10/08/2021

Vman aviation services have launched in India. Read our analysis of the first aircraft leasing company in the 'Gift City'.

The Indian aviation market saw tremendous air traffic growth before the Coronavirus pandemic. As of June 2021, India has the fourth largest domestic aviation market according to IATA. According to IBA's InsightIQ, as of July 2021, there are 737 aircraft in India, of which 72% of these are leased. This is higher in comparison to 36% in Asia and a 46% leased share globally.

It is amidst this dynamic market, and powered by the Atmanirbhar Bharat Abhiyaan ('Self Reliant India') initiative, that India's first leasing company, Vman, has launched. The Indian government aims to develop a domestic aircraft leasing hub in the Gujarat International Finance Tech City, also known as 'GIFT'.

Vman Aviation Services IFSC Pvt Ltd (Vman) is India's first aircraft leasing company in the GIFT city. Vman placed their first order with Airbus Helicopters for one H125 helicopter on the 7th July 2021, with delivery of the asset expected between September and October 2021. The H125 has been a preferred choice for lessees in the region, including Himalayan Heli, UTair India and Global Vectra Helicorp for heli-pilgrimage, rescue, airborne missions and charter services. Vman's future plans involve acquiring a more varied aircraft portfolio, and offering reasonably priced leased equipment in India.

As per the Indian civil aircraft register, there are currently 176 helicopters, of which 32 (18%) are leased. This is twice than the global share of approximately 9% of helicopters leased.

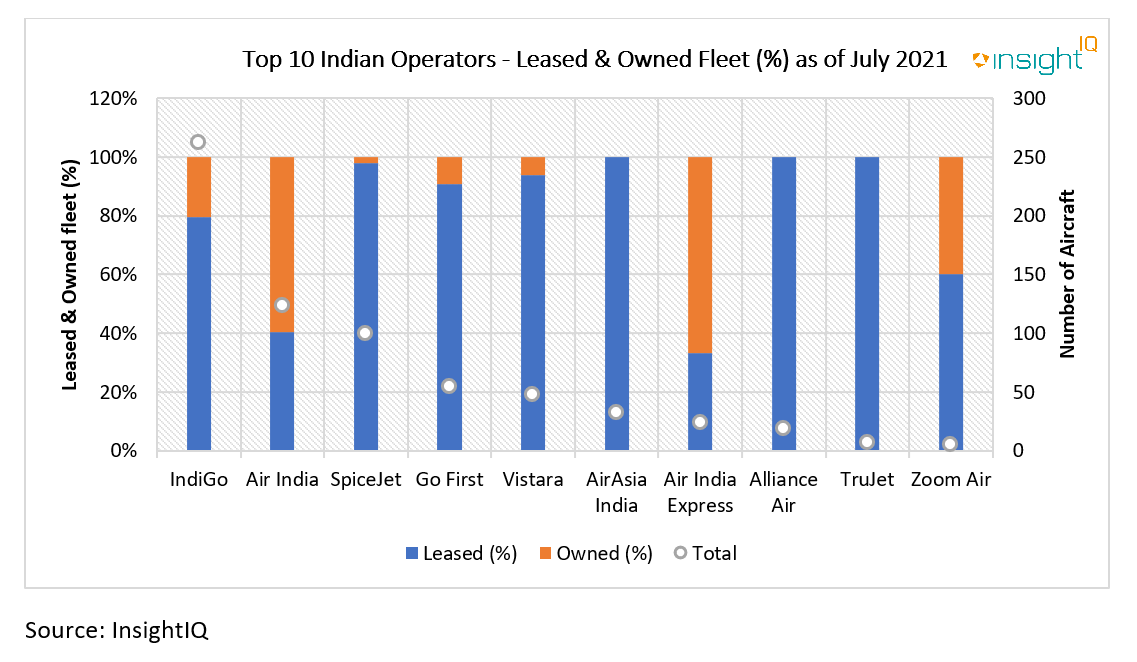

The chart below shows that the top 10 carriers in India are leasing approximately 80% of their fleets on average as of July 2021. This figure has remained consistent in the past five years, and despite the notable leasing trend, there appears to be no notable commercial aircraft leasing company based in India.

