04/11/2022

In the first in our series of ‘Ask the Appraiser’ webinars, our experts Jonathan McDonald and Mike Yeomans examined the trajectory of freighter values, identified the hottest trends in P2F conversions, and explored the impact of macroeconomic factors on the air cargo market.

IBA has one of the largest teams of certified senior appraisers in the industry who partner with aviation and financial sector clients globally to give independent advice on wide-ranging, complex asset valuation requirements.

Find out more about IBA Valuations

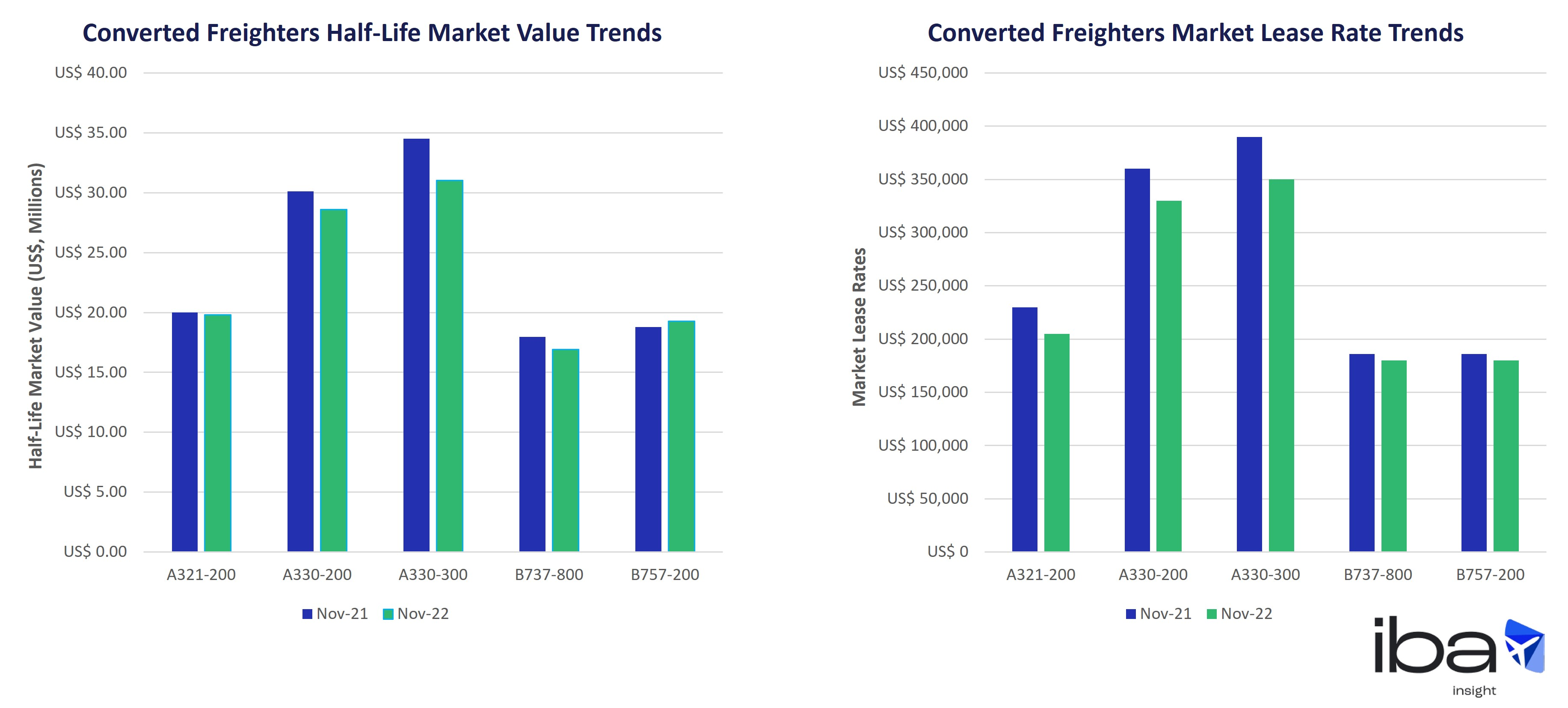

IBA anticipates a general softening in freighter aircraft values in the mid-term. According to IBA Insight Values, half-life values for the Airbus A321-200 converted freighters have remained the most stable in the past year, whilst the A330-300P2F has seen the largest value reduction of around $3.5 million USD. Looking at lease rates, the Boeing 737-800P2F and Boeing 757-200P2F have shown the most stable performance over the past 12 months, and the A330-300P2F again shows the most notable drop.

