In this season of mixed airline performance, RTX reported better-than-expected earnings for Q3, as the avionics/aerospace component side of the business offset the negative Pratt & Whitney, triggering a 6.3% boost in early trading that could remain firm through a $10Bn share repurchase program. That being said, the market remains on tenterhooks for information on what the full effect will be to rectify the GTF issues and restore confidence. As we saw at ISTAT EMEA and Airline Economics New York, the repeated questions asked by the audience trying to extract opinions on the subject, but with little success. The questions, I fear, will continue until we see the effect of inducting the number of engines intimated in earlier announcements by RTX. Although a common question I have heard appears to have been answered regarding the induction of PW1500G/PW1900G engines that power the A220/E2 respectively. Apparently, they will not require the same approach and will fit within the shop visit plans already in place for those types.

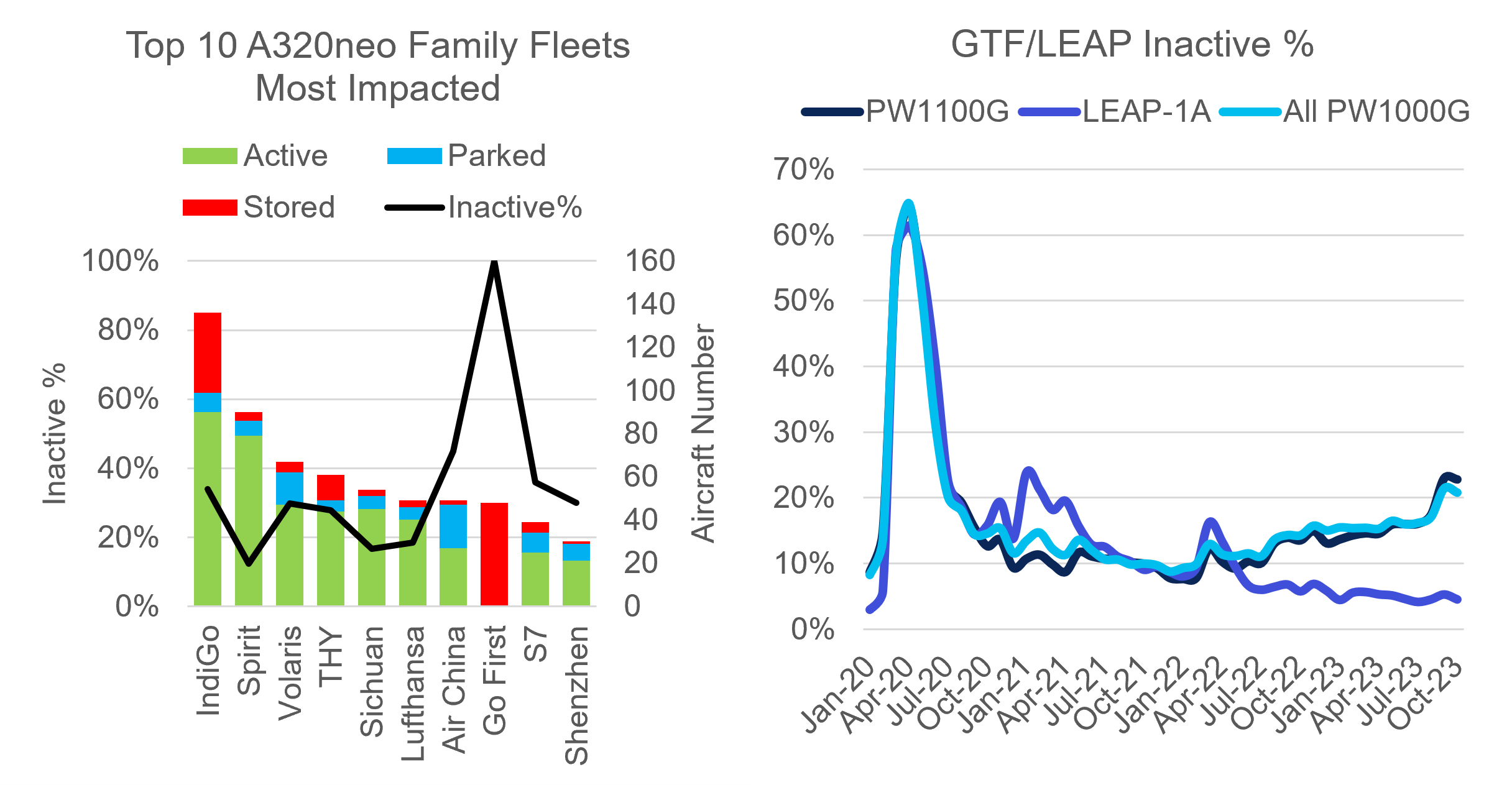

By late October, the number of A320neo family aircraft fitted with GTF engines that appear inactive has been creeping up. Of course, this is partly due to GoFirst, but the trend cannot be ignored. First and foremost, this is an engine issue rather than an aircraft issue and as such the spare coverage that has been assigned by Pratt will go some way to mask the overall fleet disruption. However, even a larger than normal spare coverage is not expected to completely obfuscate the rising parked fleet once the induction process begins in earnest as tight shop capacity, parts availability, and the risk of finding further faults once the modules are separated remain unknown. Whilst RTX have issued statements that they don’t expect further impact above the most recent disclosure, history tells us, however, that early findings can manifest into other issues as the fleet matures. It is worth noting that all new engine technology goes through teething problems. The early V2500s, CFM56-5s, CFM56-3s, PW2000s, PW4000s, CF6s, GE90s, RB211s, and Trent 1000s, to name but a few, all had entry-into-service issues that required mediation and subsequent development to create far greater reliability. That is our long-term view for the GTF and as such, we have not impaired the value profile for any of the GTF families in our value scenarios, provided the market does not shift meaningfully.

