Date: 15/03/2024 (Edition 5) Download PDF

.png)

A few things have piqued my interest this week…

It’s no surprise that we are starting to see operators adapt their 2024 fleet plans (again) to account for further Boeing delays. Southwest Airlines disclosed in its latest regulatory report this week that they had been advised to expect 46 737 MAX 8s and no MAX 7s (down from a combined total of 79 as mentioned in their Q4 report, 27 of which were expected to be MAX 7s). Coupled with a flatter outlook, this sent shares tumbling by 15% on Tuesday, which seems harsh given their performance.

Similarly, listening to United Airlines CEO Scott Kirby at the JP Morgan Industrials Conference this week, Jamie and Mark’s questions were pointing to some response on what United will look to do given the MAX 10 delays. Across the session, he said they would take more MAX 9s instead and have asked Boeing to stop building MAX 10s for them until it gets certified. In terms of comparison, the seat count variance (for them – 179 v 185) is relatively small so not a big revenue problem either. But also, he took a seemingly relaxed view, probably more than we had previously seen, on the whole issue. To paraphrase, he was “encouraged at the first step” that Boeing had taken the problem onboard and were working on it such that deliveries this year will be “way behind.” To cap it, Delta Air Lines CEO Ed Bastian said they were “already anticipating if it came in ’25, it’d be late in the year,” but he guessed that it will likely “be another year or two beyond that.”

So, in terms of how IBA is currently allocating deliveries within our guidance and our IBA Insight platform, more MAX 9s for United and further trimming back of MAX 8s for Southwest will be required. Provided the price is right, we could even see more A321s being pencilled in for United. All of this going on whilst Boeing continue discussions about a possible takeover of Spirit AeroSystems to bring it back into the Boeing camp. It would make sense and something I have thought has been a long time in coming – certainly from the perspective of getting on top of supply volume, but ultimately, a step in the right direction for quality. However, it is important to note that there is some added complexity involved given that Spirit also builds frame sections for the A350 program.

At the other end of the spectrum, it was announced by C&L this week that another 787 is going to be parted out in 2024. That will make it the fourth 787, and the first GEnx powered production 787 (Ln 17) to be scrapped. So far, Boeing has parted out one of the GEnx test aircraft (line no. 5), and Eirtrade parted out a pair of 10-year-old Rolls-powered ex-Norwegian 787-8s mid-last year.

There is certainly going to be demand from the market to get hold of some of the components it has, especially considering that Boeing would have performed a thorough storage program. The bare engines depending on thrust and generation (pre-PiP/PiP1 or PiP2) could be $20-30m each as they have barely moved since the aircraft was first flown in 2015, and the additional required aircraft/engine equipment (RAE/REE) is another $2m per engine when new. Other expensive items will include thrust reversers (potentially up to another $10m), APU, landing gears, avionics, and those massive power units.

It may seem odd when aircraft shortage appears to be a major problem that an aircraft that cannot endure airframe corrosion is undergoing a part-out – the same thought for the ex-Norwegian pair that were scrapped last year. Essentially, the cost to bring back to service versus market demand for the smallest member of the family was tilting in favour of the value of the parts. For this latest victim, it is probably clearer cut as it is one of the early build “terrible teens”. These first examples had lower MTOWs (484,000 lb) and high empty weights affecting their operating performance. Aside from the first five test aircraft that have since been retired, the remaining 14 are with Ethiopian (6), ANA (2), Air Austral (1), and Air Japan (1), with the remainder being used for corporate roles. Depending on how well this goes, we may see more like it.

A week after the results of their peers, Lufthansa Group’s annual results came in with similarly bright messaging. With revenue up 14.7% to €35.4bn and a net margin of 4.7%, from 2.6% in 2022, their results came in the middle of the three groups, as expected. International Airlines Group (IAG) had a net margin of 9.0% with Air France-KLM (AF-KLM) recording a 3.1% net margin.

Similar to AF-KLM, Lufthansa’s revenue was still less than 2019 at 97.3%. What was more significant was how ASKs were only 83.8% of 2019 levels (but up by 16% from 2022). AF-KLM were reportedly at 93% of 2019 capacity levels (although their public numbers suggest 89.1%), whilst IAG were at 95.7%. This will partly be explained by the continued closure of Russian airspace, affecting their Asian markets. The other significant detail, looking at Lufthansa Airlines specifically, is that 76 out of 301 of their aircraft were parked or stored at year-end 2023, including 10 of their 14 A380s. The airline only had 25 aircraft parked or stored at year-end 2019, with a similar fleet size (298) including only one of their 14 A380s. Swiss were the best performer in the group again, accounting for almost the same EBIT as Lufthansa Airlines, despite being a third of the revenue of the German carrier.

The group’s similar revenue to 2019, despite more parked aircraft, can be explained by elevated passenger yield. An average fare of EUR222 was higher than €194 in 2019. However, a warning flag for 2024 is that this was less than the €228 of 2022. We have seen yields drop in the US and this trend is starting to cross the pond. Whilst one might view the capacity deficit as ground that LHG can reclaim, generally it costs yield or load factor to do so. This is assuming that it is not already lost to competitors. Lufthansa were at least able to up their load factor in 2023 to 82.9% from 79.8% in 2022 (although this is less than both of their competitors).

