07/05/2021

Jie Zhou, Senior Aviation Analyst, IBA Advisory, uses InsightIQ fleet and flights data to share a detailed view of HNA's current exposure and explore what the restructuring process could mean for lessors.

Chinese conglomerate HNA Group filed for bankruptcy and announced reorganisation plans in January this year after a long period of financial struggle. The liquidity issues its airlines group has faced since 2017 have been exacerbated by Covid. In early April 2021, HNA disclosed that over 4,000 creditors are seeking to reclaim around USD 45 billion from Hainan Airlines and seven other subsidiary carriers as part of the group's restructuring process. The world's third largest lessor with 14 airlines and a 636-strong fleet, Hainan's substantial growth over the last two decades has involved some organic development but has primarily depended on debt-fuelled acquisitions and joint venture start-ups. The group has been searching for investors and strategic partners to accelerate its reorganisation. Encouragingly, post-Covid demand in the Chinese aviation market is displaying strong resurgence. Will Hainan survive? IBA uses its intelligence platform InsightIQ to share a detailed view of HNA's current exposure to aircraft assets and ask what the restructuring process will mean for lessors.

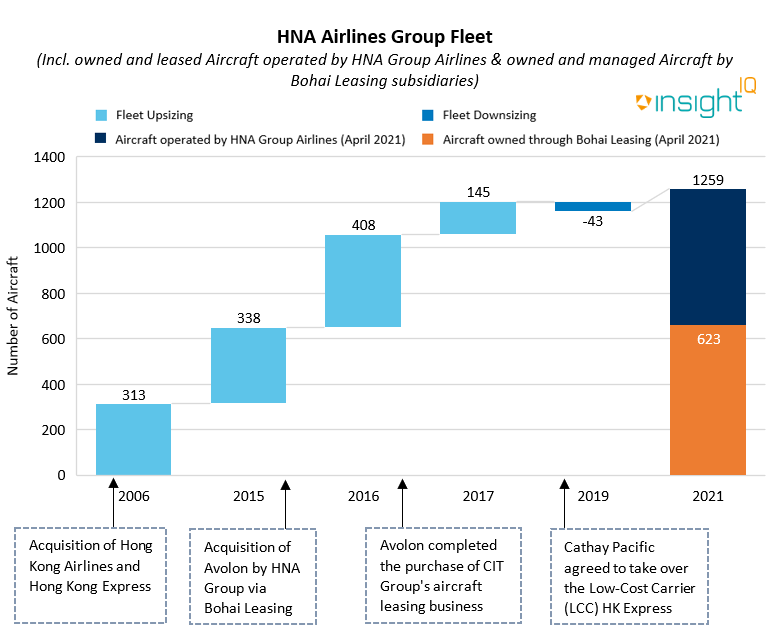

Headquartered in Hainan, HNA Group was established in 2000 after the restructuring of Hainan Airlines in 1997. Until 2019, it was actively investing in various industries including aviation, tourism, real estate and financial services. Its airlines sector, HNA Aviation, has grown significantly over the last 20 years through acquisitions and investments in domestic and foreign airlines.The first being the acquisition of Hong Kong Airlines and HK Express in 2006. The following graph uses InsightIQ data to summarise the timeline of HNA Airlines Group's historical acquisition activities since 2006.

Source: IBA's InsightIQ Aircraft Fleet Data

One such example shown is the aquisition of Irish lessor Avolon through its Bohai Leasing affiliate in 201. The owned, managed and committed fleet at the time consisted of approximately 418 aircraft, across both Avolon and HKAC's aircraft portfolios. In April 2017, the Dublin-based lessor acquired CIT Aerospace, adding over 360 owned and managed aircraft to Bohai Leasing. As of April this year, the HNA-owned aircraft leasing firm is ranked as the world's third-largest lessor by number of owned and managed aircraft.

HNA's acquisitions, mainly fuelled by raising debt, have caused concern about the Group's sustainability, high borrowing costs forcing it to divest some of its assets. For example, in 2019 HNA sold its Low-Cost Carrier (LCC) HK Express to Cathay Pacific in a bid to ameliorate its debt burden. Covid, having caused massive reductions in airlines' revenues, was the straw that broke HNA's back and forced it in February to request help to manage its mounting debt from the Hainan government.

