Date: 15/03/2024 (Edition 5) Download PDF

.png)

A few things have piqued my interest this week…

It’s no surprise that we are starting to see operators adapt their 2024 fleet plans (again) to account for further Boeing delays. Southwest Airlines disclosed in its latest regulatory report this week that they had been advised to expect 46 737 MAX 8s and no MAX 7s (down from a combined total of 79 as mentioned in their Q4 report, 27 of which were expected to be MAX 7s). Coupled with a flatter outlook, this sent shares tumbling by 15% on Tuesday, which seems harsh given their performance.

Similarly, listening to United Airlines CEO Scott Kirby at the JP Morgan Industrials Conference this week, Jamie and Mark’s questions were pointing to some response on what United will look to do given the MAX 10 delays. Across the session, he said they would take more MAX 9s instead and have asked Boeing to stop building MAX 10s for them until it gets certified. In terms of comparison, the seat count variance (for them – 179 v 185) is relatively small so not a big revenue problem either. But also, he took a seemingly relaxed view, probably more than we had previously seen, on the whole issue. To paraphrase, he was “encouraged at the first step” that Boeing had taken the problem onboard and were working on it such that deliveries this year will be “way behind.” To cap it, Delta Air Lines CEO Ed Bastian said they were “already anticipating if it came in ’25, it’d be late in the year,” but he guessed that it will likely “be another year or two beyond that.”

So, in terms of how IBA is currently allocating deliveries within our guidance and our IBA Insight platform, more MAX 9s for United and further trimming back of MAX 8s for Southwest will be required. Provided the price is right, we could even see more A321s being pencilled in for United. All of this going on whilst Boeing continue discussions about a possible takeover of Spirit AeroSystems to bring it back into the Boeing camp. It would make sense and something I have thought has been a long time in coming – certainly from the perspective of getting on top of supply volume, but ultimately, a step in the right direction for quality. However, it is important to note that there is some added complexity involved given that Spirit also builds frame sections for the A350 program.

At the other end of the spectrum, it was announced by C&L this week that another 787 is going to be parted out in 2024. That will make it the fourth 787, and the first GEnx powered production 787 (Ln 17) to be scrapped. So far, Boeing has parted out one of the GEnx test aircraft (line no. 5), and Eirtrade parted out a pair of 10-year-old Rolls-powered ex-Norwegian 787-8s mid-last year.

There is certainly going to be demand from the market to get hold of some of the components it has, especially considering that Boeing would have performed a thorough storage program. The bare engines depending on thrust and generation (pre-PiP/PiP1 or PiP2) could be $20-30m each as they have barely moved since the aircraft was first flown in 2015, and the additional required aircraft/engine equipment (RAE/REE) is another $2m per engine when new. Other expensive items will include thrust reversers (potentially up to another $10m), APU, landing gears, avionics, and those massive power units.

It may seem odd when aircraft shortage appears to be a major problem that an aircraft that cannot endure airframe corrosion is undergoing a part-out – the same thought for the ex-Norwegian pair that were scrapped last year. Essentially, the cost to bring back to service versus market demand for the smallest member of the family was tilting in favour of the value of the parts. For this latest victim, it is probably clearer cut as it is one of the early build “terrible teens”. These first examples had lower MTOWs (484,000 lb) and high empty weights affecting their operating performance. Aside from the first five test aircraft that have since been retired, the remaining 14 are with Ethiopian (6), ANA (2), Air Austral (1), and Air Japan (1), with the remainder being used for corporate roles. Depending on how well this goes, we may see more like it.

A week after the results of their peers, Lufthansa Group’s annual results came in with similarly bright messaging. With revenue up 14.7% to €35.4bn and a net margin of 4.7%, from 2.6% in 2022, their results came in the middle of the three groups, as expected. International Airlines Group (IAG) had a net margin of 9.0% with Air France-KLM (AF-KLM) recording a 3.1% net margin.

Similar to AF-KLM, Lufthansa’s revenue was still less than 2019 at 97.3%. What was more significant was how ASKs were only 83.8% of 2019 levels (but up by 16% from 2022). AF-KLM were reportedly at 93% of 2019 capacity levels (although their public numbers suggest 89.1%), whilst IAG were at 95.7%. This will partly be explained by the continued closure of Russian airspace, affecting their Asian markets. The other significant detail, looking at Lufthansa Airlines specifically, is that 76 out of 301 of their aircraft were parked or stored at year-end 2023, including 10 of their 14 A380s. The airline only had 25 aircraft parked or stored at year-end 2019, with a similar fleet size (298) including only one of their 14 A380s. Swiss were the best performer in the group again, accounting for almost the same EBIT as Lufthansa Airlines, despite being a third of the revenue of the German carrier.

