19/05/2020

As many of you will know, the effects of Covid-19 are going to change the size and makeup of airline fleets, and do so quickly.

In the next 20 months, it's possible that many older aircraft types could be universally withdrawn from service, along with significant numbers of older variants of current generation aircraft including the Boeing 777, A330 and A380. IBA, the leading aviation consultancy, estimate there will be an aircraft oversupply of up to 2,500 narrow and widebody aircraft in the market, with global demand, once the current restrictions are lifted, possibly declining by 20% by the end of 2021.

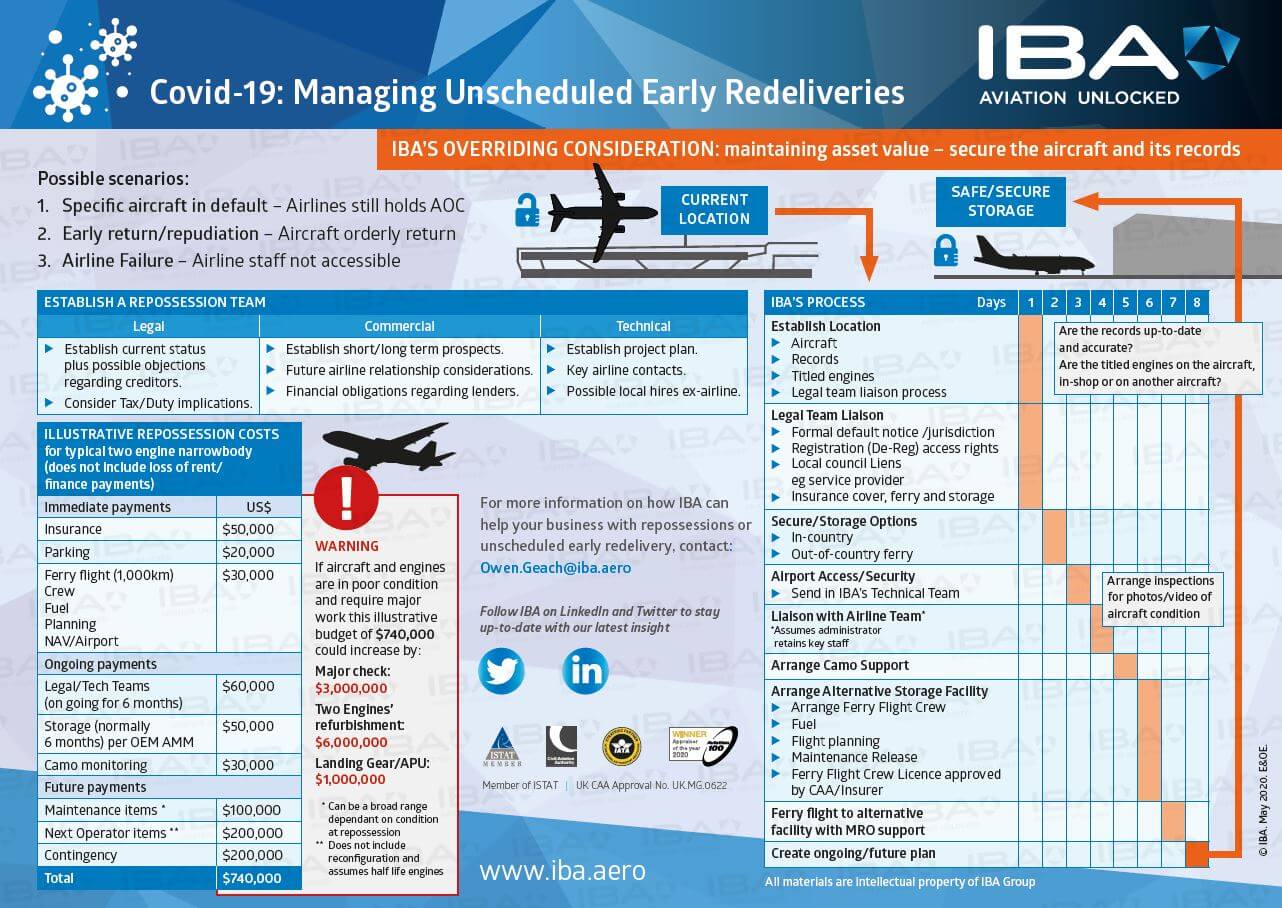

This potential reduction in widebody and narrowbody fleet may result in an uptick in early returns, lease re-negotiations and the worst case scenario - repossessions.To help manage, maintain asset values and reduce overspends during a repossession, IBA's asset management team have summarised key steps, considerations and typical costs to navigate and manage such scenarios as best as possible.

If your tech team needs additional support in remarketing, redelivery, repossession or lease reviews, our large and experienced asset management team can help.To receive more information about our services please contact us using the form below.

Author

See full profileRelated content