20/01/2022

IBA has forecasted a sharp recovery in capacity and demand in our recent commercial aviation market update.

Image: Paul Thompson, Flickr

Combining third party data with our expert insight and intelligence from our InsightIQ platform, IBA has published predictions for key aviation trends in 2022. IBA has over 30 years' experience in providing specialised aviation advisory services to a wide range of clients including leading aviation finance and leasing companies, aircraft operators, insurance firms, lawyers, OEMs and MROs.

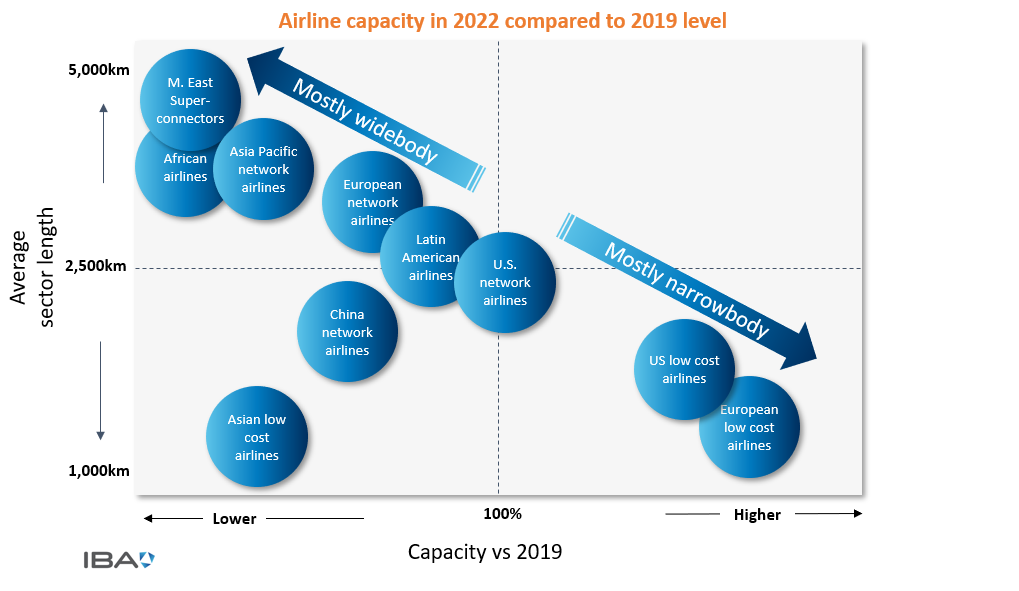

Our insight shows that low-cost airlines operating in Europe and the United States will experience a growth in airline capacity in 2022. This is likely to exceed pre-Covid capacity levels. The key drivers of airline capacity in Europe are buoyant travel demand from domestic and intra-EU markets, and relatively light travel restrictions.

We expect demand for transatlantic flights to recover to 2019 levels in 2022. This is a particularly positive development for the three major European network carriers, including IAG whose transatlantic capacity is set to reach 100% of pre-pandemic levels by summer 2022.

IBA will continue to monitor changes to aviation carbon emissions data brought about by changes in capacity and demand in 2022 as part of our Carbon Index. Our recent analysis of CO2 emissions at IAG verified the published carbon emissions data for the group's airlines within 1-2% accuracy.

A selection of airlines in North America are expected to reach or approach pre-pandemic levels in 2022. Capacity at Delta Air Lines and United Airlines is predicted to reach 90% and 105% respectively this year. Some US carriers are already exceeding this, with capacity at Spirit Airlines already at 110% in the last quarter of 2021.

In contrast to this is the Asia Pacific region. IBA's intelligence reveals that airlines most exposed to the Asia Pacific region will recover slower than the industry average. According to data from IBA's InsightIQ platform. Qantas Group's capacity is expected to reach 45% of 2019 levels in 2022, while Singapore Airlines was at 43% in December 2021. It is likely that hub carriers based in the Middle East will also feel this impact given typical airline passenger flows to and from the region.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.