does the top two aircraft leasing companies in the aviation industry. The leased aircraft fleet has recorded significant growth over the last decade. As of March 2021, InsightIQ shows the in-service leased aircraft fleet represents nearly half of the overall in-service fleet. Before this acquisition, the aircraft leasing market exhibited a relatively high concentration. As indicated by the chart below, the 10 largest aircraft lessors by in-service fleet size and order backlog currently make up nearly 40% of the overall leased aircraft fleet. Among the top 10 lessors by fleet size, half are based in Ireland: AerCap, Avolon, SMBC AC, NAC and GECAS (Dublin and Norwalk based). Three are American leasing firms: BBAM, ALC and ACG and the remaining two are based in the Asia Pacific region: ICBC and BOCA, which are headquartered in Beijing and Singapore respectively.

InsightIQ's data identifies AerCap and GECAS as the leading two lessors by fleet size, owning and managing in-service fleets of 1,080 and 984 aircraft respectively. Overall, AerCap and GECAS's fleets represent 7.2% and 6.6% respectively of the worldwide leased fleet and the acquisition would therefore result in a total combined fleet of approximately 14%. Both lessors have a convergent strategy; most of AerCap and GECAS's backlogs are heavily weighted towards narrowbody aircraft. 79% and 92% of their orderbooks respectively involve narrowbodies.

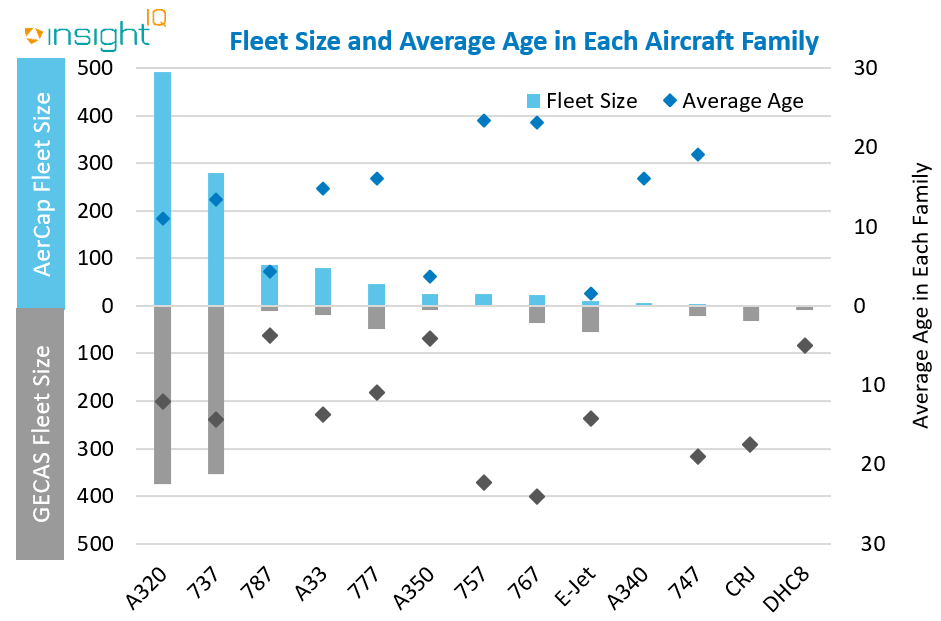

The deal could consolidate the different ownership and management strategies followed by each aircraft lessor. AerCap and GECAS have similar distributions of narrowbody aircraft, AerCap currently owning and managing a fleet that includes 72% narrowbody aircraft, 64% of which belong to the Airbus A320 family. GECAS meanwhile owns and manages a fleet comprised 75% of narrowbody aircraft which is well distributed between A320 family and Boeing 737 family aircraft. In terms of other aircraft classes and roles, AerCap has a larger widebody exposure at 27% of its entire fleet while GECAS has more presence in the regional and freighter markets. Both lessors have order books with Boeing 737 MAX, Boeing 787, Airbus A320neo and Embraer E2 family aircraft as the types dominating their backlogs. GECAS though has a more diversified order backlog, as it also includes Airbus A330neo family, COMAC C919 and ARJ21 models.