Right now, we are monitoring 316 parked/stored GTF-powered A320neo family aircraft, along with 45 A220s, and 8 Ejet-E2s. This equates to a relative effect on each fleet of 23%, 15% and 9% respectively. Comparatively, the LEAP-powered A320neo family sits at 74 units or 5%. That doesn’t mean the LEAP is clear, just that any entry- into-service issues haven’t manifested into a problem to trigger an extensive inspection program. Either way, it’s yet another reason to keep hold of those ultra-reliable A320ceos for a few more years yet. We will continue to monitor this situation on a regular basis as the process evolves. A service bulletin is due in early November that will direct further actions on deadlines, intervals and limits for an identified set of engines. Once that is out, the market will be able to better estimate the size of the grounding problem for 2024. The upside to this will be that the shop visit network should be well-geared up for the future.

Source: IBA Insight & Intelligence

Following Southwest’s earnings release yesterday, the four largest US airlines have now reported their Q3 results. On the surface, all four were again praising record quarterly revenues. This was as high as $15.5 billion for Delta. One could therefore assume that the good times are continuing. However, all the airlines also had a drop in revenue per ASK (RASK), showing that pricing is becoming more important again, and with that, airline results are diverging.

Out of the four airlines, Delta and United had the most favourable results, with Q3 operating profits of $1,984m and $1,739m respectively. These represent 12.8% and 12.0% operating margins respectively. Both airlines praised transatlantic revenue, with it increasing 34% for Delta and 70% for United quarter-on-quarter. This is perhaps showing that with a tightening market, tactical opportunities to differentiate exist. Delta also pointed out that premium cabin revenue grew by 17%, whilst standard cabin revenue only increased by 5%. They highlight returning to office culture, but this may also be recessionary fears, of sustained high interest rates, affecting wealthier demographics less. Having said that, the US GDP growth of 4.9% last quarter seems to be questioning that recession fear.

The other two airlines, Southwest and American, both had worse performances in Q3 year-on-year in terms of profitability. Southwest had a slim operating profit of $117m (1.8% margin), whilst American actually recorded an operating loss of $223m (-1.7% margin). Of the four, these two had the largest RASK drops, 6.8% for Southwest and 6.3% for American (Delta dropped 2.5% and United dropped 2.8%). Southwest also predict a yield drop of 9-11% for Q4. The drop in this yield metric is perhaps showing that we have caught up with the pre-covid growth trend in that market. North America is at 107% of 2019 September ASKs.

The big headwind for American Airlines was a $983m one-off initial settlement payment with pilots. Whilst that is non-recurring, it does act as a flag that the new employment agreements are starting to kick in. All four carriers’ salary costs increased by greater amounts than their ASKs. For United, it was over 20 percentage points higher. There has been lots of news about the various employment settlements in the US, however, it is important to note that most were future dated. Therefore, for many, their effect is only coming into play now. Now, alongside the Middle East conflict expected to put upward pressure on oil prices again, CASK will likely rise for most, this coming year. The good times may be coming to a close.

The aviation market in India has seen some airline collapses in the past decade, with those defaults being followed by lessors’ efforts to retrieve their leased aircraft. In the case of GoFirst, those attempts were later met with India’s bankruptcy court siding with the airline and preventing the lessors from seizing their aircraft. Therefore, to mitigate the potential risks for lessors and shape the leasing environment into a more favorable one, India has decided to align its repossession laws with the Cape Town Convention.

That move will certainly impact the leasing costs, which in turn will help airlines such as IndiGo, which has a backlog of 963 aircraft on order and leases 90% of its fleet. The airline has also been known to be increasingly reliant on sale-leaseback (SLB) transactions with lessors, recording 40+ SLBs every year since 2019. The lower lease rates in connection with the SLB model as a source of financing the new orders often employed by the Indian carrier might translate into significant savings in the coming years. Unsurprisingly, the representatives of the major Indian airlines, including Indigo, have already met with the Civil Aviation Minister on 17th October to voice their support for the decision. Another winner is Akasa Air, who are also very dependent on aircraft leasing. The airline is rumoured to be preparing to make a 100+ aircraft order later this year.

India is not the only body looking to sharpen its regulations, as it was reported this week that the EU was seeking tougher airline merger concession rules. That move aims to ensure fair competition and proper allocation of airport slots. It comes not long after a series of announcements of merger deals. This includes ITA Airways joining the Lufthansa Group and AF-KLM acquiring a sizeable stake in SAS. There is also the potential TAP privatization. In the past, similar regulations caused Avianca to completely abandon the merger with Viva Colombia due to prolonged antitrust proceedings. The question is to what extent this regulation will affect Europe’s ongoing consolidation trend and whether it might jeopardize it altogether.

Our weekly update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。