There has been a lot of talk about lease extensions in recent months from just about every corner of the industry in reaction to supply chain/reliability problems. Anecdotal levels of 70-100% are not uncommon. The overall trend is nothing new and was one of the key points I raised that would influence the market at our Dublin Breakfast Briefing back in January during the Airline Economics conference. Since then, I have dedicated a significant amount of time to digging further into this situation given the difficulty in tracking extensions as and when they occur. More recently, I presented an initial overview of the situation at the Shannon International Leasing Conference (SILC) in Limerick and judging by the questions raised in the following weeks, I thought it would be worthwhile raising here and covering additional factors not already discussed.

For those not in the know, a lease extension is an arrangement where a normal operating lease term can be extended from the initial termination date, postponing the transition back to the lessor. Extensions have been around since the advent of leasing when terms were often much shorter than we find today and motivated by operators who need to retain lift as an alternative to getting another aircraft from a different source. Some leases have preset extension terms already built into the initial lease, whilst the rest are negotiated before return discussions get underway. There are advantages and disadvantages to both transitions and extensions and generally, the market conditions at the time will normally dictate which way it will go. Similarly, there are key trends amongst certain lessees that influence it too. In all, there are around 20 good reasons (equally balanced) that tend to appear time and time again.

To benefit transitions, we would tend to see a mix of high fuel costs hurting old tech aircraft, demand for younger fleet, the need to negotiate better terms (lessor or lessee driven), lessee wanting to switch to a different aircraft type altogether, the lessor has another need for the aircraft, or new aircraft are on the way. Right now, high fuel costs and the need to negotiate much better terms (for the lessor) are the principal drivers for transitions.

To benefit extensions, the drivers tend to include, low lessee cash levels preventing return conditions from being met, lessees needing a payment holiday, OEM supply being constrained, new aircraft pricing rising, poor reliability with the replacement technology, transition costs/downtime avoidance, MRO supply constrained, or airlines have no clear replacement direction selected. Right now, just about everything is in play!

From both sides, there are generally more aspects in favour of extension than transition as it delays the high costs and uncertainty relating to maintenance, downtime, and remarketing. Consequently, it is not unusual to see narrowbody extensions sitting marginally above 50% (extensions ‘v’ transitions) over the past 25 years. As such, it is typical to see extension lease rates being set below transition lease rates. The typical terms are also normally just 1-2 years agreed ~1 year ahead. That’s for a normal market though!

We are clearly not in a normal market! Demand is up, backlogs and delivery lead times are way beyond historical levels, the reliability of the previous technology is vastly superior, and higher fares can offset higher fuel/staff costs (for the time being). Of course, this is not a new phenomenon, as previous downturns and supply constraints have triggered prior trends, however, the combination of drivers we face today far exceeds that seen previously. Not surprising when I estimate that the travel system will be missing >4,200 aircraft that will never be made through lost production over the eight years since the MAX grounding. Almost double the number I have seen estimated by others.

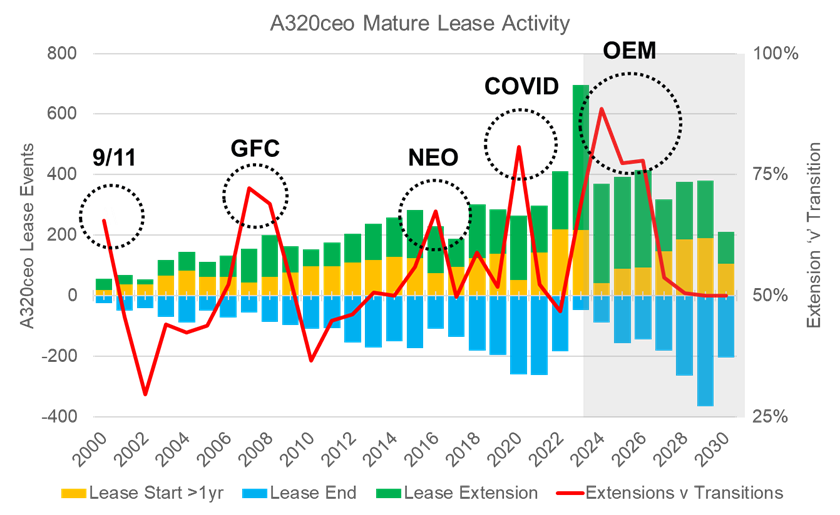

To illustrate this dynamic, I have compiled the mature lease activity for the A320ceo (as a proxy) from 2000 to today and projected out to 2030.

