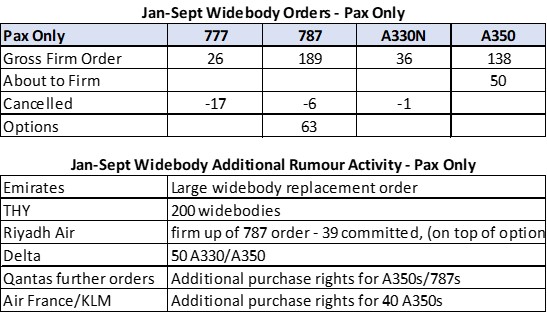

As is an age-old tradition, once airlines get cash, it quickly burns a hole in their pockets. That’s certainly a recent re-emerging trend based on the firm order activity this year. As mentioned in the Paris forecast before the summer, 2023 will certainly prove itself in terms of being a strong year for “firm” orders, as opposed to just commitments - spurred on not just by the race to recovery, but also in reaction to the environmental pressures and the perennial reaction to high fuel prices. Aside from the heavy action already, there continues to be no shortage of planted rumours out there too that could mean even more is yet to come, specifically for widebody activity. Whilst Piotr will go into further detail on the most recent widebody orders, I will round up the bigger picture.

Currently, by just assessing the main narrowbody/widebody passenger markets, widebodies account for 20% of the aircraft, and ~40% of the traffic, although this is due to an accelerated shift from the 22%/47% split pre-2020. There is still a good number of widebodies that remain in storage that I still expect to re-enter the system, (~100 of which are <10 years old) once the Asian market comes back to full strength. The gradual shift towards longer-range narrowbody aircraft for certain routes is certainly something we expect to a point, although only 4.5% of routes ≥ 7 hours still only use a narrowbody; a metric that has not moved to any degree for some time. These markets are often referred to as niche as airspace capacity is assumed to be the limiting factor, however, the economics are compelling.

