22/08/2019

In this comprehensive report our analysts take a deep dive into the commercial aviation industry in South Korea, sharing our insight on market growth, fleet dynamics, Asiana Airline troubles and Korean investment in aviation.

Amongst the rapidly growing economies of the Asia-Pacific region's aviation markets, namely China and India, South Korea has managed to ascend to the upper echelons of economic dynamism within the aviation sector. The number of aircraft in the South Korean fleet has grown significantly over the past years, which is mainly driven by the increasing number of low cost carriers (LCC) in the market.

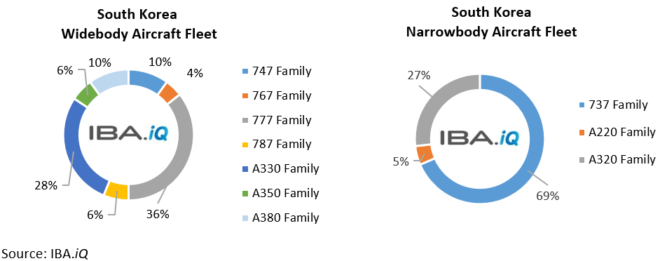

Currently there are 371 passenger aircraft in service operated by South Korean airlines. Notably, there are 146 on order from Korean operators. The top aircraft on order are the Boeing 737 MAX 8, followed by Airbus A321-200neo and A350 variants. The majority of the current Korean fleet are narrowbody aircraft, with 212 aircraft in total. Widebodies account for around 43% of the entire fleet, which is counted as 159 aircraft. In terms of the widebody aircraft types, the Boeing 777 family are prominent, with 57 aircraft, occupying 15% of the total in service fleet and 36% of the active widebody fleet. The Airbus A380 family makes up 10% of the widebody market share. Those two widebody families have an average age of just above 10 years old.

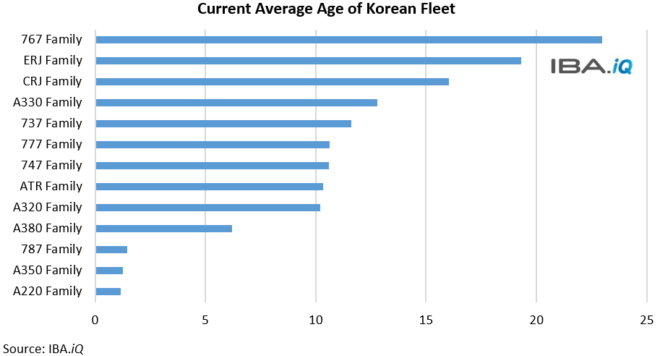

Regional aircraft and turboprops are less popular aircraft classes in South Korea, with only three Embraer ERJ-145 aircraft currently operated by Korea Express Air and no turboprops presently flying over the Korean sky.

The oldest aircraft in the Korean fleet are members of the Boeing 767 family, whose average age is approximately 23 years old. The youngest aircraft types include the Airbus A220 Family, A350 Family and Boeing 787 Family, as the majority of aircraft are less than two years old. The graph below indicates that the Boeing 737 family is the most populous narrowbody family of aircraft in South Korea, with an average age just below 12 years old.

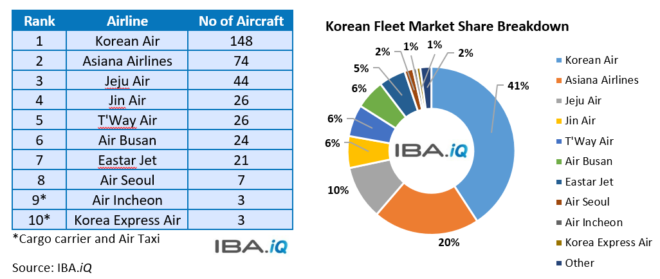

New entrants into the airline market are helping to fuel Korean market growth, featuring the likes of Air Premia, Hi Air, Aero K and Fly Gangwon. The LCC business model has stimulated a dramatic increase in passenger numbers over the past decade. Korean LCCs account for a significant proportion of the business models currently utilised in the region, competing against Full-Service Carriers (FSC) such as Korean Air and Asiana Airlines.