Source: IBA Insight & Intelligence

From the chart, we can see the spikes of extension demand triggered by poor lessee cash flow (9/11, GFC, and Covid-19 pandemic), supply constraints coupled with slow re-fleet decisions (NEO), and supply constraints (OEM). Similarly, we can see how levels fall once demand has been met, and how the baseline grows towards 50% as the fleet matures and lessor ownership widens. It is important to note that we see a similar trend for the 737-800, except worse as it started earlier and has freight demand to contend with. Similarly, the same trend is seen for widebodies like the 777-300ER and A330ceos, although they continue to occur at a lower level than the narrowbodies.

What makes the current spike so different from the prior ones is how the terms have changed. Whilst it is normal for 1–2-year extensions set a year ahead, we are now seeing terms grow to 4-6 years with deals being set for leases not expected to end as far out as 2026. Coupled with that, lease rates in some cases have risen >40% above the ages-specific rates negotiated just prior to the spike. Essentially, this means that in some extreme cases, aircraft that were due to return at year 12 are not expected to return until 2032 when they are 18 years old. More generally, it also means that mid-life A320 lease rates have shifted from the mid-100s to above 200. If airlines aren’t willing to go that far, then lessors are quite happy to get the aircraft back and re-lease elsewhere. What it goes to show is just how skewed the balance really is when demand recovery strikes.

I’m of the firm belief that the fallout from this doesn’t end there. If terms are lengthening and rates are improving (significantly), then surely these leases are worth more, provided credit quality doesn’t diminish too much. Whilst we correctly predicted that trading would be down this year, I’m more upbeat about 2024-2025. Supply still won’t be back to full strength, however, the demand for sale-leasebacks for those that do deliver will improve and be funded by the higher number of lessor sales with leases attached that should occur given the higher achievable pricing. Leases signed in the low-interest, high-supply environment, allow for a rebalance of expected returns and perhaps the trigger the market needs to attract new equity into the space. We’ve seen lessor consolidation, but that can be quickly undone with some sizeable portfolio sales to new entrants. Perhaps even the re-invigoration of the ABS market too!

So how long does this go on for? Ultimately no change until we reach a balance of predictable and reliable new technology deliveries against falling demand and interest rates. Aside from a sudden demand reset, not until 2027. With delivery lead times >7.5 years for A320neos and more stacking up, it could go out further.

There remains an element of caution though. Kicking the can down the road does potentially build a lease-end bubble further out. However, given the average age of the fleet will be quite high when the lease end spike hits, it might finally mean we get some real part-out activity to liberate the engines and parts the industry so desperately needs. Despite the huge commitment by the lessees to extend leases, I still don’t think they’ve fully thought through where they expect to get the engines from to keep them all flying. Surely this will mean the demand for shop visits will kick in just when the market expects to bank the cash! I expect engine lessors won’t have much left either!

We’re once again in the running for 'Appraiser of the Year' at the upcoming Airline Economics Aviation 100 Global Leaders Awards – but we need your help to secure the title!

Click the link below to vote for IBA on Question 18. Votes close on Wednesday, 20th December 2023.

