17/03/2022

IBA's InsightIQ has identified key widebody aircraft value trends, published in our latest aircraft values webinar.

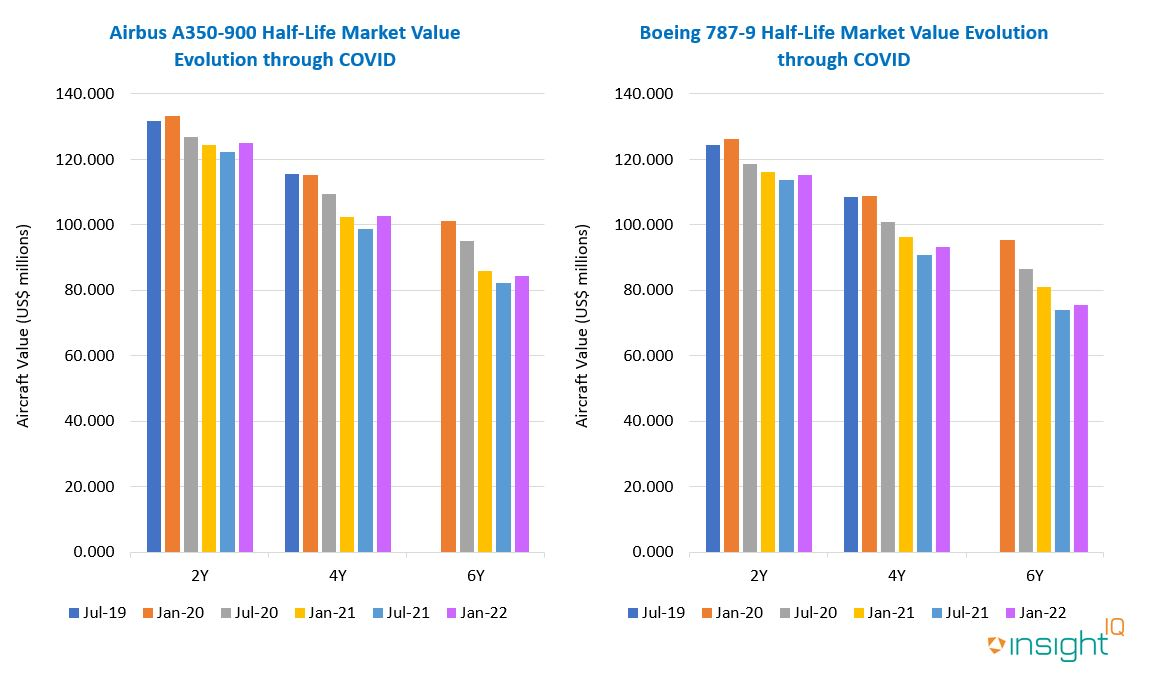

IBA Insight shows that new generation widebody aircraft values are recovering, but overall widebody recovery is lagging behind narrowbody types. Whilst market values for the Boeing 787 Dreamliner and Airbus A350 families remain below base, IBA anticipates a bounce back in the coming 12 months. Some notable aircraft trades made with lease arrangements attached have exceeded base value. Sale and leaseback demand remains present, and on-lease aircraft to good credits will trade at a premium.

