14/03/2019

IBA Report: issued March 2019

Jon Whaley, IBA's Freight Analyst, explores fleet composition, market share and growth opportunities for the P2F market.

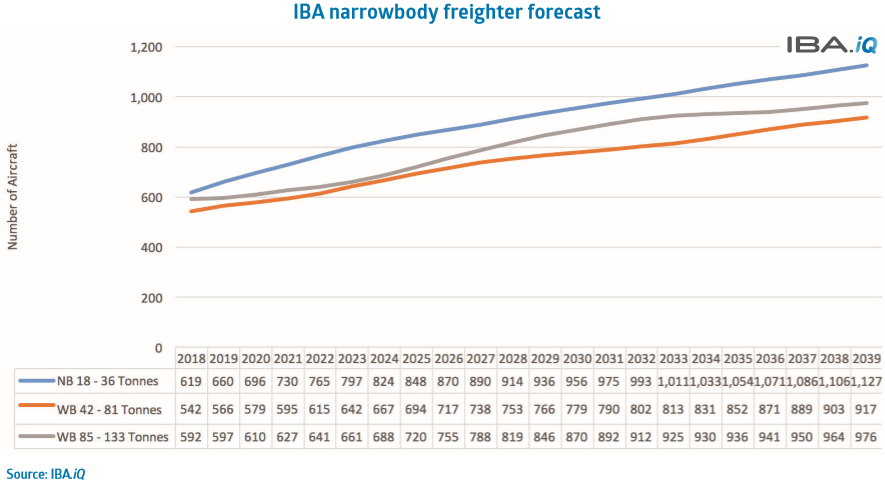

Accounting for Boeing 737, Boeing 757 and MD-80 family freighters, the current number of inservice freighters totals circa 620 aircraft. Both Airbus and Boeing have released their 2018 to 2037 market forecasts. Airbus forecast that there will be a requirement for approximately 950 narrowbody or mid-size payload freighter aircraft, which Airbus classify as being up to 40 tonnes, of which 480 are aircraft which will be converted. Boeing forecasts a slightly larger increase in narrowbody freighters between 2018 and 2037, with 1,280 aircraft forecast to be in service by 2037.

It is IBA's opinion that by December 2037 the number of narrowbody freighter aircraft will increase to 1,086 aircraft. The majority of the future freighter fleet will be located in Asia Pacific and North America, with Asia Pacific seeing the largest growth.

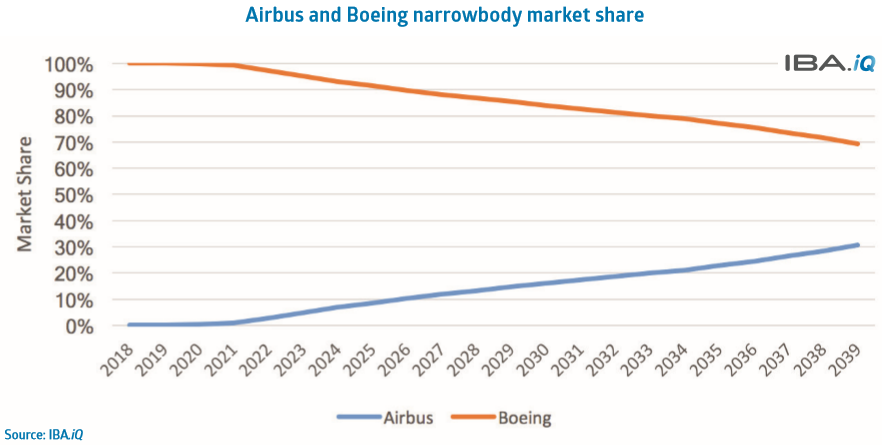

The composition of the fleet will be significantly different in 2037 compared to how it is today. Currently the narrowbody market is dominated by Boeing types, with a small amount of McDonnell Douglas MD-80 family aircraft being used as freighters. Going forward, Boeing will maintain its position as being the dominant player within the narrowbody freighter market as the number of Boeing 737NGs, predominantly 737-800s, increases over the period. Additionally, there will be interest in the 737-700, though not to the extent of the 737-800.

There will also be a substantial Boeing 757-200 freighter fleet for a number of years as we are still seeing conversions occurring for some aircraft, whilst some of the older converted 757-200 are being retired. There will be a gradual decline in the number of converted Boeing 737 Classics in freighter service as the years progress due to the age of the aircraft. The Airbus A320 Family aircraft will also occupy a portion of the market, it is expected that the Airbus A321P2F will be the more popular choice.

Airbus' market share will grow over time, in particular for the A321P2F, as the types enter service and feedstock becomes suitable. Feedstock suitability is a particular factor for the A321-200, a type which did not flourish until quite late into its production run and therefore most examples are still on lease and much sought after.

Additionally, a lot of the Boeing freighters currently in operation are quite old with the average age of the current in service fleet being 25.81 years. It is expected that the Airbus A321P2F will be well suited to replace a portion of the older Boeing 757-200 fleet, which will help Airbus gain a larger foothold in the market. The difficulty Airbus will have is drawing customers away from the Boeing products they have been accustomed to for many years. Plus, with the first production-converted Airbus A321 not expected to roll out until the end of 2019 at the earliest, and with the initial conversion slot availability being restricted, inroads into Boeing's market share will take time.

