Date: 02/02/2024 (Edition 2) Download PDF

.png)

Goodbye Dry January…

Thankfully, another successful Dublin conference has drawn to a close, and as expected, the mood was positive. Well, positive about the tight demand for practically everything, but not a lot of positivity around OEM supply though. Largely the same sentiment was echoed from the stage, throughout meetings, and in the pubs.

However, the flavour was more varied than that. To list but a few…

Overall, asset-wise, everyone with skin in the game was upbeat about the tight market. Pricing and Lease Rates are up, and defaults are down. This is good for lessor, lender or investor returns for assets in place. However, for those either looking to grow or reliant on moving dynamics, it is more frustrating, and they were the ones who remained quietly cautious.

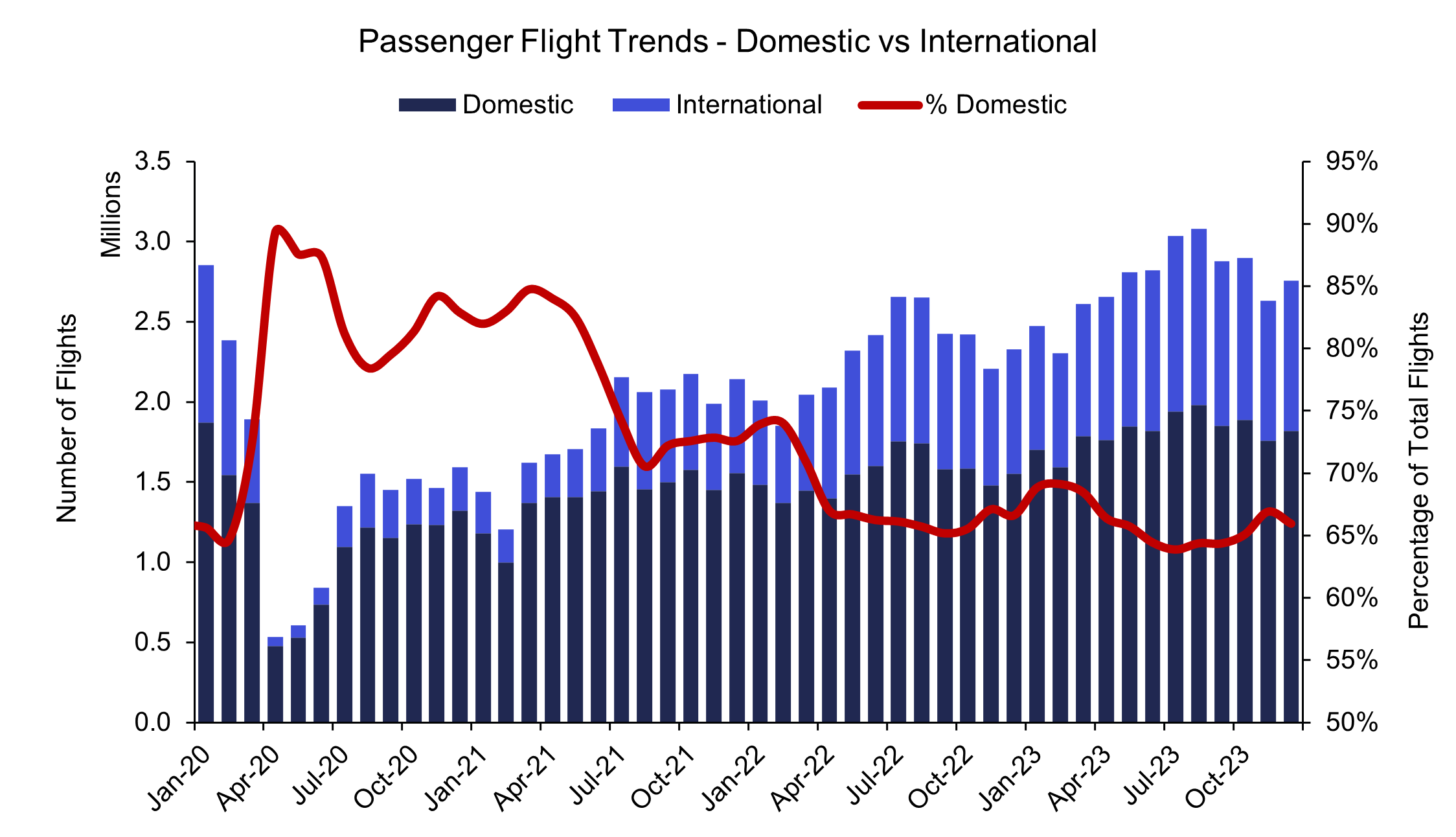

An interesting story throughout 2023 has been the difference in performance between the US low-cost sector and legacy carriers. From late 2022, the latter managed to get long-haul back online which plumped up their margins, cushioning against the sustained high fuel price and salary hikes. The low-cost sector had no such luck.

Whilst Spirit Airlines’ results are fully expected to be poor ($9m EBIT margin of -6.9%), it was slightly disheartening to also see JetBlue report negative margins for FY 2023 (-2.4% EBIT margin and -3.3% net margin). This is perhaps showing that the, now blocked, merger was out of necessity, rather than JetBlue having great growth ambitions. Southwest Airlines did manage to remain in the black (net margin of 1.9%). Interestingly, with a low use of leasing and debt, Southwest’s net finance income of $409m exceeded the operating income of $267m. Foreshadowing Spirit’s results, when they do come in, it is not a good sign when management is referencing potential GTF engine-related compensation payments as a source of liquidity, as they did earlier this month...