The most common widebody aircraft type in AerCap's fleet is the Boeing 787, numbering around 86 units and representing 8% of its overall fleet. The Airbus A330 family aircraft follows at approximately 79 examples which makes up around 7% of AerCap's portfolio. The average age of these A330s is relatively high at nearly 15 years. Conversely, the Irish American lessor has a lower exposure to widebody aircraft at only around 15% of its overall owned and managed fleet. Most of these widebodies belong to older generation aircraft families; GECAS' fleet currently includes 36 Boeing 767 aircraft with an average age of over 24 years and 21 Boeing 747s whose average age is close to 20 years. Comparative data collated by InsightIQ shows that, unlike GECAS, AerCap has focused primarily on newer generation widebody aircraft, both Boeing 787 and Airbus A350 families representing only approximately 10% of its portfolio.

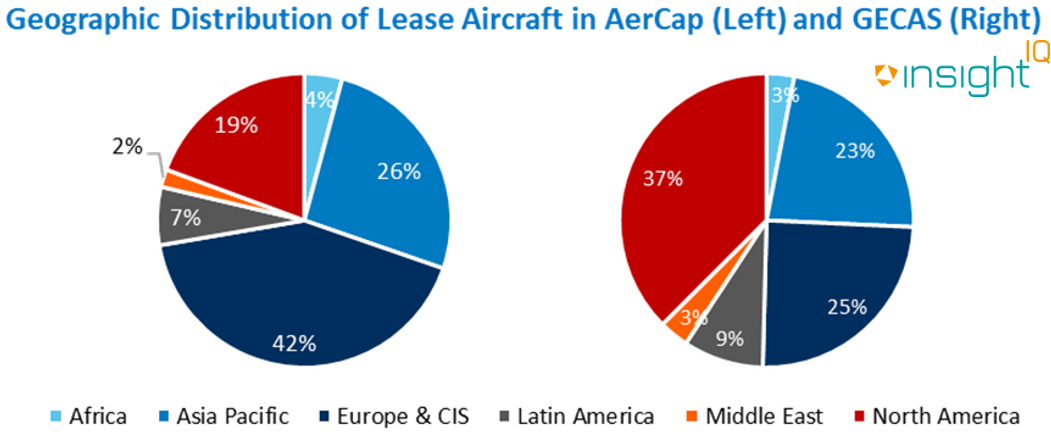

InsightIQ Fleets demonstrates the geographical distribution of AerCap and GECAS's leased aircraft highlights two distinct market approaches. While the lessors lease similar aircraft numbers to operators based in the Asia Pacific region, AerCap has a much higher exposure to the European market. Europe forms around 42% of its overall portfolio. GECAS has focused instead on the North American market, having a total operator exposure of 37% in this region. The union of AerCap and GECAS would thus create a well-diversified portfolio in terms of geographical distribution, with balanced exposure to North American and European regions.

