The Dubai Airshow kicks off on Monday, so this week I will cover my thoughts on how successful it will be. Traditionally, except for a few stand-out big orders, the activity from previous Dubai Airshows falls somewhat short of the Paris events that precede them. It normally attracts regional interest from Africa, the Middle East and Western Asian carriers predominantly. However, Indigo Partners out of Arizona, have also used this stage on both occasions to announce their massive orders. As I stipulate in all air show predictions, the timing is a PR stunt for both the OEMs and the customers, whilst order confirmations will align with financial performance, strategic goals, and tactical responses.

So far, 2023 has been strong on the order front. We had a record Paris result when looking just at firm orders as opposed to commitments and LOIs, global profits have returned, and demand continues to rise. Sounds straightforward? Far from it! In fact, the driving forces are pulling the market in opposing directions such that experts are torn into thinking more orders make perfect sense, whilst others think they are mad! Thinking about the argument for more orders: oil and fuel pricing has been volatile and high, airlines have cash to spend, many have yet to establish growth within their backlogs as the market is so much larger than when they placed the last load, and operators are staking out their battlegrounds for the future.

In terms of the counterargument: supply chains (whether triggered by engine reliability or not) are still struggling (order to delivery for A320s is now at 7.5 years). Debt levels continue to remain high, there is a case that operators are double counting, backlogs are already huge owing to the missing 4,000 aircraft that will never be built, airlines are committing to extensions above all else, and escalation/inflation makes buying direct an expensive proposition.

These provide a strong reason for why lessors won’t be placing many (if any) speculative orders and will wait for the up-and-coming demand to finance the new deliveries through re-priced sale-leasebacks in the future. That doesn’t exclude those lessor/airline combined announcements we tend to see more often at airshows now. However, for the airlines, competitive behaviour and cash on the hip tends to outweigh the rest. I don’t think the old adage of “airlines buy when they have cash and accept deliveries when they don’t” has changed all that much. Therefore, I think we will certainly see some activity at the air show next week.

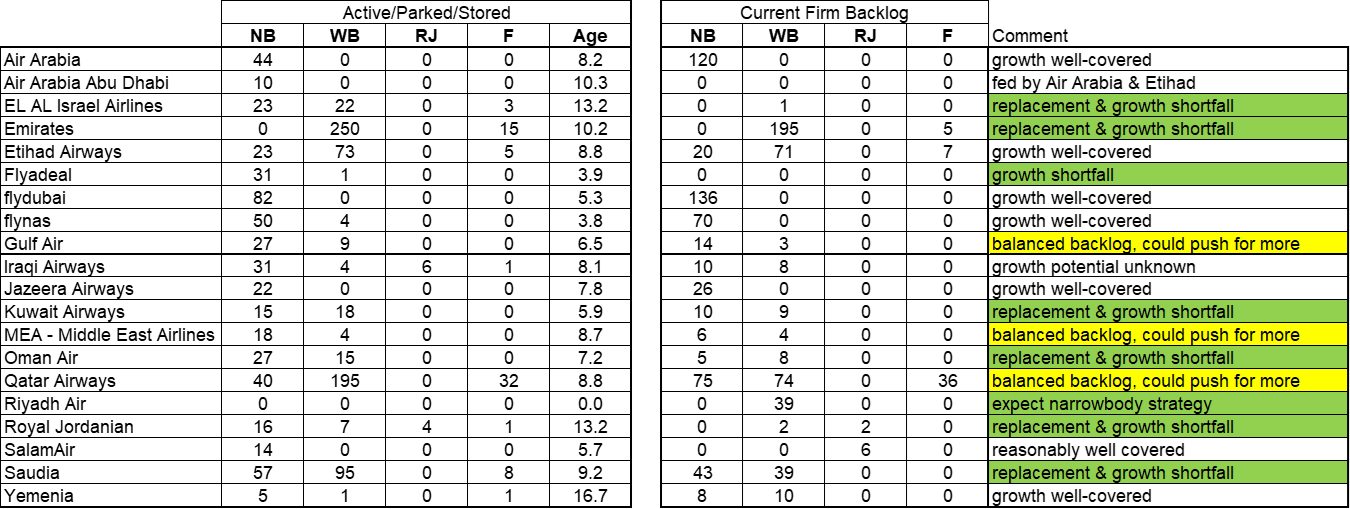

If I start with the home team and spread out, it is no secret that Sir Tim Clark has been suggesting that Emirates will be placing a large order very soon. Looking at seat count within the system, their current backlog only covers ~63% of the current 777/A380 fleet, both of which will be getting long in the tooth by the end of the decade, even more so when we consider the extension activity too. By my reckoning, they need another 150 or so A350s and 787s to add to the 195 777X/A350/787s already on backlog if they want to factor in growth. Flydubai on the other hand, still has the vast majority of their future fleet yet to arrive (as set out in their DAS 2017 order). That being said, deliveries will likely be completed by 2029 and they will need to consider the top-up, if not this year, before 2025.

