27/05/2021

A new batch of P2F converted freighters is currently entering the market but what makes an aircraft appropriate for conversion? Here, IBA considers the factors influencing suitability and anticipates the market's likely direction.

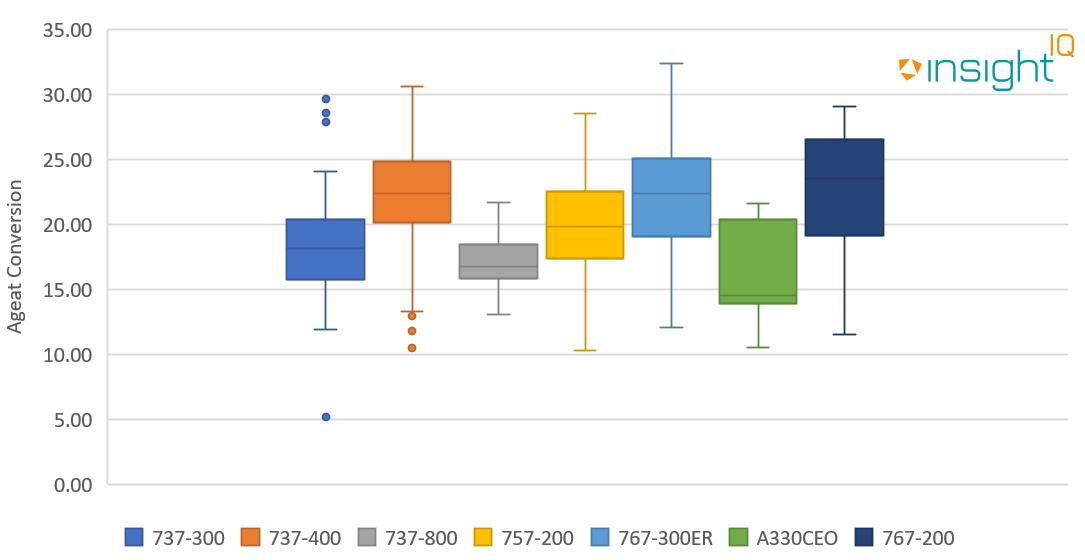

The main factor in conversions is, of course, the asset's age. However, there is no typical age or even age range as each aircraft model will have its own optimal conversion period, largely driven by the level of demand from the passenger market. Demand also obviously feeds into the residual value case for freighters as well as affecting the ease of lease placement for aircraft converted by a lessor. Typically, aircraft are converted when they become available within the passenger market. This has tended to be around 15 years of age and above. However, there have been occasions where IBA has witnessed younger aircraft being converted and, conversely, where aircraft over 30 years of age have been involved.

Airbus A321-200ceo fleet

The Airbus A321-200ceos which have already been converted or are reserved for conversion fall into the 20-to-23-year bracket. The narrow age range is not unexpected due to the newness of the aircraft's programme and the small number of aircraft involved. Boeing 737-800s as young 13 and as old as 21 have undergone conversion and more young aircraft are expected to be converted in the near future. To date, the youngest Boeing 737-400 converted was only ten years old at the time.

Airbus A330ceo fleet

Despite the limited number of aircraft so far converted, the age range for Airbus A330ceos is relatively broad. This has been influenced by declining residual values in recent times, enabling earlier-build aircraft to be acquired for conversion. The youngest A330-300 we have seen converted so far was just under ten years old. This, however, will be surpassed by a soon-to-be-converted ex-Singapore Airlines example which was manufactured only in 2013. IBA anticipates the trend for younger A330-300s to be converted will continue, another recent announcement involving a second ten-year-old example being reserved for conversion. Covid's continued pressure on A330ceo aircraft values increases the type's conversion appeal still more.

Source: IBA's InsightIQ Aircraft Fleet data

As well as age, another consideration is an aircraft's Limits of Validity (LoV) or Design Service Goals (DSGs). The DSG/LOV being the limit, either in cycles and/or hours, which the design of the aircraft has been approved for at which point Widespread Fatigue Damage (WFD) is unlikely to occur, after the limit this cannot be guaranteed. For the Airbus A321-200, the relevant limits are 48,000FC/60,000FH, for non-enhanced Airbus A330ceos, 40,000FC/60,000FH and for those A330ceos which are enhanced, the limit is set at 33,000FC/100,000FH. For the Boeing 737NG series, the LoV is established at 75,000FC. Before an aircraft is selected for P2F conversion, consideration must be given to how many cycles and hours the aircraft will accumulate during its time as a freighter. By accounting for future cycles and hours, any additional maintenance costs that could be encountered in order to action an Extended Service Goal (ESG) can be avoided. Alternative feedstock can be sourced with suitable flight hours and cycles remaining until the LoV or DSG is reached.