HNA's creditors applied to a Chinese court in late January, asking for the company to be made bankrupt and to restructure. The Chinese conglomerate announced in March that it planned to merge its 321 owned companies (including HNA Aviation's assets) into a single entity and that it was looking for investors. It added it would ensure its subsidiary air carrier, Hainan Airlines, would be unaltered by future investments and restructuring.

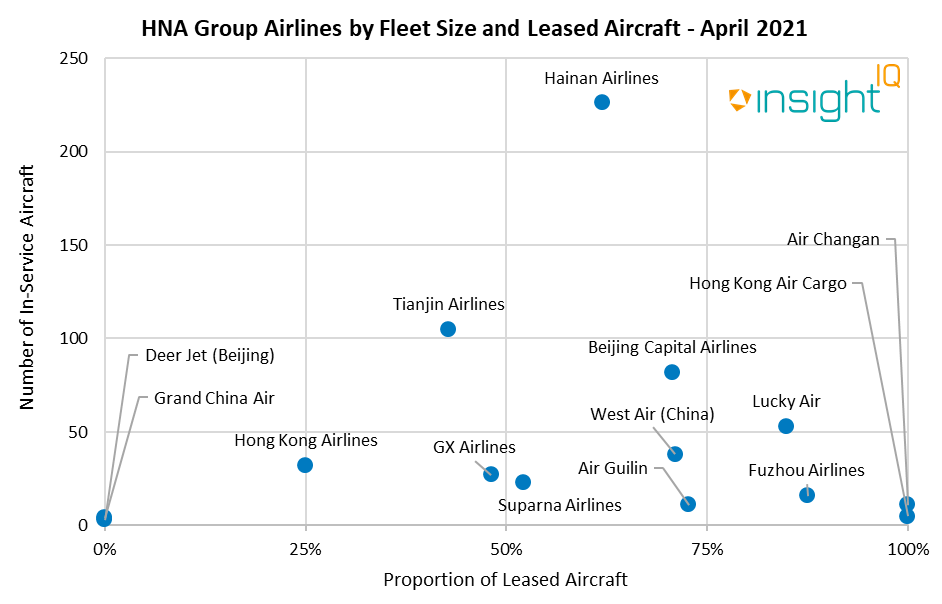

As of April 2021, HNA's airlines sector consists of 14 airlines with an entire in-service fleet of 636 aircraft. Most of the operators owned by the Group are passenger airlines, except Suparna Airlines and Hong Kong Air Cargo, which are cargo operators.

HNA Group's core asset is Hainan Airlines, which has controlling stakes in other subsidiary operators within its airlines group. The following bubble graph represents the size of its in-service fleet and the percentage of leased aircraft each of the airlines owned by HNA Group operates, including Hong Kong Airlines and Hong Kong Air Cargo.

Source: IBA's InsightIQ Aircraft Fleet Data

The aircraft portfolio within the HNA Airlines Group is diversified in terms of fleet size and ownership structure. The Chinese conglomerate owns not only regional carriers such as Air Guilin and Grand China Air, it also operates the fourth and ninth largest Chinese airlines in terms of fleet size, Hainan Airlines and Tianjin Airlines respectively. Overall, airline operations within HNA rely heavily on leased aircraft; they represent nearly 70% of the in-service fleet as of April 2021. In contrast, the fleets of the 'Big-Three' state-owned Chinese carriers, China Southern Airlines, Air China and China Eastern Airlines have an average ratio of 29% leased in-service aircraft.

