09/02/2024

With 2023 now concluded, a retrospective analysis of the trends and developments within the business jet sphere is in order. By all accounts it has certainly been an interesting year in this market, with IBA observing a downshift in values, a stark contrast to the inflated prices witnessed in 2021 and 2022. However, despite what we usually see post-downturn, the current decline in values hasn’t necessarily followed the expected bounce-back trend we’ve come to expect.

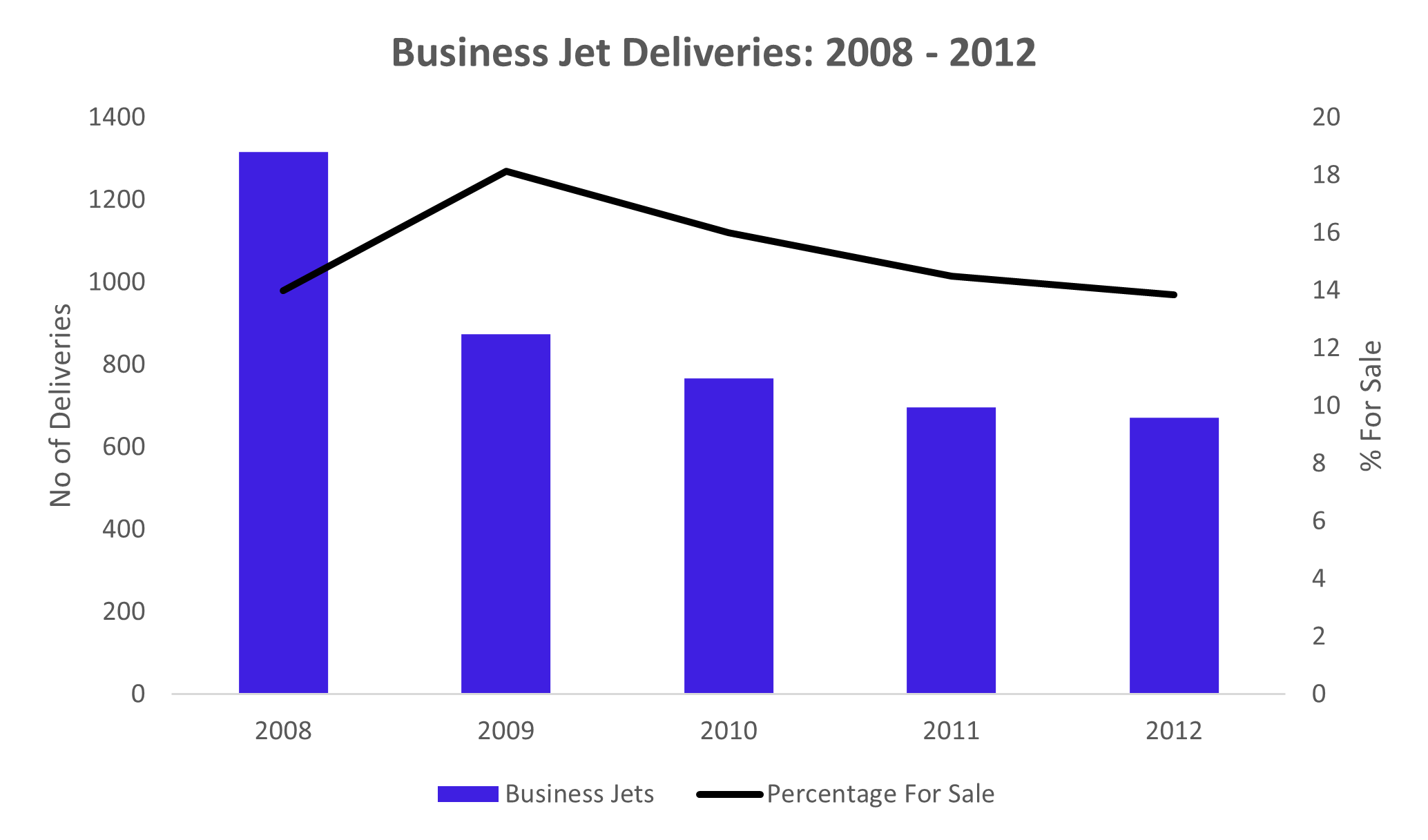

Following the onset of the 2008 financial crisis, the business jet market experienced a significant slide in its prospects. During this time, owners were looking for the exits as stock markets plummeted, personal portfolios hit, and uncertainty were at all time highs. Between 2008 and 2009, 18% of the fleet was for sale which was the highest recorded of recent times. This situation was exacerbated by lenient lending terms, which facilitated the purchase of aircraft by individuals lacking strong financial stability. Many owners found themselves unable to maintain payments or justify retaining their corporate jets.