IBA's leading online aviation intelligence platform, InsightIQ, illustrates the geographical distribution of the lessors in the Indian market. Local operators rely heavily on lessors based primarily in the Europe & CIS market. Lessors from North America and APAC also feature, primarily from Japan. According to InsightIQ, the majority of fixed wing aircraft lessors used by Indian operators are based in Ireland, with a market share of 51%. The United States and Ireland were also the most common bases of lessors to the Indian helicopter market.

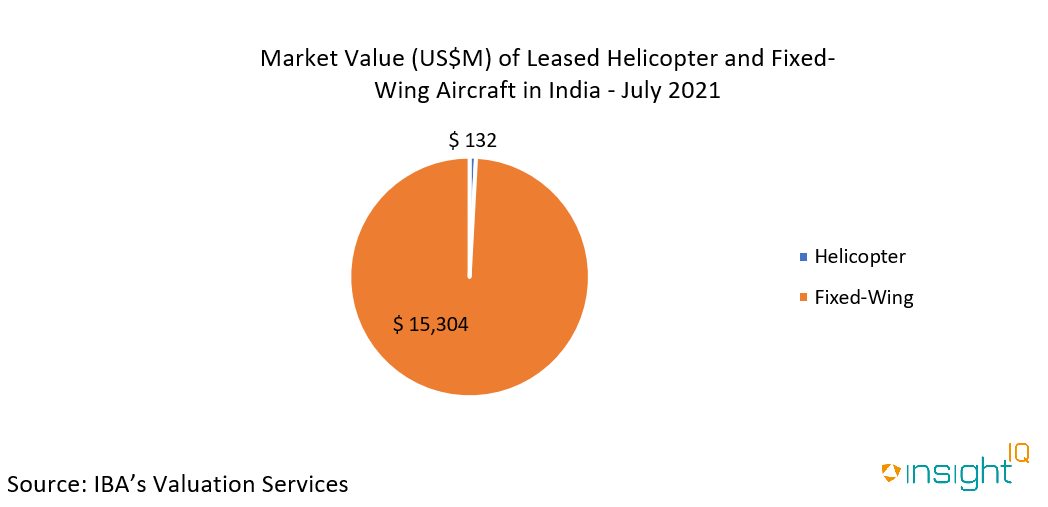

According to the CEO of Vman, their launching H125 transaction was valued at approximately EUR 5 million (USD 6 million). IBA's InsightIQ shows the total current half-life market value of Indian fixed-wing leased aircraft at USD 15,304 million as of July 2021, while the total current half-life market value of leased helicopters stands at USD 132.4 million.

Until recently, Indian banks have prohibited from financing leased equipment. This has recently changed with the official introduction of 'aircraft leasing' as a formalized financial product in 2020. This service can be offered by entities in the Gift City with the flexibility to transact in foreign currency. As a result, foreign lessors are enticed to set up businesses there. Alongside Vman Aviation, Ireland's Acumen Aviation, business charter JetSetGo and London-based Investec Aviation have also shown interest in setting up a leasing business in the GIFT city.

Further tax incentives grant a tax holiday for Indian lessors, and a tax exemption for operators who lease aircraft from those lessors. These benefits provide a competitive edge for Indian based lessors, and the support is likely to see an upsurge in new entrants. Despite this, the authorities still face a challenge in persuading well-established foreign lessors to extend their leasing business to India, mostly because India has yet to fully implement the Cape Town Convention's laws on insolvency and bankruptcy.

The entry of Indian lessors such as Vman Aviation bears benefits for airlines and the wider economy. Businesses are less exposed to foreign exchange risks, local contributions and the risks of diverging into a new and underdeveloped segment. Furthermore, a home-based lessor means better accessibility and local market knowledge for operators.

Due to Covid-19, many operators have been forced to attempt to renegotiate their leasing terms. Vman could potentially benefit from this conflict with foreign lessors if they are able to expand their aircraft portfolio and provide better leasing terms (though the financing and expansion capability at Vman is uncertain at this stage) If recent developments are successful, current foreign lessors are at risk of losing market share and negotiation power over their lessees.

Whilst these recent movements in the market are positive, India has some way to go towards becoming a truly successful leasing hub. The developments in the Gift City are a start and may pave the way for new investors to extend their business in India. With the financial fragility among airlines and helicopter operators under current market conditions, a strong level of support from the government and a well-regulated jurisdiction is required for Vman to succeed and for India to be a viable and appealing option to lessors.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.