Whilst it has been a long while since checked baggage was included in most fares, an unwelcome post-pandemic trend was the extra charge for carry-on baggage by many carriers. This was coupled with many airlines shrinking the allowable size and weight, providing travellers with an unwelcome surprise at the airport. This fortnight, however, the European Parliament passed a resolution requesting the European Commission to standardise the carry-on allowance and potentially remove supplementary costs with regard to baggage and seating.

It is unlikely that this would provide travellers with cheaper tickets, with costs likely passed back into fares, but it could affect consumer behaviour. Low-cost carriers are able to appear higher up on search algorithms due to their unbundled fare structure. If this were to change, full-service carriers may receive more traffic.

Full-service carriers typically do not separate out ancillary revenue in their reporting, however, it is commonplace for LCCs. For Ryanair’s last financial year, ancillary revenue was 35.7% of total revenue. For Wizz Air, this was as high as 48.0%.

If the European Commission does follow up on this, it could be as significant to airline pricing as EU261 was to airline punctuality back in 2005. However, unlike the older directive, this may not be universally good for consumers. It should be considered that Ryanair is the largest airline both in terms of capacity and flights in Europe, flying over twice as many as 2nd place Turkish Airlines. There is therefore strong appetite for the low-cost product, excluding certain comforts. As components of fares are reintegrated, differentiation and therefore competition may decrease.

