27/05/2021

Tim Boon, Senior Aviation Analyst, IBA Advisory, uses InsightIQ Carbon Emissions Calculator to explore British Airways's LAX-LHR route and how new gen aircraft and sustainable aviation fuel could impact carbon emission efficiencies.

International Consolidated Airlines Group (IAG) recently announced its forward looking commitment to powering its entire fleet with a 10% blend of Sustainable Aviation Fuel (SAF) by 2030. IAG stated that they intend to purchase one million tonnes of SAF each year by 2030 which will certainly contribute towards their ambitious 2035 target of reducing carbon emissions by 78%. This coupled with a fleet renewal strategy, especially focussing on the ageing ultra and widebody aircraft will assist in driving down the group's overall yearly carbon intensity per seat.

Whilst the pandemic has obviously reduced the total CO2 output for operators; bigger emphasis is being put on the overall efficiency of the aircraft on a per seat basis. Throughout 2020, airlines have typically favoured newer generation aircraft due to the operational cost savings when compared to older more inefficient aircraft, a twofold benefit both from a fuel perspective but also a reduction in the probability of unforeseen maintenance.

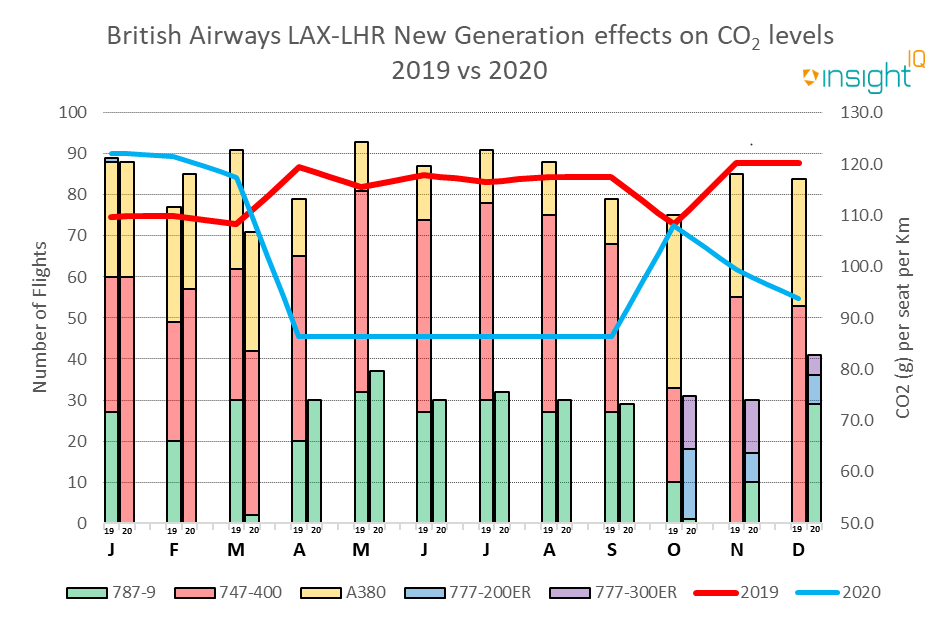

Using analysis from InsightIQ's Carbon Emissions Calculator, we have analysed the London Heathrow (LHR) to Los Angeles (LAX) route served by one of IAG group's airlines: British Airways. Demonstrated in the chart below, we can show the impact on CO2 per seat/per Km metrics from the induction of more new generation aircraft during 2020 - such as the Boeing 787 family. In this example, LHR to LAX 2019 vs 2020 clearly illustrates the efficiency impact from new generation aircraft.

Using InsightIQ's Fleet and Flight data, our Carbon Emissions Calculator has the added benefit of retrospectively analysing routes with real world data across aircraft types. As demonstrated in the charts above, we can show the impact of British Airways fleet evolution across routes in the two comparison years. In 2019, high volumes of Boeing 747-400 and Airbus A380 aircraft were operating the London Heathrow -Los Angeles route; the 747 being largely inefficient aircraft in relative terms when compared to its newer counterparts. In 2020 the London Heathrow to Los Angeles (LAX) shows a significant drop off in emissions per seat due to the early phase out of the Boeing 747-400 and long-term storage of the Airbus A380. Post pandemic, British Airways opted to utilise its large 787 fleet which was favoured for many months until October 2020 when it was served solely by Boeing 777-200ER and 300ER aircraft, showing a large jump in emissions per seat.

The average age of the quad engine aircraft operating the route in 2019 and early 2020 was 17.6 years old, when compared to 2020's average new generation fleet age of 3.7 years old. When averaging the fuel burn per seat per month within a 12-month period for the London Heathrow - Los Angeles route, the overall efficiency improvement per seat is circa 25% better in 2020 when compared to 2019.

The comparisons above demonstrate the paradigm shift between the use of older generation aircraft vs new generation widebodies. Although, it must be noted that British Airways does not have a fleet of new generation aircraft large enough to serve its worldwide commitments, and will continue to utilise its ageing fleet when demand finally returns. However, if anything, the pandemic has served as a key demonstrator of what can be achieved in terms of fuel burn efficiency per seat once the old stock of aircraft has been retired.

All Data used and displayed in this article is derived from IBA's proprietary data platform IBA InsightIQ.

If you have any further questions or comments please contact: Tim Boon

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.