Whilst it has been a long while since checked baggage was included in most fares, an unwelcome post-pandemic trend was the extra charge for carry-on baggage by many carriers. This was coupled with many airlines shrinking the allowable size and weight, providing travellers with an unwelcome surprise at the airport. This fortnight, however, the European Parliament passed a resolution requesting the European Commission to standardise the carry-on allowance and potentially remove supplementary costs with regard to baggage and seating.

It is unlikely that this would provide travellers with cheaper tickets, with costs likely passed back into fares, but it could affect consumer behaviour. Low-cost carriers are able to appear higher up on search algorithms due to their unbundled fare structure. If this were to change, full-service carriers may receive more traffic.

Full-service carriers typically do not separate out ancillary revenue in their reporting, however, it is commonplace for LCCs. For Ryanair’s last financial year, ancillary revenue was 35.7% of total revenue. For Wizz Air, this was as high as 48.0%.

If the European Commission does follow up on this, it could be as significant to airline pricing as EU261 was to airline punctuality back in 2005. However, unlike the older directive, this may not be universally good for consumers. It should be considered that Ryanair is the largest airline both in terms of capacity and flights in Europe, flying over twice as many as 2nd place Turkish Airlines. There is therefore strong appetite for the low-cost product, excluding certain comforts. As components of fares are reintegrated, differentiation and therefore competition may decrease.

