Moving on from last week’s Q3 scheduled capacity review, it’s time to reflect on how actual seat capacity performed during the second quarter, as bullish sentiment can easily be pushed aside by a lack of demand, or from aircraft and labour shortages.

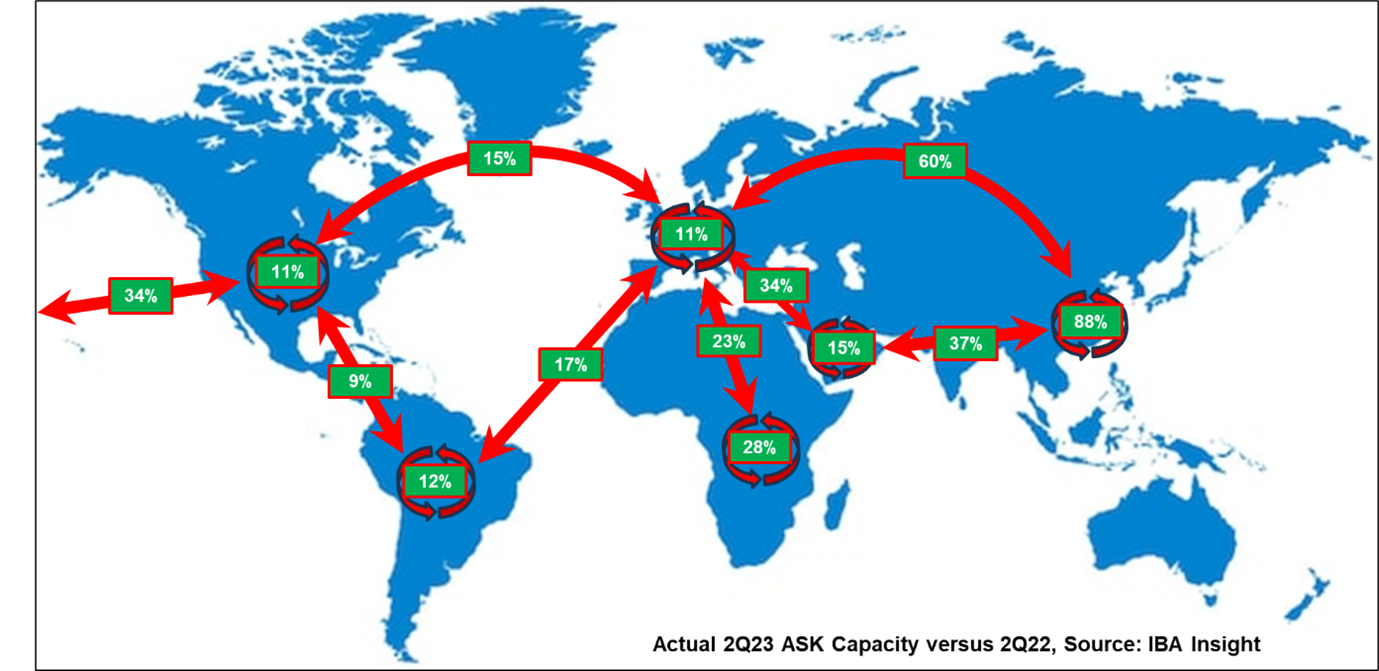

As the first chart below indicates, actual capacity increased compared to 2022 across the board ranging from 9% between North America and Latin America to 88% for intra-Asia Pacific due to the low base last year. For the case of the latter, this is a stark contrast to published scheduled capacity due to the reluctance of Asian operators to issue figures for Q2 earlier in the year.

Estimations based on published schedules indicated that intra-Asia Pacific capacity would rise 44%, whereas the real number was closer to double that. In contrast, whilst trans-Pacific capacity was expected to rise by as much as 88%, the real number was closer to 34%. The largest contrast occurred, however, for capacity scheduled between Europe and Asia Pacific which indicated that performance would remain marginally lower than that seen in the second quarter of 2022, where in fact the final number shows an increase of 60%.

In relative terms, the increase in capacity between Europe and Asia is largely across the board with only Air China trailing 2022 levels in the top 25. The largest relative increases came from Cathay, Korean, Asiana, China Southern and BA – all at >100% compared to 2Q22.

