21/07/2021

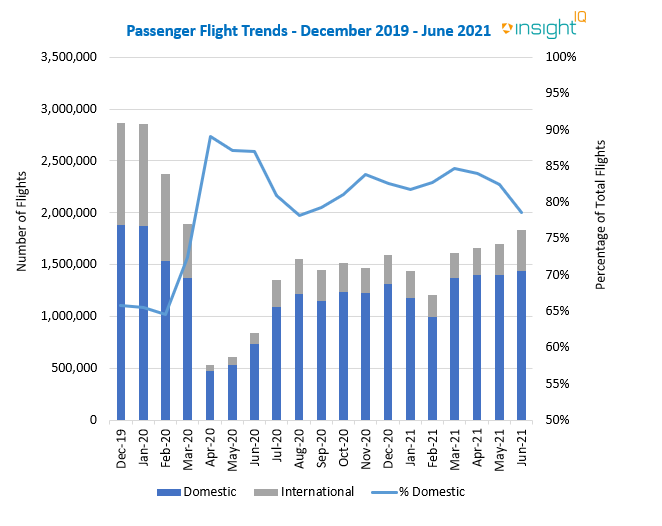

Flight data from IBA's InsightIQ aviation intelligence platform shows that from the end of June 2019 to the end of 2021, domestic flights have dropped below 80% of the total for the first time since last summer.

Whilst domestic travel still dominates industry recovery, this signals that international markets are finally beginning to recover from the challenges of the pandemic. It is clear, however, that international recovery will take longer than the domestic.

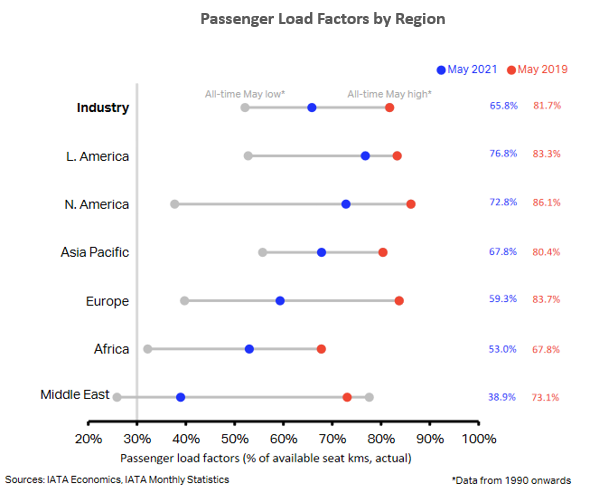

The latest data from IATA confirms positive RPK trends in domestic Russia and China, and we are seeing load factors in markets such as Latin America, North America and the Asia Pacific region gradually improving.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles. Book a free demo today to discover the unique features of InsightIQ.

Author

See full profileRelated content