18/05/2018

According to IATA's March 2018 Freight Analysis report, global freight volumes slowed to a 22-month low, 1.7% year-on-year in March. This outcome represents the slowest pace of annual growth since the early part of 2016. The decline in growth can predominantly be attributed to the end of the restocking cycle which was one of the drivers behind the high growth figures. IATA have cautioned against reading too much into the most recent figures and expects growth of 4-5% overall for 2018.

Looking back at past trends, the demand for freighters follows the cyclical pattern of global trade. As world merchandise exports fell due to the Global Financial Crisis in 2008, demand for freighters also fell for the following few years, with only three good years since 2007. Until 2017 air freight has gone 10 years with very little net growth which has negatively impacted demand for freighters. This has been compounded by the rapidly increasing belly capacity in passenger aircraft and increased fuel prices.

There was a post-GFC surge in 2010 as inventories were replenished but that then dipped in 2013 on the back of weak global trade, and commodities have remained pretty stagnant since, with retirements and deliveries almost matching 1:1.

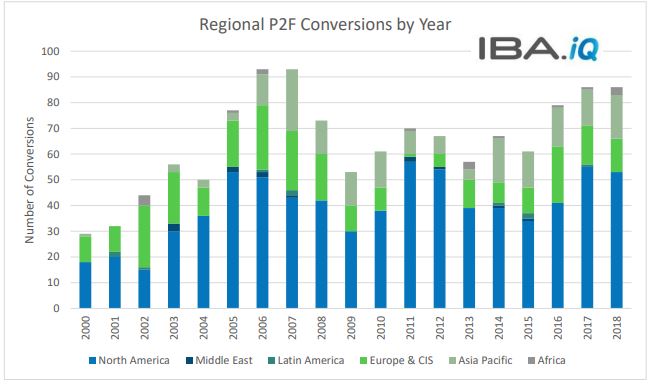

Conversion rates hit a recent high during 2017 with IBA.iQ identifying 86 conversions with similar numbers expected during 2018, but still not matching the 2006/7 levels.

Nearly 62% of the conversions over the last 18 years were for North American operators. European and Asia Pacific operators make up the majority of the remaining conversions with 21% and 14% respectively.

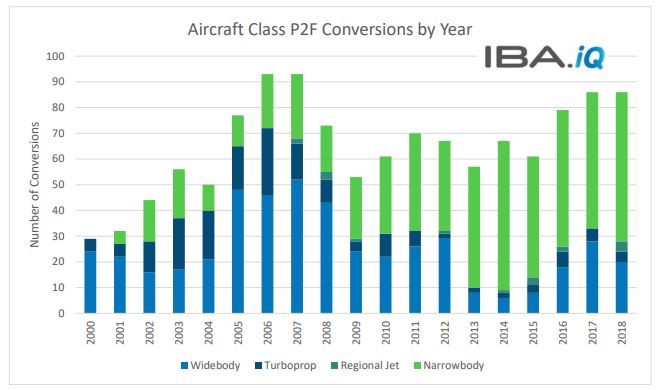

Between 2000 and 2008, widebody conversions drew most of the demand, while turboprop and narrowbody conversions saw similar levels. Since 2008, narrowbody conversions have driven most of the demand as operators switched to meet growing needs from e-commerce and express deliveries.

Widebody conversions have dropped but remain steady, however, turboprop conversions have suffered most with a 226% drop in demand in the 9 years following the financial crisis.

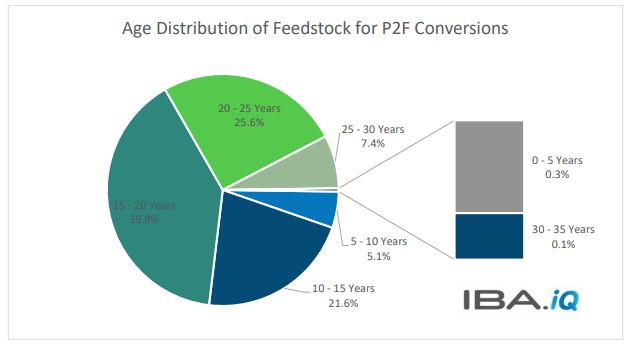

Around 87% of conversions represents feedstock aged between 10 and 25 years, highlighting a 'Goldilocks' zone for P2F conversions. The 'sweet spot' appears to be for aircraft aged between 15 and 20 years as this accounts for around 39.8% of conversions. It comes as no surprise that suitable feedstock should be found within this range as the aircraft come off their first and second lease, and generally coinciding with structural checks. We recommend combining this with the conversion that requires full interiors to be removed.

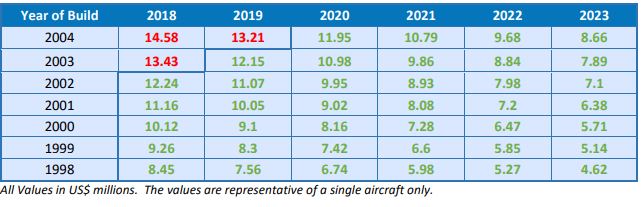

Identifying viable feedstock is essential, from a values perspective, to ensure the conversion remains economically attractive. As an example, to obtain an Airbus A320-200 for around US$ 11 - 12.5 million, the airframe would need to have been built between 1998 and 2004. Demand is still strong for passenger configured aircraft built beyond 2005 keeping values buoyant. The values obtained from IBA.iQ, highlighted below in green, are what IBA deem as suitable for A320-200 P2F operations, while those in red represent the population where values have not softened sufficiently.

Going forward IBA forecast around 1000 conversions being required in the next 17 years, slightly less than Airbus/Boeing estimates.

For more information on P2F candidate selection see our new whitepaper report on our Insights collection.

Book a demo of our new intelligence platform IBA.iQ.