Source: IBA Insight & Intelligence

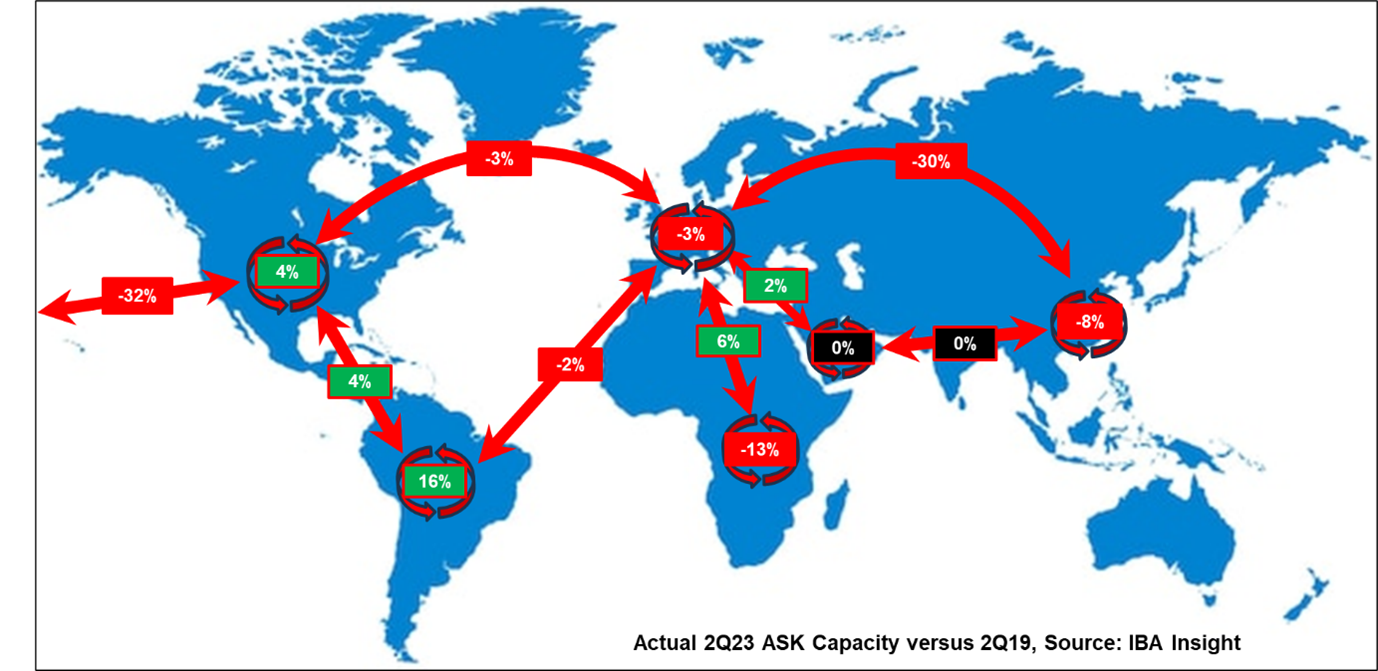

As in 2022, THY continues to lead in the flows between Europe and Asia Pacific, one of the odd ones that show growth compared to 2019, joined only by EVA (54%), Virgin (26%) and Air India (5%) in the top 25. Others like Lufthansa, BA, Air France, Thai, KLM, Cathay, and Finnair continue to trail by 30-40% compared to 2019 figures for the second quarter but occupy a significant portion of the overall capacity for the route. Lufthansa originally held the top spot for Europe-Asia capacity back in 2019 with a substantial margin but currently remain in third spot. Whilst we expect them to add more capacity, competition on the routes from others with huge growth aspirations, like THY, could shake up the balance.

Plotting this along with the rest of the 2023-2019 comparison on a map, a more familiar story appears whereby most regions and routes are in the red, whilst a few have fought to illustrate growth on a modest scale. As expected, all domestic and intra-regional capacity across the Americas exhibited capacity growth whilst traffic across the Atlantic is still not quite there yet – but it’s close. Latin America, as covered last week, remains the most bullish. Capacity between Africa and Europe has also exceeded 2019 levels now, joined by Europe-Middle East, which has just nudged over the line.