As a consequence of the success of LCC operation and demand in South Korea, Korean Air responded by founding Jin Air a LCC subsidiary. Jin Air is currently the only low-cost carrier in South Korea that operates widebody aircraft, with the Boeing 777-200ER. Similarly Asiana Airlines have also followed suit with Air Busan in 2007, the airline currently operates 16 Airbus A321-200s and seven Airbus A320-200s. In terms of the start-ups, Air Premia is due to commence operations in 2020, with the operation of the Boeing 787-9. Although, the carrier is seeking to exploit a "gap" in the market, through the implementation of the hybrid carrier business model.

Aero K is due to start operations in 2022, utilising the LCC business model and employing the Airbus A320 aircraft. As well as this, Fly Gangwon also plans to launch by 2022, using Boeing 737-800NGs. On a regional level, Hi Air, a full-service start-up carrier, is intending to begin turboprop operations in late 2019, with plans to operate with a fleet of up to ten ATR turboprops.

Although the Korean market has experienced strong growth in recent years, Asiana Airlines has suffered from numerous financial issues. As a result, Kumho Asian group (majority shareholders) has put its 31% stake in Asiana Airlines and its LCC subsidiaries, Air Busan and Air Seoul, up for sale. Accordingly, IBA has downgraded the airline's score in its latest risk index to 5B. Korean Development Bank announced a package, consisting of a hybrid bond, short-term debt and debt guarantees in late April this year for Asiana Airlines in a bid to ease liquidity concerns, although it did not go a long way in relieving the beleaguered carrier's leverage.

Kumho Asiana Group are reportedly looking for around 1 trillion won for the airline and its LCCs. Given foreign ownership restrictions, the buyer (or consortium) will be domestic, with rumours suggesting Aekyung Holdings (majority shareholder of Jeju Air) are interested in acquiring Kumho's stake. The Korea Corporate Governance Improvement (KCGI), the second biggest shareholder in the parent company of Korean Air, has also said it was interested in acquiring a controlling stake in Asiana Airlines.

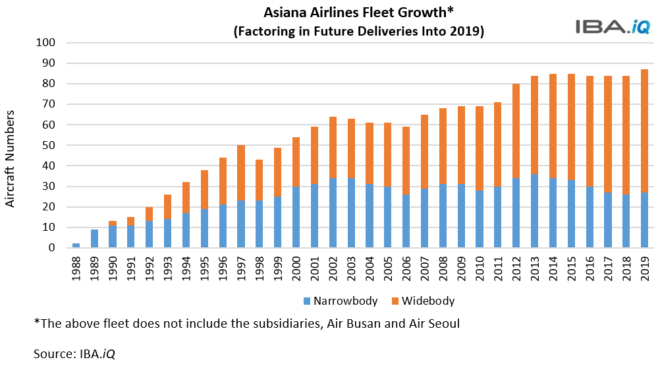

Looking at Asiana's fleet since its inception, the airline has grown significantly in terms of its long-haul and short-haul networks, requiring an increase in widebody capacity, as seen in the graph below.

Whilst this graph exhibits a positive growth trend, due to financial issues, the airline has changed its strategy and as such, is dropping a number of routes as well as decreasing its fleet size. Crucially, the airline currently operates six Airbus A380-800's which has previously proved unprofitable for several other airlines. The aircraft is currently operated on trunk routes including Seoul to New York, Hong Kong and Sydney.

