02/12/2019

Read our short analysis of the UK Government's 2024 airport slot reform here.

Using a London Heathrow example, we investigate the valuation process of airport slots and the factors affecting their market performance.

An airport slot is permission given to an airline, by an airport coordinator to use the runway and other airport infrastructure at certain slot-constrained airports at specific dates and times.

Opening and closing times - night jet bans, curfews, quota limits

Airport Infrastructure

Weather conditions – Fog, monsoons and other extreme weather

Airport congestion

Runway availability – e.g. Airports with two runways will have greater slot availability that single-runway operations

Annual Movement Quota (AMQ)

Hourly Runway Movement Limits

Terminal flow limits - Check-in, Security, Baggage, Customs, Immigration etc.

Let's use London Heathrow Airport (IATA: LHR) as an example. With a combined movement limit of around 9,500 movements per week, on a per-hour basis, this equates to an average of around 40-45 movements per hour. Operating capacity at London Heathrow Airport is now at 99% of that total capacity and with no additional capacity available, and constant high demand, airlines will resort to buying slots at significant prices for their preferred times

Compare this with London Gatwick Airport (IATA: LGW) which, while less congested than LHR, still faces heavy congestion due to its single-runway operation. Along with its geographical location in a very busy built-up airspace still creates a high demand for slot availability. LGW's rate of growth over the years is a key indicator of demand at the airport, for both airlines and the potential to acquire new slots.

Globally, airport slot allocation is governed by the International Air Transport Association (IATA)’s Worldwide Airport Slot Guidelines (WASG). However, within the European Union (EU), the EU Slot Regulation 95/93 is responsible for the allocation of slots at community airports.

There are three categorisations of constrained airports, regulated by IATA:

Level 1 (non-coordinated airport)

Level 2 (slot-facilitated airport)

Level 3 (coordinated airport)

Slot allocation occurs at airports designated as Level 3 - where there is a significant and lasting shortfall in capacity to land or take off. In these cases, it is necessary for airlines to have a slot allocated by a coordinator.

At LHR (like many others), the slot allocation, exchange and trading is coordinated by Airport Coordination Limited (ACL). Airlines can earn historic rights or grandfather rights to a series of slots, provided they operate the slots as allocated by the coordinator at least 80% of the time during a season - the use-it-or-lose-it rule. Airlines can lose historic rights to slots for repeated and intentional slot misuse.

Unless prohibited by the laws of a country, airlines can trade their rights to historic slots in a secondary market. These trades may be accompanied by monetary or other types of compensation. Within the EU, slots are traded by way of a slot exchange - slots are swapped between airlines on a one-for-one basis. The exchange may involve swapping two existing slots or a historic peak-time slot for a newly allocated off-peak slot. LHR and LGW are prime examples of airports actively involved in slot trades for monetary compensation. It is also important to mention that only airlines can hold and trade slots i.e., banks, lessors and financial institutions cannot own a slot.

The main factors affecting airport slot value include:

Constraint level

Economic cycle

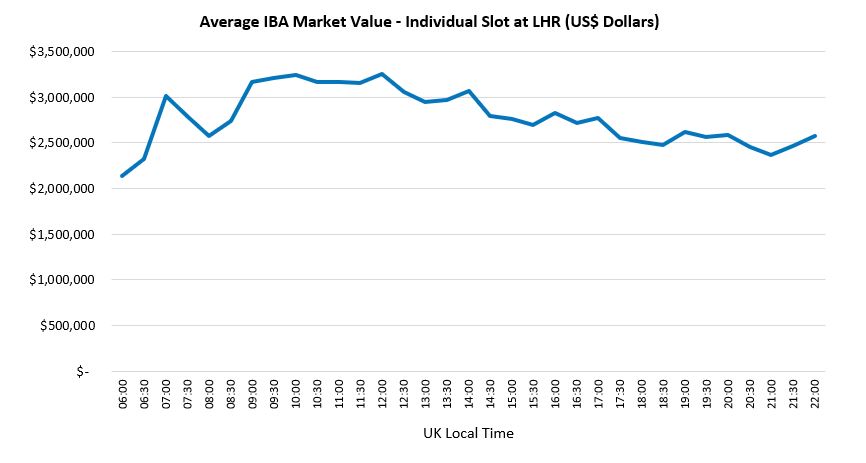

Time of day - for example, a 06:00 AM arrival at LHR is worth considerably more than a 10:30 AM arrival

Frequency of slot pair - a daily slot pair (operating 7-days a week) will be worth more than a once-a-week slot pair

Turnaround time

Seasonal differences (applies mainly to LGW where summer slots are worth considerably more)

Hundreds of slots are traded weekly between airlines, with some having financial compensation in place whilst others are done for strategic/network purposes only. In 2015, American Airlines reportedly purchased one slot pair from Scandinavian Airlines (SAS) for US$ 60,000,000. In February 2016, Oman Air purchased one slot pair from Air France-KLM for US$ 75,000,000. In 2017, SAS sold two slot pairs to American Airlines for US$ 75,000,000. All of these were LHR-based transactions.

One of the main factors influencing slot value is the level of constraint i.e. airport capacity. If the airport is operating at 100% with no available slots in the pool, then this will significantly drive-up values as a result of supply and demand.

Ultimately, it is important to note that a slot's value will lie on the basic principle of how much an airline is willing to pay. This has the potential to result in pricing wars if the carrier sees a strong strategic gain that would justify the high investment. For example, the Oman Air transaction mentioned above (which holds the record for the highest-paid slot transaction in LHR history) was closed at a time when Oman launched its 25-year National Tourism Strategy to increase its international arrivals and boost the country's GDP. In this case, the high transaction cost for the daily slot pair may have been directly linked to this initiative.

The graph below illustrates IBA's average market value for an individual slot (not a pair) at LHR between 06:00 and 22:00 UK time. Please note that this is an average for arrivals and departures and actual values for each one will vary depending on the time of day. For example, we would typically ascribe a higher arrival value between 06:00 and 10:00 for arrivals due to the strong influx of North American traffic. Vice-versa, we would ascribe a higher value for a departure slot at mid-day due to the strong demand for transatlantic services. Please treat the graph below as representational and indicative only, as each portfolio will vary depending on the aforementioned factors.

In 2015, IBA was involved in Europe's first-ever bond transaction tied to airport slots. Virgin Atlantic Airways (the Issuer) secured a £220 million senior secured note using the airline's take-off and landing slots at London Heathrow Airport. The bond was used to invest in new Boeing 787-9 aircraft and had a tenure of 15 years. The notes were split between two tranches: £190 million A1 notes and £30 million A2 notes. The A1 notes have a weighted average life of 12 years, while the A2 notes have a weighted average life of 10 years. This was the first time in European air travel history that airport slots had been leveraged in this way and claimed The Treasurer’s Deal of the Year in 2016 for bonds below £500m.

IBA are one of only a very few appraisers recognised for airport slot valuations, having completed a variety of assignments at airports including those for London Heathrow and London Gatwick. These valuations were conducted for several purposes, including slot securitisation, balance sheet purposes, and disposal/acquisition of slots.

相关内容