As the year draws to a close, we are close enough now to get a more accurate view of how the OEMs will perform. It is also a key starting point for my detailed delivery forecast which will be released soon after the New Year break. As in years gone by, we expect OEMs to pull out all the stops for the final month and end the year on a high. This is certainly the case when I view the activity going on at the various final assembly sites. If the OEM wants to get the aircraft delivered in time, flight testing and customer approval flights would already need to be underway. Supply chains have been discussed to the nth degree by now so I’m going to limit myself by running through the near-term outlooks for the key programs and publish the final table.

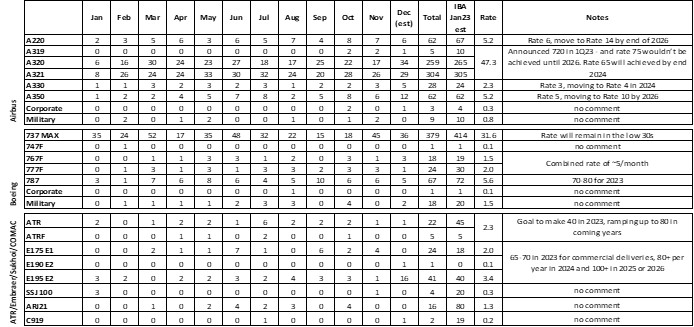

Back in January, Airbus stated they would produce 720 commercial aircraft, a sizeable 11% increase over 2022. Looking at which aircraft are mobilising today across the five main sites (Mobile, Mirabel, Toulouse, Hamburg, & Tianjin), the final tally is going to be very close if not bang on! Very impressive given the curve balls served to OEMs this year. Our predictions a year ago were at 733, so not far out. Looking at the main commercial programs, the A220s will be near to rate 5.2, which is close to what I would expect, but will need to go some to get up to the rate 14 target required by the end of 2026. Next, we have the A320neo family which has the added complexity of relying on two different engine OEMs and the infamous GTF issue. At the outset of 2023, the intention was for the program to deliver rate 43, and then move up to rate 50 by year-end. Naturally, this is difficult to monitor monthly due to the erratic flow of deliveries month over month, however, by taking that broad average for each quarter we get to ~555. Based on my observations, they will hit 568 units, split almost perfectly 50:50 by the LEAP and GTF. The A321s take the prize with 54% of deliveries and the bias towards the GTF. Across the year, the rate averages out at 47.3 but clearly tipped towards the backend of the year. A great achievement, but rate 75 is less than three years away. Turning to the Airbus widebodies, the A330neo will be at ~28 deliveries by our reckoning, ~20% off rate 3, although they did hit it for the last four months of the year and the three MRTTs they delivered possibly should be included too. The A350 will deliver ~62 and therefore delivering at rate 5.2, close to Airbus’ guidance since Covid. The medium-term plan is for the A330neo to increase to rate 4 by the end of next year, whilst the A350 will move to rate 10 by 2026. Combined with the other programs, that will potentially mean that by 2027, Airbus will be producing 103 aircraft per month, a jump of ~72% over today! The backlogs can sustain it but not sure there is enough market bandwidth and tarmac to take it.

On the Boeing side, there has been less focus on delivering huge volumes, but more applied to consistency. They have been plagued with quality issues this year, as can be seen when you plot out the MAX delivery results. ~50 in the good months, 15 when things grind to a halt. So, it’s no surprise that Boeing provide their guidance in loose ranges. Within 2023, we had three instances where Boeing announced a quality issue leading to further adjustment. At the outset, they had indicated their target was 400-450 deliveries. With hard work and two further problems, they managed to limit the damage to the guidance of 375-400. By checking reams of tracking/observation data, they will deliver 379 commercial 737 MAX aircraft (380 including the single BBJ delivered). The number would be larger if the hordes of Chinese MAXs weren’t being held in political limbo. Again, it would seem they are becoming more accurate, albeit far too conservative still. Going forward, there certainly isn’t much publicised commitment yet on the ramp-up timings but the pressure emerging from their customers would be considerable. Whilst they will end the year in the mid-30s, the mission must surely be to achieve the older NG rates before pushing through to match the competition. For the Boeing widebodies, the combined target for the 767 and 777 programs of rate 5 slipped to 3.5 this year. Lower than expected, but then again, the line must bridge the gap until the 777X achieves certification and Everett completes its transformation. Finally, on the 787, despite more problems, the initial target of 70-80 units wasn’t far off if recent activity is to be believed. At this point, it would seem a total of 67 787 units will be delivered to customers this year. Pretty good when we consider the year took three months to start. Ultimately, that equates to rate 5.6, only marginally off the mark. In the medium-term, the ambition will be to reach rate 10 and beyond to reduce order-delivery timelines to win more orders. In terms of where Boeing will end up, we expect them to deliver 489 commercial aircraft, against our prediction from last year of 536, and their expectation of 590 units. I was a little heavy on the MAX and 777F outlook, but then I was probably only expecting two production issues.

