Despite a continually growing dedicated freighter fleet, judging by the latest utilisation data, the number of dedicated freight flights continues to decline and has done since the end of 2021. In the first nine months of 2023, the total number of dedicated freighter flights has fallen by over 4% from the same period in 2022. Of course, this is mostly impacted by the North American domestic market which accounts for over a third of the movements, which itself has fallen by nearly 6%. Fleet-wise, the number of in-service dedicated freighters has actually increased by nearly 6% from the same point last year which does beg the question of how efficiently aircraft are being operated.

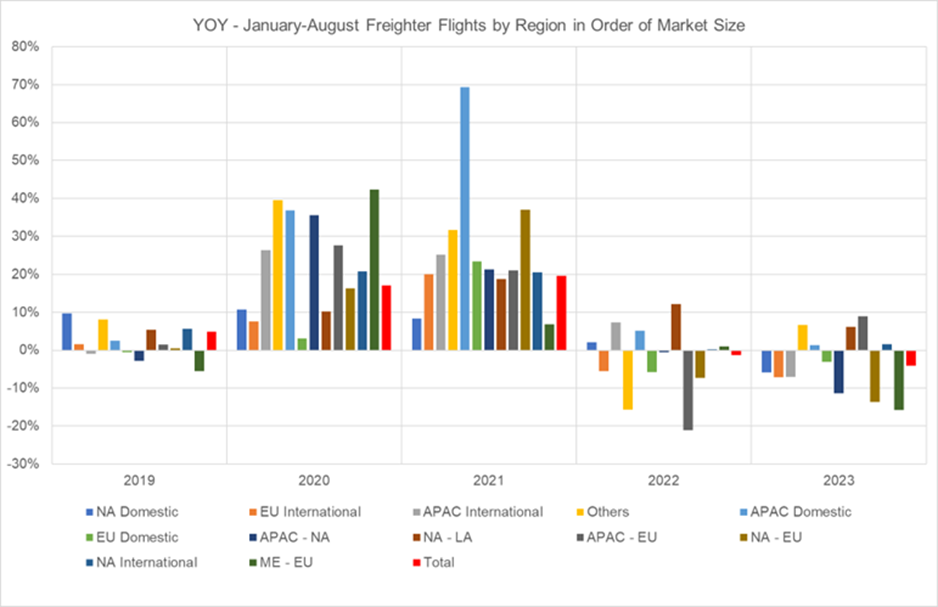

The chart below displays the year-over-year dedicated freighter flights as measured between January and August. As we see, the largest three sectors, North American domestic, intra-European international and intra-APAC international have been impacted the most. One particular example is Hong Kong – Incheon, which has seen dedicated freight frequency halve from the peak in October 2021. Globally, this has been impacted by the return of passenger belly freight, but also by the lower demand for PPE and vaccines, the increase of alternative transport options, and the effect of the economic headwinds. Conversely, the movement of freight by air between North and Latin America, APAC-Europe, and the smaller emerging markets (others) continues to show frequency growth.

Source: IBA Insight & Intelligence

In fleet terms, the number of aircraft has been steadily increasing to both account for the loss of belly freight in 2020/2021 and to find a home for unwanted passenger aircraft suitable for conversion. Conversions themselves have doubled since the recent low point in 2019 when just 74 aircraft were inducted, which doesn’t highlight a drop in demand but underlines the peak of demand for just about every passenger aircraft flying. Last year, the number was 151, just shy of the record set in 2021 by one. In the same vein, retirements have been plummeting since the peak of 2010 when 131 made their way to the desert after the market cratered. Last year, that number was just 38, the second lowest position over the past 15 years, after 2020 when zero serviceable aircraft were either retired or scrapped. Deliveries of new freighters have also continued to rise with 57 last year, again another record matched only by the resurgence in 2012. To combat the new deliveries and conversions, storage has also increased by 200 units since the start of 2022.