The group’s similar revenue to 2019, despite more parked aircraft, can be explained by elevated passenger yield. An average fare of EUR222 was higher than €194 in 2019. However, a warning flag for 2024 is that this was less than the €228 of 2022. We have seen yields drop in the US and this trend is starting to cross the pond. Whilst one might view the capacity deficit as ground that LHG can reclaim, generally it costs yield or load factor to do so. This is assuming that it is not already lost to competitors. Lufthansa were at least able to up their load factor in 2023 to 82.9% from 79.8% in 2022 (although this is less than both of their competitors).

An extra context piece about Lufthansa is that their staff count ended 11.7% down on 2022 year-end. Unfortunately, this was not the case of a great up in efficiency (they actually averaged a higher staff count over the year). This drop was the sale of their catering arm LSG at year-end. Whilst this may help with cost control going forward if they reduce food services, they play a dangerous game in diminishing their product. With premium leisure performing strongly at the moment, they could lose market share.

For 2024, IBA gives Lufthansa Group an IBA Risk Rating of 4B. Air France-KLM score 3C and IAG score 2B. If they do take on ITA, which CEO Carsten Spohr has stated he still intends to do (despite new necessary slot concessions), the risk of Lufthansa Airlines could increase.

Environmental consciousness is increasingly influencing business and leisure travel decisions. Business travellers and companies are opting for sustainable travel options such as eco-friendly airlines, hotels with green certifications, and carbon offsetting programs. Leisure travellers are also beginning to go for more eco-friendly airlines, destinations, and tech-driven sustainability solutions. These are evident in reports by the Euromonitor Sustainability Index, stating that about 80% of passengers are willing to pay at least 10% more for sustainable travel features.

Also, SITA’s Passenger Insight 2023 report shows that 64% of passengers are more aware and interested in using technology to reduce airline emissions. The report also revealed that nearly 60% of passengers are keen to understand the concept of Sustainable Aviation Fuels. IBA sees this as an upward trend gradually impacting the industry. We see more research being carried out as efforts into awareness continue to grow.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight, the ultimate aviation intelligence platform.