Still staying in the same spot, Air Arabia is another with an already sizeable backlog and still only in their early days, that I don’t see them springing into action for more A320neo family aircraft quite yet. However, the earliest neo slots are a few years further out than for the MAX such that final Air Arabia deliveries will only overlap slightly! They currently operate a wide network that stretches to India, Southern Europe and East Africa that could widen further with more longer-range neos.

Finally, for the UAE, there is Etihad. They already have a sizeable backlog that is equivalent to what they currently operate in terms of seats, that once they retire the older assets, will provide a fleet ~50% larger than today. So, I don’t expect much activity during the show from them.

Moving further out, we get to Qatar. With the Airbus dispute firmly behind them and the restatement of the A321/A350 orders, we can more accurately assess that the current backlog/retirement consideration will give them an overall growth over today of ~7% by seat count. We expect deliveries to peak around 2026-2027 before petering out by the early 2030s. With the retirement of Al Baker, earlier this week, it is hard to predict just what may happen during the show, but they certainly don’t need to order anything more just yet. Of course, these decisions are made over many months of analysis and discussions and the Qataris will be mindful of the Indian market’s growth plans. If any ordering activity does come from Qatar, I feel it will be a top-up of existing plans.

Currently, Saudia only have 787s and A320neo family aircraft on order which is roughly equivalent to half of the current fleet on a seat count basis. Clearly, Saudi Arabia is going through a long transitionary period of diversification at a time when expansion is occurring both to the North and East of the region. Similarly, there is also Riyadh Air to consider as well. If I look at this in a combined way and consider the retirement profile over the next 10 years, the backlog approximately covers replacement only for what’s in the system today.

So, if the Kingdom want a show of strength, then further widebody orders will be required in the coming years to bolt onto the back of the current backlog, and Riyadh Air will need to commit to a narrowbody strategy. Similarly, Saudia may continue to feed flyadeal with more A320s from their backlog or extend it as part of joint action with Riyadh Air. Finally, for Saudi, there is Flynas, who already have a sizeable backlog so it's possibly too early to call unless they wish to diversify into larger asset classes.

Looking further, yet within the region, there are a good number of carriers that have a relatively small yet important presence that we could see action from. EL AL is certainly one of these whose backlog has dwindled to practically zero and is reliant on their small fleet of 787s, ageing 777s and NGs. Similarly, Kuwait Airways, Oman Air and Royal Jordanian are also carriers that show some modest backlog but once the medium-term retirements are considered, they are not prepared for expansion. Back in June, I also indicated that EgyptAir may be ready for expansion and the signs continue to show they are close to potentially placing an order for 10 widebodies. Whilst those I feel are not ready for further expansion above and beyond what they already have in service, on the backlog, and set to retire before the end of the decade, are Gulf Air (30% net growth), Jazeera (87% net growth), and Yemenia (253% net growth).

Slightly outside the region, there is of course the potential movement from THY on the mega order that the market has been baited with all year. The most recent commentary indicated that it was delayed due to engine reliability concerns, although that doesn’t specifically play out because they could split the order to include programs not experiencing those issues. They placed a small top-up for A350s back in September, agreed to take three 787s and 25 MAX 8s from AerCap, and quite frankly, there shouldn’t be any technical barrier for them to place a substantial order at the Dubai show. The goal appears to exceed 800 aircraft by 2033, approximately 500 narrowbodies, 270 widebodies, and 50 freighters. Whilst some will come from lessors, a sizeable chunk needs to be ordered now to meet the targets towards the end of the decade. Realistically, they need to acquire 190 A320neos, 165 MAXs, another 120 787/777s and 80 A350s at some point in the not-too-distant future. Plus, some 777 freighters too. Whilst they might continue to keep us waiting for longer, Dubai may be a good place for them to play their hand and capitalise on the coverage – at least for some of it.

Freighters may also take some of the action next week as geographically, the Middle East is well positioned between Europe, Africa, and the Far East to be served with high capacity widebodies like the 777F, 777-8F or A350F. Not sizeable perhaps, but generally a few small orders make the cut.

In summary, if I assume the best bets are coming from Emirates, Riyadh Air, EgyptAir, EL AL, Kuwait, Oman, Royal Jordanian, and THY, the order tally could get large and match the last big year which was 2017. We may also see some action from African operators (in small numbers) other than EgyptAir, as their networks begin to grow. To counter, I still don’t feel THY are ready to place the bulk of the order quite yet, and it’s hard to judge just what might be coming via the lessors. In August, Kuwait announced that they would be taking eight A321neos from lessors over the next decade. Similar action may be coming from the other smaller carriers who don’t want to place all their options with just the OEMs. Indigo partners were the saviours of the 2021 and 2017 shows, and operators like Emirates in years gone by. If I assume most of the best bets come in, then we could easily get to 500 (assuming THY come in with something sizeable). If madness continues to spread, that number could grow beyond 700.

Want to see more of this analysis? Click here to book a demo of IBA Insight or to request a copy of Stu's data.

