18/12/2018

Recently qualified as a Senior ISTAT appraiser, Mike Yeomans, IBA's Head of Valuations takes a closer look at the 777-300ER. Whether you are an existing owner or a potential investor, this analysis overview looks at how this aircraft is performing in the market, possible remarketing opportunities and what to expect over the next year and into 2020.

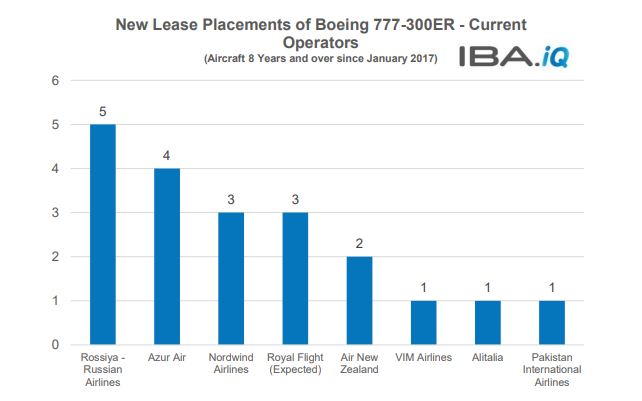

Against a backdrop of increasing lease returns, the secondary lease market for the 777-300ER is developing and IBA has noticed some interesting trends. In the following paragraphs, we explore the secondary leasing market for this aircraft, the origins of secondary market supply and the sources of demand for these used examples.The chart below shows which carriers have taken aircraft on lease from the secondary market since the start of 2017.

It is clear that the primary source of demand is Russian carriers in the form of Rossiya, Nordwind, Azur and VIM, accounting for 65% of secondary lease placements of 777-300ERs over this period. The aircraft which was originally placed with VIM is now in operation with Azur. This is due to the cessation of operations at VIM.

When we consider the previous lives of these assets, most have been in operation with Emirates, which accounts for around 60% of the redeployed aircraft.The following chart shows the previous lessees/operators of these aircraft.

.jpg)

.jpg)

.jpg)

Jet Airways faces financial difficulties and this could result in some examples of its 777-300ER leased fleet entering the market. However, the prospect of expensive redelivery payments may incentivise extensions.

We have already seen Emirates aircraft transitioning to new carriers and this is likely to continue into 2019. This may not be for all aircraft however. In light of its recent profit slump, the redelivery maintenance payments may incentivise them to retain their Boeing 777-300ERs via lease extensions at reduced rentals.

We could potentially see aircraft coming out of LATAM as the carrier has a backlog of A350-1000 aircraft.

Air Canada does not appear to have a direct replacement, so IBA would expect to see extensions of the carrier's 777-300ER leases.

Air France will likely hang on to its aircraft and we have seen some extensions already.

Cathay has Airbus A350-1000 aircraft on backlog and we have already seen some 777-300ER redeliveries from this carrier.

KLM appears to have no direct replacement on order. IBA expects KLM to retain its 777-300ERs via lease extensions.

Given the prospect of increased redeliveries over the next year and into 2020, we expect to see further transitions. At present, storage levels remain low at only 10 aircraft. As highlighted above, aircraft are being placed in the market on secondary leases.

There are however, questions as to how the market will cope with increased supply. The profile of lessees that have taken secondary 777-300ER aircraft so far is a departure from the Tier 1 credits that occupy the primary operator base. Given the nature and size of this aircraft, there are some barriers to secondary market placement. Reconfiguration is potentially an expensive prospect and the high capacity of this aircraft model may be a barrier to placing the aircraft with some carriers. IBA is aware that Kenya Airways struggled to fill its Boeing 777-300ER aircraft, leased from GECAS. As such, these are now on lease to Turkish Airlines.

Whilst the secondary market for the Boeing 777-300ER is largely untested, IBA is aware that the achieved lease rates on these early placements are below base expectations. If we see an increase in supply, expect to see lease rates and values soften further. IBA has moderately softened its value and lease rate expectations for the Boeing 777-300ER accordingly. This is a market we will continue to monitor closely, particularly as further aircraft enter the secondary market.

For more information on our Valuations, Aviation Intelligence platform- InsightIQ, Market Analysis or how we can help your business, email: Mike Yeomans

We are currently offering free trials of our Fleets, Values and Trends iQ modules. Book a demo using the link below.

作者

查看完整档案相关内容