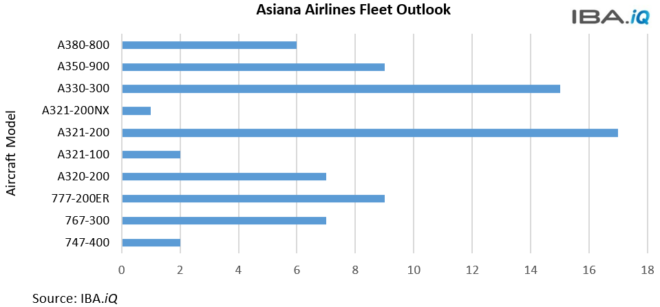

According to IBA.iQ, the narrowbody fleet consists of 18 Airbus A321-200s, which includes newly delivered A321NEO, seven Airbus A320-200s and two Airbus A321-100s. The widebody fleet consists of 15 Airbus A330-300s, nine Airbus A350-900s, nine Boeing 777-200ERs, seven Boeing 767-300s, six Airbus A380-800s and two Boeing 747-400s.

The active role Korean conglomerates played in the domestic aviation industry is not a new story. Korean Air, the largest airline and flag carrier of South Korea, went fully privatised and was acquired in the late 1970s by the Hanjin Group, which initially focussed on shipping and is now a hol

ding company comprising 20 subsidiaries. In 2008, the Hanjin Group established an LCC, called Jin Air, which has become the second largest and only widebody LCC operator in South Korea. Furthermore, Hanjin has also invested in its own travel agency to serve the growing number of tourists, particularly for foreign travellers.

Apart from the Hanjin Group, the Kumho Asiana Group has invested in three different carriers in South Korea, the fully owned flag carrier Asiana Airlines, LCC Air Busan, and the newly established Air Seoul, which only operates international flights.

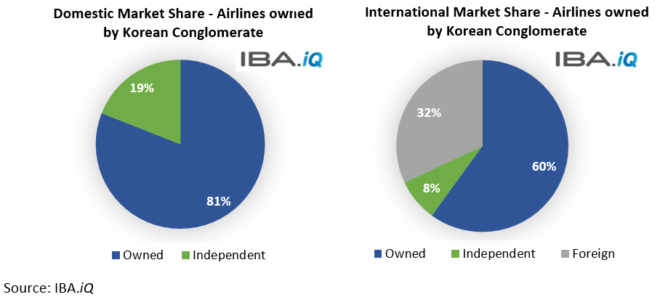

Following Hanjin and Kumho Asiana is the Aekyung Group, which started Jeju Air in 2005. Jeju has become the largest LCC in both the domestic and international markets of South Korea. Recently, the holding company of the Aekyung Group, expressed interest in acquiring Asiana Airlines, which is currently undergoing restructuring. Independent Korean airlines only account for 8% of international markets and 19% of the domestic market.

In 1999, at the behest of the South Korean government, a joint venture between Samsung Aerospace, Daewoo Heavy Industries (aerospace division), and Hyundai Space and Aircraft Company, named as Korea Aerospace Industries (KAI), was formed to develop the domestic aerospace and defence industry. Up until now, KAI has produced a number of fixed wing aircraft, jointly developed a few helicopter programmes and manufactured parts for other civil and military aviation OEMs. Furthermore, this joint consortium has drawn investments from both domestic and international financial institutes, which accounts for over a third of the ownership in KAI at the moment.

On the financing side of the aviation market, Korean investors have been seen as key players for over a decade and they continue to extend their capabilities and influence into a wider sphere of the aviation funding market.

South Korean institutional investors began with funding in mezzanine debt tranches backed by aircraft assets. Some have moved into equity investment, and now regularly provide dollar-denominated senior debt, which indicates that some of the more recent transactions are being closed with entirely domestic groups of arrangers, investors and lenders.

The first Korean-born aircraft leasing company, Crianza Aviation, was formed by Korean-based venture capital firm IMM Investment and Cerritos Holdings in 2016. Crianza has grown quickly since its inception and secured three Boeing 787-9 medium-widebody aircraft delivered new to Etihad Airways from November 2018 to February 2019.

The Dublin-headquartered Stellwagen Group opened an Asia branch office in Seoul. In December 2018, Stellwagen Korea, together with Meritz Securities Co. Ltd, completed its first transaction which involved the acquisition of one Boeing 777-300ER aircraft on lease to Qatar Airways. The asset management unit of the Stellwagen Group acted as servicer for this aircraft.

