03/06/2021

Despite current aircraft utilisation falling far short of pre-pandemic levels, the industry is witnessing a modest boom in new airlines, with over 130 start-ups preparing for take-off in 2021 and 2022.

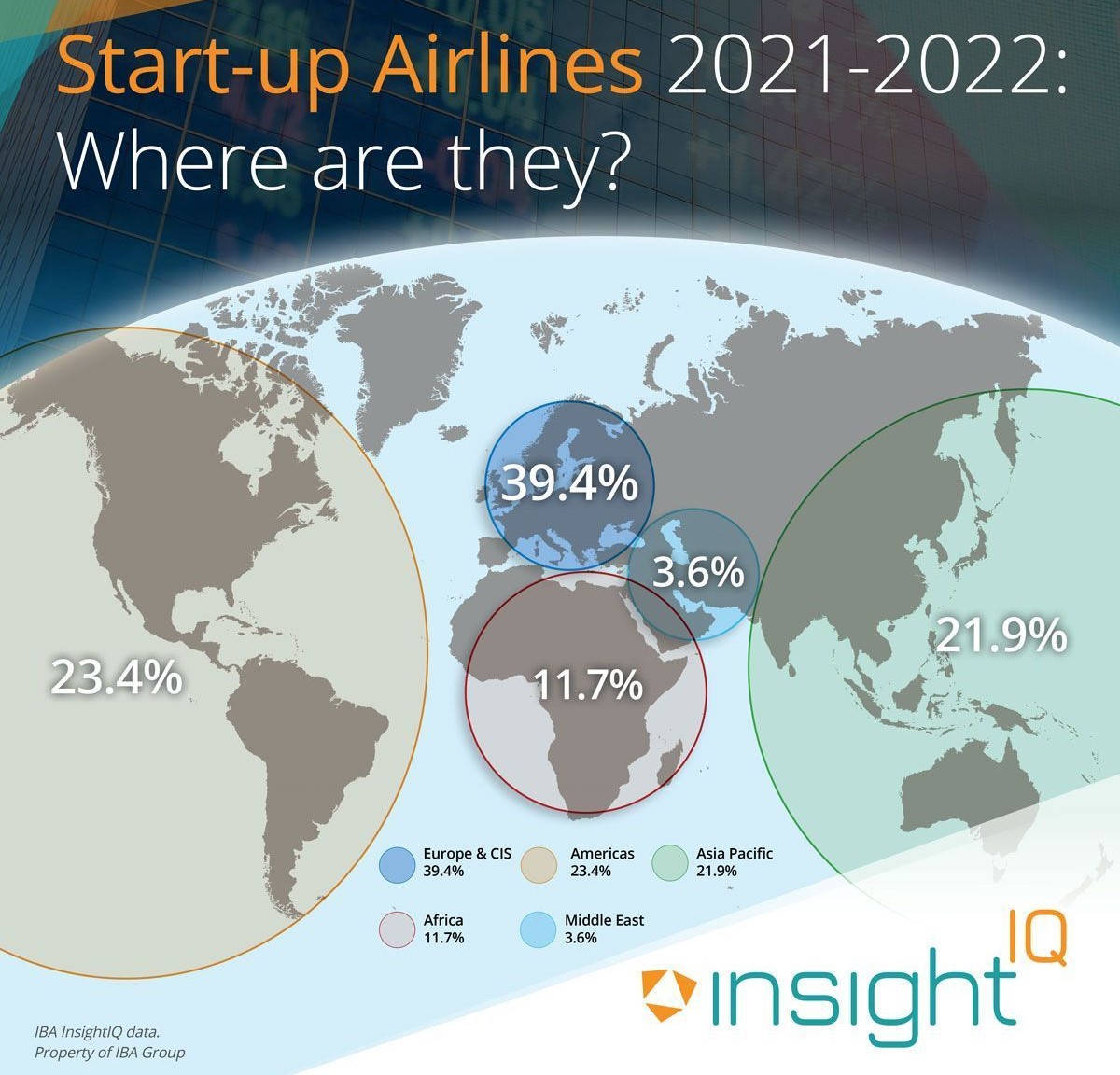

Data from InsightIQ shows that many of these start-up airlines formulated their business plans before the onset of the Covid-19 pandemic and are focusing on the shorter-haul and regional market segments. Our intelligence shows that as well as discounted operating costs, these start-ups are grasping the opportunity to enjoy heavily discounted depressed asset and lease values, interest rates, maintenance, MRO service and pilot costs. Our insight shows that almost 40% of the new entrants will be Europe and CIS-based.

With such a focus on new short haul and regional operations, it is perhaps no surprise that narrowbodies and turboprops are proving to be the aircraft of choice for emerging operators, with the A320 family in particular standing out as a favourite.

The start-up boom is not exclusively a short haul phenomenon, with a selection of low-cost long-haul businesses also planning to enter the market in the coming years. Given the impact of Covid-19 on the long-haul sector, the activity centred around this business model is perhaps surprising. In our recent poll on LinkedIn, 67% of users stated they did not think that the LCLH business model is viable in the long term. However, market failures and cutbacks have created openings for carriers such as Norse Atlantic to fill voids, such as that left by Norwegian. Asset types with lower acquisition or leasing costs are favoured, an example being Hans Airways' plans for a low-cost UK to India service employing the A330.

The current low-cost environment is a fertile ground for operators with no legacy debt to establish an airline with a clean slate. However, operating costs will ultimately increase as the market recovers and robust business modelling with effective liquidity provision will be vital.

If you have any further questions please get in touch: Phil Seymour

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.