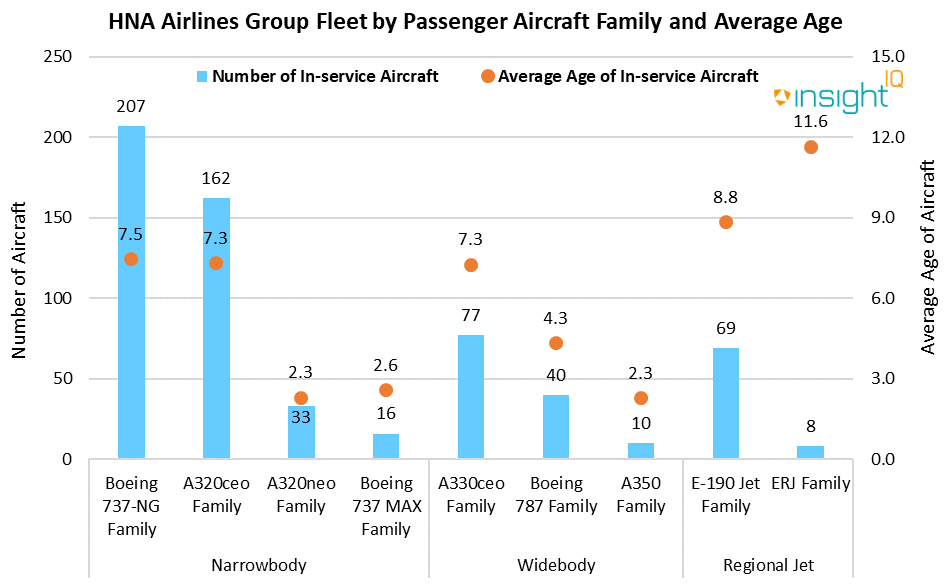

The combined passenger fleet of all HNA airline operators is dominated by narrowbody aircraft at nearly 70%. This highlights the regional and domestic focus of HNA's airlines. Flight data available in InsightIQ shows that, prior to Covid, the Group's airlines operated approximately 87.8% of flights on domestic routes.

Source: IBA's InsightIQ Aircraft Fleet Data

The bar chart shown above indicates HNA Group's airline carriers operate a relatively young fleet with an overall average age just under 7 years. Several newer generation aircraft models joined HNA recently, such as the Airbus A320neo and the Boeing 787 family. The newer generation aircraft represent nearly 16% of the overall fleet operated by the HNA airline group.

The most popular aircraft model is the Boeing 737-800 with nearly 200 examples in the combined fleet. The Airbus A320ceo is also a preferred aircraft type, the total in-service fleet including more than 115 A320-200s. Orders from Hainan Airlines dominate the order backlog; they include four Boeing 787 family and 43 Boeing 737 MAX aircraft. The Civil Aviation Authority of China (CAAC) has yet to recertify the MAX in China, leaving the aircraft's fate in limbo. There are 15 domestically manufactured COMAC C919 aircraft in the order backlog.

For widebodies, the Airbus A330ceo family is by far the most utilised type among all airlines owned by the Chinese conglomerate. The overall fleet size of the A330ceo family represents 77 out of 617 passenger-configured aircraft in HNA.

Tianjin Airlines focuses primarily on regional routes and operates almost all of the in-service regional aircraft in the group's fleet, consisting of 52 E-Jets and eight ERJ family aircraft.

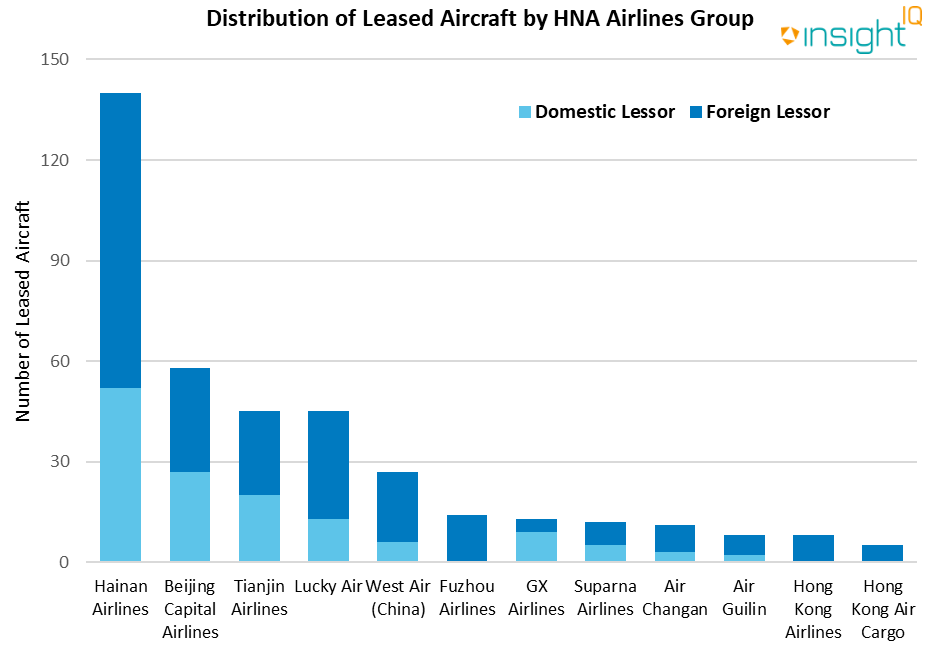

InsightIQ data reveals the extent of each airline's leased fleet within the HNA Group and highlights the exposure of foreign lessors, mostly based in Ireland and the United States. The following graph shows, in aggregate, there are 441 leased aircraft in an in-service fleet of 636 aircraft, representing nearly 70%. In addition, 12 out of 14 carriers within the group operate aircraft leased from foreign lessors, comprising almost 57% of the total leased fleet.