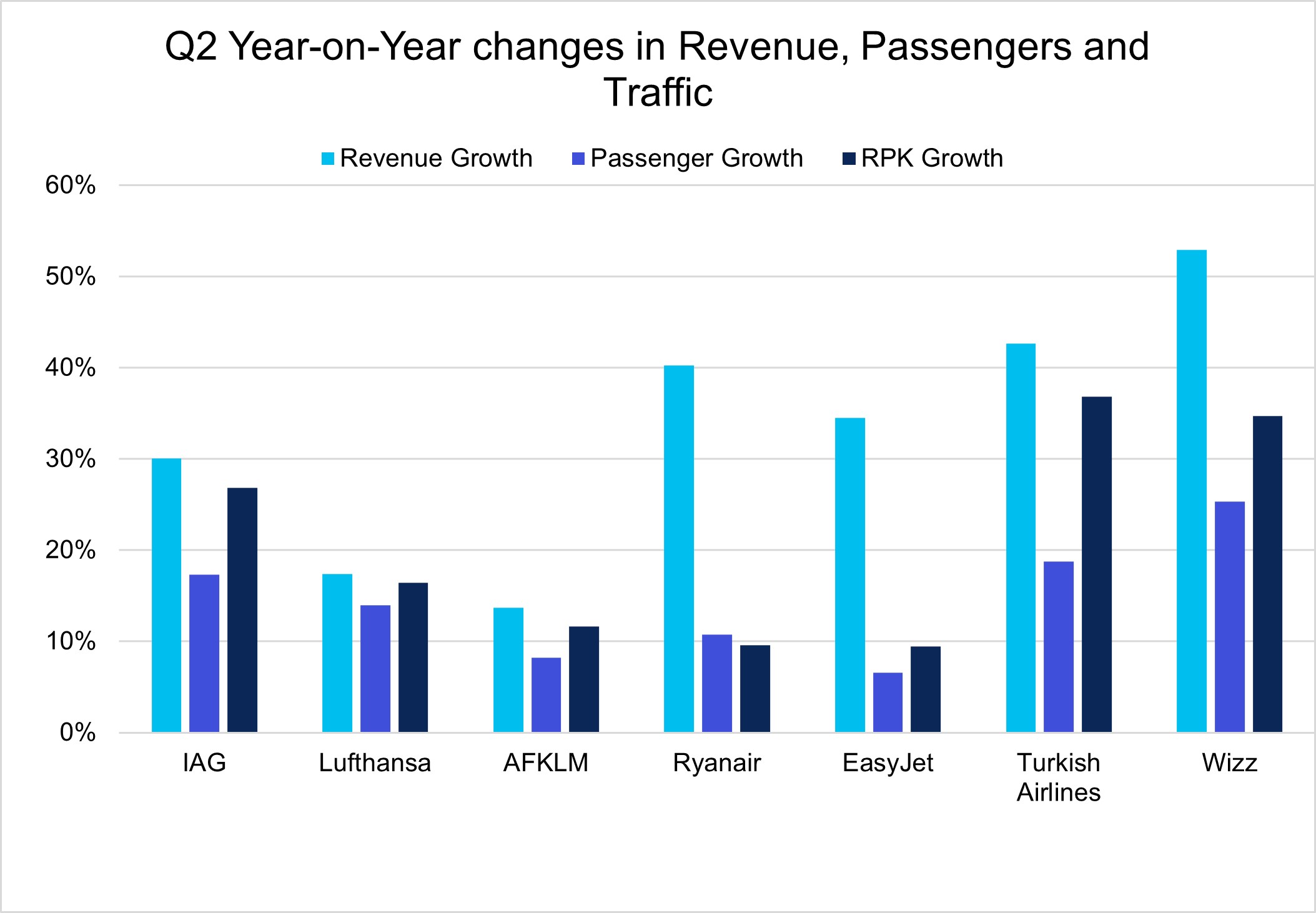

Nonetheless, the Q2 results do perhaps show they have grounds to consider such a decision. Among a subset of international carriers, European low-cost carriers’ revenue increased more significantly than their full-service peers. By showing both RPK growth and passenger growth alongside revenue growth, as well as yield, one can see whether fares are driven by longer sectors or simply fare hikes. European low-cost carriers appear more capable of implementing fare hikes at the moment. Following the EU directive, the waning of pent-up demand may no longer be the only thing to bring that to a close.

Source: IBA Airlines & Intelligence

Source: IBA Airlines & Intelligence

The current theme of consolidation in airlines does not seem to be slowing, with the Air France-KLM Group’s recent announcement to purchase a 19% stake in Scandinavian flag carrier SAS, the latest move. This is part of the airline’s restructuring efforts and as a result, SAS will be delisted from the stock exchange. It will be owned by a consortium led by private equity firm Castlelake 32%, Lind Invest 8% and AF-KLM, together investing $1.175 Billion in the Scandinavian airline. The Danish state will continue to hold the 26% whilst the Swedish government’s stake is expected to be wiped out under the proposed deal.

The SAS Group filed for Chapter 11 bankruptcy protection in July 2022, after several significant setbacks, including the pandemic, crew strikes and closure of Russian airspace. The airline has been restructuring under its “SAS Forward” plan ever since, which included an attempt to raise capital and streamline operations.

The recent acquisition news marks a big step forward in the reorganization process. With AF-KLM stepping in, SAS, a founding member of Star Alliance, is expected to strengthen ties with the French-Dutch giant by joining the SkyTeam alliance. For Star Alliance, this move means the loss of a key partner in Northern Europe, with the region being divided mainly between SkyTeam and Oneworld.

Moreover, despite the AF-KLM acquiring a non-controlling stake, the Group has indicated that its agreement contains a way to become a controlling shareholder. This could potentially mean a full integration between the airlines in the long-term.

As consolidation processes are ramping up, especially in Europe, many see TAP Portugal as the next airline in line. Notably the Portuguese Government recently announced intentions to step up the privatisation efforts. All three European full-service carrier groups are reportedly interested, with the aim of increasing presence in the LATAM region, in which Portugal’s national carrier holds an established position. However, both Lufthansa Group and AF-KLM are currently engaged with acquiring ITA Airways and SAS respectively, which would leave IAG as the third option. The question remains whether the EU Commission will look favourably at the major Southern-European airline being acquired by its biggest competitor.

Tech giant Google - through its Google Research branch - and Breakthrough Energy, together with American Airlines, conducted a study to reduce contrail emissions that showed great potential. Using machine learning technology (AI), a group of researchers were able to predict contrail emission zones at a greater level and apply its tool to real-life flights. The researchers used large satellite and weather forecasting datasets to predict ice-supersaturated zones that are more prone to generate contrails and taught the machine to identify these.

Compiled into a tool, the programme was given to pilots who flew test flights to prove its efficiency. The tool would then advise the pilots when to adjust the aircraft altitude or flight path to avoid these areas, a similar approach to how to avoid turbulence. The output of the experiment showed a 54% reduction in aircraft contrail emissions, although the avoidance burned 2% additional fuel. IBA views the experiment as an interesting development in tackling the non-CO2 effects of aviation.

