27/09/2021

We examined widebody aircraft reconfiguration to identify key trends for popular Airbus and Boeing types.

Airlines tend to reconfigure the cabins of their owned aircraft for the purpose of improving passenger experience and boosting flight revenues. For a lessor, cabin reconfiguration can allow for a more flexible asset that is easily marketable to a flag carrier, low-cost airline, or even freight operator. Despite the benefits of altering cabin configuration, it can prove a costly process. We used data from IBA's InsightIQ aviation intelligence platform to look at trends in reconfiguration for widebody aircraft.

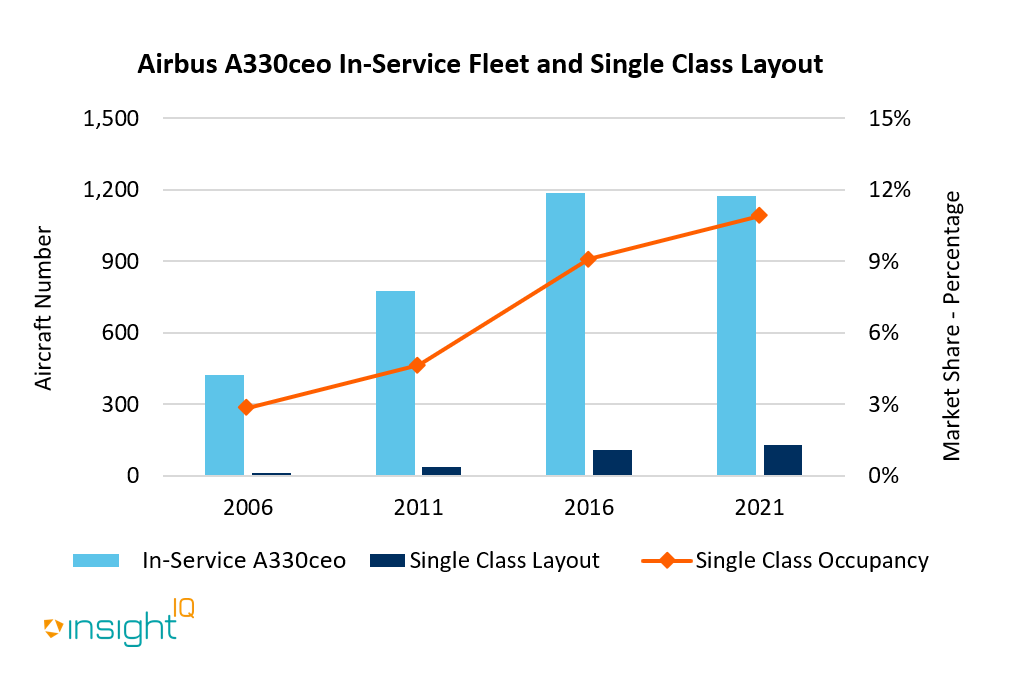

Widebody passenger aircraft are less likely to be reconfigured into single-class cabin layout. As of September 2021, fleet data from IBA's InsightIQ records nearly 130 Airbus A330ceo family aircraft operated with a single-class configuration, representing only 11% of the total in-service fleet. Despite this figure, The A330 is the twin-aisle aircraft type with the highest single-class occupancy. Among A330ceo aircraft, budget airlines account for most of these full-economy configured airframes (including the A330 fleet operated by Lion Air and Cebu Pacific Airlines) In addition, there are 13 single-class configured A330-300 aircraft currently operated by the Indonesian national flag carrier - Garuda Indonesia.

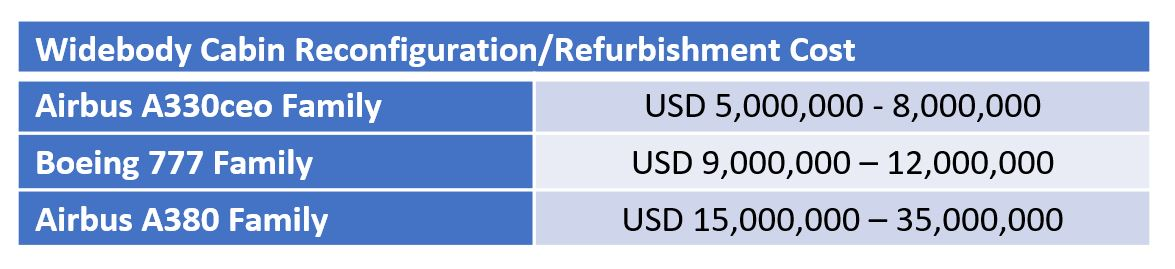

Twin-aisle operators and owners are more inclined to refurbish their aircraft cabins with premium products than they are to install a single class configuration. The installation of advanced Business Class features with upgraded seats and in-flight entertainment (IFE) is common. HAECO Xiamen has completed cabin reconfiguration work for 10 Virgin Atlantic Airbus A330-300 aircraft across the past five years, with a C4 heavy airframe check conducted in parallel. Each project took around 12 months to complete. Longer aircraft downtime and higher reconfiguration cost can be significant detractors to remarketing the widebody aircraft on the secondary market, representing a major challenge for large twin-aisle passenger aircraft such as the Boeing 777 family and Airbus A380.

The reconfiguring expense incurred for Airbus A330ceo and Boeing 777 family aircraft are based on a typical two-class cabin layout. The major contribution to the reconfiguration cost is down to the seat upgrade, representing 20-30% of the entire project, followed by monuments and In-Flight Entertainment (IFE) system installation.

Looking at the A380, IBA understands that only Singapore Airlines and Qantas have recently conducted A380 cabin reconfigurations in order to bring back their upgraded A380 fleets once traffic demand resumes to the Pre-Covid level. The reconfiguration cost to A380 operators will be considerably higher than those highlighted above, with operators such as Emirates and Qatar Airways spending around $30-50 million USD on the initial BFE configuration at delivery.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.