*Grand China Air and DeerJet do not appear on the graph as their fleet is fully owned

Source: IBA's InsightIQ Aircraft Fleet Data

Domestic lessors with exposure to HNA Group include BoComm Leasing (36), Changjiang Leasing (33), BOC Aviation (22) and CDB Aviation Lease Finance (17).

Major foreign lessors have exposure to the leased fleet of HNA Airlines: GECAS (20), Avolon (14) and AerCap (seven). InsightIQ Fleets also indicates that Avolon, the aircraft leasing firm owned by HNA, and AerCap are the foreign lessors with the highest exposure to the conglomerate in the widebody sector. Each lessor manages respectively 15 and 10 widebody aircraft on lease to HNA. To drill down into InsightIQ Fleets further, we learn that Avolon leases seven Boeing 787-9s, five Airbus A330s and three Airbus A350-900s to HNA carriers while AerCap manages five Airbus A330s, three Boeing 787 Dreamliners and two Airbus A350-900s.

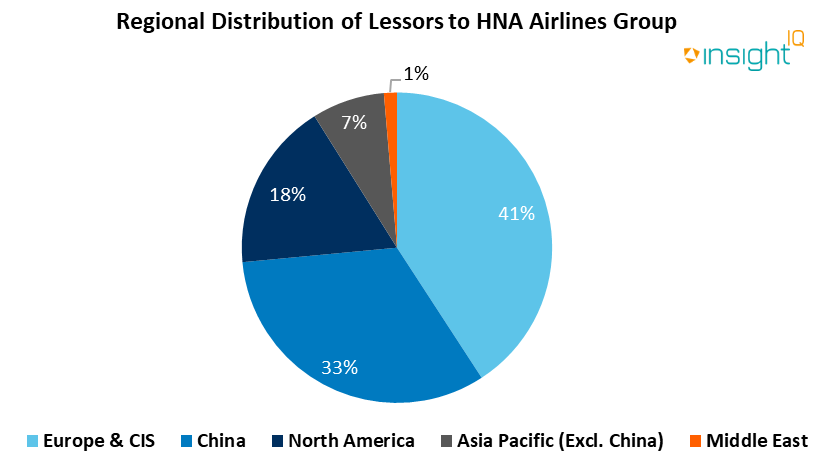

As represented in the above pie chart, 41% of HNA's foreign lessors are based in Europe (including AerCap, Avolon and SMBC Aviation Capital). GECAS, along with other comparatively smaller lessors from the United States, account for 18% of aircraft leased to airlines owned by the conglomerate.

InsightIQ intelligence demonstrates HNA operates a diverse leased portfolio of 441 aircraft with over 60 lessors and leasing entities and we have conducted further analysis on the aircrafts' lease end dates.