Globally, the figures are more impressive. When comparing 2Q23 to 2Q22, capacity has grown by approximately 30%, whilst when comparing to the same period in 2019, we are still only adrift by 4.5%. With a busy summer schedule ahead, the comparison of schedules and actuals will be put to the test. As with last quarter, I still expect misses for Asian routes due to the reluctance of some to put their figures out there, but I would expect a step up from most of the top 25. However, judging by my own experiences of short-term cancellations, yield management will dictate that still for most for the time being, with one eye remaining on the competition.

Source: IBA Insight & Intelligence

When in December 2021 Emirates took the last delivery of an A380, most took that as a signal of the beginning of the end for the ‘superjumbo’. UK start-up, Global Airlines, is now putting that into question by launching an exclusively A380 airline. Having acquired three more A380s on the secondary market this week, their total reaches four, with them hoping to start operations in spring 2024.

At the announcement of the end of the program, most carriers adjusted orders to the A350 and A330neo which offer greater fuel efficiency, but lower seat capacity. In single class, an A350 can get to 480 seats (440 for A330) whilst an A380 can get to over 850. Boeing are also lacking in higher capacity aircraft still in production.

The question, therefore, arises whether there is still demand for larger widebodies. The largest client is by far Emirates with their 118 in-service A380s representing 51% of the global fleet. Alongside the 777, the A380 has been fundamental to their transit traffic long-haul business model. With widebody traffic finally recovering, this led them to a record net profit margin of 9.9% in FY22/23.

Perhaps the greatest value of large widebodies is around slot constrained airports, however. To meet demand, sometimes up gauging necessitates widebodies to be run, even on short-haul routes. Global Airlines’ decision, as a UK airline, may be partly motivated by five of the top 10 revenue generating routes (in 2019) involving London Heathrow.

There are of course drawbacks to the A380. As a quad-jet, the aircraft has worse emissions per-seat per-mile than even current-generation narrowbodies (analysed with IBA’s NetZero platform). The A380 in a typical configuration will emit 176g CO2 per-seat per-mile compared with 130g by a 787 (the widebody with the lowest emissions). Some nations such as Israel have used this as a reason to ban quad-jets this year. It is also worth noting that only 140 airports have sufficient length runways to accommodate the A380 (7.3% of global international airports). This will place a ceiling on Global Airlines’ future growth if the emission fees and fuel economy do not already.

At this stage, it is unclear what sort of product Global Airlines will be offering. One of the final challenges of taking over A380s is the refurbishment costs. Singapore’s refurbishment of 14 x A380s in 2017 came at a cost of $61m each and Global Airlines will have this extra expense to consider. This can of course work both ways though. Full-service carriers that rely on the highest quality product may move out the type to avoid this cost. The average age of the type is 9.6 years, and that decision may be arriving soon for many operators, pulling down the price. There may still be economic life for the type, yet.

Aerospace company Tecnam have put on hold the development of their all-electric passenger aircraft ‘P-Volt’. The aircraft was supposed to be put into service in 2026 on domestic routes in Norway, but battery limitations have hindered its commercial viability. After extensive research, it was concluded that battery technology is not advanced enough to be an operational reality. Tecnam conducted three years of research on the entire lifecycle of the all-electric aircraft and determined that after only a few hundred flights the operator would have to replace the battery. The slow charging and undercharging of the battery mean that the lifecycle emissions from production and operations are deficient.

However, not all electric aircraft manufacturers have experienced technological downfalls. It was announced at the Paris Airshow that Miami-based AeroLease had signed a letter of intent to purchase 50 Eviation Alice electric aircraft, ZeroAvia announced multiple deals including a large order from California-based Flyshare for 250 hydrogen-electric turboprops, alongside various other deals, collaborations, and investments. Current electric aircraft are limited by a short-range and low seat capacity and will be accommodating mainly regional flights with limited passengers.

With international short- and long-haul flights the main cause of emissions in aviation, and electric aircraft energy density currently unable to serve these routes (and unlikely to within the next 20 years), IBA question whether electric aircraft investments should be a priority area in decarbonisation strategies. If electric aircraft will be a focus for regional travel that can be achieved via rail transport, then government investments should be for enhancing efficient and cost-effective rail transport instead.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.