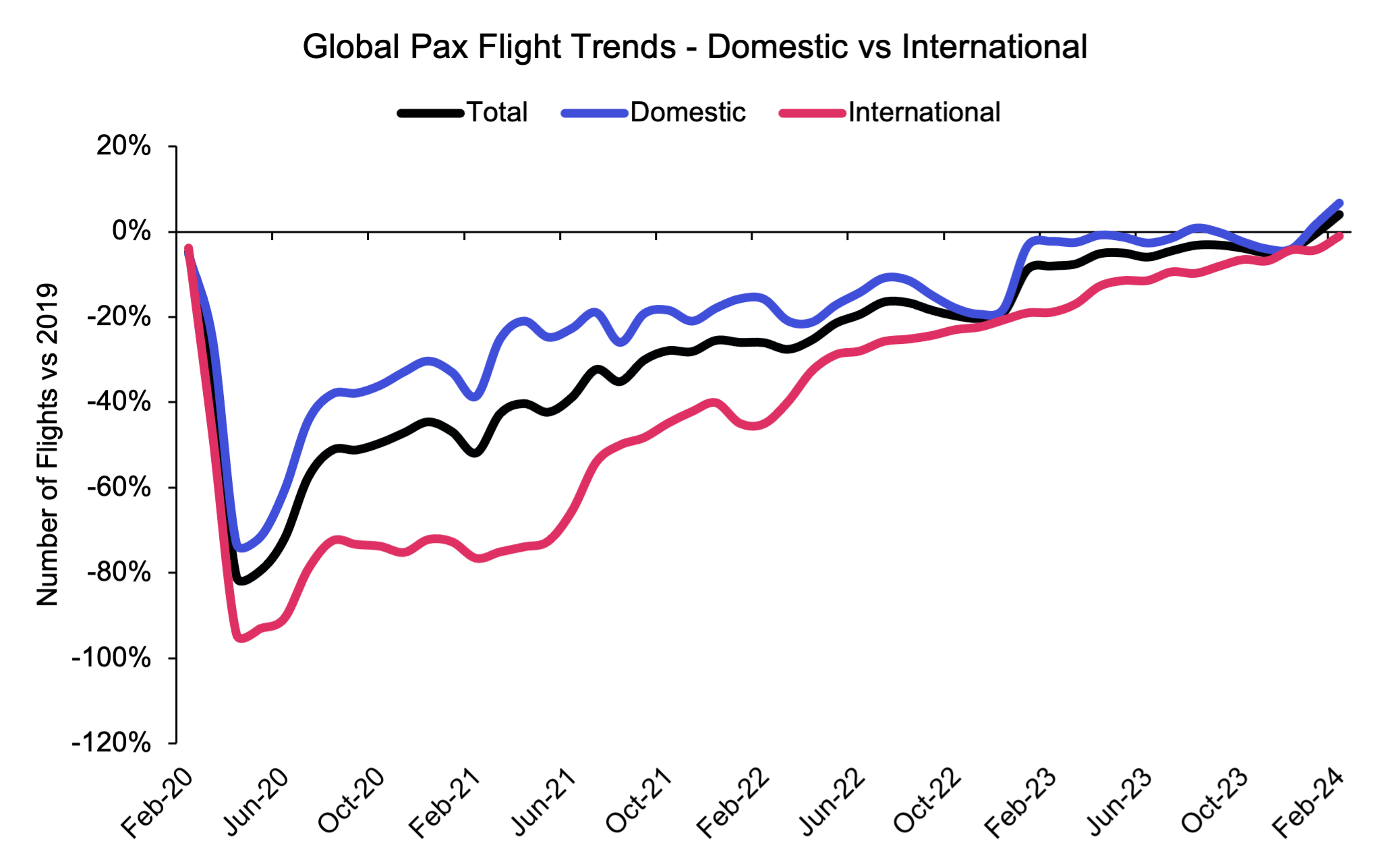

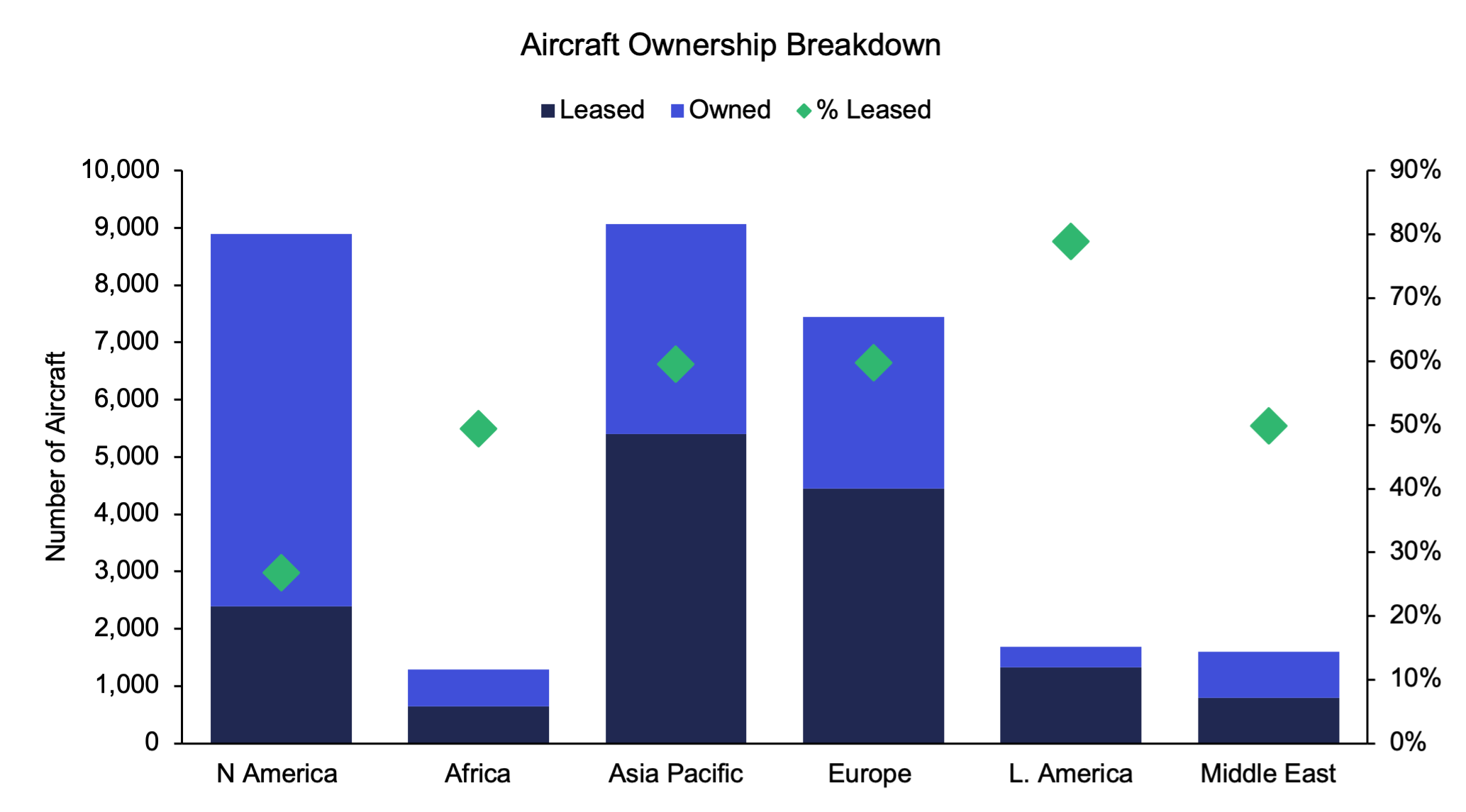