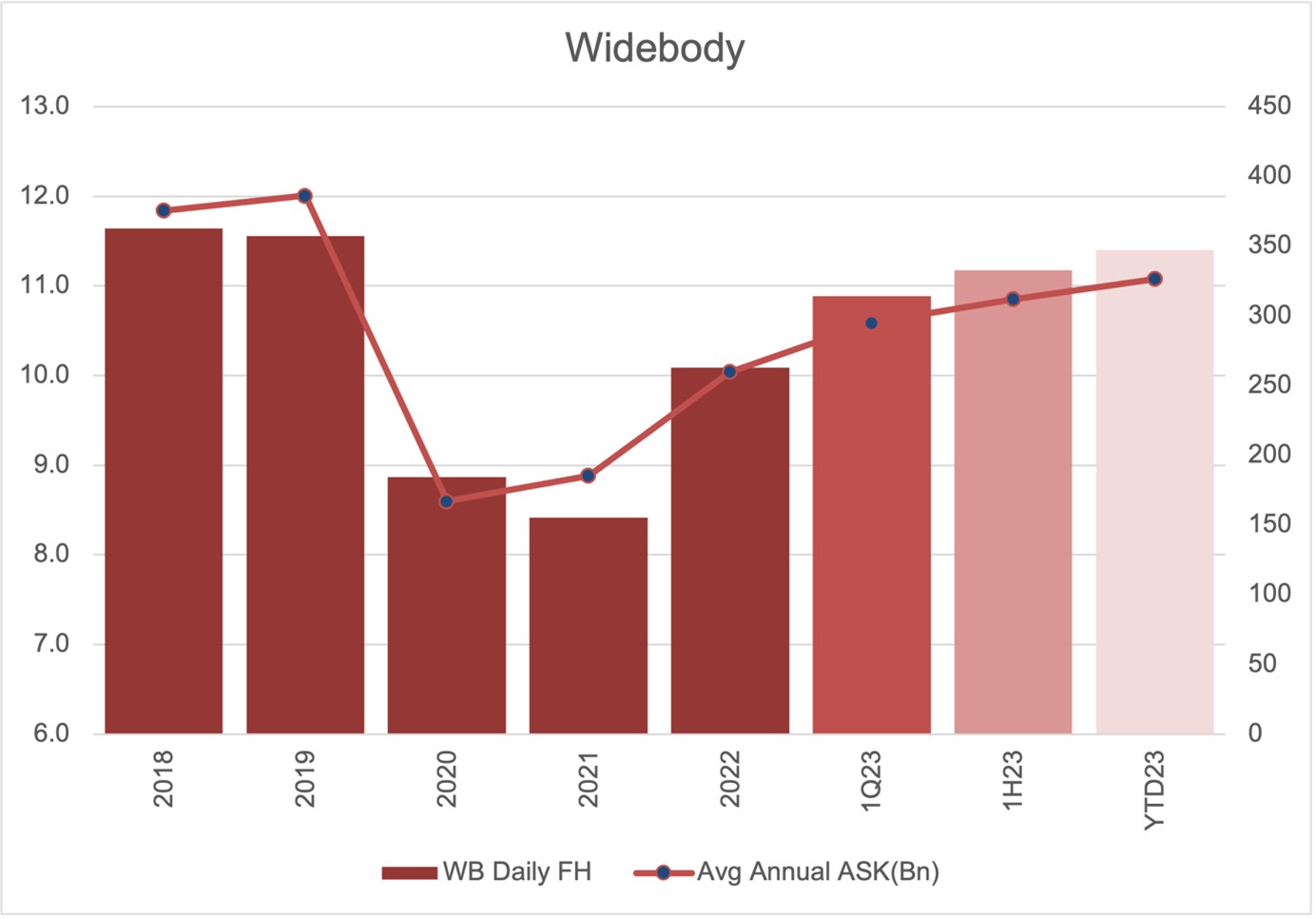

The big capacity drops we’ve already seen can be partially linked to the lower A380 utilisation (plus the retirement of the 747s) which is running at just 60% of 2019 capacity levels. In the long-term, we still expect the balance to stabilise where at least 40% of the capacity is handled by widebodies, with a higher proportion from next year across the medium-term whilst more aircraft coming back online. As I covered in our most recent market update, widebody passenger utilisation is fast approaching prior daily usage levels, however, capacity remains down due to the reduced fleet size. We expect utilisation to continue to rise whilst capacity won't return until next year. Another trend that we expect to continue is a reduced average seat count.

Source: IBA Insight

With that in mind, despite an already-impressive year-to-date order spree, the widebody backlog remains low at just 11.9% (WB vs. NB), which in turn would eventually reduce the in-service fleet size to just 16% by the middle of the next decade as retirements and conversions take place. A lot more orders are expected.

So far this year, 389 firm orders have been identified (including Qantas), with the Air France/KLM 50 aircraft order yet to be confirmed. Prior to the latest announcement, the 787 had the lead, however, the confirmation of Air France/KLM will essentially match 787 and A350 orders for this year. So far, the 777X has only managed to pick up orders from Air India, whilst Emirates switched from the -8 to the -9.

It’s been close to 10 years since Boeing managed to pick up the initial orders for the 777X, however, the program has been plagued with delays in addition to the exogenous factors we’ve all faced, that still prevent the program from entering service until 2025 at the earliest. 2023 is also the first year where the A350-1000 orders are outstripping those for the -900, whilst the direct comparison 777-8 received its only remaining orders 10 years ago at the Dubai Airshow in 2013!

Other indications of near-term orders have come from Delta, Emirates (who have indicated they are planning on placing a large widebody order to arrive in time for the retirement of the A380), THY’s 200 widebody indicative order, and the firming up of Riyadh Air’s additional widebody commitments (probably after it confirms its awaited narrowbody deal). Focusing on the Middle East briefly, there are >500 widebody aircraft on order covering most of the usual suspects already, however, many will be considering the top-ups beyond the top-up! Decisions, however, may be delayed if buyers fear reliability issues spread back into the widebody camp. Lead times from order to delivery already exceed 6 years and unless rates ramp up soon, the re-growing backlog will extend it further.

Ultimately, under these timelines, practically all top-tier operators will need a backlog in place before long. Partly for growth, partly for replacement, and heavily driven by environmental pressures. For the Europeans, there will be no choice. For others, it will only be a matter of time before they need to catch up.