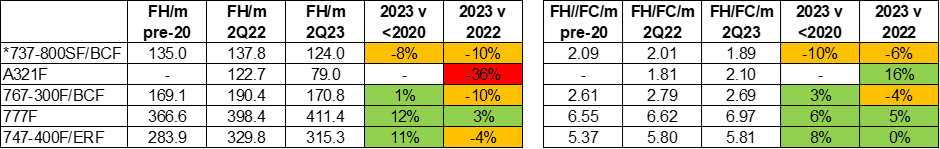

How specific models have been impacted is also important to note. In the table below, we show the monthly utilisation change from last year for five aircraft groups. Despite an impressive increase in 777F utilisation, bearing in mind the fleet has increased by 10%, the NGs, 767s and 747s show a decline of between 4 and 10%, highlighting the impact of the North American domestic market. The figures for the A321 may appear alarming, but this is because the fleet was very small last year, and the fleet is changing rapidly on a relative basis.

With 270 new aircraft on backlog and double that for conversions, it is sensible to assume that something must give if demand fails to return in short order. I suspect that outside of the already-announced retirements from FedEx, more will likely follow. As for conversions, it is natural to assume that some will be deferred. However, for many, this is a long-term play and not a reaction to short-term demand so the impact may remain limited to the availability of feedstock. That would certainly appear the case based on the number of “new line” announcements we see in the press. In the short to medium term though, reducing lease rates continues to highlight the supply/demand imbalance and the risk for those thinking of adding more supply.

Source: IBA Insight & Intelligence

Last edition, IBA followed the common conversation around Asia: when will they catch up with other regions’ recovery on 2019 levels? At 93% they still have some ground to make up (although Europe is also only 95%). When looking at profitability, however, dedicated long-haul carriers were some of the first out of the blocks. Now, with an H1 operating margin of 32.6%, Air Asia X are adding weight to this pattern.

Singapore Airlines managed to turn a healthy operating profit of 15.1% in 2022, through having a network outside of the locked down broader region. They have now stretched this to 22.9% in Q2 (their Q1). Similar profile, Cathay Pacific were able to benefit in the same fashion later on, recording an operating margin of 15.2% in H1. Air Asia X’s strong results is all the more significant as, excluding the restructuring cash flow, their 2021 operating margin was -105%.

The carrier is also an interesting case study as they run exclusively A330ceos. The airline was able to reduce CASK in other areas to compensate for high fuel prices on an old technology aircraft. Long-haul typically benefits from not needing as aggressive cost control as short-haul. Fellow Malaysian carrier Air Asia, the narrowbody sister airline, and Garuda, the neighbouring flag carrier, are both still loss-making. The latter recorded an H1 operating margin of -38.7% and is now rumoured to be considering merging with Pelita. As well as cost synergies, margins can be improved through aligning products (after the initial pain of refurb costs). In the US, there are rumours that fares on Spirit Airlines could rise a further 40% after being acquired by Jet Blue.

Elsewhere in the Asia Pacific region, both Qantas and Air New Zealand returned to profitability this week, in their annual results. Qantas had a strong operating margin of 13.6% whilst Air New Zealand also recorded an operating margin of 9.2%. Both were also comfortably profitable at the net level. Air China were also the first of the Chinese big three to publish their full H1 results. They are still at an operating loss of margin -1.4%, although this is much improved on the -67.0% in FY2022. With China returning to strength, Asian carriers with short-haul fleets may have their moment in the sun soon.

The Saudi aviation industry has been picking up the pace lately, with newly established national carrier Riyadh Air ordering 39 787-9s (with an option for 33 more). Now the national lessor, AviLease, is making even bigger moves by purchasing its Irish counterpart, Standard Chartered Aviation Finance, including all assets. This will result in almost tripling the existing AviLease portfolio, bringing it to a total of 167 aircraft, worth almost $7bn. This move as well as the purchase of 13 aircraft from Avolon in June this year go well in line with the Saudi government's Vision 2030 programme, which aims to make AviLease one of the top 10 lessors worldwide by the end of the decade.