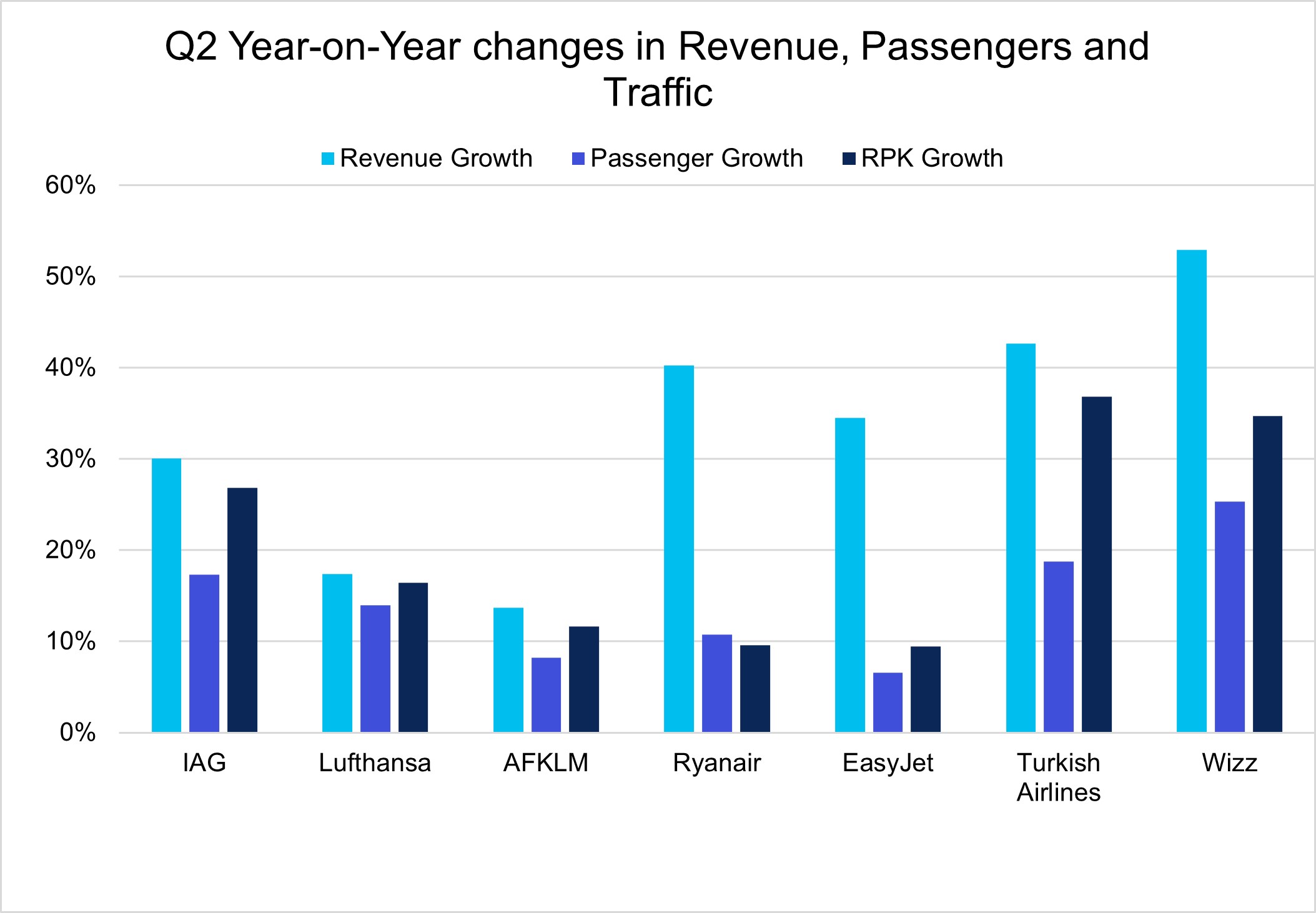

Nonetheless, the Q2 results do perhaps show they have grounds to consider such a decision. Among a subset of international carriers, European low-cost carriers’ revenue increased more significantly than their full-service peers. By showing both RPK growth and passenger growth alongside revenue growth, as well as yield, one can see whether fares are driven by longer sectors or simply fare hikes. European low-cost carriers appear more capable of implementing fare hikes at the moment. Following the EU directive, the waning of pent-up demand may no longer be the only thing to bring that to a close.

Source: IBA Airlines & Intelligence

Source: IBA Airlines & Intelligence

The current theme of consolidation in airlines does not seem to be slowing, with the Air France-KLM Group’s recent announcement to purchase a 19% stake in Scandinavian flag carrier SAS, the latest move. This is part of the airline’s restructuring efforts and as a result, SAS will be delisted from the stock exchange. It will be owned by a consortium led by private equity firm Castlelake 32%, Lind Invest 8% and AF-KLM, together investing $1.175 Billion in the Scandinavian airline. The Danish state will continue to hold the 26% whilst the Swedish government’s stake is expected to be wiped out under the proposed deal.

The SAS Group filed for Chapter 11 bankruptcy protection in July 2022, after several significant setbacks, including the pandemic, crew strikes and closure of Russian airspace. The airline has been restructuring under its “SAS Forward” plan ever since, which included an attempt to raise capital and streamline operations.

The recent acquisition news marks a big step forward in the reorganization process. With AF-KLM stepping in, SAS, a founding member of Star Alliance, is expected to strengthen ties with the French-Dutch giant by joining the SkyTeam alliance. For Star Alliance, this move means the loss of a key partner in Northern Europe, with the region being divided mainly between SkyTeam and Oneworld.

Moreover, despite the AF-KLM acquiring a non-controlling stake, the Group has indicated that its agreement contains a way to become a controlling shareholder. This could potentially mean a full integration between the airlines in the long-term.

As consolidation processes are ramping up, especially in Europe, many see TAP Portugal as the next airline in line. Notably the Portuguese Government recently announced intentions to step up the privatisation efforts. All three European full-service carrier groups are reportedly interested, with the aim of increasing presence in the LATAM region, in which Portugal’s national carrier holds an established position. However, both Lufthansa Group and AF-KLM are currently engaged with acquiring ITA Airways and SAS respectively, which would leave IAG as the third option. The question remains whether the EU Commission will look favourably at the major Southern-European airline being acquired by its biggest competitor.

Tech giant Google - through its Google Research branch - and Breakthrough Energy, together with American Airlines, conducted a study to reduce contrail emissions that showed great potential. Using machine learning technology (AI), a group of researchers were able to predict contrail emission zones at a greater level and apply its tool to real-life flights. The researchers used large satellite and weather forecasting datasets to predict ice-supersaturated zones that are more prone to generate contrails and taught the machine to identify these.

Compiled into a tool, the programme was given to pilots who flew test flights to prove its efficiency. The tool would then advise the pilots when to adjust the aircraft altitude or flight path to avoid these areas, a similar approach to how to avoid turbulence. The output of the experiment showed a 54% reduction in aircraft contrail emissions, although the avoidance burned 2% additional fuel. IBA views the experiment as an interesting development in tackling the non-CO2 effects of aviation.