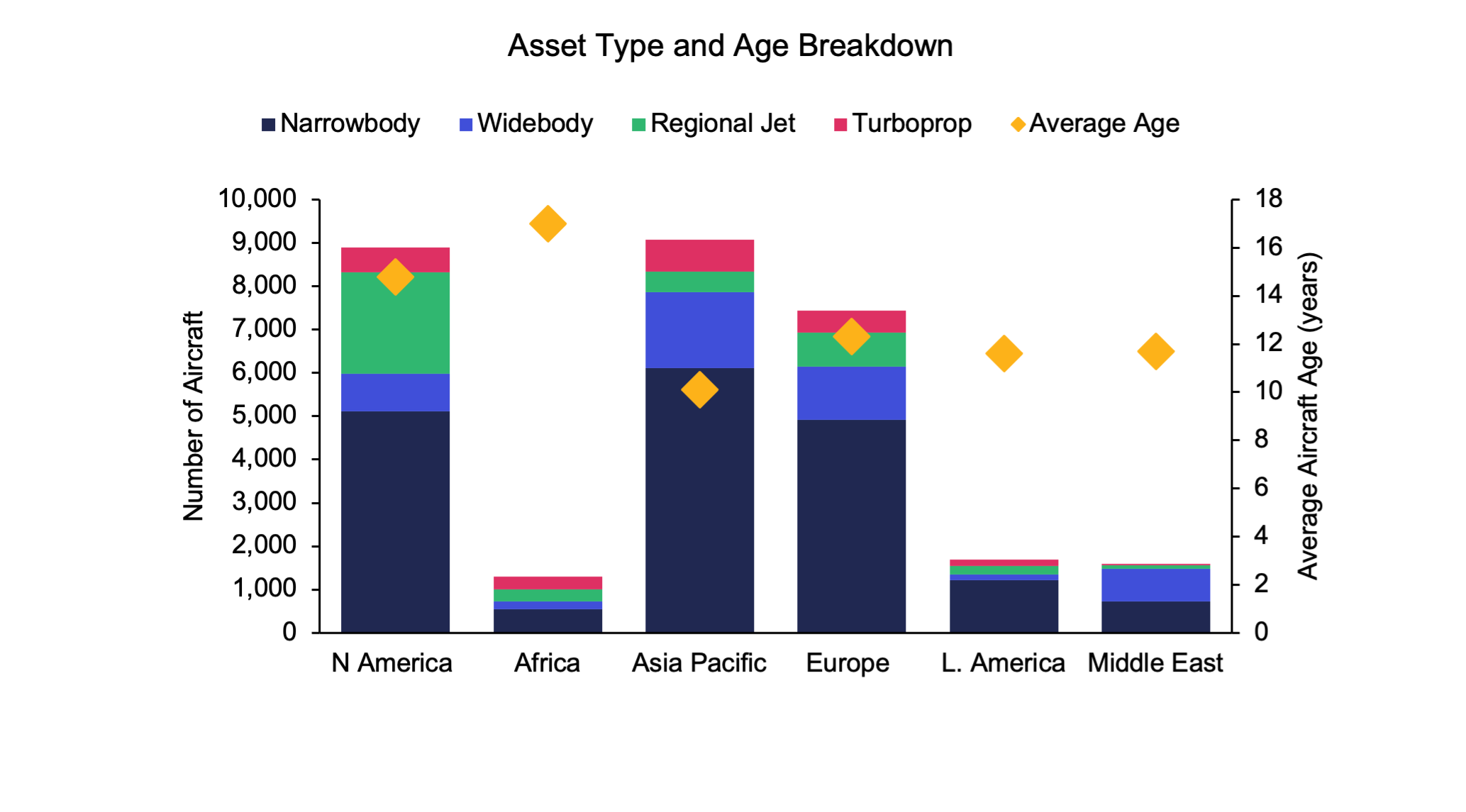

Source: IBA Insight

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。