The aviation leasing sector has bounced back strongly after last year’s Russo-Ukrainian war-related asset write-offs. The industry’s biggest players - AerCap and Air Lease Corporation noted astonishing Q2 net profit margins of 26% and 20% respectively. AviLease’s strategy is particularly well timed with the shortage of aircraft amid strong demand continuing. To further this state of affairs, Boeing has recently identified yet another quality problem at Spirit AeroSystems - its sole 737 fuselage supplier, and responsible for around 70% of the airframe parts. At the same time, Airbus operators are affected by faulty P&W GTF engines, with over 15% of A320s with that engine type grounded.

With waiting times longer than ever before, the decision to acquire a portfolio, which is ready to be leased makes sense. Additionally, according to IBA Insight, 97% of Standard Chartered’s fleet are Boeing 737NG/MAX and Airbus A320/A321 narrowbodies, which currently are the most sought-after aircraft by many airlines including Saudi-operated Flynas and flyadeal.

Currently, most of the aircraft are being leased to operators from North America and Asia Pacific, however, the question arises whether this will continue. The Middle East region is continuing to grow and now, alongside DAE, there is another large lessor in the region well placed to support it.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

IBAのワンストップ航空インテリジェンスプラットフォームであるIBA Insightを紹介します。IBAの広範なフリート、価値、市場データと飛行データ、専門家の意見とを組み合わせ、投資、リスクプロファイリング、航空機ポートフォリオの監視に大きな自信と保証を提供します。

受賞歴のあるISTAT認定鑑定士の大規模なチームと 30年以上にわたる独自のデータを活用しているIBAは、価値評価市場のリーダーです。グローバルに活動し、航空機、エンジン、ヘリコプター、貨物機、航空貨物、発着枠、スペアなど、さまざまな資産の価値について、独立した公平な意見とアドバイスを提供しています。お客様の期待を超えるように常に努力しており、IBAの客観的な判断は、融資、資産の回収、商業開発、転売に必要な保証をサポートします。

IBAは、世界中の大手航空機・エンジンリース会社と協力しています。当社の業界知識の深さは、専門家としてのアドバイスにも反映されているので、投資サイクルを通じてお客様をサポートし、お客様の旅のあらゆる段階で自信を与えています。評価、フリートの選定、ポートフォリオ開発からリース終了時の引渡、転売まで、リース期間中のあらゆるリスク評価と資産管理活動において、お客様をサポートします。

航空投資は複雑な問題を抱えていることがあり、多額の金銭的な利害関係が絡んでいるため、運に任せることはできません。初めて投資をされる方でも、市場で実績のある方でも、IBAは資産クラスの複雑さを切り開き、投資機会をよりよく理解するためのお手伝いをいたします。お客様と協力し、ポートフォリオの開発、多様化をサポートし、戦略的なニーズを充足いたします。

IBAは30年以上にわたり、世界的な航空会社や地域の航空会社と協力して、評価やアドバイザリーサービス、航空データインテリジェンス、航空機やエンジンの引渡におけるサポートを提供してきました。世界中の様々な航空プロジェクトに協力して取り組み、クライアントのさらなるリソースの要件を満たし、必要な時にはいつでもどこでもプロジェクト管理のサポートを提供しています。

当社は、訴訟支援と紛争解決に臨機応変なアプローチをとり、クライアントの法的戦略に合わせた思慮深い解決策を見出しています。30年以上にわたる独自の航空データへのアクセス、戦略的M&Aへの定期的な関与、および航空機管理の専門知識により、当事者間の典型的な争点となっている分野に定期的にアクセスできます。IBAは、航空機の損傷や損失に対する保険関連の和解から、貸手と借手の間の紛争、多くの場合、引渡時の紛争に至るまで、様々な側面からクライアントを直接、または法務チームを通じて支援します。