Date: 01/03/2024 (Edition 4) Download PDF

.png)

In our Market Update Webinar back in mid-January, we highlighted that 2024 would see an uptick in Chapter 11/failure activity. In most years, mature economic dynamics (fuel cost, dollar strength, labour costs) and shock events would naturally align with a prolonged CASM/RASM mismatch and the increased probability of failures. 2021-2023 was naturally different. Recovery from a low point, coupled with revenge travel meant that despite rising costs across all fronts, demand recovery and toppy fares have potentially papered over the cracks.

The signals are mixed though. Even if we assume that revenge travel should be subsiding by now (or we will have to change the name again!) as yields head back towards pre-pandemic levels, aircraft and engine demand continues to strengthen, as indicated by the lease rate and value recovery metrics. This is undoubtedly going to add further strain to lessor-heavy operators. The ones historically most vulnerable when failures start to rise, are seeing a big step up in lease and maintenance costs that will require higher load factors without selling cheap. This is made worse when operators and lessors still can’t rely on when new deliveries will show up, MRO and parts availability lead times, and reliability for in-service equipment.

This year, we have already seen:

GOL seek Chapter 11 protection (yet still carrying on with sale-leasebacks)

Pacific Airlines shrinking towards just 5 aircraft and relying on wet leasing to cover the rest

Bamboo Airways shrinking towards just 6 aircraft (from 30)

SpiceJet using Indian courts to refute repeated insolvency pleas from lessors

SriLankan Airlines trying to find a buyer before they are grounded

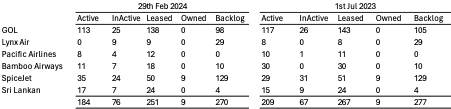

These six airlines represent a total of 260 aircraft (76 of which are parked up – two-thirds were inactive back in July 2023), and 270 aircraft on order! Of the 260, only 9 are owned (SpiceJet’s mostly inactive DHC8s that are on finance lease).

Purely based on these metrics, the remaining five in-service have some work to do to remain solvent or convince the market that their business model is viable. Despite the apparent risk, lessors remain bullish as the options to re-lease repossessed assets currently remain high provided you can cover the maintenance and reconfiguration needs. CALC recently managed to shift the ex-Bamboo 787s over to Austrian. Similarly, four have successfully shifted from SpiceJet and GOL to new homes. At the Dublin conference, there was certainly a mood of expectation that getting aircraft back now that are on older rental agreements would provide sufficient upside if in place before the summer.

Of the remaining five, the activity to continue persists. In Brazil, GOL is actively working on its DIP financing and continuing to take new deliveries (that AerCap appears to be willing to buy and leaseback), whilst, in Vietnam, Pacific Airlines has reduced its fixed costs and is utilising more expensive wet leasing options until it is folded into its parent (Vietnam Airlines). Bamboo has reduced its costs by moving away from long-haul and looking to rebuild. Whereas in the Indian subcontinent, SpiceJet has placed bids to absorb GoFirst and SriLankan is looking for a new owner before next Tuesday! That may sound bleak; however, SriLankan did return to operational profitability in 2023 and continues to look to bolster lift requirements and avoid expensive new orders for the time being. It is highly unlikely the four A350s on backlog will be delivered given the lawsuit they filed against Airbus in 2021. I don’t normally expect state-owned airlines to fold so I still have this one on low probability.

In terms of the failure/Chapter 11 chart that I have maintained for well over a decade now, only GOL and Lynx Air have so far been added, but it won’t end there. The shift to higher leasing and maintenance costs against shrinking fares will cause more to rethink strategies, seek protection, or consolidate.

On Thursday, February 29th 2024, two of the big three European groups released their results. Unsurprisingly both had a positive message amidst the high passenger ticket prices of 2023. Air France-KLM boasted a 15.1% increase in annual revenue with a slight lift of net margin up to 3.1% (having led the three groups with 2.8% in 2022). This performance was eclipsed by IAG, however, with the group increasing annual revenue by 27.7% and net margin swinging up to 9.0% from 1.9% in 2022.