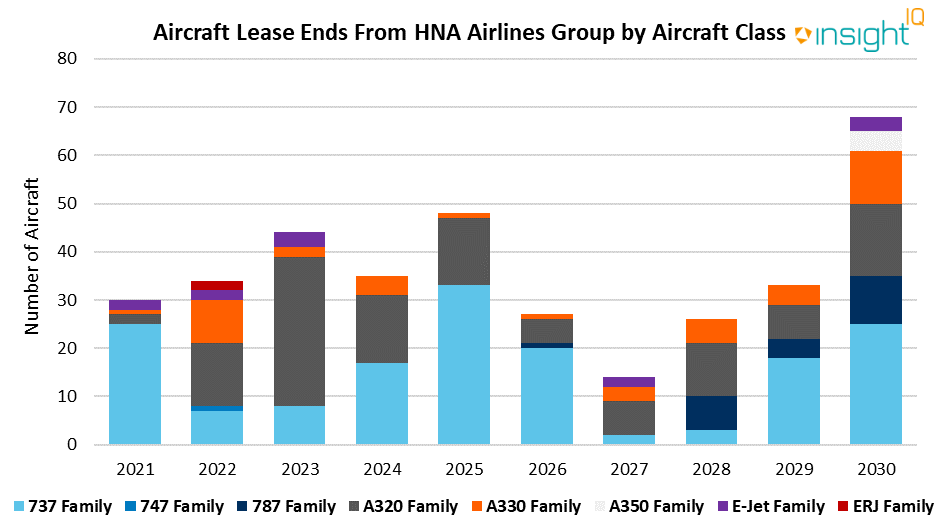

The lease end chart below displays a steady growth is expected in the next five years, airlines scheduled to return over 50% of their leased fleets based on current lease terms. However, it is worth noting that there will be some lease extensions depending on HNA's fleet strategy. In terms of aircraft type, the lease ends will be heavily concentrated on narrowbody aircraft, particularly the Boeing 737NG and Airbus A320ceo family, which represent 90 and 74 lease end events respectively. In 2021, HNA airlines are scheduled to return approximately 30 aircraft, 25 of which are Boeing 737-800 models.

Source: IBA's InsightIQ Aircraft Fleet Data

Widebody types such as the Airbus A330ceo and Boeing 787 family will also see a number of lease ends in the coming years, 41 Airbus A330ceo aircraft and 22 Boeing 787s having lease end dates in the next decade. In addition, around 70% of lease contracts related to HNA's widebody fleet are not scheduled to terminate until 2026. The widebody fleet is usually more exposed to international routes and, as these are heavily impacted by the current travel restrictions in Asia and many other countries worldwide, Hainan Airlines could potentially seek to agree rearrangement with lessors.

Annual lease end events will reach a peak in 2030 with nearly 70 in total. However, HNA will be able to adjust its leased fleet sizes in accordance with air travel demand recovery over the next five years.

Over the last two decades, HNA Airline Group has built up its fleet through organic growth, by acquiring other airlines and enhancing its market share by setting up new start-up airlines via joint ventures with the local government in China. Despite the recent headwind and ongoing restructuring process, HNA Group recently declared that the operation of its subsidiary airlines, especially its core carrier Hainan Airlines, will not be affected. According to IBA's InsightIQ data, the total number of flights operated by HNA in March 2021 recovered to nearly 95% of the monthly flights pre-Covid. 52,710 HNA flights were recorded in March, surpassing the monthly figure logged during the same month in 2019.

HNA has benefitted from rapid demand growth in the Chinese aviation market during the past decades, which has contributed to its domestic market expansion and the establishment of its international routes.

InsightIQ Flights data unveils the number of commercial passenger domestic flights within China increased by 21% in April this year compared to April 2019. The International Air Transport Association (IATA) published within its Q1 report that RPKs (Revenue Passenger Kilometers) related to the Chinese domestic market in March 2021 were down by only 2.6% compared with 2019. In terms of the number of carried passengers, few local airlines have reported recent traffic figures. However, official traffic figures from China Southern Airlines and Air China suggest that demand for domestic air travel in China has recovered from the pandemic. Indeed, these two airlines reported respectively an 8% and -0.3% trend in terms of carried passengers in March 2021 compared with the same month in 2019. This recovery in demand for the Chinese domestic market is positive for HNA. With a pre-pandemic exposure to domestic routes close to 90%, the Group will benefit from the resultant growth in revenue.

Despite such a demand surge for air travel and higher revenue forecasts, the aviation division of HNA Group is still far from profitable. In late April 2021, Hainan Airlines posted an annual loss amounting to 64 billion yuan (US$9.9 billion) for 2020. The subsidiary airlines also reported further losses in Q1 2021, totalling 2.6 billion yuan (US$400 million).

Despite the Group's significant losses, the relative youth and vibrancy of HNA's fleet should enable its airlines to achieve profitability through benefitting from the domestic market's recovery in China once its ongoing reorganisation is completed.

All Data used and displayed in this article is derived from IBA's proprietary data platform IBA InsightIQ.

If you have any further questions or comments or would like to discuss how IBA can support your business, please contact: Jie Zhou

InsightIQ is a one-stop intelligence platform combining speed, accuracy, visual analytics and intuitive navigation. Its ease of use and exportability creates information clarity which, united with IBA's trusted asset optimisation and valuation methodologies, makes it the global aviation industry's must-have tool.

InsightIQ offers market leading aircraft and engine fleet data, valuations, liquidity analysis, flight data, carbon emission calculations and market trend information.

Sign up for a system demonstration

相关内容