Finally, looking at the other OEMs, the movement tends to be more erratic in the aftermath of the Covid shutdown. For ATR, the intention was to produce 40, before ramping up to 80 in the coming years. From my estimations, the 2023 number will be closer to 27 and 14% of the backlog, a trend that has held for three years now. Prior to 2020, it was common to see deliveries hitting ~35% of backlog, and even 75% in the period spanning the early noughties when a strong duopoly was in play. Embraer announced their target at the start of the year to be 65-70 commercial deliveries, moving to 80+ next year and >100 from 2025/2026. My estimates have them at 66, but it requires them to cancel Christmas first to deliver over 25% of their delivery stream in one month. Surprisingly I don’t have them down for any 175 E1s in December, whilst it is dominated by the 195 E2. Unsurprisingly, my predictions were out for both OEMs. I was bullish on ATR, and bearish on Embraer – but not by a lot.

Source: IBA Insight & Intelligence

We’re once again in the running for 'Appraiser of the Year' at the upcoming Airline Economics Aviation 100 Global Leaders Awards – but we need your help to secure the title!

Click the link below to vote for IBA on Question 18. Votes close on Wednesday, 20th December 2023.

In past months we have discussed M&A activity a lot. The pandemic caused performance divergence, giving some carriers cash arsenals whilst others’ weaknesses made them targets. This continued this week, with the announced $1.9bn transaction plan of Alaska Airlines to acquire Hawaiian Airlines.

The first thing to note is the wording. As an acquisition, the target maintains its brand and Alaska CEO, Ben Micucci cited the importance of this. Since both carriers represent the US’ youngest and, crucially, most remote states, they represent a large part of local infrastructure, and the brands respectively hold large value. As well as that cultural link they are both full-service carriers so there is plenty of synergy. If the respective shareholders approve the transaction, estimated as soon as Q1 2024, it is expected to close in 12-18 months. The transaction cost is expected to be in the realm of $400-500m, whilst annual cost savings are forecast by management to be $235m: recouped in only 2 years.

It is astute timing of Alaska as they were able to return to profitability early in the pandemic (2021), whilst Hawaiian still have negative EBIT in 2023 (-8.9% margin 3Q 2023), depressing their valuation. IBA Airlines had forecast a continued erosion of their book value up to 2025. The outlook is now more positive, not only due to the parent’s financial support but also the combined scale. This will allow them to better compete with the US legacy carriers domestically as well as the large APAC carriers internationally.

The Pacific carrier will also benefit from a broader US feeder network whilst Alaska Airlines will benefit from Hawaiian's international routes, largely a new venture for them. This will also create challenges for Alaska in additionally managing widebodies as well as now mixing between Boeing (their historical preference) and Airbus aircraft.

The most obvious benefit will be more control, and therefore more pricing power, of the US Mainland-Hawaii routes. The combined entity will only represent under 4% of the US domestic market but will represent 49% of flights from the US mainland to the Pacific islands. The airlines will be very aware of US DOJ’s recent zealous challenges to the Spirit-JetBlue merger and Northeast Alliance. Details of break-up settlement are already in the public domain, showing that concerns about regulators are real. A last detail is positive, however. The deal is reportedly all-cash. This is typically a move by an acquirer only feeling particularly bullish since the stock alternative would share risk (and reward!). As the US market yield drops paint a not-so-bright picture, a couple of the airlines will still be feeling festive going into the holidays.

The European Union, represented by Wopke Hoekstra, the EU’s climate commissioner, plans to champion the implementation of an aviation fuel tax at the upcoming 28th Conference of the Parties (COP28). Hoekstra envisions the tax as a significant revenue source, with charges applied per flight. The Commissioner's strategy involves thorough discussions during COP28 to address the rationale, specifics, and execution of the aviation tax. Additionally, COP28 aims to establish a fund for loss and damage associated with global warming, a contentious topic with the EU committing a substantial amount, contingent on positive outcomes. The financial requirements for addressing climate change impacts, estimated in the trillions annually, have led to proposals such as the EU's "polluter pays" principle, making fossil fuel producers financially responsible for climate damage and renewable energy transitions in developing nations. Eamon Ryan, the Irish climate minister, emphasizes the need for taxing the aviation industry and sourcing diverse financing solutions in the final COP28 agreement. IBA agrees with this inclusion into the agenda as such policies promote aviation decarbonisation. Furthermore, as the discussion unfolds, it would be two steps in the right direction to have a conversation around the incentivisation of SAF as one of the potential outcomes. Additionally, taxing the fuel producers causes a ripple effect impacting airlines and passenger cost.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。