17/03/2020

Stuart Hatcher, IBA's COO, says the impact of Covid-19 on airline and lessor finances will lead to a decline in aircraft values of over 10% for newer aircraft types and up to 30% for older aircraft in the short term.

Looking at evidence produced by significant historical events such as 9/11, the first Gulf war, the Asia Crisis and the Sars outbreak in the early 2000s, we see periods during these crises when both market values and lease rates of aircraft drop off.

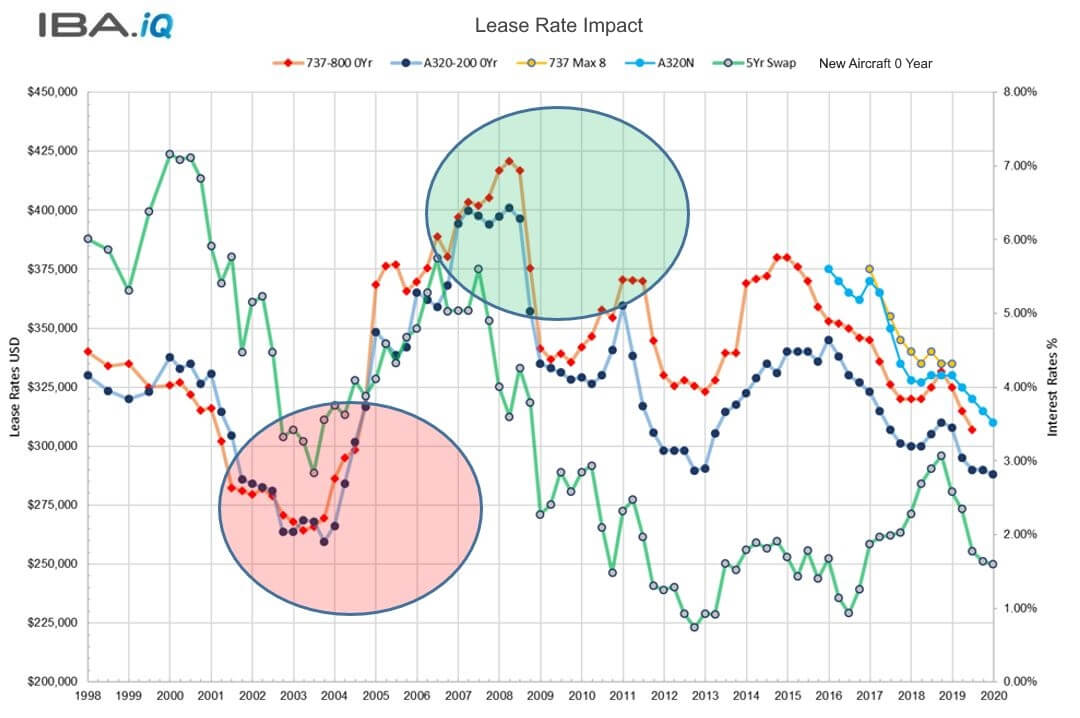

Lease rates suffered negative effects of 20-30% for liquid narrowbody aircraft post 9/11 until mid SARS:

Following these events, we encountered a period of positive recovery up to 30% in market lease rates from 2005 to 2007.

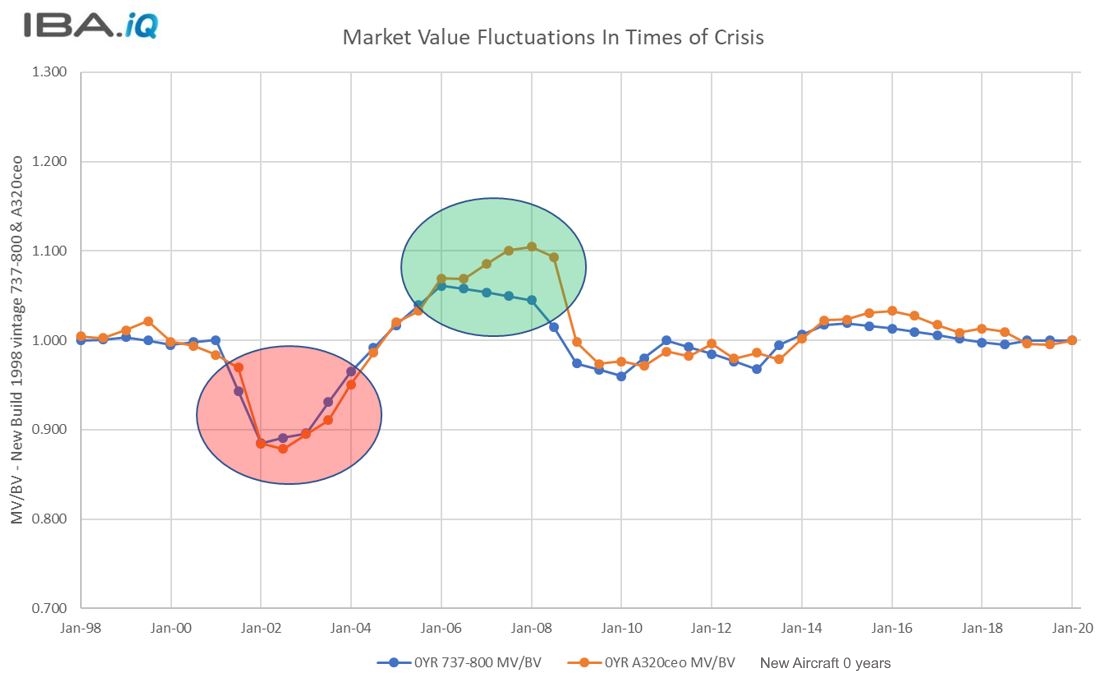

Similarly, using IBA.iQ Values, market values are expected to decrease during crises. The market values of in-production type aircraft such as the B737-800 and A320ceo dropped by more than 10% during the 9/11 and SARS incidents. Between 2005 and 2007 the rate of recovery was comparable at around 10%.

Older aircraft such as the B757 suffered a reduction in value in excess of 30%.

It is very much a question of investors holding their nerve. A long-term outlook is needed as the market has shown remarkable resilience in the past and reduced values will recover over time.

For further guidance on valuations, contact Mike Yeomans

For advice on credit risk, we offer a range of risk services including credit monitoring, an operator score index and operator risk assessments. If you would like more information on how we can possibly help your business in this area, please fill out the form below.