07/05/2021

There are various strategies lessors can adopt to reduce their fleets' carbon emissions and, in doing so, potentially benefit from lower financing costs, strengthen their investor relations' story and develop a greater competitive advantage with lessees.

IBA outlines two key strategies: purchasing new technology planes with lower emissions levels and committing to offsetting a proportion of the emissions their lessees generate.

Airframe and engine OEMs are working on many initiatives that will improve technology and produce more efficient and potentially carbon free aircraft, but this is evidently a longer-term proposal. In the medium term, buying new gen technology planes will potentially provide a good investor relations story, fit with many airlines long term strategies and also potentially provide a 'Greenium' benefit, with access to lower cost finance.

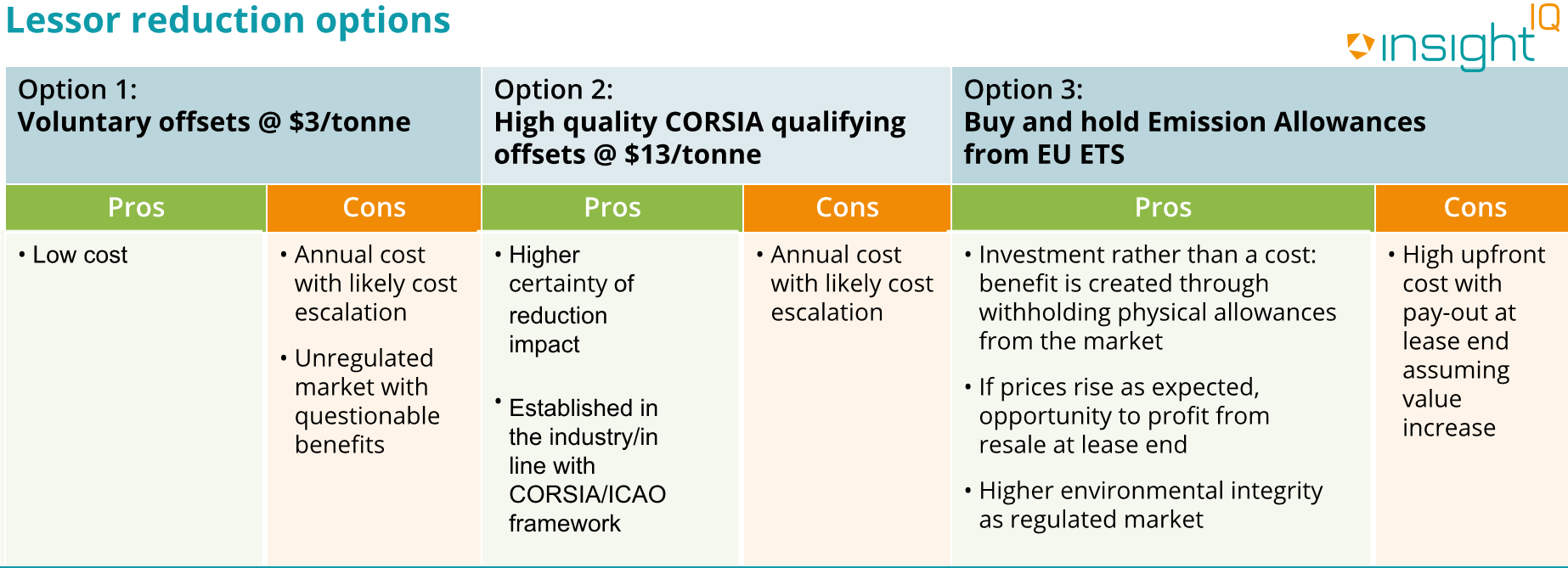

There are three offsetting options, the impact of which can be calculated using rich intelligence from the InsightIQ platform and newly launched Carbon Emissions Calculator (CEC).

Voluntary offset schemes at $3/tonne

High quality offset schemes at $13/tonne

Buying and holding emissions allowances from the EU Emissions Trading Scheme (ETS)

Source: IBA InsightIQ CEC

Based on calculations and analysis from InsightIQ CEC, we conclude that buying and holding Emissions Allowances from the EU ETS may be the most efficient carbon reduction strategy for lessors. Although upfront costs are higher, buying emissions allowances at the start of a lease and holding them until lease end is an investment. Current market expectation is that these assets will appreciate in value by 70% - 75% by 2030. Investors will therefore have an opportunity to profit from their re-sale at lease end. Emissions trading also enjoys high environmental integrity as a regulated market. To understand the maths behind this conclusion, we have created the following Case Study:

Case study- Airbus A321 neo (Non-ACF/ACTs) with LEAP-1A33 Engine

A lessor can commit to offset emissions as a competitive differentiator in a bid to win a lessee. Using the example of a new A321neo narrowbody bought in April 2021 for US$ 56M and offered on a 12-year notional US$ 360K monthly rental, its residual asset value will be US$ 35M at lease end. We can mine the emissions information our CEC generates to calculate the following CO2 outcomes to calculate the offset costs and impact on IRR.

All Data used and displayed in this article is derived from IBA's proprietary data platform IBA InsightIQ.

If you have any further questions or comments please contact: Ian Beaumont