An extra context piece about Lufthansa is that their staff count ended 11.7% down on 2022 year-end. Unfortunately, this was not the case of a great up in efficiency (they actually averaged a higher staff count over the year). This drop was the sale of their catering arm LSG at year-end. Whilst this may help with cost control going forward if they reduce food services, they play a dangerous game in diminishing their product. With premium leisure performing strongly at the moment, they could lose market share.

For 2024, IBA gives Lufthansa Group an IBA Risk Rating of 4B. Air France-KLM score 3C and IAG score 2B. If they do take on ITA, which CEO Carsten Spohr has stated he still intends to do (despite new necessary slot concessions), the risk of Lufthansa Airlines could increase.

Environmental consciousness is increasingly influencing business and leisure travel decisions. Business travellers and companies are opting for sustainable travel options such as eco-friendly airlines, hotels with green certifications, and carbon offsetting programs. Leisure travellers are also beginning to go for more eco-friendly airlines, destinations, and tech-driven sustainability solutions. These are evident in reports by the Euromonitor Sustainability Index, stating that about 80% of passengers are willing to pay at least 10% more for sustainable travel features.

Also, SITA’s Passenger Insight 2023 report shows that 64% of passengers are more aware and interested in using technology to reduce airline emissions. The report also revealed that nearly 60% of passengers are keen to understand the concept of Sustainable Aviation Fuels. IBA sees this as an upward trend gradually impacting the industry. We see more research being carried out as efforts into awareness continue to grow.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight, the ultimate aviation intelligence platform.

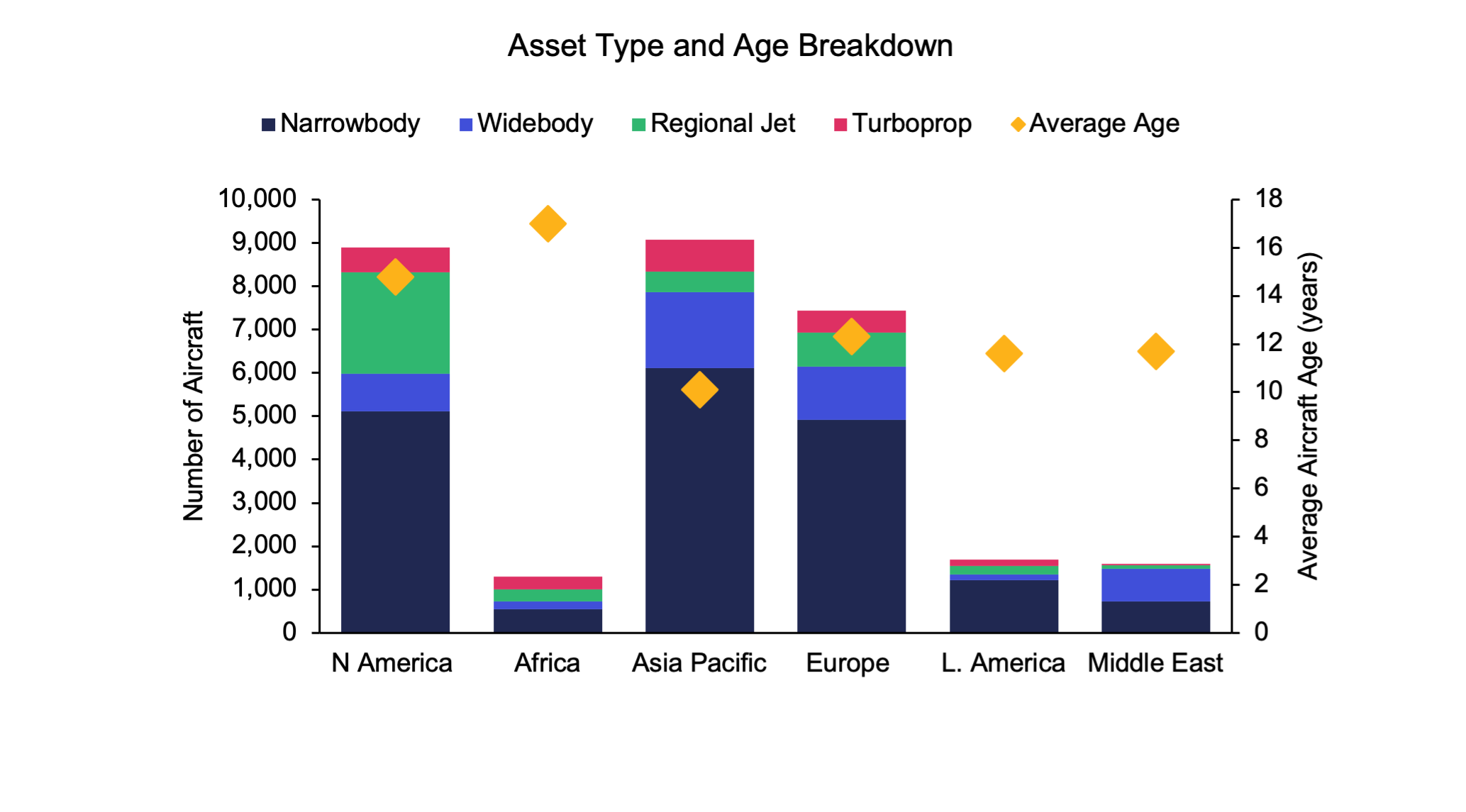

Source: IBA Insight

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。