Sources of aircraft feedstock for conversion

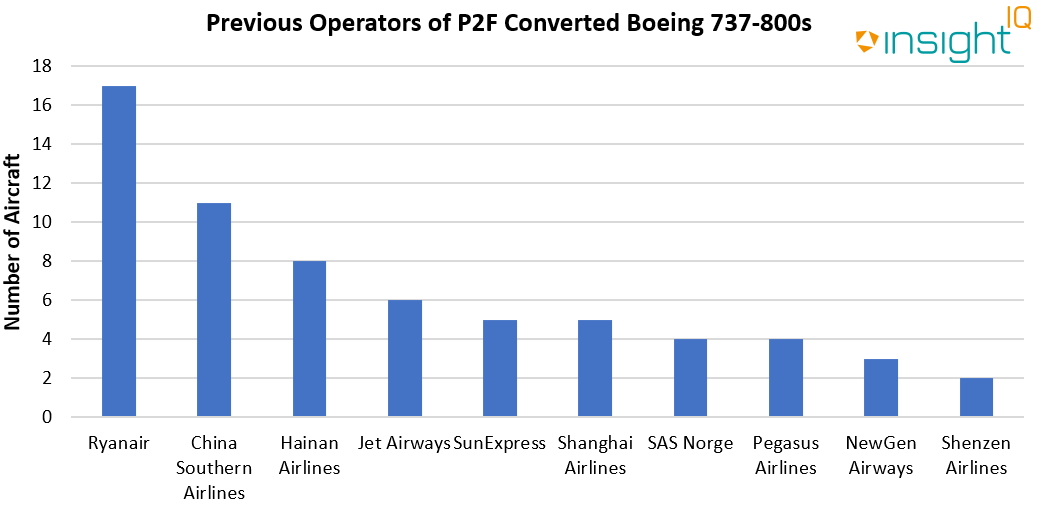

When the Boeing 737-800BCF programme started to process its first aircraft conversions they were all of a similar specification and history, primarily ex-China Southern assets built in 1999 or the early 2000s. Today, the range of aircraft being converted by AEI, Boeing and IAI/Bedek is more diverse; the youngest Boeing 737-800, expected to be converted shortly, is only nine years old. On top of the greater age range, aircraft feedstock sources have also diversified significantly as fleet numbers have grown. Ex-Ryanair aircraft now account for the bulk of the Boeing 737-800 P2F fleet, followed by China Southern Airlines and Hainan Airlines.

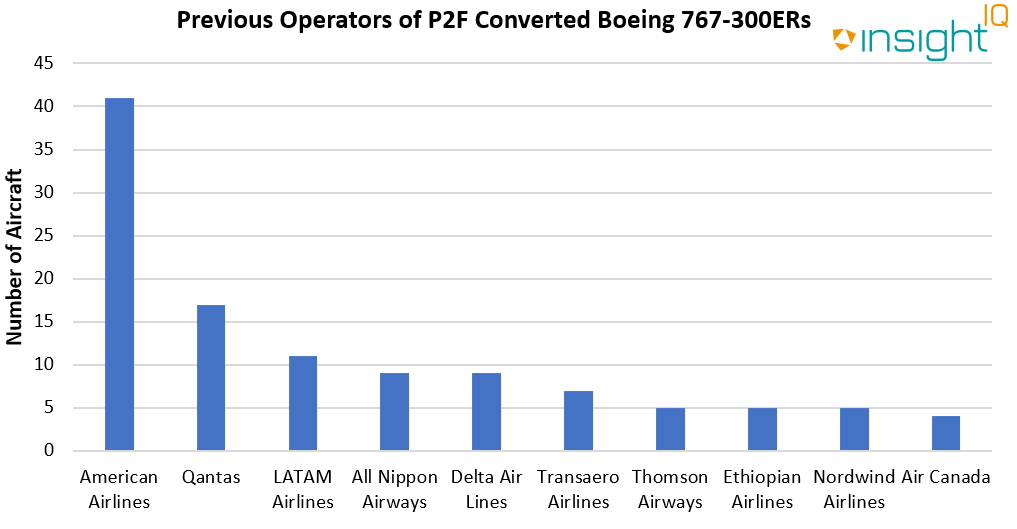

The sourcing of aircraft from a core group of operators should perhaps be expected in these new programmes. We witnessed a similar trend with American Airlines' Boeing 767-300ERs as we're now seeing with ex-Ryanair aircraft. The American legacy carrier was clearly the largest supplier of feedstock into the Boeing 767-300ER P2F programme previously, 41 examples having either been converted or reserved for conversion.

Source: IBA's InsightIQ Aircraft Fleet data

Source: IBA's InsightIQ Aircraft Fleet data

P2F conversion programmes for the Airbus A321-200ceo and A330ceo are likely to ramp up in the near future, particularly in respect of the former as long as feedstock is available. While Boeing 737-800s are being converted at a steady pace as more conversion lines become available, we expect conversion rates will increase subject to aircraft feedstock. With Covid having prompted capacity alterations across the industry and as newer types are entering the passenger market, we believe sourcing adequate feedstock should not be a significant problem for most types. Assuming readily available supplies, we expect aircraft being converted to come from a wider age range. The Boeing 777-300ERSF programme will also have an impact. The prototype airframe is now at Tel Aviv with IAI and we foresee this too will be a healthy feedstock source in future. There are concerns regarding oversupply of the type within the secondary market which, as with the Airbus A330ceo currently, should see assets with residual value enter the wider age range deemed suitable for conversion.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.