25/06/2021

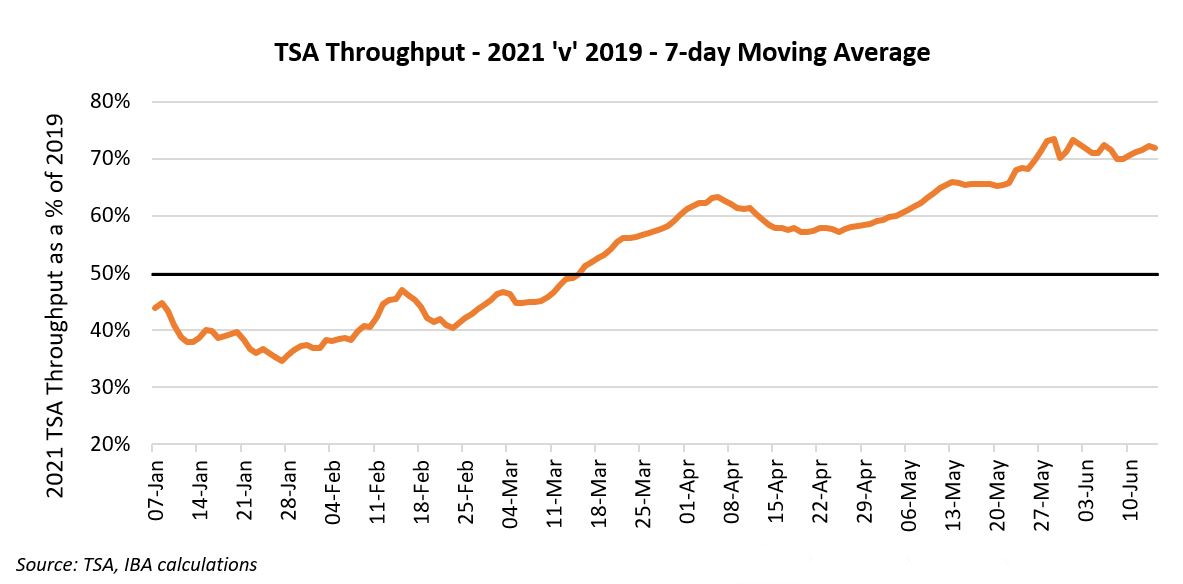

Demand for U.S air travel is increasingly encouraging. Numbers of travellers passing through TSA checkpoints on 13th June 2021 surpassed 2 million for the first time since early March 2020.

With just over half of the U.S. population having had at least one vaccine dose as of mid-June, key statistics around airlines and airports are promising as we move towards the Independence Day weekend.