Before teaming up with Stellwagen, in late 2016, Meritz Securities had its first transaction of 20 aircraft purchased from GE Capital Aviation Services via joint aviation fund with Mizuho Securities Co. Ltd. Subsequently, an offshore Special-Purpose Entity (SPE), Labrador Aviation Finance, was set up and backed by these 20 aircraft. Two years later, in December 2018, Meritz together with Mizuho Securities formed their second portfolio aircraft investment, purchasing 18 used aircraft from Dubai Aerospace Enterprise (DAE) Capital.

Likewise, there are a number of Korean brokerage and investment companies actively being involved in aviation funding activities. KTB Investment & Securities Co. Ltd has a 30-year track record in specialised investment and asset management and brought institutional investors into their first aircraft deal via its fund structures. Samsung Securities Co. Ltd. and Mirae Asset Daewoo have been consistently seeking to include top-tier airlines in their aviation fund portfolios. Not to mention, KEB Hana Bank, who signed a Memorandum of Understanding (MOU) to take a majority stake in Arena Aviation Capital. KEB and Arena helped to finance the acquisition of a Boeing 777‑300ER aircraft on lease to Air Canada.

Korean private aircraft funds raised a total of 1.3 trillion won ($1.1 billion) in 2017, more than quadrupling the 293 billion won raised in 2012, according to KG Zeroin, a fund rating firm. At the same time, numerous government institutional investors have been playing a key role in the aviation funding market. In 2017, South Korea's National Pension Service (NPS) made its first investment in a blind-pool aircraft fund by committing US$100 million to a US$1 billion fund of BBAM, according to Korea investors. Alongside Korea Investment Corporation (KIC), the sovereign wealth fund of South Korea, invested heavily in the aviation fund raised by Castlelake. Several other Korean saving funds, i.e. the Public Official Benefit Association (POBA), the Korean Teachers Credit Union and the Military Mutual Aid Association (MMAA) have entered the aviation fund investment in recent years, driven by the stable returns and investment diversification.

Private aviation funds feature an increasing number of investors, both foreign and domestic, with American and European aviation funds seeking investments from South Korea. However, some early Korean investors have become cautious about declining returns from the increasingly crowded market.

Air Transport plays a crucial role in the South Korean economy. The number of passengers travelling by air in South Korea has exceeded 30 million in the first quarter of 2019, according to the latest data from IATA. This is the first time ever that quarterly passenger numbers have reached this figure, which is backed by the growing Korean LCC presence in both domestic and international markets. The period between 2015 and 2018 has seen average annual passenger growth of 43% amongst Korean LCCs, notably Jeju Air, Jin Air and Eastar Jet.

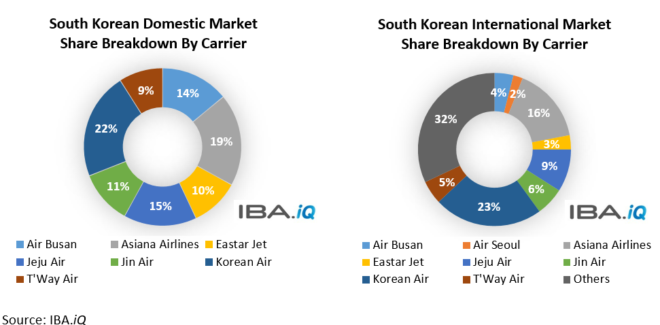

Undoubtedly, this ever growing number of travellers brought by the carriers has strengthened South Korea's economy. The flight between Jeju International Airport and Seoul Gimpo Airport is regarded as the world busiest domestic route, with 200 flights per day and nearly 80,000 annual flights. This high-demand route has helped Jeju Air, the oldest LCC in South Korea, to develop into the largest LCC in the market. With 44 aircraft in its fleet, Jeju Air carried 12 million passengers in 2018, which represents a 15% domestic market share. Even though the domestic passenger numbers have been relatively flat since 2016, its international service launched in 2009 has since experienced double-digit annual increase, including 27% growth in the first quarter of 2019, and has reached 9% international market share in South Korea, according to IATA published data. As such, as part of its recent Operator Score Index update, released in July 2019, IBA has ascribed Jeju Air a rating of 4C.