The future market share between Airbus and Boeing between 2018 and 2039 is anticipated to converge with a market share ratio of 69:31, expected by 2040.

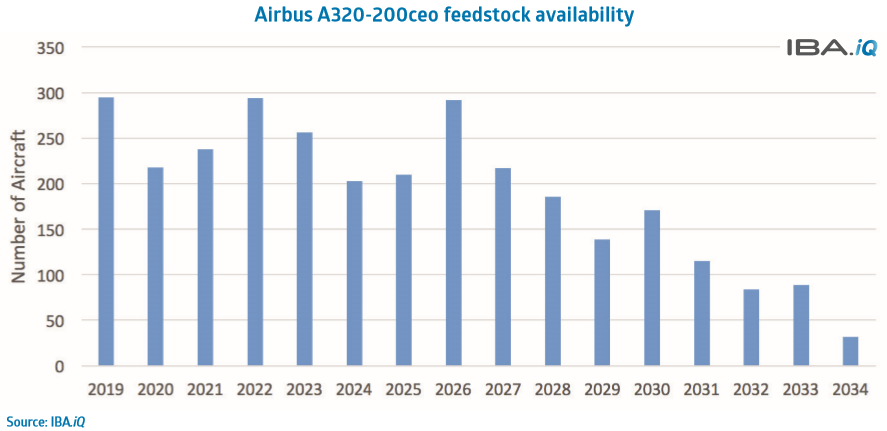

Outlined below is IBA's forecast of the availability of Airbus A320-200ceo which are suitable for P2F conversion. Aircraft under eleven years old are deemed too young to be considered for P2F conversion as the residual value of these aircraft is too high, additionally competition from the passenger market will be intense for such young aircraft. At the opposite end of the scale there are some aircraft which are classified as being too old, this applies to aircraft which are 20 years old and above. Older aircraft have been discounted as it does not make economic sense to place the aircraft through a P2F conversion based on the remaining service life of the aircraft.

From the above chart it is clear to see that between now and 2026 there is ample feedstock of P2F suitable Airbus A320-200ceos. In some instances, there will be competition from the passenger market for those aircraft which are of good specification and have a good operator history, in this case it is likely that the aircraft will see further passenger use before potentially being converted.

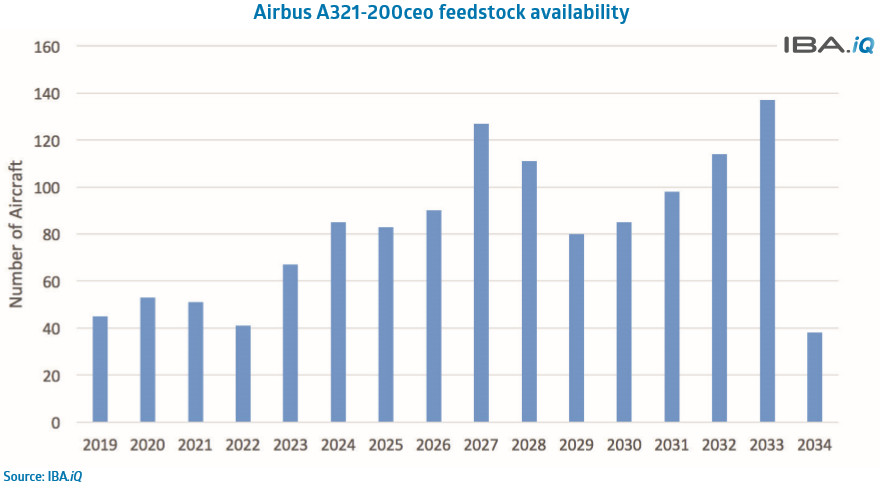

Using the same method as that outlined for the Airbus A320-200ceo, the future feedstock availability forecast for Airbus A321-200ceo is shown below.

Unlike the Airbus A320-200ceo feedstock which sees a high number of aircraft becoming available in the immediate near future, the A321-200 sees a gradual increase in the number of aircraft becoming available, with a peak occurring in 2033. The difference in trends is a result of the Airbus A321-200ceo becoming popular at a relatively late stage of its production run and therefore most examples are still too young to be considered for P2F conversion.

Regardless of whether one takes the slightly more conservative Airbus view, the opportune view of Boeing, or IBA's view, it is probably fair to say that the narrowbody - P2F fleet will grow by a factor of between 1.5 and 2 (IBA predict it will be around 1.75 - 1.8) over the next 20 years. Regardless of which forecast is taken, all are fairly reasoned in IBA's view. Much of this increase will be fed by the Boeing 737-800SF/BCF due to the successful launch of its programme. There are still numbers of Boeing 757-200 passenger aircraft out there that will fuel some of the growth, along with reducing numbers of Boeing 737-300s and 737-400s, as well as some Boeing 737-700s. However, it is evident that there is a window of opportunity in this market sector for Airbus products to penetrate with both the Airbus A320-200 and Airbus A321-200 aircraft.

Contact Owen Geach for more information and to discuss further.