Developing technologies, primarily to support scientific experiments, that turn into practical tools to tackle climate change is an increasing trend. We will be keeping a close eye on how the outcomes of the first 100% SAF transatlantic flight, scheduled for November 28th, influence this exciting corner of sustainability in aviation.

Join IBA's asset management experts, plus guest speaker Johnny Champion from law firm Stephenson Harwood, as they share their best practice advice for redelivering aircraft and engines.

Drilling down into the results garnered in IBA’s 2023 Redelivery Survey, our panel of experts will review the challenges faced by both airlines and lessors when redelivering aircraft, sharing guidance on how both parties can prepare for lease ends.

This session has been designed to equip airlines, lessors and the finance community with information on the latest trends, real-life examples of disputed redelivery issues, guidance and best practice advice.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

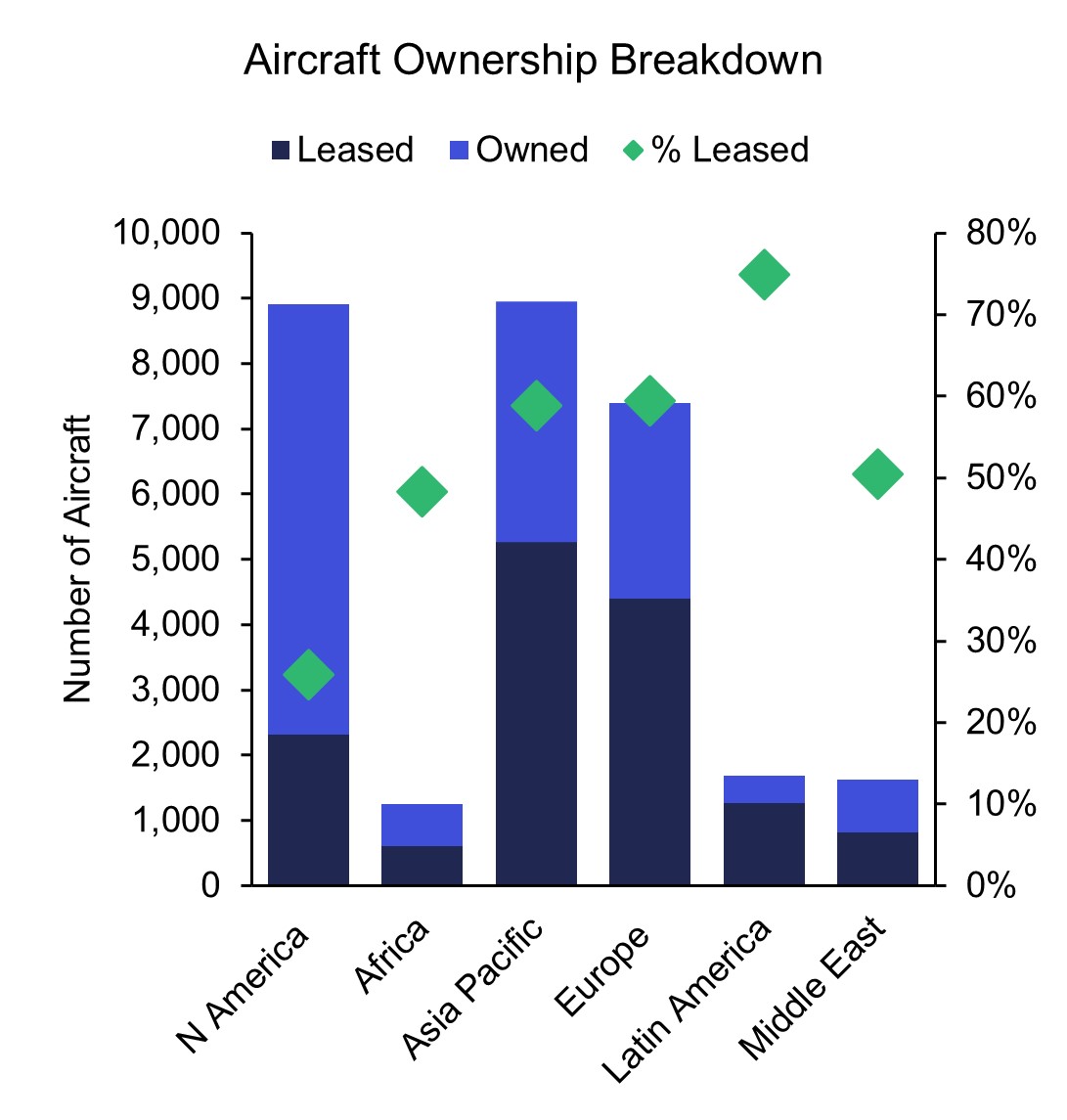

Source: IBA Insight & Intelligence

Source: IBA Insight & Intelligence

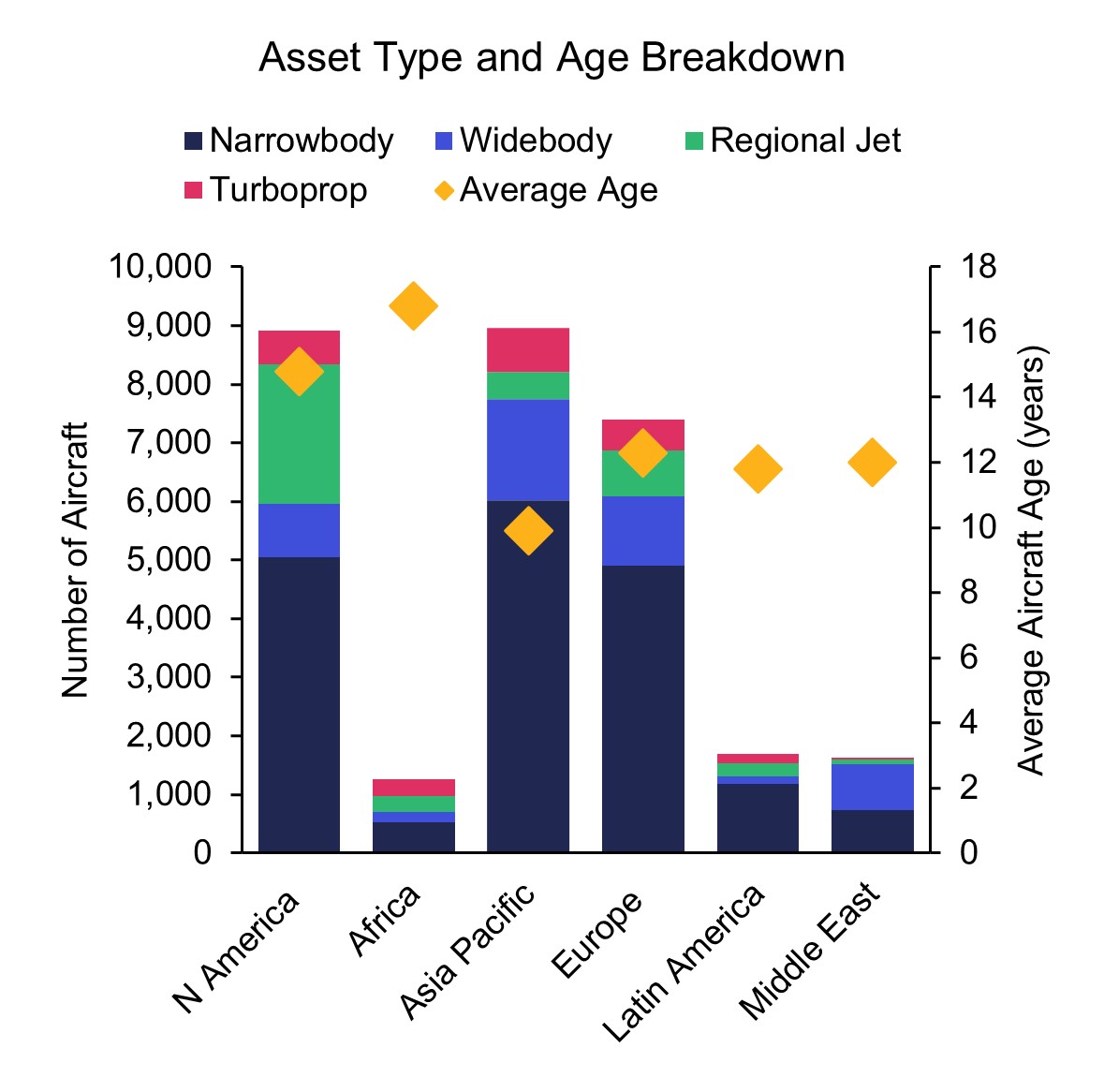

Source: IBA Insight & Intelligence

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。