15/03/2019

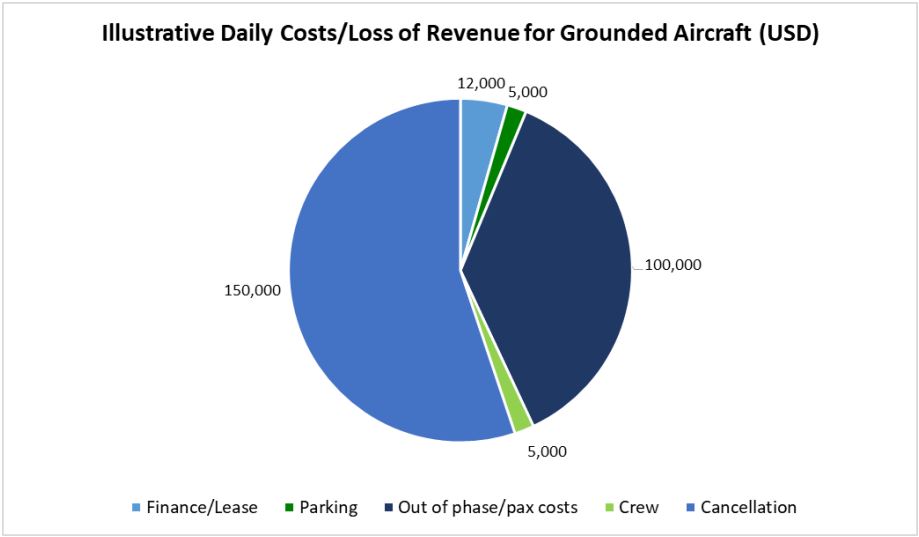

For Airlines, the direct cost of grounding the 737 MAX 8/9 Fleet will be in the region of 150,000USD per day per aircraft grounding. IBA takes a look at the impact and which airlines will be hit the hardest.

Direct costs that are not absorbed are as follows:

Leasing/finance costs: a typical lease rental of 360,000USD per month means every day 12,000USD is lost. Airlines have to pay those lease rentals/finance costs irrespective of whether the aircraft flies or not.

Staff costs: flight and cabin crews used specifically on the type cannot be transferred onto another type. Using rough order of magnitude figures.. for 2 flight crew and 4 cabin crew this could amount to 5,000USD per day.

Parking fees: Airports (particularly major city ones) can be very expensive places to park aircraft. We will use a typical fee of 5,000USD per day.

Passenger re-routing/compensation: the major issue is the logistics of keeping promises to fly passengers from A to B (and back). For the purpose of this exercise we will assume 6 flights per day at 90% load factor @ 180 pax max. This can be a nightmare for an Airline/tour operators to organise and extremely costly. Options may include simply cancelling the flights and repaying the revenue, to organising alternative flights via wet leasing. Wet leasing short-term may be a preferred option for some Airlines who have high load factors and want to provide continuity to their loyal customers. Large Airlines with some excess capacity may be able to provide alternatives from their own fleets, other Airlines will be less flexible as they won't have such capacity available. We estimate costs to be in the order of disruption to 1,000 passengers per day to be an average of 100USD per pax, totalling 100,000USD per day.

There are several variations on options that an Airline may adopt and the loss of profit will clearly be less than loss of revenue.

Passengers may also be stranded and incurring hotel bills that may not be fully paid for by the Airlines but may become travel insurance claims.

Aircraft will be left stranded at airports other than their main bases, whilst their crews will have to return home. Likewise when the "fix" is organised engineers will need to perform pre-flight checks and the relevant fixes. If software upgrades are required they will need to be uploaded by the engineers.

Is there any upside? Not really, but Airlines and ACMI operators not using the MAX 8 will likely cash in.

In very broad terms the direct costs will be in the region of 150,000USD per day per aircraft grounding.

Yes, of course, some elements of costs will not be incurred but the key benefits of new aircraft such as the MAX and NEO are that their costs are lower than the older fleets. The purpose of the MAX 8 was to save circa 15% fuel burn and to improve cost per seat mile compared to the NG version. Some Airlines may be able to place their NG's on the MAX 8 routes using their older tech kit, therefore increasing cash cost per flight.

A much more complex calculation but cash generation is vital. Many airlines will have had "thin" Northern Hemisphere Winters and already in a "low cash" situation and to lose revenue in March could tip them into the red (and beyond). We are closely monitoring a handful of Airlines who are close to the edge through our Operator Risk Index.

In terms of loss of revenue, there are several ways to calculate it. In recent years, the IT outage that caused one Airline to cancel 2100 flights was costed at 150mUSD - circa 75,000USD per flight.

For more information on any of the above or for details of our Operator Risk Index, please contact us using the link below.