This week saw the sudden announcement by RTX to upgrade its earlier statement to inspect 1,200 GTF engines to rectify metal powder contamination that could lead to the cracking of HPT disks to include up to 3,000 engines. Already last month, the FAA issued a mandate to inspect the first and second stage high-pressure turbine disks of certain engines within 30 days. With the new announcement, RTX estimates that an additional 600-700 engines will require a lengthy visit to the shop over and above those already scheduled for shop visits between 2023 and 2026. The scary part is that the initial estimate of 60 days has been shifted up to 300 days! As a result, RTX expect there to be a high number of grounded aircraft from now until the end of the first half of next year. This comes as a significant blow to both Pratt & Whitney and operators who have already been experiencing reliability issues on top of supply chain problems. Both Wizz and Lufthansa have voiced their reaction to the situation by announcing capacity reductions and the higher use of existing ceos. RTX have consequently estimated the profit impact for themselves at $3-3.5bn whilst their program partners will face a similar impact over the next three years.

What I find surprising is that both RTX and Airbus continue to remain firm on the ramp-up plan. We’ve already seen problems with the provisions of spare engines to support the current AOG situation to maintain new deliveries, but surely if we end up with the situation whereby circa 650 aircraft ended up grounded for an extended period, the pressure to take engines from the line to support the in-service fleet will reach epic proportions. That also assumes that the problem remains limited to what they have announced so far. RTX remain firm that sales are not expected to be impacted which I feel is optimistic given operators have a choice, although it’s not as if CFM have any short-term gaps in production this side of 2030.

On the positive side, the already high demand for serviceable narrowbody aircraft will take a further jump. This will speed up the re-entry into service where possible of the remaining 250 A319/A320/A321s in storage that were parked up between 2020-2022, which ignore those that have been in storage for over 3 years, those already in between leases, and those stuck in Russia. Well, at least for a few more years anyway. Any short-term thoughts of retirements could certainly go out of the window for the time being as lease rates shift upwards. Part-outs, as already covered in previous weeks, remain at an industry low point since the peak in 2013. That said, the A320ceo family peaked in 2021 and makes up the bulk of the current part-out activity for narrowbodies. Whilst I was forecasting a resurgence of A320 part-out activity from 2025 onwards to coincide with production ramp-ups and the rectification of known issues, it may need to be pushed further out. The economics of what drives a part-out versus maintaining its serviceability for a few years more will certainly be tested.

At the moment, there are lots of stories around Asia, with one of the most prominent being about Indian carrier’s large order backlogs. However, if one applies context in terms of GDP, population and the size of existing airlines, IndiGo and Air India may not be the airlines taking the most risk. With Vietnam airline’s recent 50 x 737 MAX order and Thai Airways reportedly about to order 95 aircraft (80 of which are widebodies), attention is drawn to South East Asia.