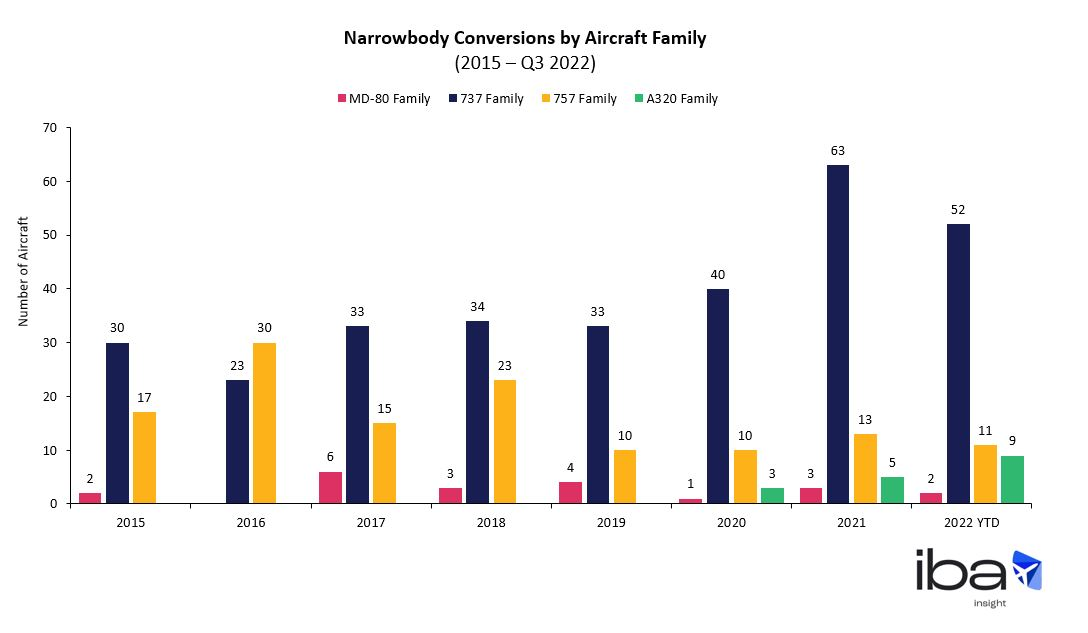

The Boeing 737 family dominates P2F conversions amidst a potential oversupply situation - the Boeing 737 family has dominated narrowbody conversions since 2015. This trend has continued, with the family accounting for just over 70% of total conversions in 2022 so far

Airbus A320 family conversions have been gradually increasing since 2020 – the proportion of annual freighter conversions for the A320 family in 2022 is double that of 2020, increasing from 6% of conversions in 2020 to 12% of conversions in 2022 so far

Whilst a niche type, the Airbus A332-200 P2F is proving ideal for some customers – we anticipate the current high demand for the larger A330-300 P2F to remain in the short to mid-term

The venerable Boeing 757 family remains popular considering the age of the aircraft – but is approaching the end of the road for conversions. 15% of conversions in 2022 so far have been Boeing 757 family aircraft. We believe the Airbus A321 P2F does not quite shape up as a successor to the 757, but a solid supplementary product

Our analysis indicates that 15–20-year-old aircraft are at the perfect age for freighter conversion – and the age of freighter feedstock has substantially reduced across popular types

Join our experts on Thursday 10th November as they reveal key values trends for regional jets and turboprop aircraft. To accommodate our truly global audience, we will be running 2 sessions at 16:00 China Standard Time and 15:00 GMT.