A year ago, the key differentiator in strategy between the three groups had been IAG’s decision to focus free cashflow into investment, rather than deleveraging, as with the other two. This led to them having the greatest difference between EBIT and net margins, reducing cash generation that year. However, the €3.5bn investment set them up better for 2023. This year the group was able to up ASKs by 22.6%, whilst increasing load factor to 85.3% (up by 3.5 percentage points). Interestingly, similar to Delta’s comments, premium leisure demand was one of the key positive forces. By contrast, business is still lagging, which has resulted in the overall ASKs still being 4.3% shy of 2019 levels.

In terms of the cost base, most operating costs changed in line with the ASK growth, with the exception of employee costs (+16.7%) and depreciation being flat. The first should be praised, given the wage pressure of a high-inflation environment. Interestingly the airline cited emissions tariffs as a reason for the lack of fuel savings. This is despite the airline being the third largest user of SAF globally in 2023 (showing they are affecting bottom lines more and more). Most of the profit growth will therefore have been through economies of scale and increasing yield (+4.7% per passenger).

Air France-KLM’s performance was positive, but economies of scale are perhaps why it fell behind IAG. They also managed the great achievement of increasing capacity, load factor and yield simultaneously. Their load factor was in fact higher than IAG, at 87.3% (up from 84.0% in 2022). They also increased yield per passenger by 1.4% and capacity by 8.8%. The latter two were more muted and will have propped up the first. This was the same trend throughout their interim results. Load factor leads to increased profitability on a per-flight business, but scale is still needed to overcome the central costs. AF-KLM will have been particularly affected by French ATC strikes; however, this is likely to only account for a minority of the difference between them and IAG. Their capacity in 2023 was still 93% of 2019 levels. Restraint may have cost them in the performance rankings and worse still may cost them market share if they are perceived to have an inferior network.

The airline’s position will further not be helped in 2024, if the airline faces repercussions from their €3.4bn Covid bailout being ruled as unfair by the European Commission in early February. As to perhaps regain ground, the Franco-Dutch group used their operating cash flow to make a €3.2bn cash investment outflow in 2023, whilst keeping financing flat. However, IAG went one better, using cash reserves in addition to operating cash to make a €3.4bn investment outflow and €5.2bn financing outflow. Their cash reserves dropped by € 3.8bn but they still are healthy at €5.4bn.

There are, of course, Lufthansa’s results coming out next week to further contextualise these two. It will be interesting to see if they made a similarly large use of cash in 2023. With production issues continuing in 2024, it may have been prudent to invest cash whilst you fully could.

India's aviation sector has recently witnessed significant developments, ranging from legal disputes to strategic investments and insolvency proceedings, highlighting both challenges and opportunities within the industry.

Go First has been facing a dire situation for a while now with the airline's downturn able to be attributed to a string of problems that have plagued its operations. Once a major player in the low-cost carrier segment, Go First halted flights in May 2023, with Pratt and Whitney engine issues grounding nearly half of its 52 Airbus A320neo fleet in December 2022. They are still seeking $1 billion compensation from Pratt & Whitney for alleged losses of $1.32 billion. Despite these challenges, potential investors are eyeing opportunities to revive Go First. Among them, SpiceJet's owner, Ajay Singh, and co-owner of EaseMyTrip, Nishant Pitti, have formed a consortium bidding $72.4 million for Go First, aiming to capitalize on the airline's market potential.

This is quite a curious pairing, as SpiceJet itself is undergoing significant financial restructuring. The airline recently raised substantial capital by issuing equity shares and warrants, amounting to $127.9 million. This move is a sign of investors’ confidence; however, it could also be perceived as overconfidence amidst the airline’s financial problems. Moreover, SpiceJet has also struggled in the legal field. The Supreme Court of India and the Delhi High Court have both ordered SpiceJet to settle its creditor and maintenance debt claims, further undermining the airline’s future credibility.

SpiceJet and Go First aren’t alone in their troubles in that market. Jet Airways is also contending with legal issues as its collapse in 2019 left $941 million of creditor claims. In 2021 Jalan Kalrock Consortium agreed to pay $42 million to settle all claims in exchange for buying the airline. However, $18.1 million of creditor claims remains unsettled, raising concerns about that airline’s future.

The struggle of stakeholders of both Go First and SpiceJet to overcome obstacles and revitalise each airline's prospects underscores the market potential of India’s aviation market. If successful, the combined fleet of over 100 aircraft plus another 200 on order could have a fighting chance against the country’s giants – Indigo and Air India. However, for now, the biggest challenge is the complicated financial and legal landscape of India’s aviation sector.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。