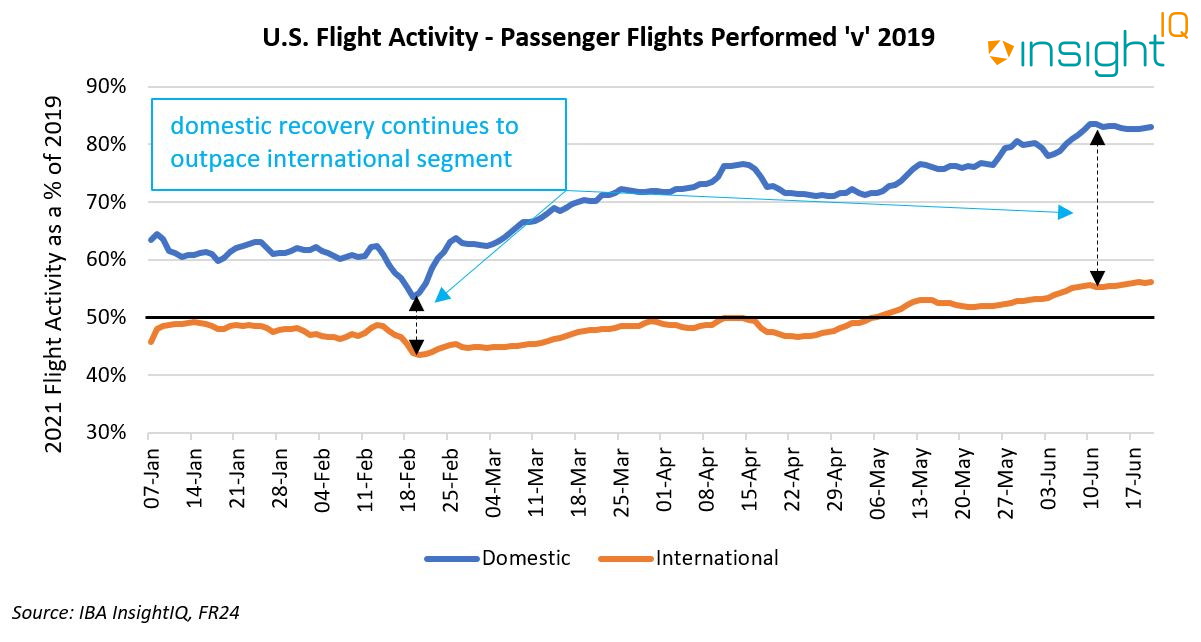

As with other key markets, domestic travel is leading recovery in the U.S. IBA expects the overwhelming majority of travel to remain domestic in Q3 of 2021. Whilst selected international flights to the likes of Los Cabos and Cancun have plateaued at reasonable levels in recent months, we believe the widespread continuation of border restrictions and quarantine requirements will limit any meaningful increase in international services. Current levels of international travel are at around 55% relative to 2019. As the chart below highlights, the gulf between international and domestic recovery has grown from 10% in mid-February to 28% by mid-June. The bullish view of key stakeholders in the U.S. regarding 4th July plans suggests this delta may widen further as we move through Q3.

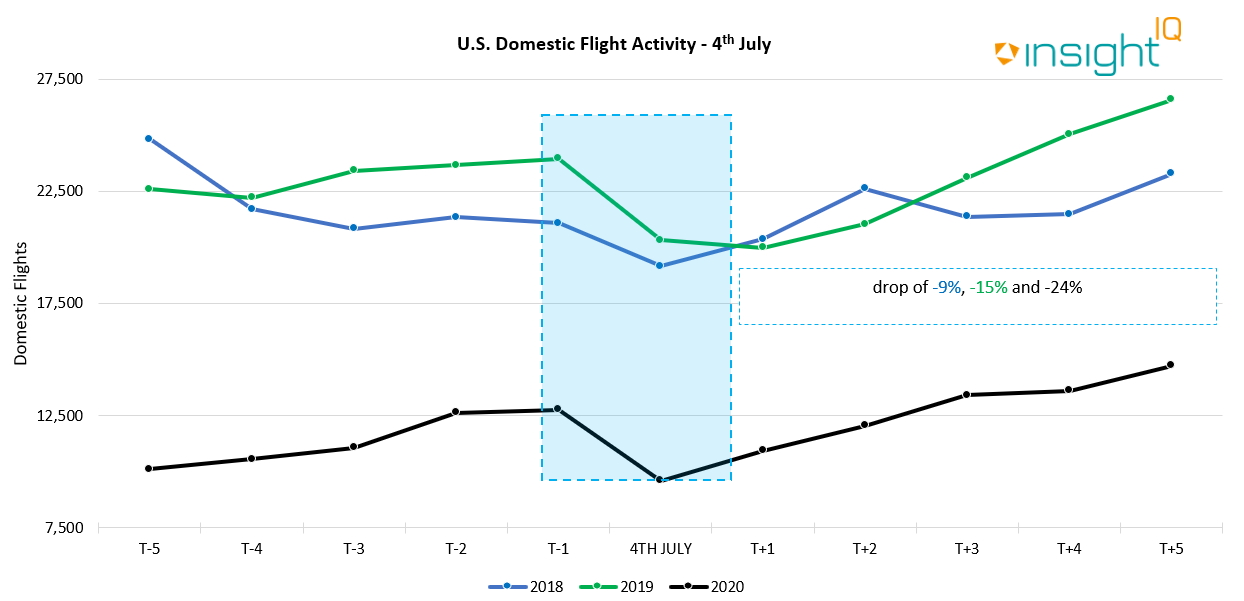

As with other widely observed holidays, air travel volumes tend to sharply reduce on the Independence Day holiday itself. Flight data from IBA's InsightIQ intelligence platform shows flight volumes on recent Independence Day holidays range from 9% to 24% lower compared to the day prior, followed by a sharp rebound as the summer season progresses.

Source: IBA InsightIQ Flight data

OAG data indicates domestic U.S. capacity (as measured by seats) will reach ~90% of 2019 levels in this year over the seven days surrounding 4th July. This represents a marked improvement over the 48% we saw in 2020. With TSA checkpoint volumes inching higher as traveller confidence builds, we would look to a base case scenario of around 1.9-2.0 million passengers per day passing through TSA checkpoints over the 27th June-11th July period. Our bullish scenario would see this figure closer to 2.2-2.3 million per day, with load factors around 90%. While this may seem high given the difficulties the industry is still facing globally, predictions from carriers are equally optimistic, with Southwest Airlines anticipating a June load factor of 85%.

If you have any further questions please contact Finlay Grogan.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.