The brighter side of the story is how the full-service carriers continue to improve. The hierarchy was the same as in 2022, with Delta Air Lines leading the way in both EBIT margin (9.5%) and net margin (7.9%). United Airlines (EBIT margin 7.8% and net margin 4.9%) and American Airlines (EBIT margin 3.3% and net margin 1.6%) both improved on both fronts compared to 2022, as well. In the case of Delta, the net profit upswing was by over 53bps. This is significant to note as during the pandemic recovery, North American carriers defied other regions and cumulatively upped their net debt in 2022. This was partly due to some airlines’ struggles but also an appetite for CapEx more than debt repayment. At first inspection this would appear to be changing, however, this upswing was primarily driven by a $1.2bn gain on investments (compared to a $783m loss in 2022). They took out $416m more financing in 2023 and the gamble appears to be paying off!

All three carriers benefitted from a fuel cost decrease of circa 5-10% whilst their ASKs increased. However, American’s increase in ASK (+6.7%) lagged both United’s (+17.5%) and Delta’s (+19%). Over the year, Delta also increased yield by 2% with management saying that their ‘premium and non-ticket’ segment had reached 55% of revenue. All have also achieved the laudable trio of simultaneous yield, capacity and load factor increase. Again, Delta led, up (+1.6%) to 85.4%, while American improved (by +0.6%) to 83.5% and United improved (by +0.5%) to 83.9%.

It should be noted that the road ahead may not be as easy. Despite the cumulative positive movement, all three experienced a yield drop in Q4, which may continue into the new year. They also have Boeing’s production worries to contend with. Due to the latter, United revised its growth ambitions down and publicly criticised the OEM in the media. Finally, Delta has been warned of their joint venture with Aeroméxico being in the sights of the U.S. Department of Transportation. It seems that consolidation does not translate into American English.

From talking about the crusade of anti-trust officials to a company whose parent has just survived one, or perhaps not. The Brazilian full-service carrier, GOL Airlines, announced last week that it was entering Chapter 11 bankruptcy proceedings. The carrier has not turned a profit since the onset of the pandemic, but its debt load reportedly reached $4.2bn at year-end. Crucially, as of Q3-23, it had $2.8bn having a maturity within a year.