Source: GAMA/Jetnet/IBA Sources and Analysis

The chart above shows the relationship between the number of business jet deliveries and the average percentage of in-operation jets available for sale between 2008 and 2018. A surge in deliveries can be picked out in 2008, followed by a high percentage of jets for sale, a direct correlation linked to the global financial crisis.

The gradual decrease in jets available between 2012 to 2020 suggests a return to market balance despite delivery fluctuations, which would ordinally indicate increased demand and market stability.

Enter the recent global COVID-19 pandemic, which has considerably impacted by the business jet market, and added a separate layer of market factors. During this period, there was a conspicuous rise in the use of business jets for travel, diverging from the traditional reliance on commercial airline flights. However, with the pandemic coming to an end, consumers have returned to favouring commercial air travel once again.

.png)

Source: GAMA/Jetnet/IBA Sources and Analysis

2023 (F) – As GAMA have not released Q4 2024 deliveries, IBA has forecasted 2023 deliveries.

As shown in the table above, the sizable drop in business jet deliveries in 2020 meant the secondary market saw heightened activity from 2020 to 2022. This was due to many reasons, however, one being the high levels of liquidity, leading corporations and high-net-worth individuals to capitalise on new opportunities. Business jets emerged as an attractive asset class for parking cash due to their stability and potential for value retention. Moreover, the surge in the secondary market was also driven by individuals seeking liberation from the various restrictions imposed on air travel. As the airlines slashed their schedules and reduced their routes, private jet demand only strengthened. There was also an influx of younger individuals entering the market. It will be interesting to see if this trend continues.

Last year saw the business jet market spike in inventory levels, surging from 3.85% in 2022 to 6.16% by the end of 2023. With values softening and buyers gaining more time to assess their options, sellers are also adjusting their asking prices in response. However, appetite is still strong, especially with the growing shifts across individual geographic regions.

The business jet market today is a very different one to 2008, where both values and demand rely heavily on the specific type and age of aircraft. The decline in values suggests a potential trend toward market equilibrium, indicating a more balanced market scenario. While the United States continues to dominate the space, the likes of Saudia Arabia and India are the ones to watch for 2024. The upcoming election cycle in the US will be fascinating to watch from a trading perspective, although while there is no trend to indicate that it will affect the number of transactions, the economic environment is still expected to play a huge part.

IBA predicts the main talking points for this year to be the escalation of geo-political issues currently occurring across the world, which could hinder the purchases of aircraft. Though inventory levels are likely to increase, it will most likely reach its equilibrium of around 10% (pre-covid levels). Furthermore, the default of a major fleet operator could be a major concern in the used aircraft sales market. A situation such as this was narrowly avoided last year when Delta bought ‘Wheels Up’, in a last-minute deal. Large operators would typically have significant number of aircraft, so if one was to fail, this would cause huge number of aircraft to flood the market. Therefore, this oversupply would drive down the prices, as sellers compete to offload their assets.

Overall, 2024’s appetite for business jets is still a promising indicator, but more so for newer aircraft. This is because customers are more after comfort, the latest technological advancements and potential long term value retention. With many first-time aircraft owners retaining their assets post-pandemic, we can expect values to remain relatively strong and most likely continue throughout the year.

Voted five times Appraiser of the Year, IBA’s experienced valuations team, including our Senior ISTAT Certified Appraisers, have access to real-time data for more accurate valuations. We partner with aviation and financial sector clients globally to provide independent advice on valuation requirements, ranging from strategic fleet selection, sell and buy-side transactions and operational decisions, to annual portfolio monitoring and financial compliance.

Learn more about IBA Valuations.