08/09/2021

We analysed utilisation trends for the four most prominent engine families in the narrowbody market to track market recovery.

Domestic travel has been the driving force behind the post-Covid air travel recovery. Trend data from IATA indicates that whilst the market is moving in the right direction, the Global travel situation falls far short of where it should be during a summer season. Using fleet data from IBA's aviation intelligence platform InsightIQ, we analysed utilization trends for the four most prominent engine families in the narrowbody market - the CFM56 Family, LEAPs, PW1000s and V2500s.

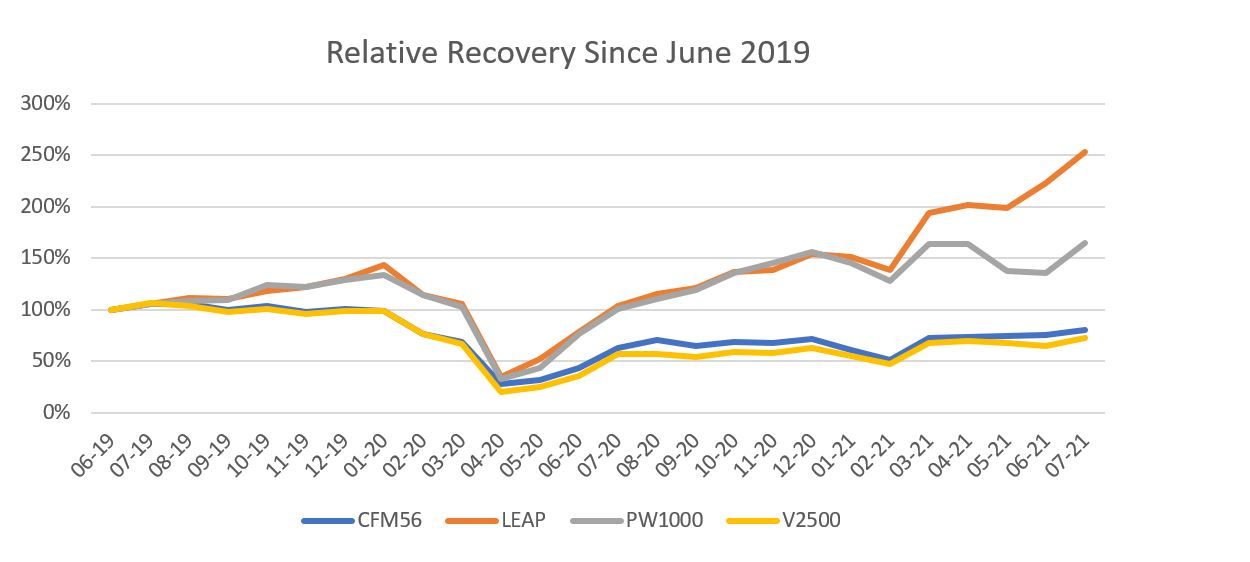

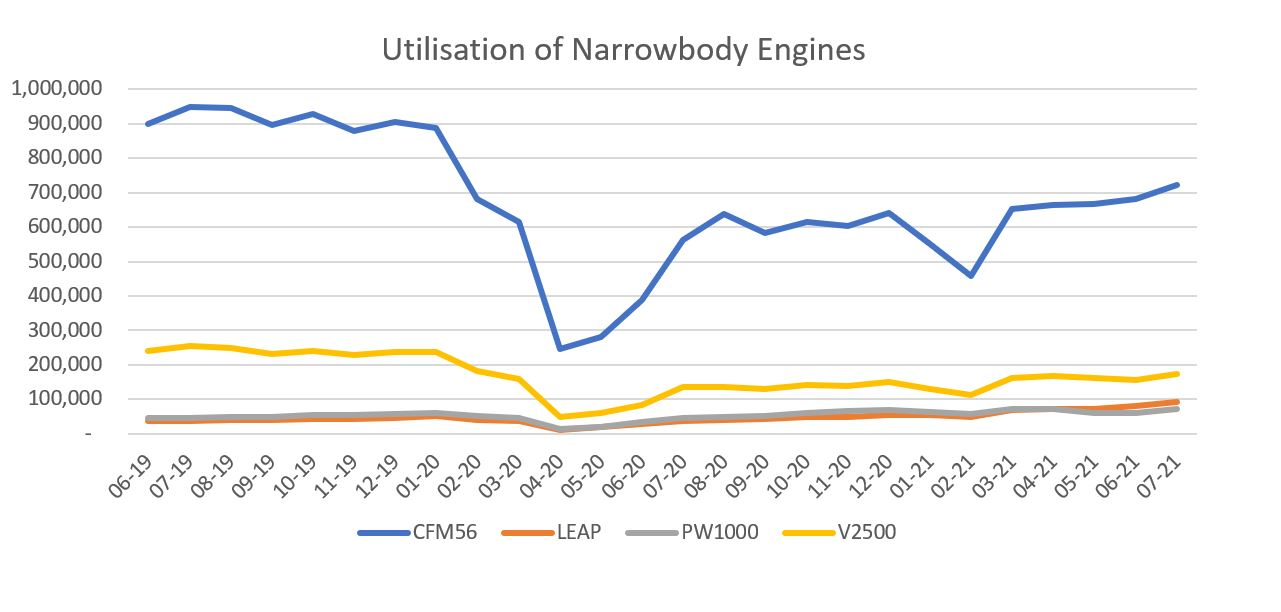

Whilst the narrowbody market recovery post COVID-19 has been strong relative to other markets, there are also clear distinctions between engine types. The CFM56 and V2500 engine families are still some way off seeing recovery to the levels of utilisation seen during the summer of 2019. April 2020 saw utilisation at its lowest for all four engine families with travel restricted worldwide.

Whilst the narrowbody market recovery post COVID-19 has been strong relative to other markets, there are also clear distinctions between engine types. The CFM56 and V2500 engine families are still some way off seeing recovery to the levels of utilisation seen during the summer of 2019. April 2020 saw utilisation at its lowest for all four engine families with travel restricted worldwide.

InsightIQ's Carbon Emissions Calculator provides detailed CO2 analysis by variables including powerplant and MSN. Click here to find out more about our unique finance-focused carbon modelling tool.

Meanwhile, the LEAP and PW1000 engines have since seen a rapid rise with operators utilising newer generation engines and increasing deliveries. A slight delta started to develop between the LEAP and PW1000 engines from early 2021, likely driven by sizeable 737MAX markets in the likes of North America and China where domestic operations have seen strong recovery.

The CFM56 and V2500 engines are dominating utilisation, mostly due to the size of the fleets operating them. Despite a stronger recovery in the LEAP and PW1000 markets, their overall utilisation remains low due to them only representing a smaller fraction of the existing 737NG and A320ceo fleet.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.