05/03/2020

Using IBA.iQ Fleets, at the time of Flybe's collapse, the carrier's fleet was comprised of a combination of De Havilland DHC8-400Q and Embraer E-Jet aircraft, totalling 68. The majority of the Flybe fleet consisted of DHC8 aircraft. With 54 such aircraft, Flybe was the largest active operator of the DHC8-400, accounting for almost 10% of the world in-service fleet. The parked and stored fleet of DHC8-400s has more than doubled as a result of the collapse of Flybe.

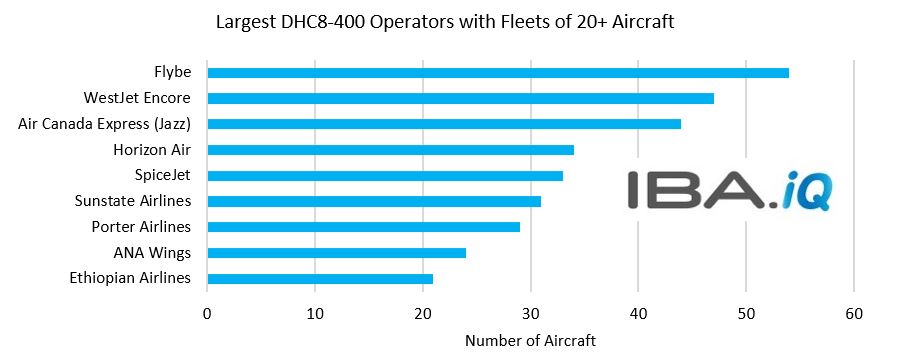

The chart below shows all operators of DHC8 aircraft with fleets of greater than 20 units at the time Flybe ceased operations according to IBA.iQ.

Given Flybe's significant position within the DHC8-400 operator base, there is potential for its collapse to create pressure on values and lease rates. According to IBA.iQ Fleets, Flybe's DHC8 aircraft range between 2003 and 2011 vintage examples, with the heart of the fleet having been delivered between 2006 and 2009, so still relatively young examples by turboprop standards.

IBA expects the majority of the fleet to find homes with new operators, however given the large number of aircraft entering the market, reduced pricing and/or lease rates may be required to stimulate expeditious placements. In the past year, the DHC8-400Q has been a slow-moving product with a relatively small number of secondary market transactions, moreover, a significant number of sold off lease transactions that have taken place since January 2019 have resulted in aircraft being stored. In terms of the primary market, there have been only 18 new DHC8-400Q aircraft deliveries since January 2019.

Many aircraft of comparable age to Flybe's appear to be struggling to be placed once lease ends occur and as a result there have been some part outs.There have been 3 comparable aged aircraft placed into corporate-shuttle service supporting the oil industry in Alaska, and 2 aircraft leased in to Papua New Guinea and Mozambique, but there are other unplaced aircraft available of a similar age.

Within Europe, Flybe account for almost 30% of all DHC8-400's in service. Of the other major European operators of the aircraft type such as Air Baltic (12) has announced its plans to replace theirs's with Airbus A220s, while Austrian Airlines (14) and Eurowings (16) have been gradually phasing them out.

On a positive note, there is still some demand in the market for 70+ seat turboprop aircraft. While the majority of the DHC8-400Q fleet is focused in mature markets for turboprop aircraft such as North America and Europe & CIS, in recent years there has been a growing demand for this type of aircraft in Asia Pacific and Africa.

In addition to the DHC8's, using IBA.iQ Fleets, Flybe had 14 Embraer E-Jet aircraft within the fleet. Nine of these were the E175 model, with two examples each of the Embraer E190 and E195 models and one E170.

The majority of the global E175 fleet are operated in North America with feeder airlines to the three major US carriers. Due to the long-term contracts held with the US majors and the popularity of the E175 due to its compliance with the major pilot unions' scope clauses, there has been relatively little availability of the E175 in the secondary market. Leased E175 aircraft that have come to market have so far performed well in terms of re-lease rates. Although nine aircraft represents a small portion of the total E175 fleet, it will represent an increase in availability compared to current levels and the performance of these aircraft in the secondary market may be a bellwether for future performance.

With the US majors largely at the limit of larger regional jets that can be outsourced to their regional partners, it may be difficult for them to induct additional capacity in the form of ex-Flybe E175s. This is particularly true given that the Flybe aircraft are in an 88 seat cabin configuration. Reconfiguration costs for E-Jets can be costly, which represents a potential hurdle to overcome should a new operator require a different cabin layout.

Flybe's high standards in terms of maintenance should see its former aircraft regarded as attractive examples of their types within the secondary market. However, the industry is facing headwinds, with the developing situation around the Covid-19 Coronavirus causing a reduction in passenger traffic flows.

With the virus established in a growing number of areas, placing additional capacity may be a challenge in the near-term, particularly in affected areas. Europe and Asia Pacific, key markets for Turboprop aircraft, are amongst the areas worst affected by the Coronavirus.

If you have any further questions, comments or feedback please contact Mike Yeomans or Lewis Leslie

Contact us using the link below for a free demonstration and trial of our leading data intelligence platform InsightsIQ