Developing technologies, primarily to support scientific experiments, that turn into practical tools to tackle climate change is an increasing trend. We will be keeping a close eye on how the outcomes of the first 100% SAF transatlantic flight, scheduled for November 28th, influence this exciting corner of sustainability in aviation.

Join IBA's asset management experts, plus guest speaker Johnny Champion from law firm Stephenson Harwood, as they share their best practice advice for redelivering aircraft and engines.

Drilling down into the results garnered in IBA’s 2023 Redelivery Survey, our panel of experts will review the challenges faced by both airlines and lessors when redelivering aircraft, sharing guidance on how both parties can prepare for lease ends.

This session has been designed to equip airlines, lessors and the finance community with information on the latest trends, real-life examples of disputed redelivery issues, guidance and best practice advice.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

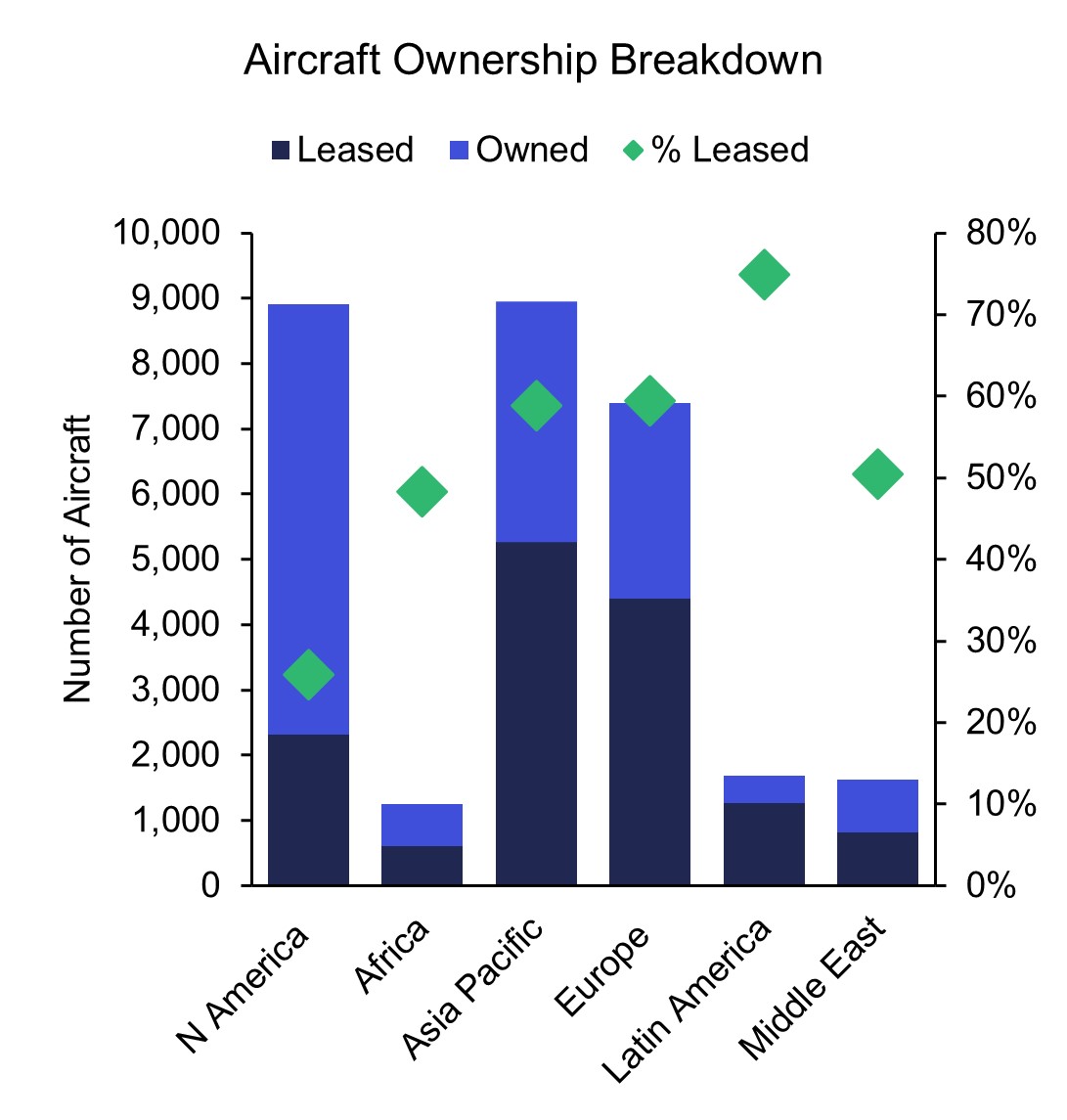

Source: IBA Insight & Intelligence

Source: IBA Insight & Intelligence

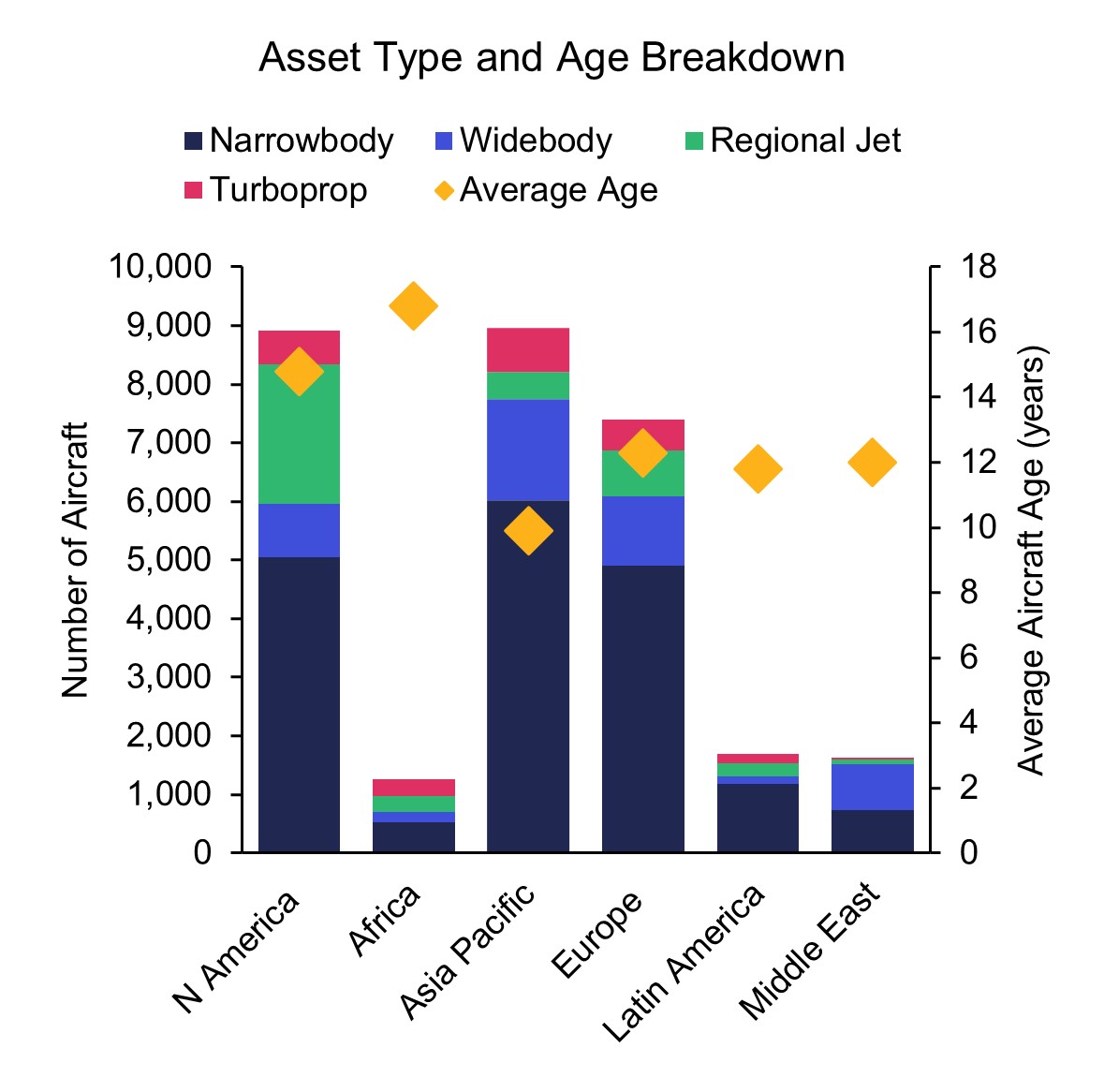

Source: IBA Insight & Intelligence

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。