17/03/2020

The European ACMI (aircraft. crew, maintenance, insurance)/wet-lease market fleet has grown with an average growth rate (AAGR) of 13.4% in the last five years. According to IBA.iQ, in 2019 the market recorded the highest ever number of wet-lease transactions and year-on-year growth. The number of aircraft servicing the European ACMI market has also grown in tandem with European passengers and fleet growth, at a rate of 13% per annum ACMI operators' preference to lease mature aircraft presents a key opportunity for lessors and investors seeking to place aircraft coming off its 2nd/3rd lease.

EasyJet and Finnair reported spend of €20m to €25m on wet-lease transactions in their most recent financial statements, with almost all of the major carriers in Europe utilising ACMI operators in some capacity as an increasingly regular and planned part of their business. ACMI leasing provides lessees with flexible capacity at short notice to cover any unforeseen events that may affect operations, such as the ongoing Trent 1000 issues and 737 Max grounding. As these key drivers of strong demand for ACMI start to reverse, and Covid-19 virus outbreak negatively affects traffic, this could potentially affect near-term demand for ACMI leasing. In 2020, IATA estimates that the Covid-19 outbreak will negatively impact the passengers' number in Europe by 9% to 24%.

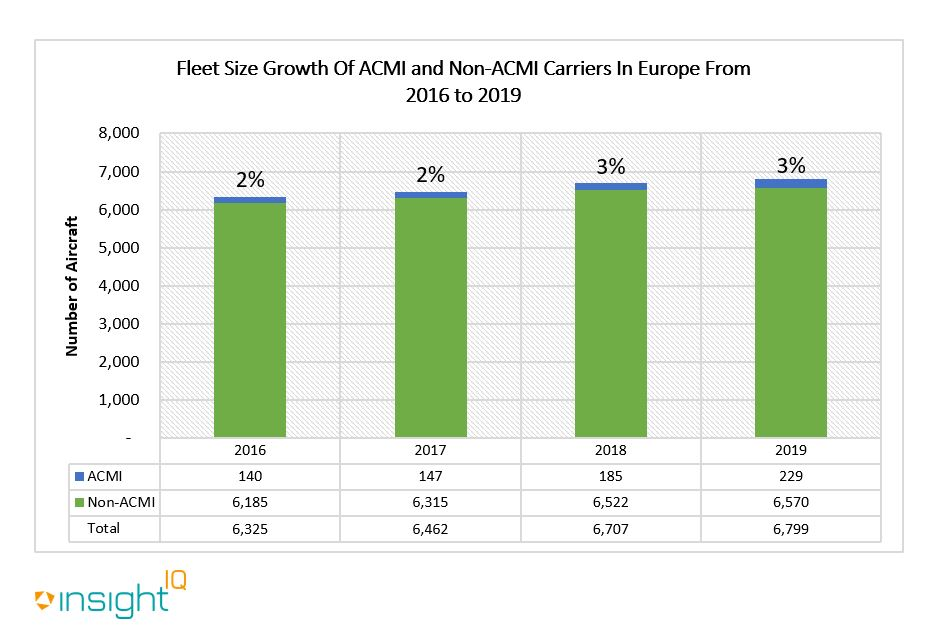

As of the end of 2019, the European ACMI market was estimated to be comprised of 160+ passenger aircraft, with the number of aircraft operated by ACMI operators growing by 22% YoY over the previous year. The number of aircraft in the ACMI market represent 16% of the overall passenger aircraft fleet operating in Europe. ACMI operators utilise aircraft with an average age of 19 years, compared to an overall average age of 16 years for passenger aircraft operating in Europe. AMCI carriers tend to lease their aircraft, with 86% of their fleet leased, compared to 40% leased for the entire population of passenger aircraft operating in Europe. The graph below shows ACMI operators' fleet growth from 2015 to 2019.