GOL is an interesting case study of looking beyond income statements, as their operating performance for the first nine months of 2023 had turned a very healthy operating profit (EBIT margin 15.7%), and the net loss was shallow (net margin -0.9%). The gap between the two was telling, however, and it was clear from looking at the cash flow statement and balance sheet that debt was getting out of control. The increase in debt increased the principal that interest was acting on, but also the rate they would need to pay on the new debt. For context, GOL’s bonds had been trading at around 30 cents on the dollar before the announcement. Now it sits at 16.

However, the picture is not entirely gloomy for GOL. Firstly, the operational performance should not be overlooked. The airline has managed to pull itself into profitability, whilst titans in the region LATAM, Avianca and Aeroméxico all required restructures through the pandemic. The airline also has more than one lifeline. To start with, its parent company, Abra Group, contains Avianca, who will be able to prop them up to an extent. As mentioned earlier, they were unfortunate to not get the Viva Air Colombia acquisition over the line, however, they will have benefitted from the latter’s demise reducing competition. The Abra Group has reportedly planned $950m in new financing, with $350m already approved.

On top of the private financing, the Brazilian government is discussing establishing a $605m fund for local airlines, issued by the Brazilian Development Bank (BNDES). The hope is that the two sources of financing (as well as restructuring the debt) can reign in interest payments and pull the airline back into net profit, whereby they can generate cash to pay off debt in earnest. In terms of profitability, they are not far off!

The funding is not an extortionate amount when one compares it to the $2bn that the Argentine government gave to Aerolíneas Argentinas over 3 years during the pandemic. For all intents and purposes, this made them a Public Service Obligation (PSO) carrier. IBA’s Latin America forecast often invites questions as to its positive view (11.0% EBIT margin in 2024). However, this needs to be contextualised that Aerolíneas Argentinas’ outlier $1.2bn EBIT loss in 2019 almost single-handedly wiped out the rest of the region’s profit. Therefore, that year doesn’t act as a good benchmark. The Argentine carrier is now predicting its first profit in 15 years. If GOL can be saved, the region may be on for the bumper year that their nine-month margins were suggesting!

Our regular update looks at the key trends and market indicators using data and analytics provided by IBA Insight.

凭借由获奖 ISTAT 认证评估师组成的庞大团队以及 30 多年累积的专有数据,IBA 在全球估值市场上处于领先地位。我们为全球范围内的一系列资产类型提供独立、公正的价值意见和建议,包括飞机、发动机、直升机、货机/航空货运、降落机位和预备件等。IBA 始终致力于超越客户的期望,我们的客观意见为贷款、资产收回、商业开发和再营销提供了必要的安全保障。

IBA 与全球领先的飞机和发动机租赁公司精诚合作。我们的专业建议植根于深厚的行业知识,因此 IBA 可以在投资周期的各个阶段提供支持,让客户放心无忧。从估值、机队选择、投资组合开发,到租赁结束时的退租和再营销,我们将全程协助客户完成整个租赁期的所有风险评估和资产管理活动。

航空投资往往错综复杂,会涉及大量财务风险,因此,放任资产不去管理绝对是下下策。无论是首次投资的新手,还是市场上驾轻就熟的资深投资者,IBA 都能帮助您克服各种资产类型的复杂性,让您更好地了解各种投资机会。我们可以与您携手合作,支持您的投资组合开发、多元化发展并满足您的战略需求。

30 多年来,IBA 与全球和地区航空公司紧密合作,提供估值和咨询服务、航空数据情报以及飞机和发动机的退租支持。我们在遍布世界各地的各种航空项目上与客户展开协作,满足他们的额外资源需求,随时随地提供所需的项目管理支持。

我们掌握着丰富资源并善于出谋划策,可为客户提供诉讼支持和纠纷调解办法,并根据客户的法律策略量身定制周密的解决方案。正是由于 30 多年来专有航空数据的积累、定期参与战略并购,以及丰富的飞机管理专业知识,我们能够经常接触到各方之间的典型争端领域。IBA 通过直接或与客户自己的法律团队合作的方式,在各个方面为客户提供帮助,从飞机损坏或损失的保险相关理赔,到常常在退租时发生的租赁商与承租商的纠纷。