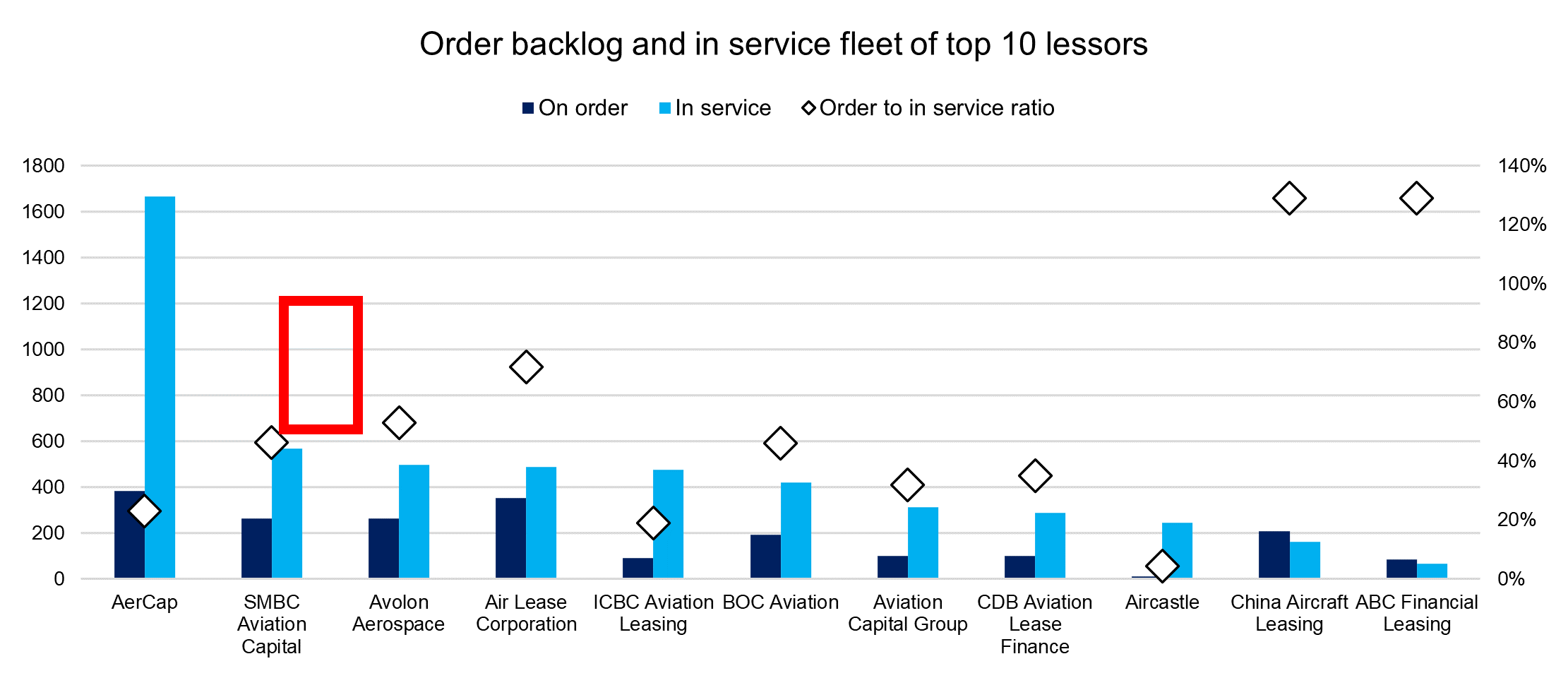

Soon after the Dubai Airshow came to an end, Airbus announced a new order for 60 A320neo family aircraft from Japan-based SMBC Aviation Capital – the world’s second-largest lessor by in-service fleet size. This order follows a September one for 25 737 MAX and will bring SMBC’s already sizeable backlog of A320neo family to 183 aircraft, which places it at the top among all leasing companies.

As of November 2023, SMBC has a fleet of 570 aircraft in-service and 264 on order. Narrowbodies make up the bulk of the fleet – staggering 92% – with 337 being of the A320 family and 190 of the Boeing 737 family. With SMBC’s competitors actively growing their own backlogs and order-to-in-service ratios higher than ever, the decision to increase the order book makes perfect sense. The delivery issues experienced by Boeing and Airbus are not expected to be over soon, which makes the lessors anticipate even greater demand for new aircraft, especially the A320neo and A321neo.

The A320neo aircraft family is particularly popular, capturing a 60% market share and with a backlog reaching over 6,700 aircraft as of November 2023, according to IBA Insight. The lessors put in over 1,000 of those orders. The aircraft’s popularity in the lessor market can be attributed in part to its fuel efficiency, which makes it a very attractive choice for airlines. This in turn drives up the demand and the waiting time, which is now around 7.5 years. Both the orders’ pace and lessor demand do not show any signs of slowing down, with backlogs and waiting times reaching historic highs. The demand-supply imbalance continues and is allowing the lease rates on the aircraft to remain elevated.

Source: IBA Insight

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。