11/05/2021

Denesz Thiyagarajan, Engine Analyst, IBA Advisory, uses InsightIQ intelligence to explore the potential impact of weather conditions in Northern China on Engine performance and utilisation.

The rollout of Covid-19 vaccines in China and increased testing has caused infection rates to fall, encouraging travellers to begin booking flights. IBA's intelligence platform InsightIQ reveals that, despite concerns about a second wave of infections in China, domestic flights have enjoyed a bullish rebound since February's Chinese Lunar New Year.

In March however, weather conditions usual for the time of year in the region resulted in the worst sandstorm for a decade striking parts of Northern China. Hundreds of flights were cancelled due to poor visibility but, despite the incident, Chinese domestic flights were barely affected which demonstrates the resilience of the market. Airframe and engine manufacturers recognise China as one of few countries it classifies as harsh environment geographic regions, compared with North America and Northern Europe. Other well-known harsh operating environments are India and the Middle-East. These regions are also no stranger to dust and sandstorms. Dubai for instance at the height of summer, temperatures can reach a high of 41 degrees in the shade. Engines operating within its territories require servicing more regularly and maintenance costs can be higher. Although the March sandstorm's impact was slight, with severe weather events happening more often OEM investment is needed to make sure airframes and engines have a greater capacity for resilience in hot and harsh conditions.

In March, Beijing and the northern part of China were hit by a thick sand and dust mixture powered by heavy winds blowing in from the Mongolia and Inner Mongolia. The storm ravaged the provinces of Gansu, Shanxi and Hebei which surround Beijing and more than 400 flights in and out of the capital's two airports were cancelled due to poor visibility. Sandstorms and high levels of dust and haze are seen as seasonal events which China has been taking measures to address; more investments have been going into renewable energy projects for example.

Engine manufacturers see China as a geographic region representing a comparatively harsh operating environment relative to North American and Northern Europe. Engines running in China's weather conditions will have high EGT (Exhaust Gas Temperature) margins and aircraft hardware degradation; they are subject to shorter removal intervals. More frequent shop visits are therefore required which can become costly. Sand and dust are not uniform and are likely to corrode blades and block cooling holes within the engine.

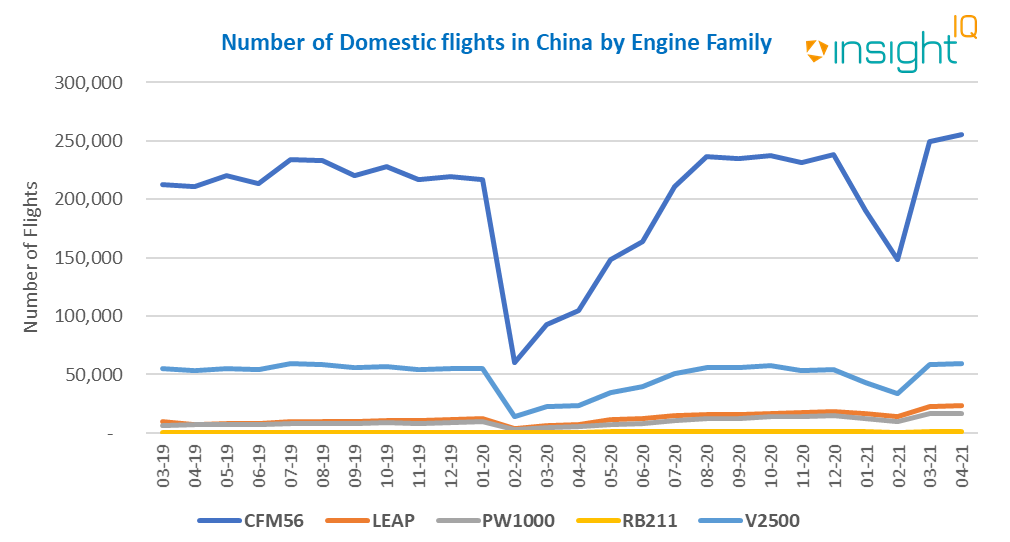

Despite the major sandstorm incident, Chinese domestic flights were scarcely affected which shows the Chinese aviation market's strong resilience. InsightIQ's intelligence shows the combined number of flights during the month of March was approximately 348,808 compared with pre-Covid March 2019's 281,086. This represents a 24% increase and is partially due to delivery of new aircraft since the Covid outbreak, underlining the amazingly robust recovery China has made following the pandemic. The International Air Transport Association (IATA) has predicted China will fly around 1.3 billion passengers every year over the next three years.

Source: IBA's InsightIQ Flights

Flight data taken from IBA's InsightIQ focusing only on narrowbody aircraft and engines illustrates domestic flight numbers in China have been moving in a positive upward trend. The CFM56 engine family takes up most of the narrowbody engine market share, with the 737-800 & A320-200 being the most prominent aircraft types in China.

Even though last month's sandstorm did not have a significant impact on flight numbers, it's vital we stay vigilant. Northern China is believed to experience an average of 30 dust storms per annum, thought to be related to global climate change. Dust storms will definitely be cause for concern moving forward and will continue to be a major aviation hazard in many parts of the world.

To prevent engine damage, equipment will need to undergo more borescope inspections and the hot operating conditions should also be considered. Airlines have faced a significant commercial disadvantage when operating in hot and harsh conditions and, to ensure a level playing field, OEMs need to invest more to produce internal hardware with greater durability offering a longer time on wing in harsh environments. Since the pandemic, more emphasis has been given to carbon emission reduction across all sectors globally. As the Chinese aviation market continues to grow, we anticipate greater interest in advanced-technology engine investment such as in the LEAP and PW1000G.

All Data used and displayed in this article is derived from IBA's proprietary data platform IBA InsightIQ.

If you have any further questions or comments or would like to discuss how IBA can support your business, please contact: Denesz Thiyagarajan

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Related content