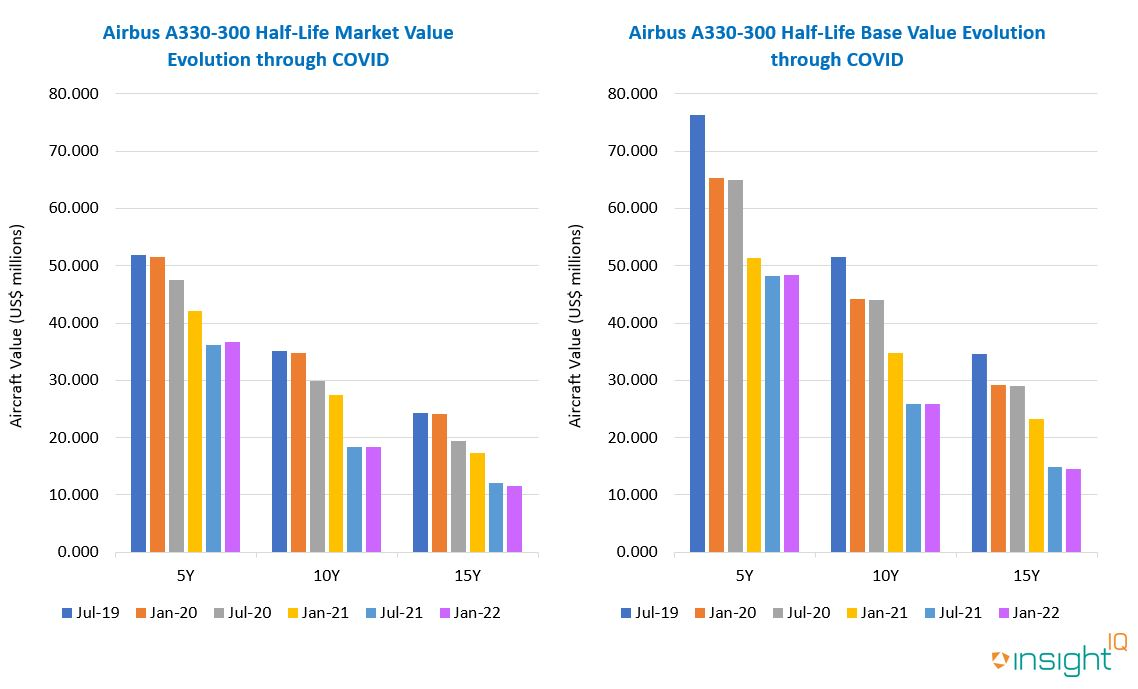

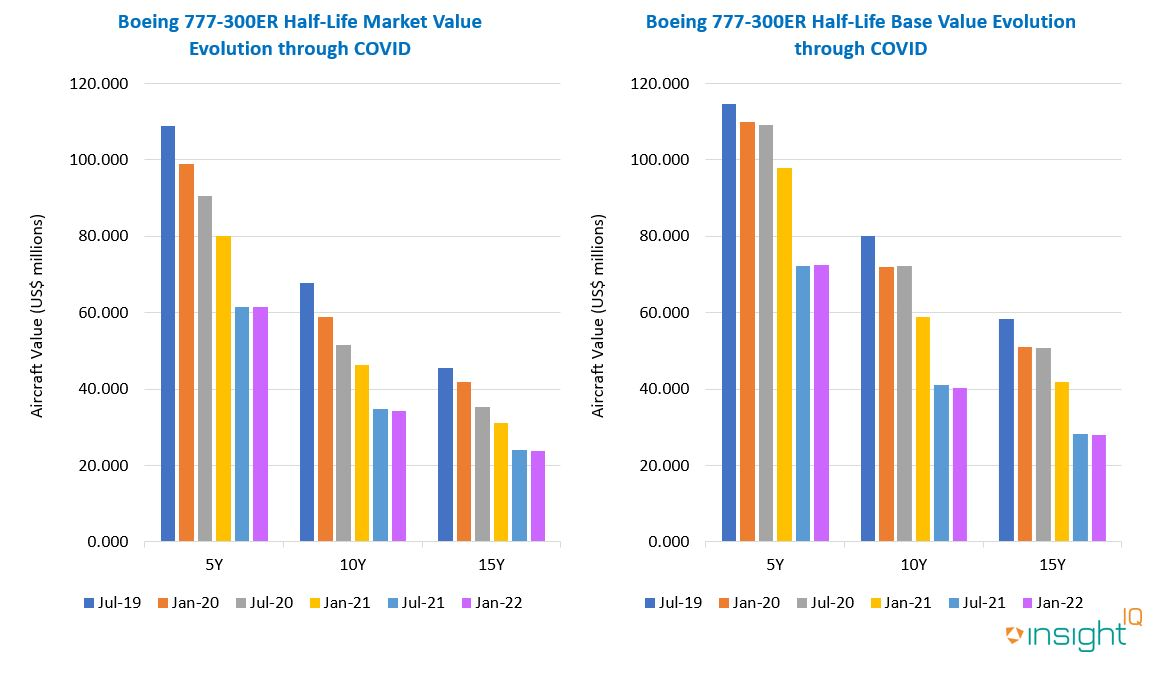

Examining previous generation widebody aircraft values through the lens of the Airbus A330ceo and Boeing 777-300ER, IBA has identified an overall stabilisation of values.

The market and base value decline for the Airbus A330ceo family we have previously observed has abated. The Airbus A330ceo continues to prove an appealing prospect for passenger to freighter 'P2F' conversions, and the trend towards converting younger aircraft has highlighted softening values. IBA has identified high storage levels of the A330ceo, with 29% of A330-300 and 43% of A330-200 aircraft parked or stored globally as of February 2022.

Lease rates, market values and base values have also stabilised for the Boeing 777-300ER, against a backdrop of improved placements. The venerable Boeing widebody has experienced a greater number of lease placements to lessees with stronger credit quality. IBA Insight suggests that 777-300ER values have not fallen further following our previous review in Summer 2021, and there has been so significant increase in retirements of the type. The 777-300ER is now out of production, with final deliveries to Russian flag carrier Aeroflot completed in 2021. The large volume of leased Boeing 777-300ER aircraft in Russia is likely to present increased risk to lessors following the Russian invasion of Ukraine in early 2022. IBA will continue to monitor the effects of the unfolding situation on the aviation industry, and will publish regular updates.

IBA's ISTAT-qualified appraisers' partner with many aviation and financial sector clients globally to advise on their distinct interests, helping them address a broad range of complex asset valuation requirements. Our specialist services extend in scope from strategic fleet selection, transaction due diligence, Asset Backed Securities (ABS) portfolio appraisal and operational decision making through to annual portfolio and financial compliance monitoring.

Be fully equipped to research and understand the value of current and future investment decisions with IBA's award-winning aircraft valuations. Voted Appraiser of the Year for the fourth time in 2021, our values provide an advanced level of confidence when modelling and researching opportunities, risk and strategy options.

Find out more about our on-line and bespoke valuations