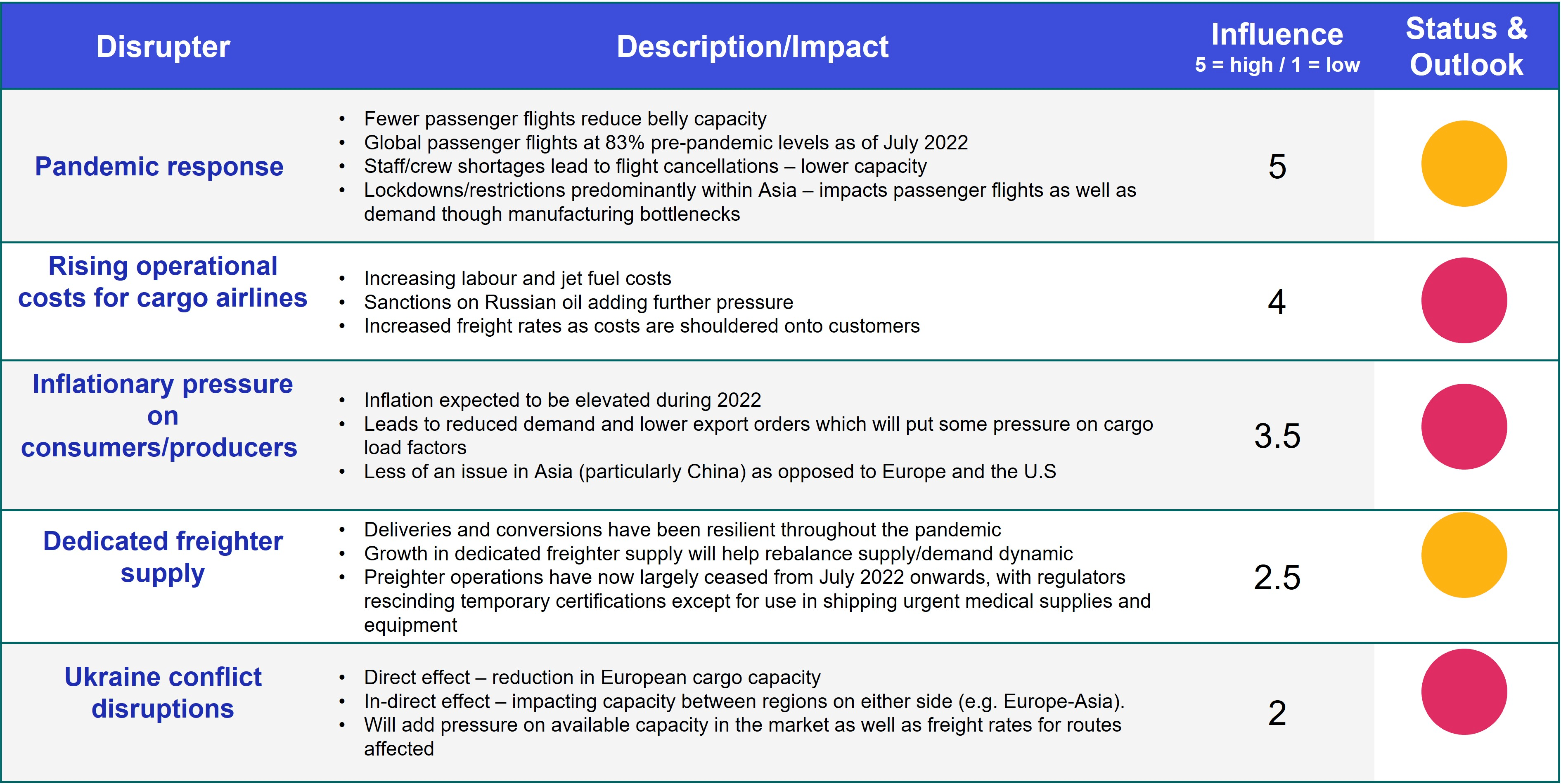

Our experts also identified 5 top disruptors to air cargo and examined their likely impact on the market. They identified that whilst the Covid-19 pandemic and subsequent recovery remain the most significant factor, the overall picture is improving. Rising costs are also a key challenge, with the unique combination of high oil price and high US dollar value resulting in increased freight rates being passed onto customers. Here’s our summary.