16/05/2022

Cover image: Ken Chen

As the first customer C919 completes its inaugural test flight, we look at the largest orders for the Chinese narrowbody.

Source: News Center of COMAC

The Commercial Aircraft Corporation of China (Comac) has completed the test flight of the first homemade C919 aircraft to be delivered to a customer. Using flight tracking intelligence from IBA Insight, we can see the aircraft operated a flight to and from Shanghai Pudong International Airport, departing at 06:52 am and returning at 09:54 am local time. Comac reported that the aircraft completed all scheduled tasks and performed well overall. This first production aircraft is expected to be delivered to China Eastern Airlines in 2022.

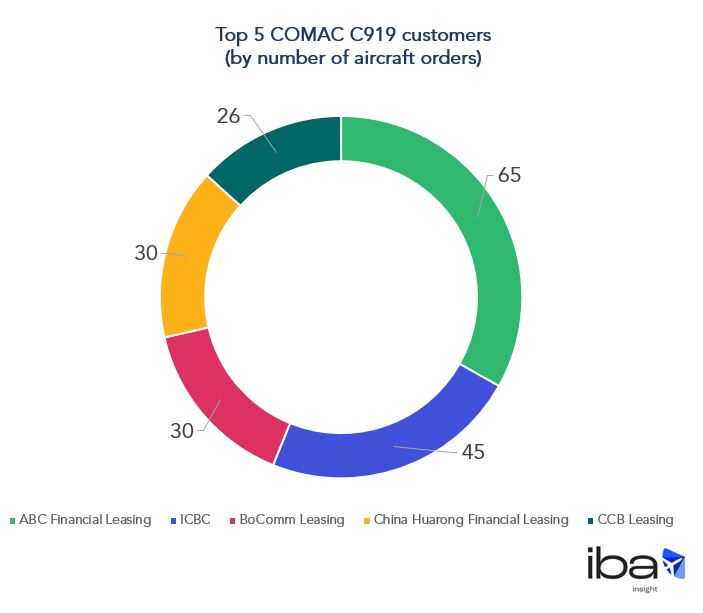

Notable customers include major Chinese lessors ABC Financial Leasing, ICBC Financial Leasing, Bocomm Leasing. The aircraft is equipped with CFM LEAP engines and is pitched as a competitor to the Boeing 737 MAX and Airbus A320neo family aircraft in the narrowbody market.

Update: New information shows that SPDB Financial Leasing's aircraft orders also have five Comac C919 aircraft whilst AVIC has 15 Comac C919 aircraft on order.

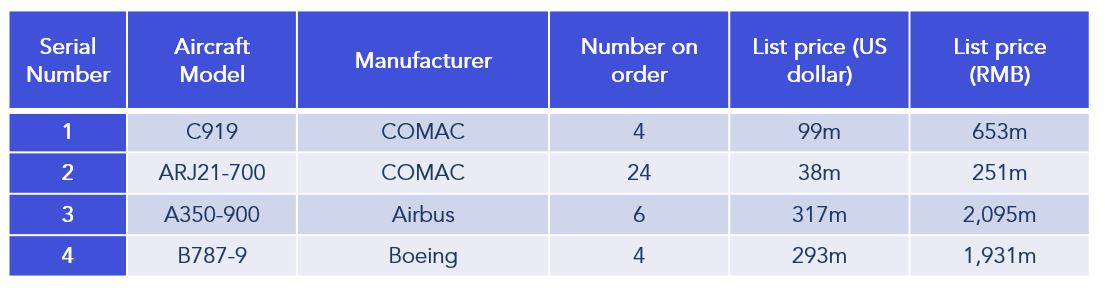

According to a press release on 10 May 2022, China Eastern Airlines plans to raise up to 15 billion yuan (USD 2.23 billion) from share sales. This is intended to replenish the working capital of the airline and expand its fleet. Based on filings to the Shanghai Stock Exchange, the airline will use 10.5 billion yuan of the proceeds from the share sale to fund the purchase of 38 aircraft. These will include 4 x C919, 24 x ARJ21-700, 6 x Airbus A350-900, and 4 x Boeing 787-9 aircraft.

1 USD = 6.6 RMB

This aircraft order data from China Eastern Airlines has revealed the list price of the Comac C919 for the first time. Whilst the real transaction price is often far below a list price, we believe it is far too early to compare the C919's fair market value with its intended Boeing and Airbus competitors, given that the program is relatively new, and no trading points are available on the secondary market.

China is one of the world’s largest and most significant aviation markets, and the sustainable actions of its largest airlines set trends for the wider region. IBA will be closely tracking and analysing their actions in the coming year, building on our work in the region, including our recent appointment as the official appraiser for the Comac C919 programme.

IBA Insight flexibly illustrates multiple asset, fleet, and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.