Source: IBA Insight & Intelligence

Following the commentary about Southwest’s results starting to wane, the other US low-cost carriers (LCCs) have since reported weaker Q3 results. Compared to Southwest’s operating margin of 1.8%, Frontier, JetBlue and Spirit have reported operating margins of -6.1%, -6.6% and -15.0% respectively. This is in stark contrast to European LCCs' strong results. easyJet’s final quarter (Calendar Q3) had an operating margin of 21.3% whilst Wizz had a margin of 24.4%. All the while, Ryanair continued off the back of their strong Q2 performance to hit a 34.6% operating margin.

This pattern supports the broader trend that pent-up demand is expiring in the US, whilst airlines are still able to up yield in Europe. There is of course greater seasonality in Europe propping up their results, but the continued weakness of US LCCs (especially Ultra-Low-Cost) since the pandemic only adds to divergence in that market. Spirit were unfortunate to not only report a drop in yield (-13.5%) but also revenue as a whole (-6.3%) in Q3 2023. The airline cites the reduced demand in the US whilst also blaming inflationary pressures. Similar to the full-service carriers, their employee cost increase exceeded ASK growth by over 16 percentage points (29.6% vs 13.5%). Maintenance costs (+25.1%) and aircraft rent (+29.3%) increases were of similar order. The latter is perhaps showing interest rate hikes starting to trickle down into lessor pricing; that and the airline getting worse deals as it becomes an inferior credit. The combination of accumulated losses and interest rate hikes has resulted in the carrier’s interest costs increasing 74.0% YoY. Spirit’s knight in perhaps white armour is meant to be JetBlue. Leaked documents revealed plans to bring Spirit’s fares in line with JetBlue’s, although this may not be enough, given the latter also was unprofitable. They too suffered a yield and revenue drop and both airlines have a worse outlook for Q4 YoY. The US DoJ’s challenge to that merger was due to start court proceedings on October 31st.

On the brighter side of the pond, all three large European low-cost carriers’ results were above 20%. This was a particular swing for Wizz, for whom sub-optimal fuel hedging had eroded profit last year. This quarter they were helped by the fuel CASK decreasing by 21.8% YoY and the load factor increasing from 88.8% to 93.8%. Interestingly easyJet’s fuel increase of 35.0% exceeded their ASK growth (14.3%). A 14.9% yield increase, the largest in the region, managed to cover this up, however.

Ryanair came out on top of the three at both operating (34.6%) and net level (30.8%). Their low use of leasing allows most of the operating profit to trickle down into cash reserves. This may give Ryanair the confidence to firm their 150 737 MAX 10 options in the near term. The airline’s strong performance was partly attributed to a 10.7% increase in yield this quarter. It should be noted, however, that their yield increase in Q2 was 26.6%. This shows that pricing power is eroding in Europe too, and Europe’s demand may soon follow the path of the US.

The results of Europe’s strongest quarter clearly demonstrate the healthy recovery of the continent’s biggest full-service carriers. The quarter’s high seasonality and pent-up leisure demand opened the way for higher fares and contributed to the growth of operating profits. This represented €1.7 billion for IAG, €1.4 billion for LHG and €1.3 billion for Air France-KLM, with operating margins being 20.2%, 14.0% and 15.5% respectively. This trickled down into net profit margins exceeding 10% for all three carriers.

IAG had been particularly successful thanks to sustained strength across the North and South Atlantic routes and in leisure destinations around Europe. The group increased its revenue by 18.0% and passenger traffic by 12.5%. Moreover, the operating costs only grew by 12.9% while ASKs increased by 17.9%, leading to a significant decrease in CASK, in an inflation environment. The CASK reduction was particularly prominent in staff and fuel costs. Furthermore, IAG had the highest net profit of €1.230 billion (net margin 14.2%). This has contributed to them reducing net debt by €2.4 billion since 2022.

A success of the Lufthansa group was that they recorded the biggest growth in passengers of the three (14.5% Q-on-Q), as the airline decided to take advantage of growing demand by adding flights and up-gauging aircraft. This came at the expense of a 5.9% drop in yield, however. It is also notable that many of the aircraft they brought back online since 2022 were less fuel-efficient current technology aircraft such as the A340 and 747. Nonetheless, the airline still managed to finish the quarter with a healthy 11.6% net profit margin, decreasing net debt by €1.5 billion since 2022.

Even though, the airline group noted a record-breaking profit this quarter, AF-KLM were third in terms of net profitability. They saw success in dropping the fuel cost by 18.5% this quarter. However, due to a 3.2% growth in operating costs compared to only a 5.0% growth in ASKs, AF-KLM reported the highest CASK of the three. This caused lower profitability than the competitors. Although, a net profit margin of 10.8% is nonetheless healthy and has allowed deleveraging of €1.3 billion since 2022. The carrier is also partially affected by the capacity constraints at KLM’s hub, which further limited its ability to capture seasonal demand.

The Q3 results mark yet another strong period of recovery. The airlines undoubtedly benefited from the leisure demand and used the surplus in cash flow to deleverage and expand. Now, all eyes are turned towards Q4 and whether airlines can maintain an optimistic outlook for the rest of the year. If successful, 2023 might be marked as the last year of post-pandemic recovery.

We’re once again in the running for the Airline Economics Aviation 100 'Appraiser of the Year' award – but we need your help to secure the title! Vote here.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。