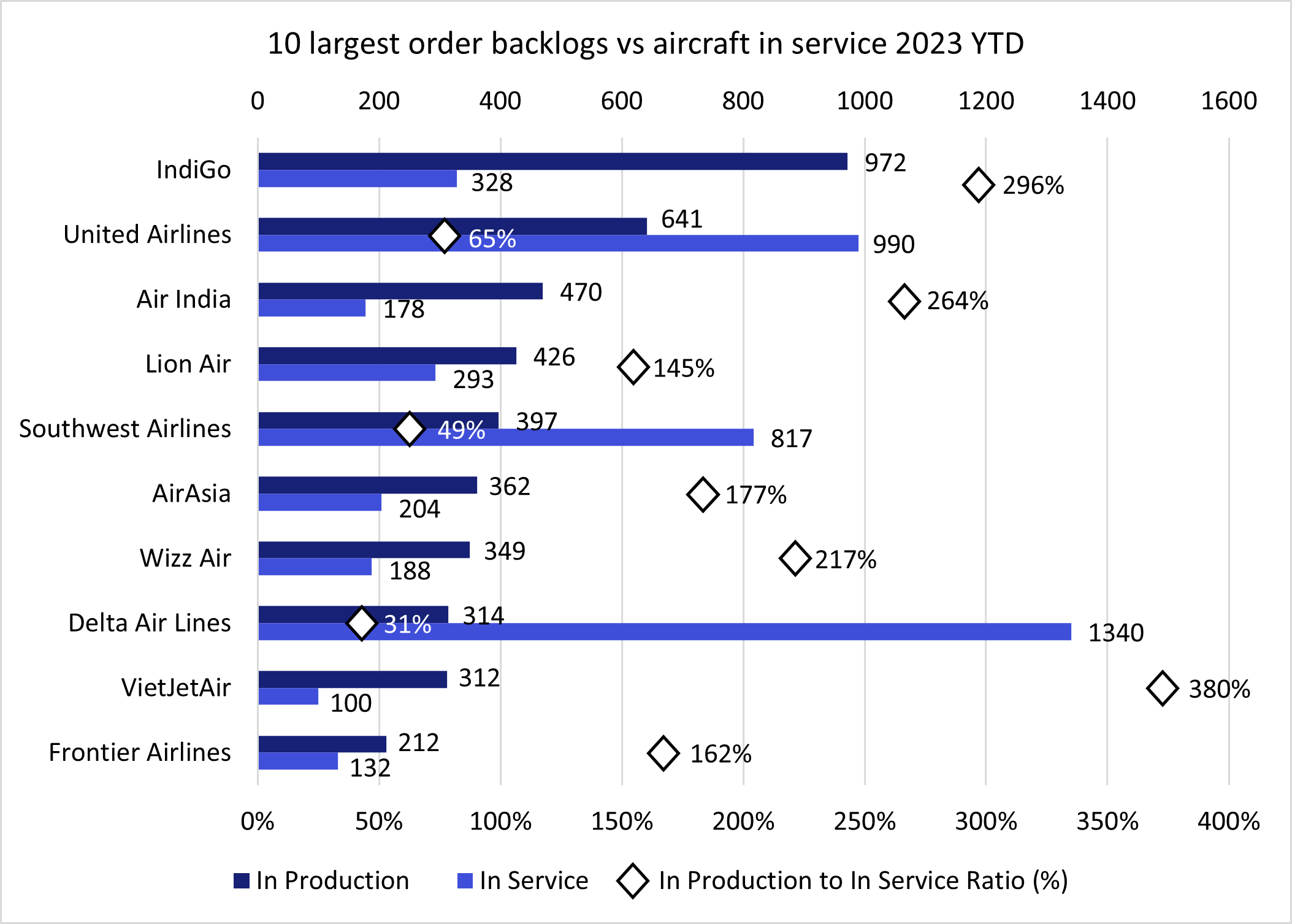

When talking about airline ambition, it is useful to contextualise the order backlog with the current fleet. This is what will provide the revenue stream to cover pre-delivery payments as well affecting the terms of a loan or SLB agreement. When looking at the ratio of order backlog to in-service aircraft for the ten largest backlogs, VietJet is the most bullish with a ratio of 380%. The ratio for IndiGo is 294%, whilst it is 264% for Air India. The latter will decrease now that the Vistara merger was approved by Indian competition authorities, this week. VietJet made two 100 x 737 MAX orders in 2016 and 2019. The airline group includes Thai VietJet, who are reportedly receiving the first 12 of these aircraft next year.

As ever, an important question is whether local markets can accommodate this growth. Unfortunately, air travel isn’t accessible to everyone, and people will often reference the growth of a country’s middle class. Vietnam has roughly 1.5 x the GDP per capita so this may be a higher proportion of their population. However, India has 14 x the population (1.4 billion). When considering that there are 807 aircraft in Indian airlines compared with 232 in Vietnam, the Indian aviation market growth seems more realistic.

Nonetheless, IBA predicts a similar pent-up demand phenomenon for Asia in late 2023/ early 2024, as was experienced in the West recently. Taking this into consideration IBA estimates an EBIT margin of 10.8%, leading all other regions. However, this is predicted to drop in 2025 as carriers sacrifice fares to accommodate the large amount of capacity coming online. Growth often comes at a cost!

Source: IBA Insight & Intelligence

Source: IBA Insight & Intelligence

Europe and the U.S. have emerged as market leaders in sustainable aviation, particularly in the production and use of Sustainable Aviation Fuels (SAF), so it is encouraging that countries extending beyond these regions are emerging as key players. Boeing says that Brazil has the potential to be a top global contender in the SAF industry. Currently, SAF is made largely from municipal solid waste (MSW). With Brazil being one of the world’s largest agricultural producers, it has a large source of feedstock suitable for use in the alcohol-to-jet SAF conversion pathway, including ethanol made from sugarcane or corn. Alongside feedstock availability, Boeing recognises Brazil’s technical capacity and workforce accessibility, all of which could contribute to the acceleration of aviation decarbonisation. However, Brazilian airline GOL highlighted that while SAF supply is an urgent matter, demand will remain low if prices are still approximately three times higher than conventional jet fuel. On top of this, simulating the necessary investments for the ramp-up of SAF is a challenge. This falls to the lack of competitiveness to conventional jet fuels. There is no compensation mechanism for the use of SAF for airlines, therefore they’ll likely continue to use the minimum required by regulations. So, without the ability to compete on price, it’s difficult for the entire value chain of SAF to demonstrate viability.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。