Following Jeju Air, five other LCCs have been formed and in aggregate LCCs occupy over 60% of Korean domestic traffic. Additionally, all Korean LCCs operate international routes in their networks, although the two full-service carriers, Korean Air and Asiana Airlines, have the majority international market share with a combined total of 40%. Moreover, the new market entrants are also likely to focus their potential revenue on international flights, due to the already crowded domestic market. Half of international tourists were from China and Japan in 2018, and China recently approved the launch of 49 new weekly flights by South Korean carriers. Most Korean carriers will benefit from this move, with the exception of Jin Air, which is currently under sanctions imposed by the Korea Aviation Authority.

The increasing number of visitors into South Korea has more than doubled in the last decade, however the outbound market (local people flying out of South Korea) is nearly twice the size of the inbound market over the same period. This dynamic market has brought in huge numbers of newly created jobs, typically within the airline companies, airport operators, airport on-site enterprises, aircraft manufacturers and air travel services. Additionally, local hotels, restaurants, shopping malls and tourism resorts support another wave of jobs. Moreover, huge amounts of foreign passenger inflow will give rise to trading and Foreign Direct Investment, which tends to increase the logistic capacity, life infrastructure development and boost financial activities. In total, more than 830,000 jobs are supported directly and indirectly by the air transport sector based on research conducted by Oxford Economics.

The money spent by foreign tourists and business people brought in by air transport, the salary earned and values created by the people employed in the Air Transport sector and its associated supply chain, will all contribute to the country's Gross Domestic Product (GDP). Those consumptions are estimated to support around 3.4% of Korea's GDP, totalling up to US$ 47.6 billion.

Since domestic routes in South Korea have been saturated for a couple of years, a number of secondary airports are under construction, supported by local government. The planned airports will support the development of Korean LLCs and continue to attract new entrants. Subsequently, infrastructure will bring more jobs and boost the local economy, as well as heightening competition within the increasingly crowded aviation market.

The ever-growing air traffic in South Korea, especially on international flights, has nurtured the growth of local LCCs. However, declining profits and increasing competition has stirred the local market, which expects more consolidation to occur in the near future. This currently vibrant market continues to lure more entrants into an already crowded space.

Monitoring the health of airline financials and understanding their operational characteristics are essential elements of successful aviation investment. With its Operator Score Index, IBA has developed an excellent and easy-to-use tool to help support investors' internal airline evaluations and to gain a valuable and informed third-party perspective from aviation experts with over 30 years in the business.

China has the most LCCs in North Asia, however South Korea has the highest LCC penetration rate among this market. In the foreseeable future, more planned routes can be expected from China into South Korea due to the growing number of outbound Chinese travellers, and potentially some routes will be created in North Korea to ease the crowded domestic market. The current US - China trade war has affected cargo demand and the Korea-Japan diplomatic row sheds a cloud on the travel revenue between these two countries.

An increasing number of South Korean investors have switched from traditional real-estate investments to more profitable and stable mobile assets such as aircraft. As a result, more diversified aircraft funds and financing deals have been made available in the Korean market. Meanwhile, Korean investors have transformed themselves from purely cash providers in the aircraft leasing transaction to leasing deal arrangers and servicers. At the same time, there have been more joint developments established between local companies and foreign leasing entities.

Going forward, IBA expects Korean entities to represent an increasing proportion of the global aviation finance market. IBA would not rule out the possibility of a standalone Korean leasing platform in the near future. Despite investment in domestic airport infrastructure, Korean LCCs must explore international expansion to secure sustained growth. In such a competitive market, from both an airline operator and investment perspective, understanding the risks to growth is key.

Co-authored by Jie Zhou, Lewis Leslie & Caroline Finnegan - Aviation Analysts, IBA.

If you have further questions, comments or feedback please contact: Mike Yeomans

Related content