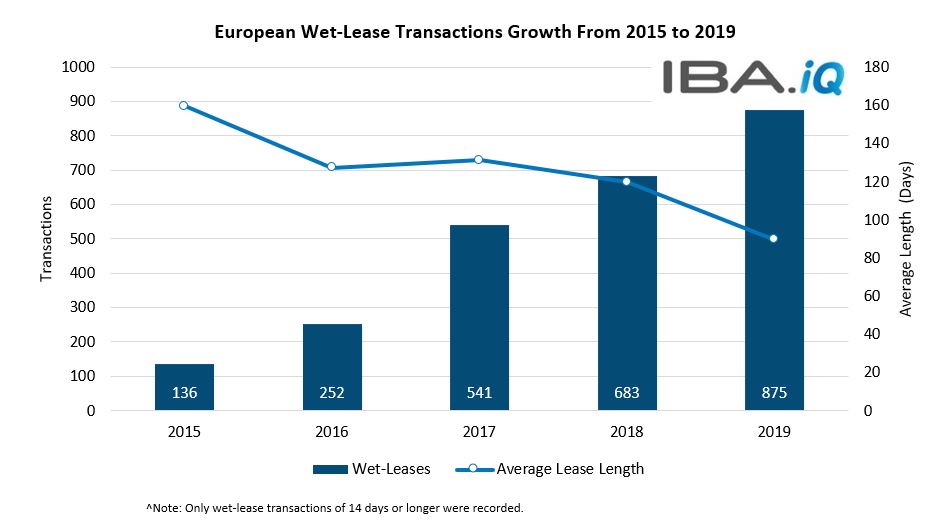

Using data from IBA.iQ Fleets, we can see the ACMI market in Europe stood at 875 recorded wet-lease transactions of 14 days or longer in 2019, an increase of 28% YoY from the 683 transactions noted in 2018. Nearly a third of recorded transactions in 2019 featured Boeing 737-800s with 233 transactions, followed by the Airbus A320-200 with 136 transactions. Widebody aircraft transactions doubled over the last two years, with 99 transactions in 2019. Over the 2015 to 2019 period, IBA has seen a noticeable AAGR increase of 64% in the number of identifiable wet-lease transactions in Europe, which includes wet-leases between associated & group partner airlines. We also note that wet-lease transaction durations are shortening, from an average duration of 160 days in 2015 to 90 days in 2019, as shown in the graph below.

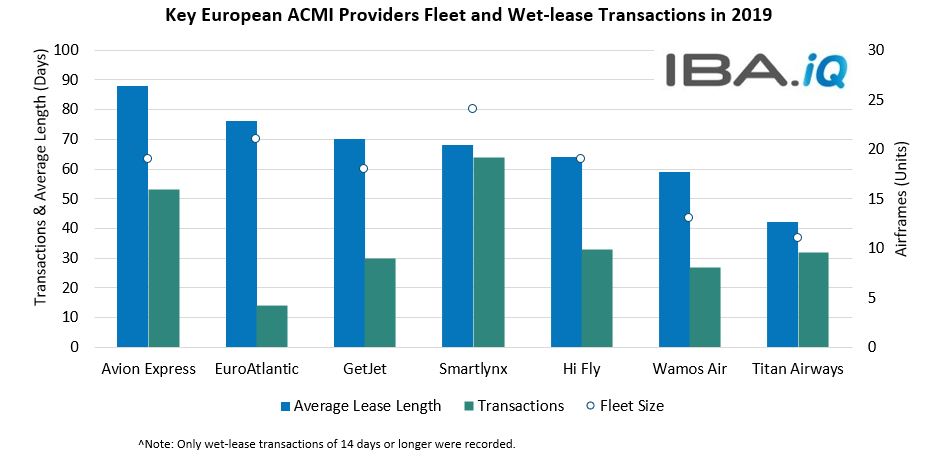

The key ACMI operators that offer wet-lease services in Europe include; Smartlynx, EuroAtlantic Airways, Avion Express, Hi Fly, GetJet Airlines, Wamos Air and Titan Airways. The combined fleet of these key ACMI operators account for around 11% of the overall European fleet. IBA notes SmartLynx has engaged in the most wet-lease transactions over the past five years among independent ACMI operators in Europe. Narrowbody aircraft with ACMI/wet-Lease operators tend to feature longer lease durations than widebodies, turboprops or regional jets. The larger independent ACMI operators in Europe tend to offer wet-lease services featuring aircraft in the 15 to 20 year old age range, slightly above the 16 year old average noted overall for passenger aircraft operated in Europe.

The ACMI market is a niche market that focuses on providing wet-lease and charter services to operators looking for extra capacity during unforeseen events and during the summer months. While the recent Covid-19 outbreak places a negative outlook on the need for extra capacity from ACMI/wet-Lease operators in the near-term, we expect this market to be poised for growth in the long-term as European airlines utilise ACMI carriers to better mitigate the risk of overcapacity.

If you have any further questions, comments or feedback please contact Rami Abdel Aziz

相关内容