Source: IBA Insight

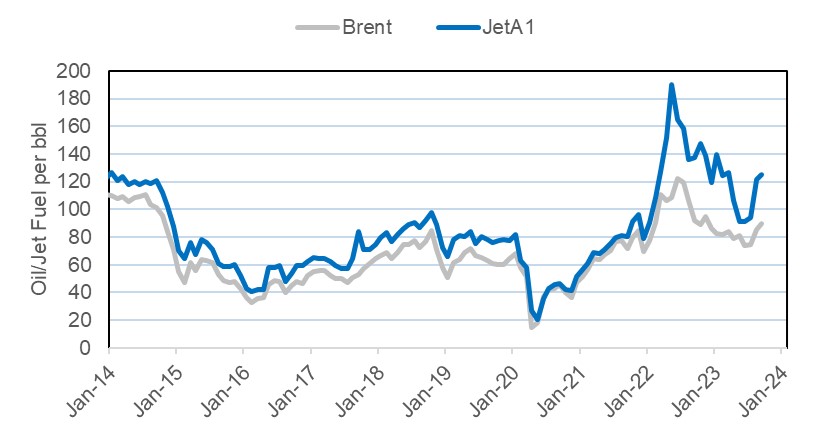

This week saw oil prices reach the highest level since October 2022. That translated into a significant increase in the price of jet fuel with the crack spread continuing to widen in the recent months. It comes right after the airlines’ record H1 profits which saw very high fares and almost unwavering demand. The carriers also continued to achieve high load factors and high fares on constrained capacity supply throughout the third quarter of 2023.

Now however, as the high season is ending and demand is naturally fading due to the season change, the high price of fuel might soon start to eat through the industry’s profit margins for this year and the next. The airlines with the highest exposure are certainly the American ones that typically have low levels of fuel hedging, unlike their European counterparts who, according to Barclays estimates, are typically 60% to 80% hedged for Q4 and between 16% and 45% for 2024. With Q3 results due next month we will likely start to see some of the early impacts of the high fuel costs.

The easiest path forward would be the fare increases like those in 2022, which saw a 20% YoY increase in ticket prices. However, this is only possible with excessive demand, which starts to waver as the carriers are gradually reaching the pre-pandemic capacity levels. Therefore, a further attempt to increase the fare levels in line with the rising prices might prove ineffective.

Replacing ageing fleets with fuel-efficient aircraft will help alleviate some of the fuel pressures but this is more of a gradual, long-term solution. With fares likely reaching their ceilings, airlines may look at the option of trimming some of the winter schedules, removing some of the least profitable flights. Airlines could then also reduce the utilisation of the older less fuel-efficient aircraft in favour of newer more fuel-efficient types to limit fuel spending.

Source: IBA research

The demand for widebody aircraft stays strong across the industry with this week’s big order coming from Air France – KLM (AFKLM), who announced intentions to order 50 A350 aircraft with the option for 40 more. That purchase would make the airline group the largest A350 operator in the world with 22 out of 41 previously ordered already in service with Air France. The order comes as part of the group’s effort to renew its entire fleet, with the share of new-generation aircraft planned to reach 64% by 2028, a significant increase from 5% in 2019.

The freshly ordered aircraft are expected to replace the group’s ageing widebody fleet in the coming years with deliveries planned for 2026-2030. According to IBA Insight Fleet data, the flag carrier of France has a large fleet of 63 Boeing 777s with an average age of 23.3 years for the -200ER variant and 15.1 years for the -300ER variant. The airline also operates 10 787-9s although has no further orders for Boeing widebodies. In addition to its Boeing fleet, Air France operates 15 A330ceos, with an average age of 20.9 years.

The fleet of KLM primarily consists of younger Boeing aircraft including 31 777s and 23 787s. The 777s are also divided into two variants with the -200ERs nearing an average age of 19 years and -300ERs being just under 10 years. Furthermore, KLM is awaiting delivery of another 5 787-10s.

Judging by the AFKLM’s fleet age and the composition of both, it is fair to assume that freshly ordered A350s will be delegated to the French carrier. So far, the airline has been operating the aircraft for some time and has expressed satisfaction with the aircraft's track record as instrumental in reaching the group’s ambitious sustainability targets, including a 30% cutdown of CO2 emissions by 2030.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。