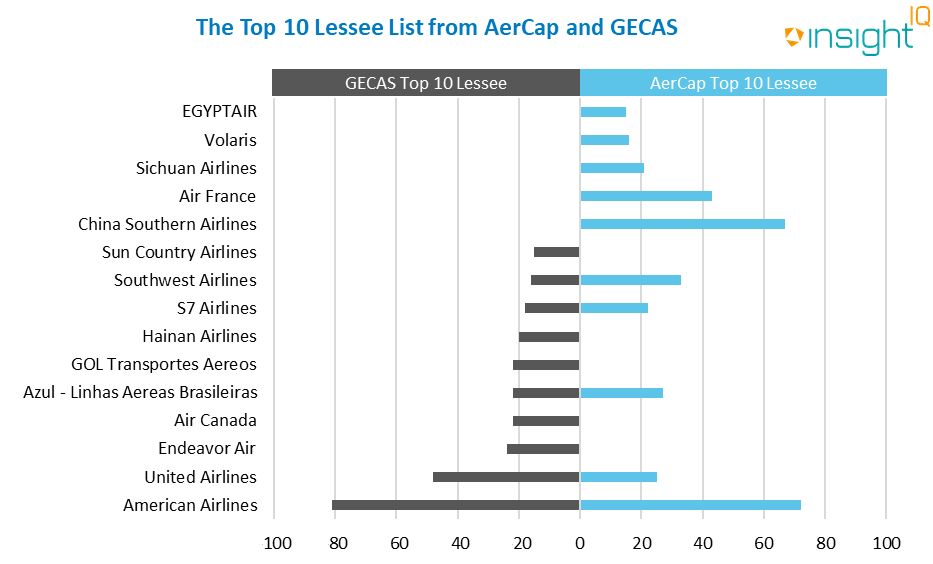

Among the 10 largest lessees of AerCap and GECAS, five operators are common to both lessors. American Airlines is their largest customer; the operator has respectively 72 and 81 aircraft on lease. Of GECAS's 10 largest lessees, seven are based in the North American region whereas only three of AerCap's major customers are North American-based lessees.

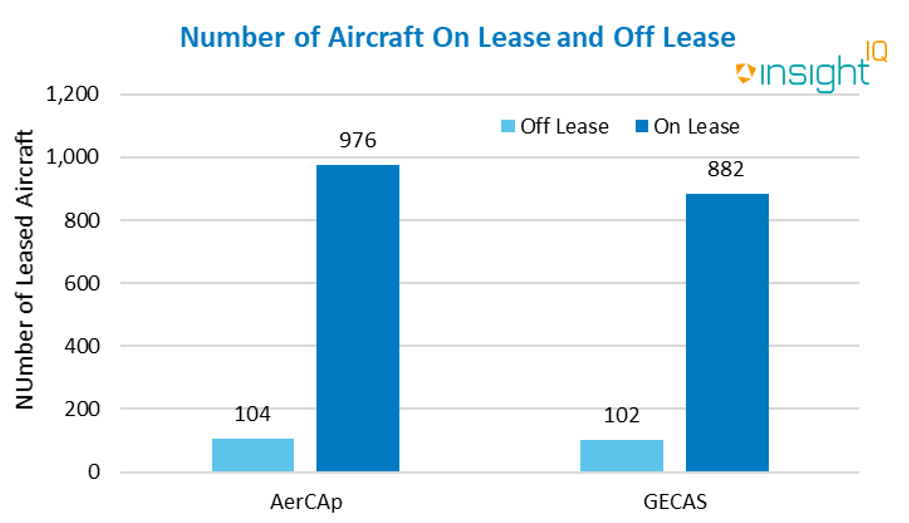

InsightIQ's intelligence reveals, as of March 2021, AerCap and GECAS have a similar number of aircraft off lease: 104 and 102 respectively. The Covid-19 pandemic has caused this number to increase significantly in the past 12 months. In March 2020, Dublin-based AerCap recorded only 35 aircraft off-lease which equates to a 66% YoY uplift. GECAS meanwhile has endured a 36% YoY increase from 65 unplaced aircraft in March 2020.

Combining the world's two largest aircraft leasing companies would create a superpower that owns and manages over 2,000 aircraft, leased to a well-diversified customer base. Together, their strong market position will enable more advantageous negotiating power in contracts with the OEMs for future aircraft orders. The strengthened market presence of the leading two lessors in the world is likely to create obstacles for the names lower down the lessor list. However, similar consolidations are expected in the aircraft leasing industry since lessors have struggled to survive the lease renegotiations and loss of rental income Covid-19 has produced. Lessors have been forced to monitor their own fleets in response to the changing environment, which will undoubtedly lead to significant restructuring activity for AerCap and GECAS during the next 12 months. Consolidation will be necessary to prepare for the recovery in traffic demand which we expect to gather pace in the next couple of years. Considering the combined fleet's size, we anticipate we'll see tranches of aircraft packaged and sold down to manage asset and lessee concentration and to focus on core asset types. The AerCap and GECAS deal remains subject to regulatory approval, and the arrangement is likely to attract scrutiny given their prominent market positions.

If you have any further questions or comments please contact Jie Zhou.

IBA's analysis platform - InsightIQ, flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate, fleet, and flight data eases appreciation of historic and future aircraft concentrations and operator profiles.